Goonetilleka

ing their products overseas would be the most influential factor.

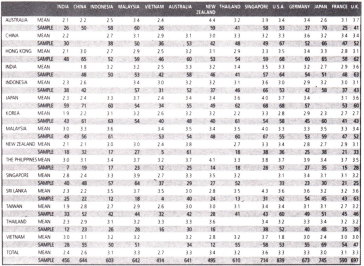

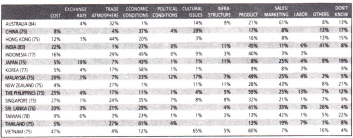

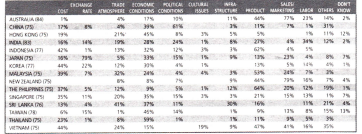

Other relevant factors influencing export performance in the next five years were, exchange rates as given by the Japanese (75%) and political conditions as cited by the Chinese (60%). In Sri Lanka, one of two respondents (49%) said the trade atmosphere would be a factor affecting export sales, while on the other hand more than one of three people (36%) said economic condi- tions played a role as well. Other in- fluences were cited as, product (18%), infrastructure (14%), cost (13%) and political conditions (12%).

The export industry, like other industries has to face its own share of obstacles and here, cost was said to be the primary obstacle. 75% in Vietnam said the trade atmosphere was another obstacle while 58% of Australians cited sales/marketing as a stumbling block.

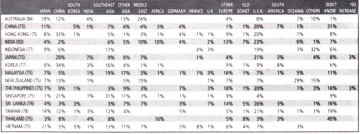

Business, like all ventures has to be initiated, and in the export business there are some countries which are very difficult to deal with; for instance India and China were grouped into this category, with 14 of the 15 countries, including Sri Lanka nodding ‘yes’ to the rate of difficulty. And Vietnam added that the US and Japan fell into this category as well.

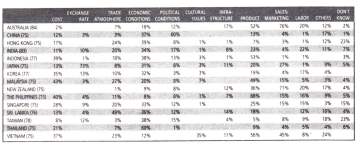

Reasons for the difficulty in initiating trade varied. Exporters in 11 of the 15 countries said the trade atmosphere was a contributing factor while others said product played a part as well. 40% of Asian exporters said the trade atmosphere in India and product in Japan were influential factors as well. Another 25% of Asian respondents, commented that economic conditions in New Zealand played a role, while 20% said, cost and cultural issues were troublesome factors in initiating trade with the UK and France.

Non-problematic initiation of trade was indicated by Australia and New Zealand as they found each other’s country the easiest to deal with. On average, respondents said that Singapore was the easiest country for trade initiation.

The reasons cited for easy trade relations by a majority, were cultural issues and trade atmosphere. 20% of Asians cited political conditions in India while the same percentage said economic conditions in Vietnam also facilitated trade. In addition to trade atmosphere and infrastructure, Sri Lankans cited economic conditions and ‘others’ as reasons for the facilitating of trade with Singapore and Japan.

The boosting of the country’s economy is the ultimate goal for any business. However in a majority of the countries surveyed, the shortage of skilled labour seemed to be a hindrance to the country’s growth. A high 80% in Thailand, Taiwan and Malaysia said economic growth in their countries were restricted by a shortage of skilled labour, and nearly all exporters in Vietnam (96%), echoed the sentiment. 67% in Sri Lanka also agreed.

Generally, the future for export businesses in the Asia-Pacific region looks fairly promising. The determining factors for exports in the coming years seem to be economic conditions and cost, while the main market targeted within the next 12 months is the US. A fact worth mentioning is that one-third of the countries surveyed (Australia, Indonesia, Malaysia, the Philippines and Vietnam) considered Australia as part of the Asian market, while a majority of exporters in the remaining countries did not agree with this view. Also, a majority from Australia and Vietnam perceived New Zealand to be a part of Asia but 13 out of 15 countries disagreed.

All facts and figures given above were provided by the DHL Export Indicator Survey from research done by the Gallup Organisation.

The DHL Export Indicator (EI) is an independently commissioned research study from DHL. DHL Worldwide Express is the world’s leading air express service, linking more than 80,000 destinations in 220 countries.