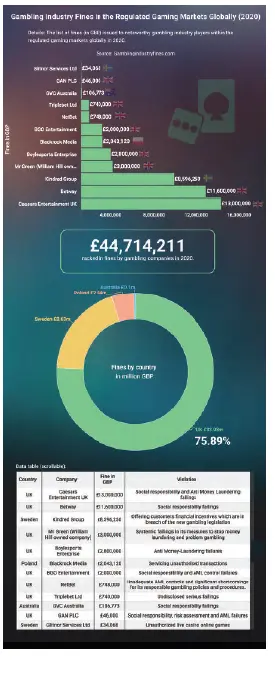

OVER £44MN IN FINES RACKED BY GAMBLING COMPANIES IN 2020, UK ACCOUNTS FOR 75 PERCENT

As the global gambling industry continues to evolve, regulators are paying attention to ensure the sector adheres to best practices. In 2020, various violations have seen several companies pay millions of fines. Data presented by SafeBettingSites indicates the global gambling companies in regulated markets have been fined £44.7 million in 2020. United Kingdom-based Caesars Entertainment leads with fines amounting to £13 million. Glitnor Services from Sweden has the least fines from the overviewed markets at £34,068. Most of the fines have been issued in the United Kingdom with the region accounting for £33.93 million or 75.89 percent of the penalized gambling companies. Australia accounts for the least share with cumulative fines of £0.1 million.

Gambling regulations and fines on the rise as industry grows

The fines are from various violations like failure to report suspected money laundering transactions, social responsibility filings, and unauthorized live casino online games. The fines are part of a broader initiative by regulators to enhance sanity in the gambling sector alongside protecting consumers. The sector has become a key component for various economies globally hence the need for close monitoring.

The covered fines can be considered hefty and it is worth mentioning that some companies violated the regulations before the 2020 period. It is no surprise that the UK leads in the fines since regulators in the country have in recent years intensified a crackdown on the sector. Regulators have been constantly proposing updates to existing laws to mirror the changing market. The changing regulations hope to improve the industry and protect the vulnerable in society.

As highlighted, some of the regulators imposed fines on unauthorized online gambling and the violation might potentially attract more fines later. In 2020, the coronavirus lockdown meant that most casinos had to turn most of their businesses online as physical meetings were banned. Regulators will be keen to determine if the shifting of operation online adhered to laid down laws. The fines might come at a later stage since investigations into such violations take time.

Most regulators, however, acted by enacting new strict temporary measures to protect consumers from gambling addiction during the pandemic. Some regions are considering enacting the regulations permanently, an aspect that contributes to more fines since most companies might not be ready for full implementation. A big chunk of the fines are due to the con[1]duct of heavy gamblers. For most jurisdictions, gambling companies are required to conduct checks on how this group of gamblers funds their bets, as a condition of their license to operate.

Among the covered regions, regulators usually require gambling companies to report any suspicious activities like money laundering. When companies fail to raise such issues, authorities take the initiative to investigate the violations and take the necessary action. In most regulated markets, authorities have already ordered a review of existing laws, an aspect that will likely contribute to more fines. For example in the UK, there are calls to review gambling companies’ schemes about large gamblers. The proposed gambling law changes are mainly geared towards protecting children and the vulnerable from gambling-related harm while reducing the risk of crime linked to gambling.

Gambling companies show willingness to change

The heavy fines and aggressive regulations might not be received well by operators in some countries. Players in the sector argue that the changes will only move the biggest gamblers towards unregulated jurisdictions that do not pay tax or offer gambling support. Most companies, however, continue to show willingness to change to avoid fines. Lobbying activities are being undertaken as regulators review existing gambling acts that seek to tighten regulations.