A Brief History Of Timeshare

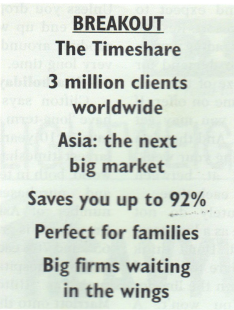

The timeshare vacation has been around since the mid-1960s. It started in the French Alps, had its ups and downs in Europe, quickly appealed to the US vacationer and now it’s Asia’s turn. Globally, some three million people have bought timeshares. That represents revenue of more than US$15 billion worldwide.

What’s The Deal?

Timeshare companies base their marketing push on the concept of buying tomorrow’s holiday at today’s prices. That means locking in your holiday costs for a period of between 20 and 40 years. Sounds like sense.

You buy a holiday apartment at a vacation resort. You receive the exclusive right to use that apart ment for a period of time each year.

In Malaysia, timeshare is fast catching on. It’s currently the market leader in South-East Asia, with some 21,000 time share purchasers. Berjaya Vacation Club, for example, offers you a 38-year membership for around US$6,500. For that you get 7 nights holiday accommodation a year, for the next 38 years, at a Berjaya resort. Berjaya estimates the scheme saves you up to 92% on your accommodation costs per year. And at the end of 38 years, you get back the price you paid for the apartment in the first place.

What if I get bored with my resort?

Enter the exchange companies. Most timeshare developers are affiliated to an exchange company. The two largest are the US firms Resort Condominiums International (RCI) and Interval International (II). It’s the emergence of the exchange industry that has given timeshare the flexibility and credibility it needs to move into the realm of very big business. RCI has some 2,900 affiliated resorts around the world, II has around 1,400. Subscribers to the exchange service can jet across the globe and enjoy different sights at different locations every year. Some 80% of timeshare purchasers buy intending to use the exchange option.

Are we right for each other?

If you’re a family then probably yes. If you’re a ‘Lonely Planet’ wanderer then probably no. Timeshare companies market themselves on being able to provide a home away from home. That is, the unit comes fully equipped with furniture, consumer durables and self catering facilities. And different grades of resort will offer different grades of amenities. The family gets to spend time together without having to dance to the deadlines of a package trip. David Clifton, group managing di rector for Asia Pacific Oceania at RCI Asia Pacific, says RCI has about 2 million families on its books worldwide. In Asia, 84% of RCI’s clients are families.

But we’re not your usual family

But families aren’t all the same and this is where you need to think about your individual needs. You may like to plan your holiday far in advance. You may like to go to popular spots at peak holiday times. Your vacation time may be determined by children’s holidays. If so, then you’ll be wanting to buy a week in high demand at a top-end resort. That could cost you anywhere from US$5,000 to US$20,000. But if you’re the type of family who can travel at short notice, is flexible on holiday destinations and can travel out of peak season, then a lower priced week is what you want. And they can be had for as low as US$1,000.

OK, so what’s the catch?

Time share companies say there really isn’t one. You really can enjoy holidays around the world years from now, at yesterday’s prices. You really can exchange your week and location when you want something different, and depending on your deal, you can either get your money back at the end of the timeshare period, or pass the unit on to your heirs.

But didn’t it used to be a cowboy?

Yes, people did once live in fear of the hard sell from the timeshare rep. That’s changed. Timeshare companies now respectably advertise through conference facilities, hotels, telemarketing. And there are a plethora of trade associations to protect consumer interests. Clifton points out that any new industry initially attracts resourceful cavaliers. But he says the timeshare industry is ‘coming out of that entrepreneurial stage and progressing to an institutional base.’ Michael Ryshouwer, managing director of II Asia Pacific, says he regards the role of exchange companies as something like policemen. The exchange company will strictly check out the credentials of the timeshare company before adding it to their portfolio of exchange resorts.

Advice to set you on your way Buying.

The cost of a timeshare doesn’t stop at the purchase price. It’s a property transaction and there’ll be taxes and transfer fees to pay. Expect to pay somewhere around US$8400 extra. The timeshare company also charges annual maintenance fees. That could be anything from US$100 to US$500, depending on the grade of resort you choose. There may also be club fees. A subscription to an exchange company will cost around US$70 per year. Also consider that maintenance fees are likely to go up with inflation. Expect prices to go up every two to three years in the region of 5%.

Exchanging. Don’t buy into a low-grade resort and expect to swap to a high-end resort. Resorts are graded on their trading power. That translates into demand for the location, the size of the unit and the calendar time on offer. If you buy a turkey, you may get stuck with a turkey. And there’s a charge for exchanging your week. You’ll be looking at between US$90 and US$125 each time.

Selling. Absolutely do not think of a timeshare as a long-term investment. It isn’t. Don’t think you’ll buy a timeshare today and sell it two years down the line for a huge profit. You won’t. A timeshare is not a liquid asset. It’s like any other consumer product. It’s not likely to appreciate. There is a resale market, but it’s in its infancy and it’s a buyer’s market. And if you do decide to sell, it won’t happen overnight either. Unless you drop your price, you could end up with an unwanted product around your neck for a very long time.

Is it a holiday from now on?

Clifton says the sector does. have ‘long-term staying power.’ He says in 10 years, Asia will be the largest timeshare market in the world, both in terms of destination and purchases. Already the number of Asians buying into timeshares is growing by between 65% and 70% each year. The emergence of hospitality heavyweights such as Hilton, Disney and Marriott onto the timeshare scene will lend added credibility to an already burgeoning market.