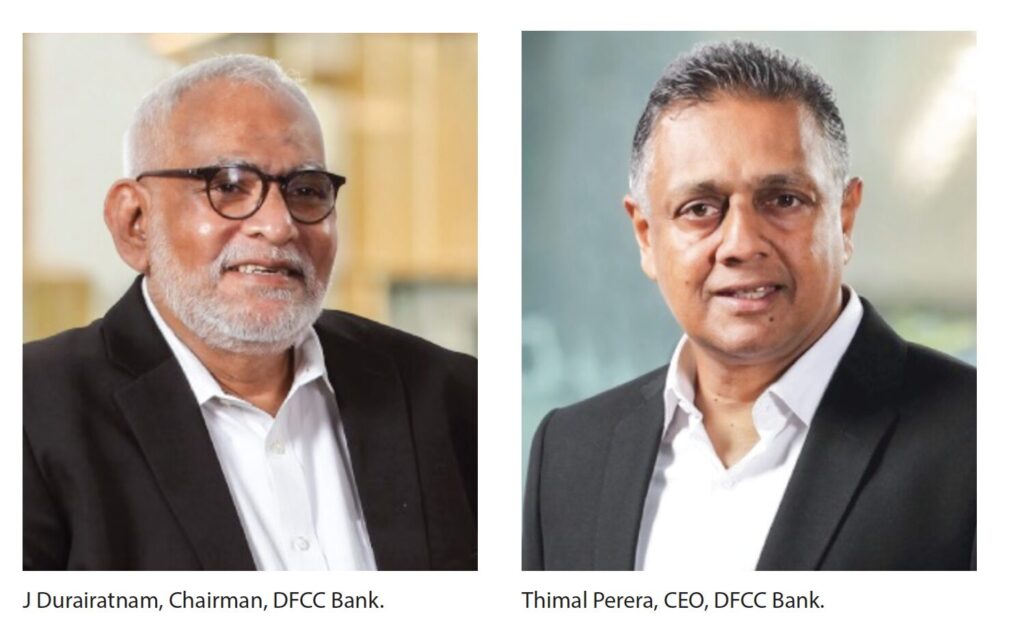

DFCC Bank reported a Profit Before Tax (PBT) of 7,910 million rupees and a Profit After Tax (PAT) of 5,555 million rupees from continuing operations, up from 7,237 million rupees and 4,654 million rupees last year. The Earnings Per Share (EPS) from core operations was 12.74 rupees, while including the gain from the sale of Acuity Partners, it was 24.13 rupees. At the Group level, PBT was 8,172 million rupees and PAT was 5,747 million rupees, compared to 7,479 million rupees and 4,875 million rupees in 2024.

The Bank’s Return on Equity (ROE) was 14.95 percent, and Return on Assets (ROA) before tax was 2.37 percent for the period ended June 30, 2025. During the six-month period, the Bank saw one percent increase in interest income and a five percent reduction in interest expense, highlighting resilience amid market pressures. Interest income grew due to a 19 percent expansion in the loan portfolio, reflecting the focus on quality asset growth. The CASA ratio improved from 24.77 to 26.54 percent, enhancing funding cost efficiency. As a result, Net Interest Income rose by 11 percent to 15,167 million rupees, driven by effective loan book growth and optimized funding costs. The Net Interest Margin fell from 4.18 percent in December 2024 to 4.10 percent by June 2025, influenced by competitive positioning and market dynamics. The Bank’s proactive strategies boosted volumes in remittances, credit-related charges, trade-related commissions, and other fees, with credit card growth contributing as well. Although related fee expenses increased to support customer acquisition and card portfolio growth, the net outcome was positive, resulting in a 43 percent rise in net fee and commission income to 3,249 million rupees, up from 2,274 million rupees in the same period of 2024. The Stage 3 impaired loan ratio improved to 4.62 percent in June 2025 due to successful recoveries and portfolio growth. Impairment provisions rose to 3,073 million rupees with added buffers for high-risk sectors due to changing economic trends.

DFCC Bank’s total assets increased by 83.7 billion rupees, a 12 percent rise since December 2024. The net loan portfolio grew by 74 billion rupees, reflecting a 19 percent increase compared to 394 billion rupees as of December 31, 2024, aligning with the Bank’s growth agenda and the improving economic environment. DFCC Bank’s total liabilities increased by 72 billion rupees a 12 percent rise from December 2024. The deposit base grew by 14 percent to 530 billion rupees from 465 billion rupees as of December 31, 2024. As of June 30, 2025, the loan-to-deposit ratio was 97.79 percent, and the CASA ratio was 26.54 percent. The Bank utilized medium to long-term concessionary credit lines to support targeted lending and affordable financing. The CASA ratio improved to 32.39 percent, while the loan-to-deposit ratio was 90 percent as of June 30, 2025. Total equity increased by 12 billion rupees, driven by a profit after tax of 10.5 billion rupees and fair value gains in the Bank’s securities portfolios.

Thimal Perera, CEO, DFCC Bank, said, “In a stabilizing macroeconomic environment characterized by easing monetary policy and renewed investor confidence, DFCC Bank achieved strong performance in the first half of 2025. The Bank recorded a PAT of 10.5 billion rupees, which includes a one-off gain from divesting its 50 percent stake in Acuity Partners. The Group’s core business Profit After Tax reached 5.7 billion rupees. Total assets grew by 11 percent, driven by a 19 percent expansion in the loan portfolio, and Net Interest Income increased by 11 percent, with a CASA ratio of 26.54 percent. This success can be attributed to customer-centric initiatives, including enhanced homeownership and mobility financing solutions. Gold-backed lending for the underbanked and an enhanced remittance service have contributed significantly. DFCC Bank’s commitment to inclusion is evident through its Islamic banking proposition and the women’s initiative, DFCC Aloka, which has surpassed 100,000 customers.”