December 15, 2022 Kris Lucas

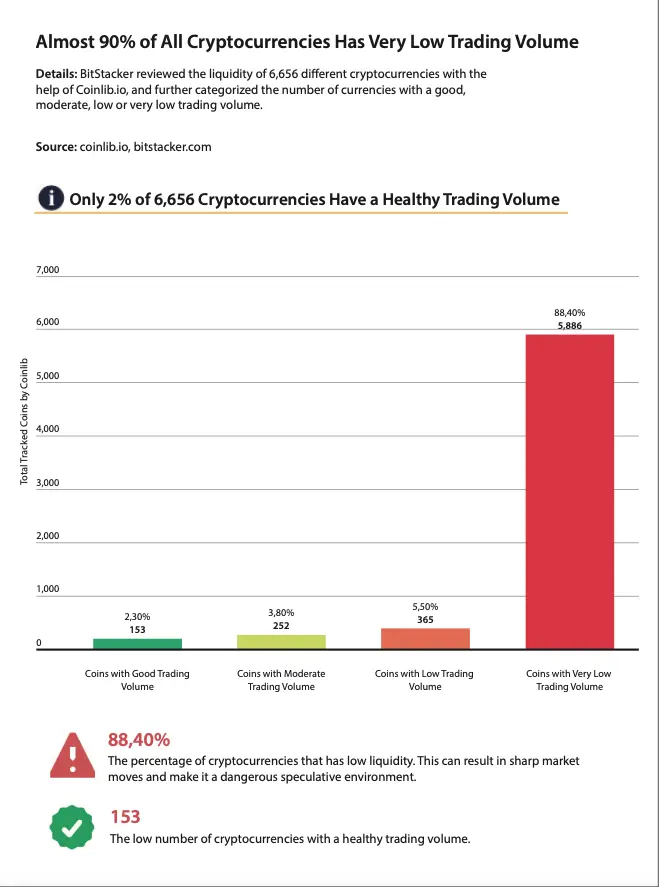

A new study has found that almost 90% of all cryptocurrencies have a low trading volume, with just 2% of crypto coins having healthy liquidity.

The report was compiled by BitStacker and it revealed that there are only 153 crypto coins with high volume that are traded in many exchanges. In contrast, there are 5,886 cryptocurrencies with very low volumes that are traded in a very small number of exchanges. The research was compiled from the liquidity metric provided by Coinlib, and it reaffirms that there is an unequal balance of trading volume among the thousands of cryptocurrencies.

Breaking Down the Cryptocurrency Liquidity Research

As of December 12 2022, there were 6,656 crypto coins tracked by Coinlib, and these were organized in categories of having either Good, Moderate, Low or Very Low trading volume.

The research revealed that there were 153 crypto coins with high volume that were traded in many exchanges that were categorized as Good. This represents just 2.30% of all cryptocurrencies tracked by Coinlib. Next, there were 252 cryptocurrencies that had moderate liquidity that was traded in a limited number of exchanges. These crypto coins with moderate trading volume made up 3.80% of the cryptocurrencies analyzed in the study.

The coins with a Low trading volume comprised 5.50% of the total number of cryptocurrencies tracked. This meant that there were 365 crypto coins that had low liquidity that was traded in few exchanges.

Finally, there were 5,886 crypto coins with a Very Low trading volume. These cryptocurrencies made up 88.40% of the total number of coins in the study, and they were traded at very few exchanges.

Understanding the Cryptocurrency Liquidity Metric

Liquidity is a term used to refer to the trading volume of an asset. The liquidity metric used in the study aims to highlight those crypto coins that have a low daily trading volume, or those cryptocurrencies where the trades take place in a very limited number of exchanges.

Such an understanding of liquidity is useful in that it can explain more than something like market capitalization. In particular, it can help traders understand when it might be difficult to buy or sell significant quantities of any crypto coin. But there is an additional factor which is that any crypto coin that has a large daily trading volume that comes from a single exchange might need to be avoided. This is because the barely regulated nature of cryptocurrency exchanges means that there is nothing stopping the exchange from artificially inflating the statistics. Plus a rogue exchange could also decide to stop trading the crypto coin at any given time.

Coinlib used a special formula to address this issue. It used a range of factors such as the number of Twitter followers the exchange had as well as its traffic ranking to get a truer picture of the legitimacy of any cryptocurrency exchange.

The study also used a formula to score each crypto coin. This factored in information such as how much a single exchange can affect the cryptocurrency’s liquidity, and the minimum acceptable number of exchanges for the crypto coin to be traded at.

While there is the potential for a crypto to have low liquidity simply because the exchanges that it is listed on haven’t become well- known, the study still presents an incisive report into the liquidity of thousands of cryptocurrencies.