As the COVID-19 pandemic continues to ravage the world, every industry, com- pany, and business is slowly learning to adapt to new consumer behavior. Industries that previously enjoyed consistent and sustained growth worldwide are now faced with new chal- lenges. Beauty and personal-care is one such industry as it is expected to shrink for the first time in over a decade.

According to data acquired by Fraicheur, consumer behavior has changed significantly as use of beauty products has declined: 90% of women state they use little to no makeup while working from home. Consumer retail spending on beauty products is experiencing a sharp decline (up to 20%) as well, leading to an A global pandemic and health crisis seems to have a significantlydifferent impact on certain sectors. unprecedented projected $175 billion USD loss in revenue for the industry.

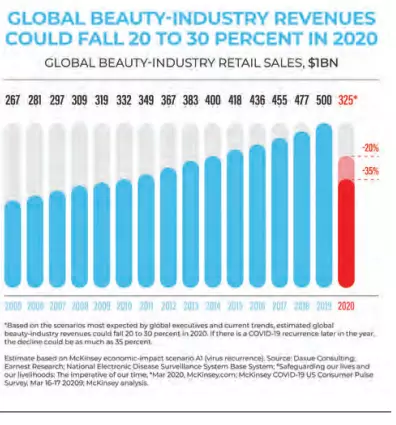

Consistent growth has been the signature of the global beauty-industry. In fact, it has been so resilient to economic turmoil that the financial crisis of 2007-2008 only had a minor impact on overall revenue. Yet, a global pandemic and health crisis seems to have a significantly different impact on certain sectors.

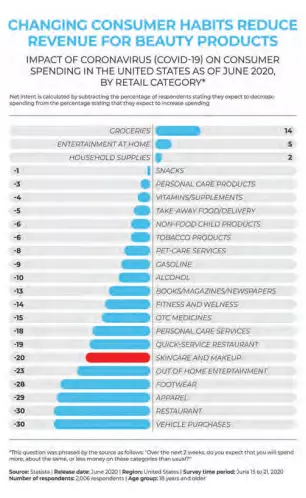

Changing consumer habits reduce revenue for almost all beauty products

The COVID-19 pandemic seems to have greatly changed consumer behavior. As work from home and significantly reduced social activity is becoming the new norm, there seems be less reason to purchase beauty and skin- care products. Beauty routines are trending towards lessened use of makeup as a large part of the consumer base is required to work from home.

Consumer spending habits are trending towards large losses for the beauty industry as well. Skincare and makeup are experiencing a sharp drop in retail (-20%) with only personal care faring slightly better (-3%). Every tendency seems to point to McKinsey’s predictions: a large expected loss in yearly revenue for the beauty industry.

For the first time in decades, it seems that the long-term attractiveness of the beauty industry has been shaken up. How could it recover faster? Is waiting for the first quarter of 2022 necessary? Our answer lies in the digitization of the industry.

Moving online could help recovery

Most industries are quickly moving towards focusing purely on online sales, the beauty industry is surging ahead. Unfortunately, in- person consultations are a large part of the sales process. Moving consultations online or remov- ing them entirely is bound to create new chal- lenges and issues. Other key aspects of beauty such as testers for fragrances only compound the difficulty of digitizing sales.

Yet, innovating in the digital space is the only way to speed up recovery. As consumers trend towards shopping online, beauty industry players report that their e-commerce sales doubled or even tripled.

Over a third of consumers state that they will continue shopping online for beauty products after the pandemic subsides and retail stores reopen. In an industry wrought with e-commerce challenges and a large preference for in-person sales (pre-COVID retail accounted for more than 70% of all purchases), innovations in the digital sphere could provide significant aid and help recover the sector quicker.

COVID-19 put the beauty industry at an impasse. Moving online has become a neces- sity in an industry where products require interaction and consumers prefer in-person consultations. Providers and producers now have one goal: innovation. Figuring out an ingenious solution that would draw in custom- ers, new and old, would be the saving grace for those hoping for a quick recovery.