May 11, 2023. Edith Muthoni

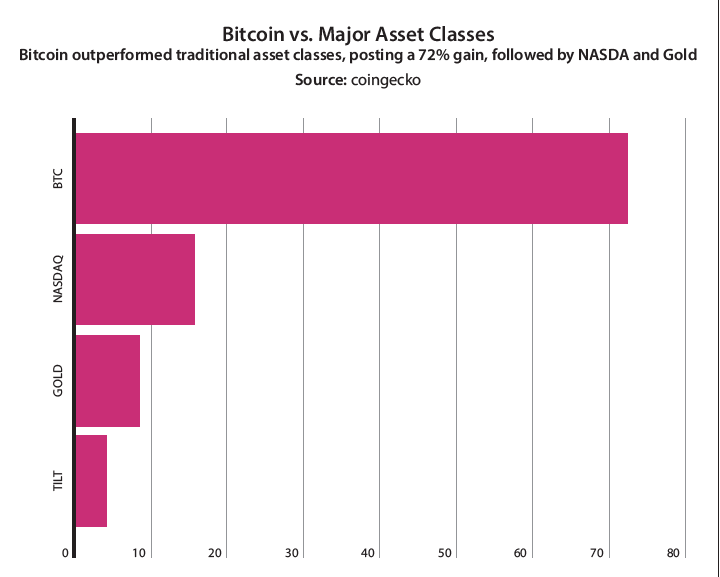

Over the past few months, Bitcoin (BTC) has experienced a surge in value that has left all other major asset classes trailing. Per a BitcoinCasinos.com report, the premier cryptocurrency had an impressive 72.4% quarter-over-quarter gain in Q1 2023.

Comparatively, the NASDAQ index jumped 15.7%, while gold had an 8.4% increase. Buoyed by positive inflation data, the US Dollar Index (DXY) remained fairly unchanged. And while all major asset classes ended the quarter with positive returns, crude oil decreased by 6.1%.

According to BitcoinCasinos financial expert Edith Reads, Bitcoin’s Q1 performance is a testament to its resilience and growth potential amidst a volatile and uncertain global market. Since its inception, BTC has been battling several hurdles, including regulatory crackdowns, hacking incidents, and market fluctuations.

Edith explains, “Bitcoin’s impressive gains clearly indicate its resilience despite the volatile market conditions. With the increasing institutional adoption and global recognition, the asset class is proving to be a reliable store of value for investors and traders alike.”

Reasons for Bitcoin’s QoQ Surge

Several factors have contributed to the coin’s impressive performance during this period. The first is the growing number of institutional investments, which have been pouring in since the end of last year. This influx of capital has helped to stabilize the market and create a better sense of security for investors, leading to increased market confidence.

Additionally, BTC’s value surge could have resulted from broader macroeconomic trends. These include inflationary pressures, rising interest rates, and geopolitical tensions, leading investors to seek alternative investment options.

Moreover, recent developments in the regulatory environment have also played a significant role in boosting Bitcoin’s fortunes. With major countries such as the US and the UK regulating cryptocurrency, more investors feel comfortable jumping on board, further propelling its upward trajectory.

Finally, the surge in the coin’s value is also driven by increased demand from retail investors looking to diversify their portfolios with alternative investments such as cryptocurrency. This demand is further fueled by the growing adoption of blockchain technology, easing crypto investments.

Is BTC a viablel longterm investment?

The latest surge in Bitcoin’s value raises questions about whether it is a viable investment for the future. It is worth noting that while Bitcoin’s Q1 gains are remarkable, the cryptocurrency is still facing significant challenges.

Of course, no investment is without risk, and Bitcoin’s unpredictability is still a cause for concern for some investors. However, with the cryptocurrency market as a whole stabilizing and BTC continuing to post impressive gains, it will likely remain a strong investment option for those looking for high returns.

Would-be investors must remember that the cryptocurrency market is notoriously volatile, and longevity is uncertain.