by Saliya N Wijesekara

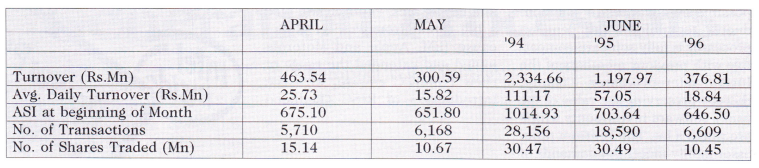

The above figures clearly indicate the current dull and unexciting nature of the stock market. The market has been gradually declining during the last three months with the All Share Index at 594.50 by the end of June, a 11.94% decline over a three-month period. The levels of turnover witnessed during this period was the lowest figures recorded in the last two years. Due to the inactivity of the market most retail investors and speculators have opted to be out of the market. Foreign investors have also opted to remain in the side-lines due to domestic, regional and international factors. Domestic factors that have kept both local and foreign investors out of the market are the following:

• The worsening power crisis which has had a negative impact on most manufacturing sector companies and a trickle-down effect on the banking sector, with regard to slow loan growth and delays in debt servicing.

• The labour unrest which swept through the private sector in late 1994 and early 1995 is still in the minds of investors and they are worried that such a situation will arise again.

• Due to the massive military expenditure the government has not been able to raise the necessary funds for the speedy implementation of the much-needed infrastructure development. This means that the overall productive capability of the economy has not improved.

• With the budget deficit expected to increase due to the shortfall in government revenue and massive defence expenditure interest rates are expected to increase. This will attract funds to fixed income securities and keep funds away from the stock market.

• The lower than expected rain fall during 1996 will also affectagricultural output, particularly the rice crop and tea plantations.

On the regional front, the South Asian region continues to be plagued by violence and political uncertainty. India, the biggest attraction to foreign investors has a weak coalition government which must depend on the Congress party to remain in power. It is now clear that the Indian government will not be able to implement at a desirable pace, the much-needed changes in the bureaucracy, and the restructuring of the economy. The other countries in the region namely Pakistan and Bangladesh are also plagued by internal violence. These factors result in foreign portfolio investors adopting a “wait and see” attitude for the whole region. On the international front, there is expectation of an interest rate hike in the United States and the Japanese economy is also gradually rebounding. These factors will ensure that substantial funds will remain in mature markets and also a movement of funds to fixed income securities will be witnessed. Of the emerging markets, South East Asian markets such as Thailand, Malaysia and Philippines are expected to attract a bulk of the funds, as they are expected to record growth rates far more attractive than the South Asian countries.

Market and Corporate Earnings Outlook for the Short Term Most of the above mentioned factors are expected to remain and be a drag on the market in the short to medium term (three to six months). Based on the above factors our outlook for the stock market in the short term is a continuation of the current dull and depressing market conditions. In the current context, we recommend investors to closely monitor the corporate results due for the quarter ended June 30. Most analysts expect them to be an extension of the quarter ended March 31, which was in most instances a decline over the previous year. But if the drop in profits for most corporates are drastic and below analysts’ expectations then, the market is expected to decline further. If the results meet with analysts’ expectations then the market is expected to stabilise at current levels.

Except for the export-oriented manufacturing sector and plantation agricultural sector we don’t expect a growth in profits for any other companies. But as some export manufacturing companies are affected by the current power crisis and loss of order due to labour problems, this will have an impact on their profitability. The plantation companies, despite facing labour problems are expected to record impressive earnings growth due to the high prices both tea and rubber fetch in world markets. Commercial banks will record stagnant earnings as they will not expand their loan portfolios in the current market conditions. But as they can maintain their current spreads between lending and borrowing rates, profitability can be maintained. Other financial sector companies such as investment banks, and leasing companies are expected to record a decline in earnings as they would be adversely affected by short-term fluctuations in interest rates.

Economy and Stock Market in 1997

We forecast the economy to rebound in 1997 and record a Gross Domestic Product (GDP) growth of 5.5%, which is a significant improvement from the 4.5% expected to be recorded for 1996. All sectors of the economy i.e., manufacturing, financial & business services, construction, agriculture and transport & communication

Investors must realise that if the country’s situation reverts back to what it was in the early 1990’s then, corporate profits will in most cases reach levels witnessed during these periods.

are expected to record significant growth in 1997 over that of 1996. The main reason for this rebound is that the poor performance of the economy in 1996 will result in growth coming from a lower GDP base in 1997. This will also result in an increase in corporate profits in 1997. If the economy and with it corporate profits can rebound in the long term, the stock market is also expected to revitalise.

This is a scenario that we expect due to the following factors:

• The government is expected to dominate most areas in the Northern and Eastern provinces and the reconstruction of these regions will result in increased economic activity for the whole country.

• With the government taking an upper hand in the military conflict the massive defence expenditure is also expected to be gradually curtailed from next year. This will also have a positive impact in that it will reduce budgetary and inflationary pressures.

• The power crisis is expected to ease out with the installation of additional generation capacity and with improved weather conditions.

This will enable the manufacturing sector to continue with their production without interruption.

• The improved rainfall expected in 1997 will result in increased production in the entire agricultural sector, particularly, rice and tea, the main contributors from the agriculture sector to the GDP.

• The blue-chip privatisation such as Air Lanka, Sri Lanka Telecom, National Development Bank (convertible debenture) and Independent Television Network are expected to materialise next year. This will give a tremendous boost to the stock market and to government revenue and also reduce pressures on the upward movement in interest rates.

In the current context, we believe that investors should take a long-term view of the market. Investors must realise that if the country’s situation reverts back to what it was in the early 1990’s then, corporate profits will in most cases reach levels witnessed during these periods. The biggest beneficiaries will be the blue-chip conglomerates Aitken Spence and John Keells, the two development banks namely, National Development Bank and Development Finance Corporation and other financial sector stocks. This will ensure that the market price earnings ratio will decline to approximately 8.0 based on current price levels. This will make the Sri Lankan market one of the cheapest markets and will certainly attract significant foreign investor interest. Another factor for the growth of the market in the long term is that with the privatisation of large-scale government-held enterprises, the market will offer high liquid growth stocks to portfolio investors. With the utilities and services sectors being the main attraction in emerging markets, these stocks will attract significant foreign investor interest.