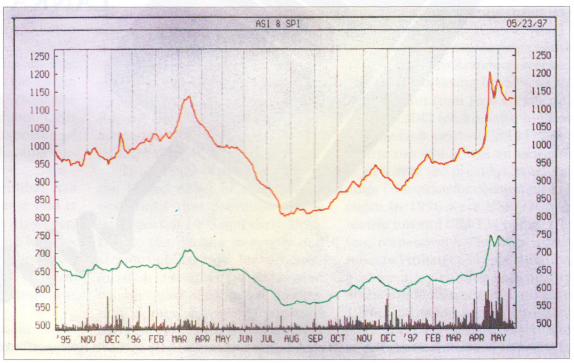

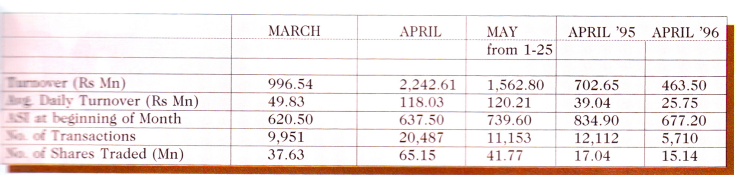

The month of May began with the market continuing to look strong with high turnover recorded, but gradually the level of activity declined and so did the indices. The market has now stabilized at current levels with both buyers and sellers waiting for fresh news in order to make their next move. Throughout May the indices have remained stable trading within a narrow range, between 746.4725.4 for the All Share Index, and between 1182-1124 for the Sensitive Index.

In the first week of May there was healthy participation by both local and foreign institutional investors, and the market declined only on retail profit-taking. Active participation by institutional investors reassured the market that the decline was only temporary. During this stocks traded at a premium of over 200% to their issue prices. During the second and third week turnover dropped drastically with local and foreign institutions remaining on the sidelines, but the market continued to consolidate. The plantation sector was again the main attraction with 3.8 million shares of Bogawanthalawa Plantations and 2.3 million shares of Kelani Valley Plantations being traded. Blue chip stocks such as John Keells Holdings, Aitken Spence, Hayleys and Richard Pieris continued to attract interest during the month.

In April, foreign participation increased to 45% of turnover, in line with the past average of 45- 50%. Due to foreign investment in plantation company stocks net foreign purchases were an impressive Rs 258 million in April, and the first three weeks of May recorded a net inflow of Rs 308 million.

Political Outlook

Currently a massive military operation is underway and most analysts are worried about the impact of this on the economy. If it is a success it would certainly weaken the LTTE and would probably increase the possibility of a negotiated settlement, which would certainly benefit the economy. If it fails the possibility of a prolonged conflict will arise which in turn will result in contin- ued massive defense expenditure which the country could ill afford. It is encouraging to note that the government is placing emphasis on economic development while

maintaining political and military pressure on the LTTE. We have also seen encouraging signs of corporation particularly on economic issues amongst the member countries of the SAARC. Particularly, the approach of the leaders of India and Pakistan certainly augurs well for the development of the region.

Corporate Results

In the banking sector, the top performers for the quarter ended March 31 was Sampath Bank and Commercial Bank which recorded 25% and 16.6% increases in earnings, respectively. But Hatton National Bank recorded a modest 5.8% growth in earnings while National Development Bank’s earnings declined by 12% for the said period. For the year ended March 31. in the manufacturing sector, Tokyo Cement showed a massive 128% increase in earnings while Dipped Products also reached an impressive 80% growth in earnings. In the hotels sector, Trans Asia recorded a 72% increase in profits, certainly the best performer in this sector. Most other hotel sector stocks are expected to record a decline in earnings for the year ended March 31, although they all recorded satisfactory YOY growth in earnings for the quarter ended March 31.

Market outlook

The main reasons for the sudden upward movement in the market has been attributed to the exchange of letters between the President and the leader of the opposition with regards to a bipartisan approach to solve the ethnic conflict. The macro and micro economic factors have also played

a key role for this welcome change in the market’s sentiment. From the macro aspect GDP growth is expected to reach 5.5%, an impressive increase from last years 3.8%, with widespread growth expected from all sectors. In the agriculture sector, with the country experiencing only a minor drought, rice production is expected to increase by 20%, while tea and rubber output will record a more modest 3. 5% growth. But both tea and rubber prices will remain at current levels in the medium term, thus ensuring attractive earnings for plantation companies. In the manufacturing sector with adequate power supplies assured in the medium term we expect production to continue unhindered. Lower interest rates will reduce the cost of funds for many companies which are burdened by high debt levels, and will also encourage investment in new ventures. The government also appears keen on promoting industries, as it attempts to attract as much foreign investment as possible in this sector. In the services sector, tourism appears to be the key growth area. This sector which saw arrivals. drop by 25% in 1996 is projected to record a 25% growth in arrivals, and earnings are expected to grow by 40% with the planned increase in room rates. The forecast for the tourism sector will only hold if the relative calm that prevails in the country is maintained. We expect growth in the banking and finance sector due to increased demand for credit and other banking activities synonymous with a rebounding economy.

The government is successfully handling its privatization program, and is certainly doing whatever it could to reach its targeted proceeds from privatization. The sale of the 35% stake and management control of Lanka Telecom is expected to be completed in the next three months. The government will also sell the controlling interest in three more plantation companies by end-June and will also sell the balance 17% it owns in the country’s largest ceremicware manufacturer, Lanka Ceramics.

Considering the above factors. we are extremely positive on the medium to long term prospects of the stock market. Barring any unforeseen events we conservatively expect the indices to record a 15% growth in the next 6-8 months. Our top recommendations are the growth companies in the banking and finance sector, the diversified holdings and selected manufacturing sector companies.