Thimal Perera, Chief Executive Officer, DFCC Bank.

A Legacy of Purpose

Born in 1955 as Sri Lanka’s first development finance institution, DFCC Bank turns 70 this year. Established by an Act of Parliament to finance industries for a nation finding its feet after independence, its mandate was simple yet immense: provide long-term capital to build infrastructure and factories, and create jobs.

In 1956, DFCC Bank became the first financial institution to list on the Colombo Stock Exchange, laying the foundation for modern capital markets. Through the 1970s and 1980s, it channelled global credit lines and technical expertise into small and medium industries, seeding an ecosystem of entrepreneurship that stretched far beyond Colombo.

From textiles to tourism, agriculture to manufacturing, DFCC Bank’s footprint was embedded in the rise of Sri Lanka’s private sector. Many of those partnerships endure today. The rhythm was always the same: see what the economy needs and build lasting credit structures.

Kandy Branch, the first branch of DFCC Bank in 1988.

From Development Finance to National Scale

That instinct shaped the country’s renewable energy journey. In 1996, DFCC Bank financed Sri Lanka’s first private mini-hydro project. The years that followed brought the first private sector wind farm, the first grid-scale solar plant, and by 2021, the country’s first waste-to-energy facility.

These were not simply transactions. They were proof that clean energy could attract investment, scale into industries, and build credibility for Sri Lanka’s green future.

In 2015, DFCC Bank merged with its subsidiary, DFCC Vardhana Bank, to become a fully-fledged commercial bank.

The development DNA remained, but the portfolio expanded into leasing, housing loans, payment cards, pawning,and digital banking platforms like DFCC ONE. This transformation allowed the Bank to stand as both a development bank and a universal bank – combining national impact with everyday accessibility.

Acquisition of Merc Bank, which became a DFCC-owned commercial banking subsidiary, DFCC Vardhana Bank, in 2003.

Driving Inclusion and Empowerment

Financial inclusion has never been a slogan for DFCC Bank. It has always been practiced.

Women’s empowerment sits at the heart of this journey. Through DFCC Aloka, more than 100,000 women have accessed credit, mentorship, and peer networks, building pathways to financial independence. Youth and families have been supported through DFCC Junior, which encourages children to start saving early, instilling financial discipline across generations.

MSMEs remain a cornerstone. Dedicated SME officers operate across the island, supported by Vyapara Hamuwa, a program that brings business development training directly to communities. These efforts extend the Bank’s founding vision: to back entrepreneurs with capital, knowledge, and guidance. Housing finance has become another critical pillar. From the DFCC Express Housing Loan for fast-track approvals to Sri Lanka’s first 20-year fixed-interest rate housing loan, the Bank has sought to give families stability in an uncertain world.

Remittances, too, have grown in importance. They are not only foreign exchange inflows but also school fees, medical bills, and seed capital for small businesses. DFCC Bank continues to expand this service, most recently through a partnership with Ceylon Remittances in Japan, giving Sri Lankans abroad safer, faster, and more reliable ways to support their families back home.

At the other end of the spectrum, DFCC Pinnacle offers tailored, personal, and precise wealth and advisory services for high-net-worth clients. In every segment, the focus is not on products but on people.

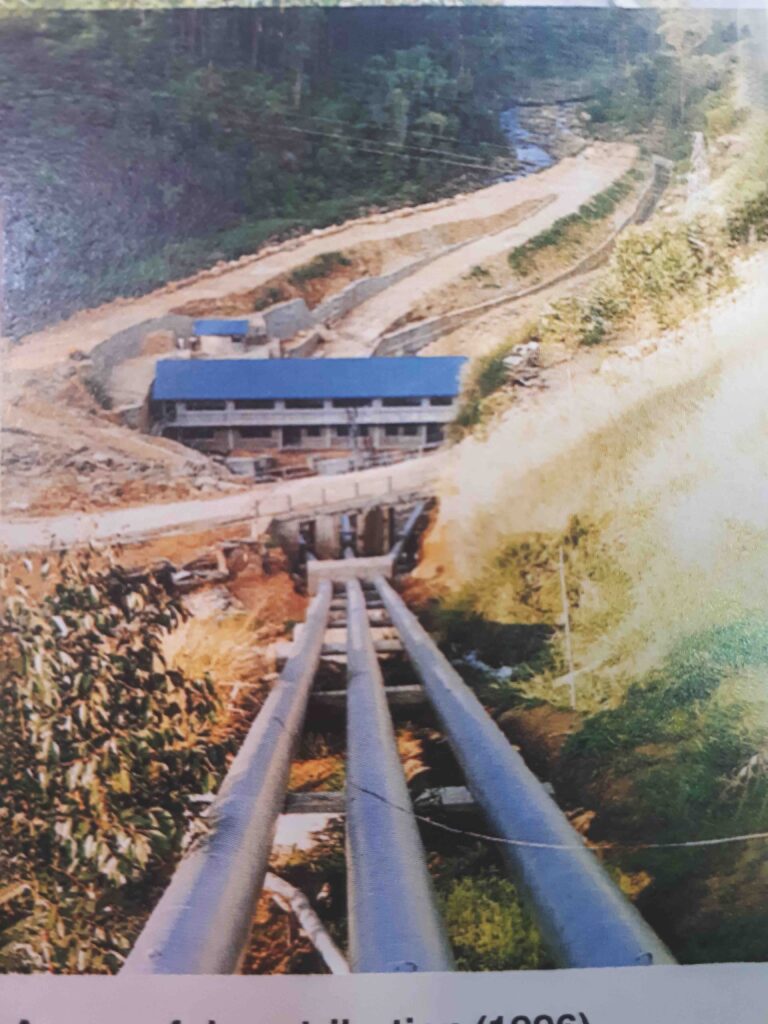

First Hydro Power Project – Hydro Tech, Dickoya funded by DFCC Bank in 1993.

Commitment to Sustainability

In 2016, DFCC Bank embedded an Environmental and Social Management System into every lending decision, moving sustainability from aspiration to mindset. By 2024, its green loan book had grown to 12.9 billion rupees, including 4.4 billion rupees in new disbursements that year alone.

In 2023, DFCC Bank became Sri Lanka’s only private sector Direct Access Entity to the Green Climate Fund, unlocking eligibility for up to USD 250 million in concessional climate finance. A year later, it issued Sri Lanka’s first Green Bond, dual listed in Colombo and Luxembourg. In 2025, it added a third listing on India’s NSE International Exchange at GIFT City.

DFCC Bank announced Sri Lanka’s first Blue Bond issuance, rated ‘A(EXP)(lka)’ by Fitch. The proceeds are being directed to clean water, sustainable fisheries, ecotourism, wastewater management, and climate adaptation. These are not symbolic exercises. They are a statement that Sri Lanka can meet global standards, attract capital, and channel it into the areas that matter most to our people and environment. From hydro to solar, from Green Bonds to Blue, DFCC Bank’s role has been consistent: not to follow global standards, but to prove that Sri Lanka can set them.

DFCC Bank and DFCC Vardhana Bank amalgamated in 2015.

Customer Centricity as Culture

DFCC Bank’s evolution has always been guided by one principle: putting customers first. That is why its portfolio extends across needs. Pawning services provide liquidity in difficult times. Remittances connect families across borders. Retail loans give people a path to home and vehicle ownership. For DFCC Bank, becoming the most customer-centric bank is not about slogans. It is about guiding customers even when that guidance requires saying no. We take pride in our unblemished track record. When you bank with DFCC Bank, you know we act in your best interests – even when it means turning down a request. That is the role of a responsible bank: to guide and protect its customers. Technology amplifies this ethos. The relaunch of DFCC ONE has made it possible to onboard entirely online. DFCC iConnect, the enterprise cash management platform, has continued to evolve. Combined with a nationwide network of over 130 branches and access to more than 6,000 ATMs, the Bank delivers reach, reliability, digital ease, and human connection.

DFCC Bank funded the first grid-connected solar project in 2016.

Building for the Future: Digital and AI

The future of banking will be digital and intelligent. At DFCC Bank, artificial intelligence and machine learning are already being integrated into underwriting, fraud detection, and customer journeys. Nearly every product is on its way to being digitally enabled. But technology alone is not enough. Capability matters. That is why DFCC Bank launched the Learning Academy in 2024, delivering more than 100,000 training hours across digital, technical, and leadership skills.

In 2025, the PACCE values framework – Passion, Authenticity, Courage, Collaboration, and Excellence – was introduced to ensure that culture keeps pace with capability.

Together, these investments prepare our people for the future, a future where digital and human intelligence must work side by side to better serve customers.

Press conference to announce the DFCC Bank’s Accreditation by the Green Climate Fund in 2023.

Pioneering the Issuance of Green Bonds at the Colombo Stock Exchange in 2024.

Growth with Responsibility

Seventy years on, the philosophy remains unchanged. True progress is not speed or scale alone. It is resilience. It is a responsibility. It is relationships that last.

Finance can change the course of a nation. It can also protect and guide. That has been DFCC Bank’s role for seven decades – from the early days of factories and SMEs, to the rise of clean energy, to the dawn of sustainable capital markets.

As DFCC Bank enters its eighth decade, the promise remains: growth with responsibility for an enduring future.

DFCC Bank became the first foreign corporate to list a bond on India’s NSE International Exchange at GIFT City in 2×025.