December 5, 2022 Justinas Baltrusaitis

With the prevailing global economic turmoil, most start-ups have shed a significant share of their valuations as investors stay back, awaiting normal conditions to resume. Despite the general market conditions, several regions are leading in the number of unicorns or private companies valued at least $1 billion.

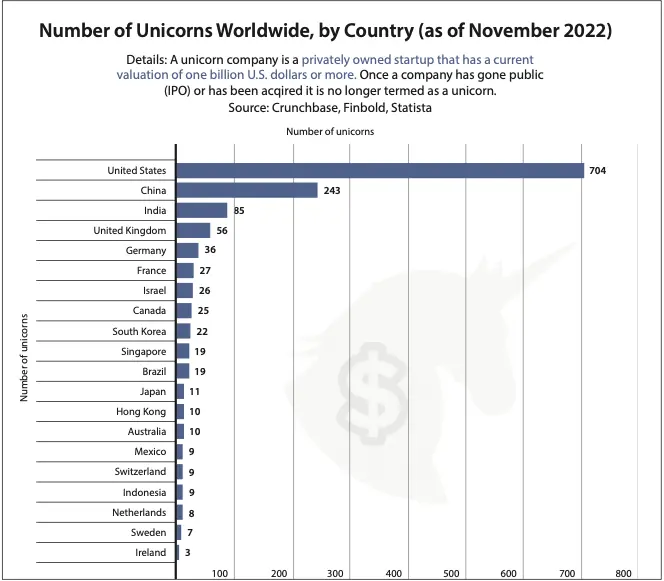

In particular, data acquired by Finbold indicates that as of November 2022, the United States had the highest number of unicorns at 704. China comes a distant second with 243 unicorns, while India ranks third at 85. The United Kingdom ranks fourth with 56, while Germany ranks fifth with 36 unicorns. Indeed, the U.S. has at least double the number of unicorns compared to both China and Indian combines.

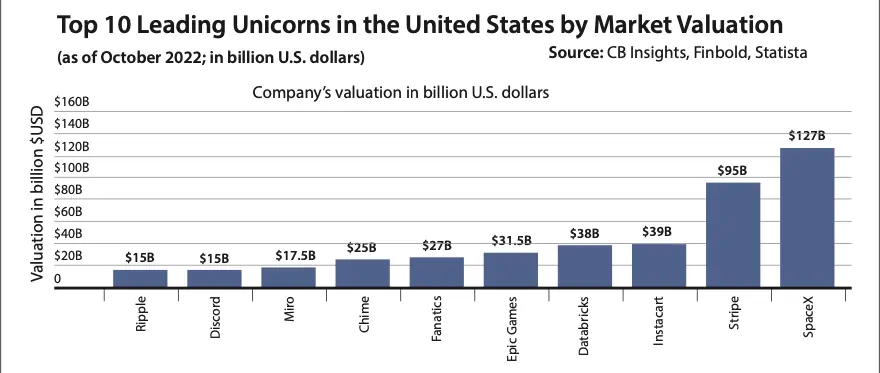

Elsewhere, a breakdown of top unicorns in the United States indicates that the space company SpaceX ranks top with a valuation of $127 billion, while payment firm Stripe ranks second at $95 billion. Instacart ranks third, valued at $39 billion, followed by Databrick’s $38 billion valuation. Meanwhile, gaming company Epic Games ranks fifth at $31.5 billion.

Why U.S. and China Dominate the Unicorn Scene

Notably, the unicorns are spread globally, but the United States and China account for the giant share considering the two countries are the largest economies in the world.However, the U.S. domination can be tied to specific factors like an enormous funding pool, innovation capability and a well- regulated environment. In this case, entrepreneurs can launch different projects without worrying about funding or the government clamping down. Additionally, the U.S. dominance over China can be linked to the Asian country’s stringent laws on the private sector. With a robust private sector led by the tech industry, the government moved to curtail the powers of such entities. In this case, there is a widespreadfear of companies accelerating their growth, with venture capitalists remaining sceptical. In this line, the regulations will likely impact Chinese firms with solid revenue growth, corporate governance, and disruptive technology. Interestingly, such companies are attractive to investors.

State of U.S. Start-up space

Furthermore, the top unicorns in the United States are dominated by select industries like fintech, cryptocurrency, and video games. In this case, the enterprises have gained popularity in recent months by building on the digitization phenomenon that accelerated during the pandemic. In this case, the unicorns are capitalizing on the newfound urgency of increased demand to attract new clients and investors. Some companies have also benefitted from late-stage funding as non-traditional players enter the market. For instance, the recent growth of sectors like fintech has ushered in funders who are solely targeting companies operating in the crypto sector.

Overall, attaining unicorn status is a crucial milestone as it helps companies attract the best talent alongside the much-needed media attention while founders move on to pursue other ventures.

The Future of Unicorns

At the same time, it is worth noting that attaining unicorn status does not translate to success. Notably, with the $1 billion valuation, most companies still depend on external funding while attempting to work out a profitable model. Critics have, for instance, stated that attaining unicorn status without profitability might be considered a fad. Indeed, the ability of the unicorns to maintain their valuation remains uncertain, considering the overriding fears of a global recession. The state of the economy has forced most firms to slow hiring, laying off staff as potential funds cut down on investments.

It is worth noting that unicorns are now prime candidates for Initial Public Offering (IPO). However, the possibility of launching an IPO will likely depend on the state of the economy. Notably, the stock market remains depressed, with most companies losing a big chunk of their valuations.