Oct 1, 2024. Andreja Stojanovic

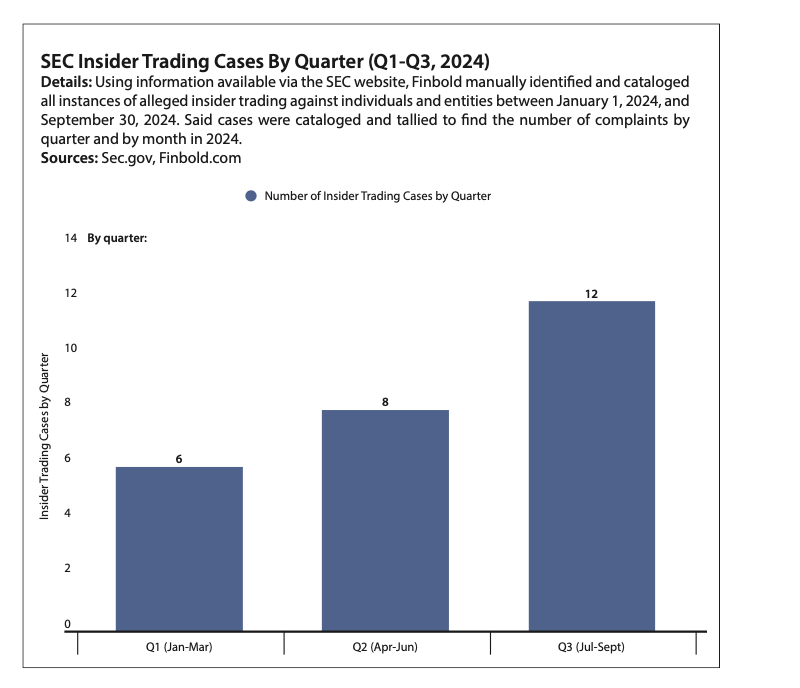

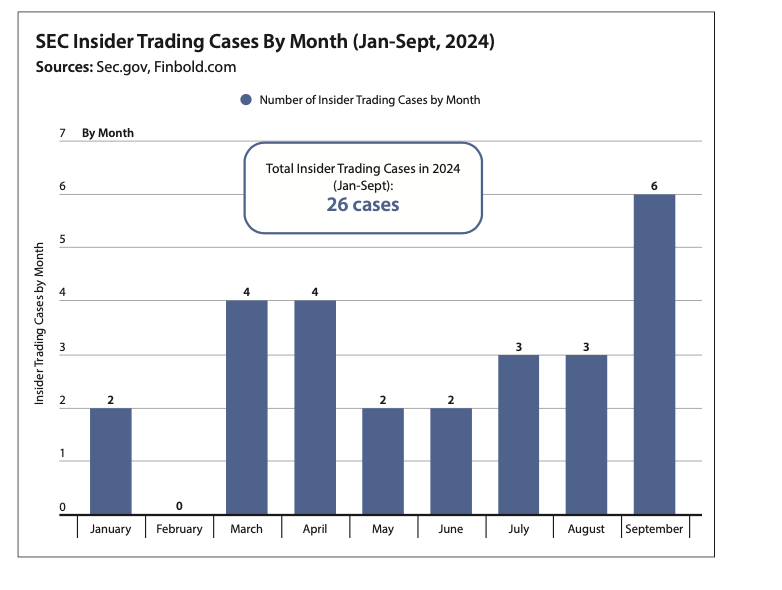

Out of the 228 cases announced by the U.S. Securities and Exchange Commission (SEC) in the first three quarters of 2024, 26 involved illegal insider trading. These cases remain especially significant because they can severely harm legitimate investors and undermine the integrity of financial markets.

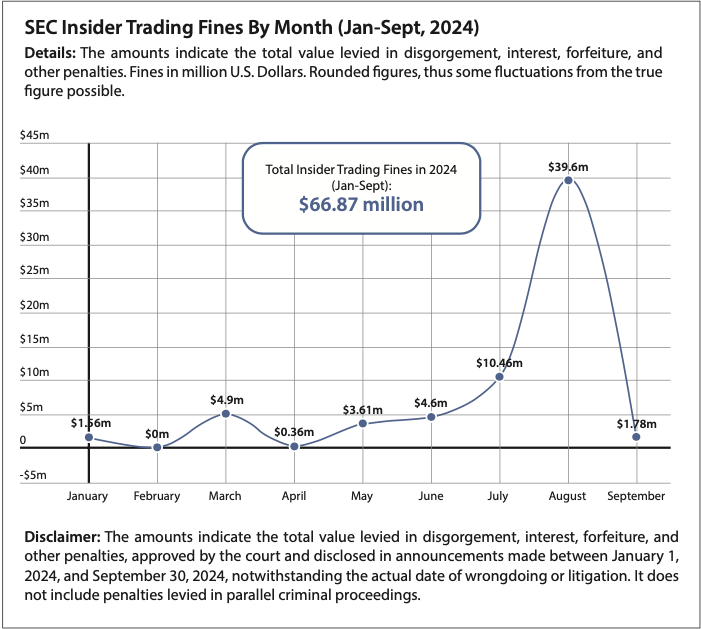

This severity of the crime is exemplified by the fact that, despite accounting for only 12 percent of all litigation in the year, Finbold research uncovered that the SEC had levied a total of USD 66.8 million in monetary penalties against insider traders between January 1 and September 30, 2024.

On average, each case has led to a fine of approximately USD 2.3 million, and the regulator has been levying more than USD 7 million per month from insider trading litigation in 2024.

Still, it is worth pointing out that not all 26 unveiled cases had received their resolution by press time on October 1, and, indeed, a handful of exceptionally major cases inflated the total penalty figure.

A single case in August accounts for more than half of total insider trading penalties in 2024

In August, fines surged nearly four times higher than any other month in 2024, primarily due to the high-profile case against Shaohua (Michael) Yin and Benjamin Bin Chow.

On the penultimate day of the month, the SEC secured a final judgment against Yin in a case involving high-profile companies such as DreamWorks Animation SKG, Inc. and Lattice Semiconductor Corporation (NASDAQ: LSCC). Yin amassed nearly USD 30 million in illicit profits from these trades.

The resulting penalty amounted to USD 39.5 million – more than half of all disgorgement, injunctive penalties, interest, and other payments the SEC levied by the end of September 2024.

Along with its size, the case illustrates the regulator’s slow and meticulous process. The judgment against the other defendant, Benjamin Bin Chow, accused of providing Yin with insider information, was entered on August 25, 2022, approximately two years earlier.

The SEC’s meticulous approach is also highlighted by the fact that most cases were resolved with the defendant agreeing to pay substantial penalties, albeit without confirming or denying the watchdog’s allegations.

SEC resolves long-standing Coinbase insider trading case in 2024

The first three quarters of 2024 have also featured a mix of high-profile and less-publicized cases.

On March 11, the SEC resolved its lengthy case against Ishan Wahi, a former product manager at Coinbase (NASDAQ: COIN). To be precise, the SEC revealed it had secured the final judgment against one of Wahi’s friends, Sameer Ramani.

Ramani was accused of using insider information about future Coinbase listings to guide his cryptocurrency trades and was ordered to pay USD 817,602 in disgorgement and a USD 1.6 million civil penalty.

The SEC also highlighted that Wahi’s actions went explicitly against Coinbase’s instructions not to use his foreknowledge of listings and delistings for insider trading.

September case highlights potential profitability of illegal insider trading Simultaneously, less prominent cases unveiled in 2024 demonstrate just how much of a stock market advantage can

be gained by illegally using material inside information.

On June 7, 2022, a financial advisor named Federico Nannini allegedly used his foreknowledge of MasTec Inc.’s (NYSE: MTZ) then-pending acquisition of Infrastructure and Energy Alternatives, Inc. (IEA) to help himself, his father and several friends accrue illicit profits in excess of USD 1.1 million.

Text messages obtained by the SEC for the case revealed that the scheme involved multiple trades driven by a string of insider updates on the progress of the acquisition provided by Federico Nannini.

While the case remains unresolved since its public announcement on September 16, 2024, the SEC is expected to seek penalties between USD 2 million and USD 4 million against the four individuals.

The number of enforcement actions and the severity of the penalties – in proportion to the illicit profits gained – demonstrate the agency’s commitment to protecting market integrity.

The uptick in the number of cases in the third quarter and the continuous updates on previous cases provided by the SEC highlight that the public and investors can expect more robust efforts to maintain fairness in financial markets.