July 1, 2025. Paul Hoffman.

Today, the world’s most resilient companies aren’t necessarily those with the fastest growth or biggest headcount, they are often the ones running with tight, strategically engineered operations in a volatile landscape. Whether it’s Babcock International riding a defence spending boom to lift its operating margin to eight percent, or Meta generating a 201 percent profit surge after cutting 21,000 jobs and doubling down on AI infrastructure, one message is clear: operational efficiency has become the defining corporate metric in today’s margin-driven economy.

Sector differences in operating margin often reflect strategic trade-offs: growth vs. profitability, automation vs. labour, or scale vs. localisation. To illustrate this, the research team at BestBrokers conducted a cross-industry comparison of large-cap companies based on the latest data from CompaniesMarketCap, analysing their operating margins to identify which sectors are achieving the most efficiency.

We discovered that the industries that portray the highest operational efficiency are Port Operations (38.5 percent), Finances & Investments (32.4 percent), Tobacco (31.2 percent), and Railway Operations (30.1 percent), showing how certain traditional sectors maintain strong average operating margins, despite economic headwinds.

Railway and Port Operations companies typically invest huge amounts of money into infrastructure and have minimal marginal costs per shipment after the initial investment. There is also very limited competition in these particular industries. These are just a couple of reasons why their average operating margin is among the highest, 38.47 percent for Port Operations and 30.13 percent for Railway Operations. The most efficient companies in these industries are International Container Terminal Services (53.4 percent) and Adani Ports & SEZ (51.9 percent), Canadian National Railway (39.8 percent), and Union Pacific Corporation (36.2 percent), respectively.

Financial companies (investors, banks, and financing firms) also record a substantial average operating margin of 33.64 percent. By borrowing money at significantly lower interest rates, banks are able to turn a major profit. For example, the Dubai Islamic Bank is among the banking companies with the highest operating margin (74.38 percent) due to the fact that the company’s strong fee-based income comes with very low marginal cost. Pure investment companies such as Industrivarden typically have very high operating margins as their main revenue comes from dividends and capital gains from their portfolio companies. The Swedish investment company is a great example, with its operating margin of 99.57 percent, a clear indicator of very low operating costs relative to its revenue.

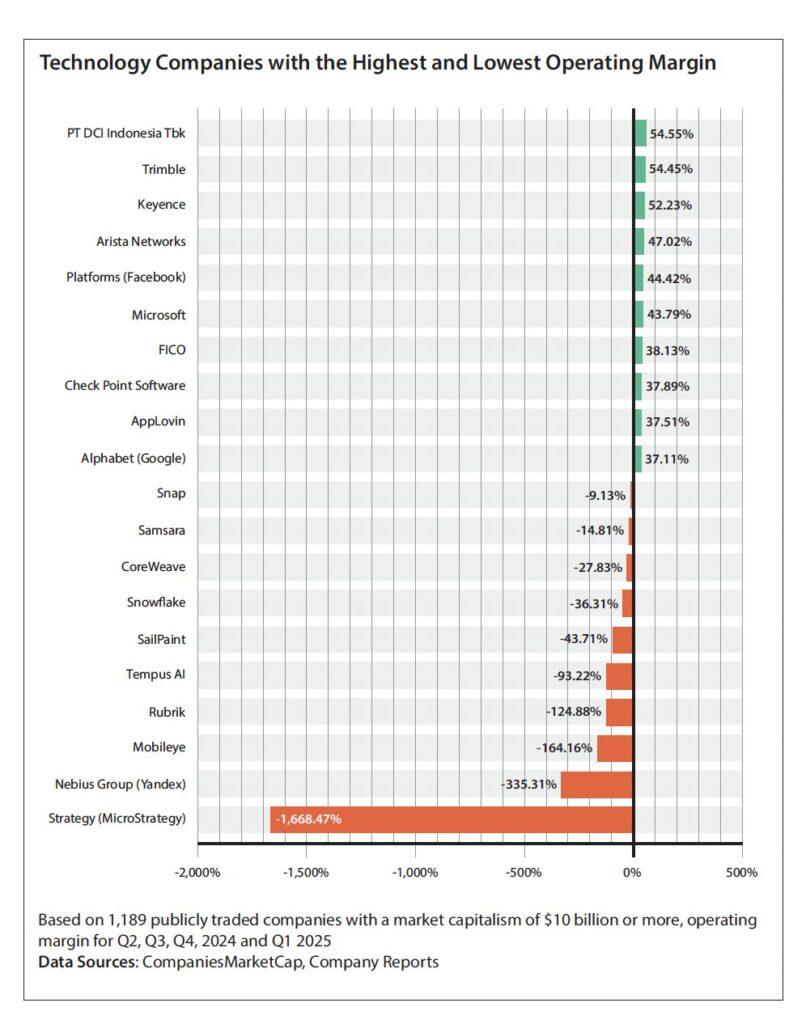

Margins in Big Tech lower than expected

The technology sector has the second-lowest average operating margin across all industries at -5.76 percent, largely due to aggressive spending. Early-stage companies in AI, SaaS, and biotech often operate at a loss for years while scaling, pulling down the industry average. In stark contrast, PT DCI Indonesia tops the list with a 54.6 percent margin, benefiting from low operating costs, benefits from large-scale operations, and steady income from data centre contracts in a fast-growing Southeast Asian market. Keyence, one of Japan’s most profitable companies, maintains a remarkable 52.2 percent operating margin by holding zero inventory and outsourcing all production, a model that has proven highly resilient amid ongoing global supply chain disruptions. Meanwhile, AppLovin leverages automation and AI to power its large mobile advertising platform, using algorithms to optimise ad placements and monetise its own game inventory.

This approach delivers a solid 37.5 percent margin, even as global digital ad spending grows more cautiously.

Similarly, tech giants like Microsoft and Meta achieve operating margins above 40 percent. Microsoft’s main source of revenue comes from software and cloud services, both of which are high-margin businesses with low incremental costs. Meta earns a big portion of its revenue via advertising, which also scales profitably once the infrastructure is in place.

At the other side of the spectrum, Nebius Group, a Dutch AI and cloud infrastructure company which recently split from Russian technology giant Yandex has an operating margin of -335.31 percent. As cloud services demand grows worldwide, Nebius is investing heavily in expanding infrastructure, typical for early-stage tech firms navigating capital-intensive growth phases, especially amid rising interest rates and tighter investment conditions in 2025. MicroStrategy, a provider of business intelligence, mobile software, and cloud-based services, reports an operating margin of -1,668.47 percent. This extreme figure largely stems from its multi-billion-dollar Bitcoin acquisitions. MicroStrategy’s capital tied to digital assets adds significant financial risk beyond its core software business.

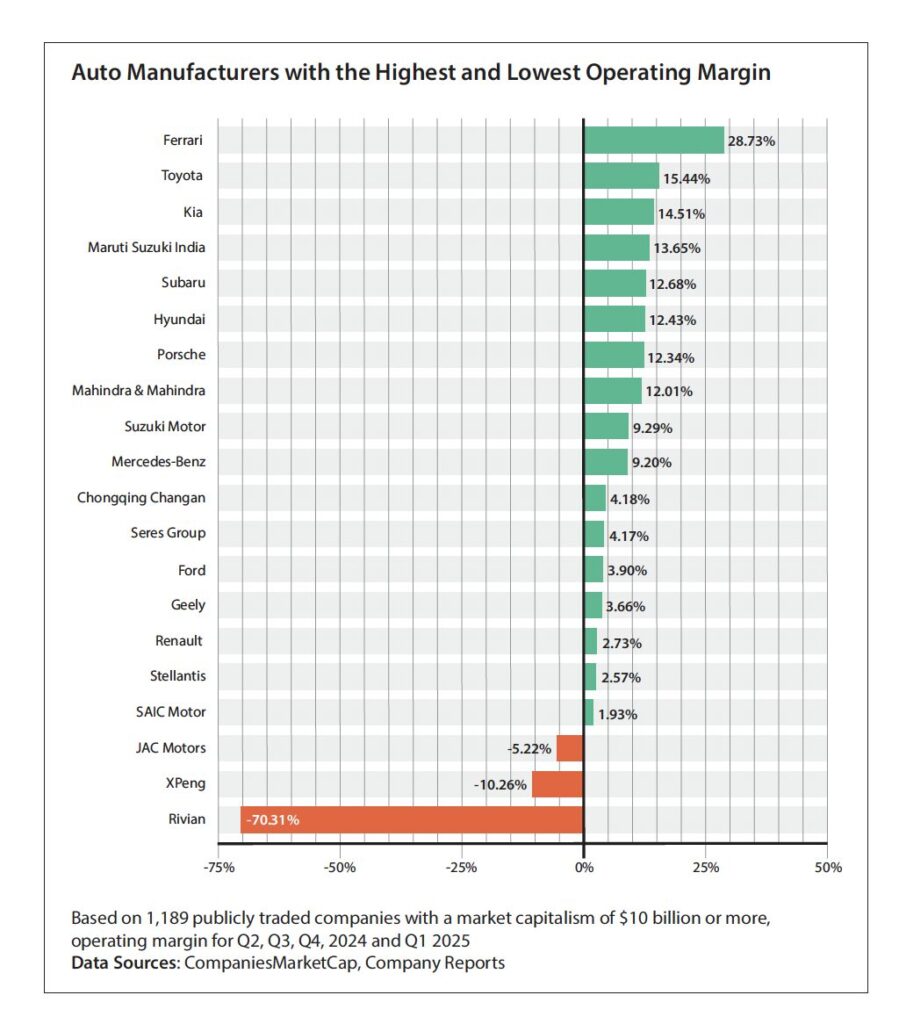

High margins for luxury automakers, deep losses for EV startups

Luxury carmaker Ferrari’s operating margin is 28.7 percent, nearly double that of Toyota, which holds second place at 15.4 percent. Unlike traditional automakers, Ferrari produces a significantly lower volume, delivering just 13,752 vehicles in 2024. Its business model, centred on limited production and premium pricing, enables Ferrari to sustain operating margins well above the industry average of 4.8 percent.

In stark contrast to luxury brands like Porsche and Ferrari, Toyota leads the global market in production efficiency and supply chain management, enabling it to achieve strong margins at scale. The company generates significant profits across a wide range of vehicles, including trucks, sedans, and increasingly, hybrids and plug-in hybrids. This broad lineup helps the Japanese automaker maintain resilience amid tightening regulations and supply chain volatility, securing its second place in efficiency with a 15.4 percent operating margin.

The lowest operating margins in the auto industry are mostly found among early-stage EV startups heavily investing in R&D, manufacturing, and delivery infrastructure. Rivian, a US electric vehicle startup, is a prime example, with an operating margin of -70.3 percent. Beyond significant upfront costs, the company also faces ongoing production challenges and supply chain disruptions that further pressure profitability.

As China intensifies its push to lead the EV race, XPeng, one of the country’s most promising EV makers, is facing fierce competition from major players like NIO, BYD, and Tesla. This has forced the company to invest heavily in marketing technology advancement, resulting in a relatively low operating margin of -10.26 percent.

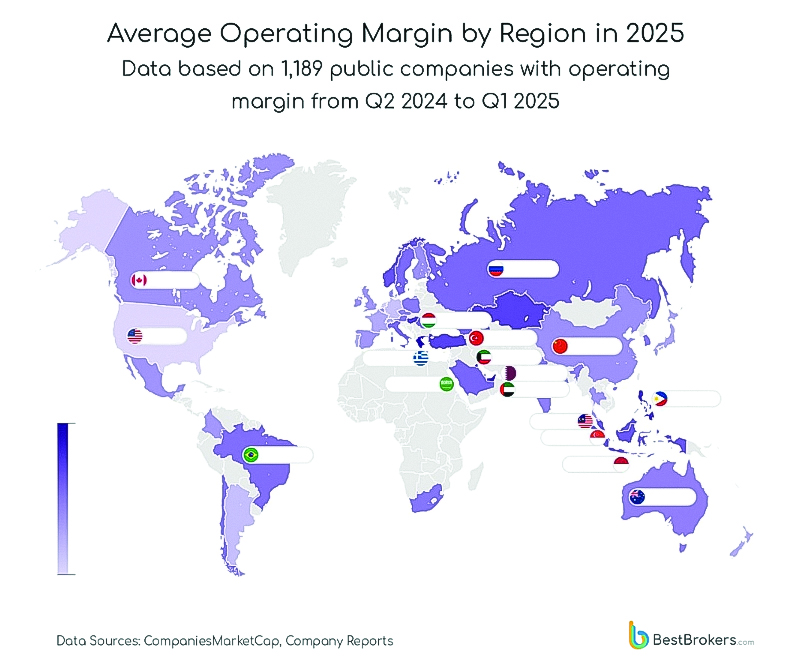

Company Efficiency Trends by Region

Looking at average operating margins by country, Kuwait (61.8 percent), Greece (60.2 percent), and the UAE (54.7 percent) stand out as top performers. However, each of those has a relatively small number of large cap companies, with between 1 and 8 valued over USD 10 billion. In the Asia-Pacific region, strong averages come from South Korea (30.6 percent), Australia (28.31 percent), and Japan (17.7 percent). In Europe, standout performers include Belgium (22.4 percent), Austria (29.8 percent), and Denmark (25.3 percent), while larger economies like Germany (7.9 percent) and France (16.4 percent) report more moderate averages, likely due to the challenges if balancing legacy industries with the costs if green transition policies and rising labour expenses in 2025 the United States (0.2 percent) and the Netherlands (three percent) have fairly low average operating margins, despite the large number of companies with market caps above USD 10 billion, over 431 companies in the US and 20 in the Netherlands. This suggests a higher concentration of capital-intensive, high-growth tech startups, and growth-stage companies in these markets, which significantly drags down the averages. Many of these firms are still investing heavily in expansion, driving losses that weigh down the overall averages as investor appetite cools and capital becomes harder to access for high-growth firms.