The COVID-19 pandemic hit the automotive industry hard, causing supply chain disruptions, factory closures, and huge sales and revenue drops. According to data presented by Stock Apps, global passenger car sales is expected to plunge by USD 440 billion in 2020 due to the coronavirus outbreak. The downsizing trend is set to next year, with revenues falling by ten percent YoY in 2021. Revenues to Continue Falling in the Next Two Years Even before the pandemic, the car industry was already coping with a downshift in global demand. In 2016, global car sales revenue, including passenger cars, sports cars, SUVs, and MPVs, hit USD 2.26 trillion, revealed Statista data. In the next 12 months, this figure slightly increased to USD 2.27 trillion. Statistics show that in 2019, global passenger car sales revenues amounted to USD 2.29 trillion. Small SUVs sales, as the largest revenue stream, generated almost 30 percent of that value or USD 647 billion. Large SUVs and large cars segments followed with USD 362 billion and USD 275 billion in revenue, respectively. However, the COVID-19 pandemic caused a huge hit, with total car sales revenues falling by almost 20 percent year-over-year to USD 1.85 trillion in 2020. Statista data revealed that revenues in the large cars segment are expected to drop by 25 percent YoY to USD 233 billion. Large SUV sales are set to witness a 24 percent cut this year, with revenues falling to USD 275 billion in 2020. Small SUVs follow with a 20 percent drop and USD 525 billion in revenue.

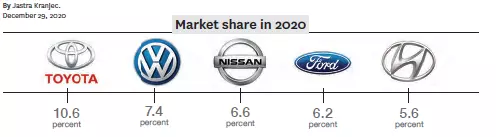

Analyzed by carmakers, Toyota represented the market leader with a 10.6 percent market share in 2020. Volkswagen ranked second with a 7.4 percent market share. Nissan, Ford, and Hyundai follow, with a 6.6 percent, 6.2 percent, and 5.6 percent share, respectively. Statistics show the downsizing trend is set to continue in 2021, with global passenger car sales revenues falling to USD 1.65 trillion. In 2022, this figure is expected to decrease by another six percent to USD 1.55 trillion. Three Largest Markets Lost USD 231.5 billion in Revenue Amid COVID-19 Crisis Statista data also revealed that all of the leading car markets are expected to witness a two-digit revenue drop this year. As the largest market globally, the car sales revenue in the United States is forecast to fall by almost 18 percent YoY to USD 507 billion in 2020. This figure is expected to plunge to USD 385 billion in the next two years, nearly 40 percent less than in 2019. China ranked as the second-largest market globally with USD 452 billion in revenue in 2020, an 18 percent fall year-over-year. By 2022, total car sales revenues in China are set to drop to USD 405 billion. As the third-largest market, Japan witnessed an almost 19 percent YoY drop, with passenger car sales revenues falling to USD 92 billion in 2020. Germany follows with USD 86.5 billion in revenue, 17 percent less than in 2019. The Statista data show the three leading markets lost USD 231.5 billion in car sales revenues in 2020 due to the COVID-19 crisis.

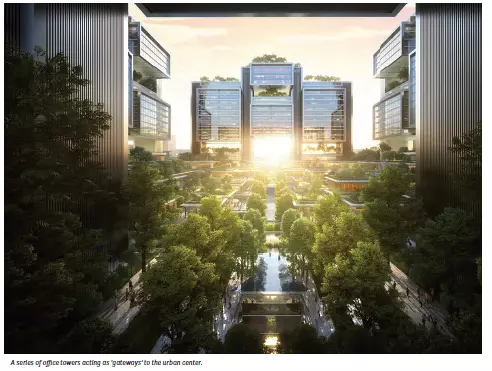

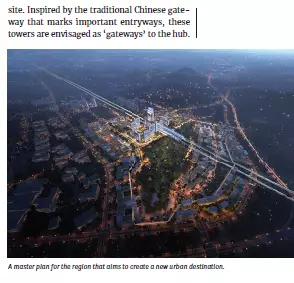

The openings at the ground level of the tower buildings mark the central access to high-speed rail station. Subways and bridges to neighbouring plots create convenient connections for pedestrians, cyclists and autonomous vehicles. A new transport museum is situated on the bridge over the high-speed rail station, connecting the eastern and western halves of the site. Visitors will enjoy futuristic exhibition displays using latest VR, AR and projection mapping technologies against the panoramic view of the high-speed rail station. In addition to controlled wind and solar access, the project maximizes landscape areas, public amenities and pedestrian priority to provide enjoyable outdoor spaces. The design aligns with the city’s Sponge City program with an emphasis on prioritizing the use of sustainable urban drainage systems through the integration of landscape, permeable pavement and bio-retention water features.