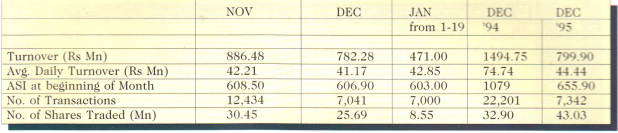

The market, as predicted, appreciated during T the first three weeks of January gaining 4.5% on the All Share Index (ASI) and 4.7% on the Sensitive Price Index (SPI). Investor optimism was the main cause for the growth in the market. When analysing past trends, it is clear that January is the month in which the in- dices appreciate. This was the case in 1994 and 1995. The reasons from a macro point are twofold, firstly, most fund managers make their allocations in January and therefore the market witnesses renewed interest. Secondly, December being a holiday month, even retail investors do stay away from the market and then enter the market in January. Turnover and volume remained healthy as active participation was seen from both local and foreign institutional investors, but unfortunately, net foreign sales were recorded during the first few weeks of January. This doesn’t argue strongly for the continued growth of the market, as local retail and institutional investors can’t sustain a growth in the market without foreign participation. The average daily turnover which declined marginally from Rs 42.2 million in November to Rs 41.2 million in December, recorded a marginal gain of 4% in January. Stocks that traded in large volumes during the last one month were Dankotuwa, Grain Elevators, Heycarb, Sampath Bank, Ceylon Brewery. Royal Ceramics, Hayleys and DFCC.

The big news in the market was the rival offers by Hatton National Bank (HNB) and the Development Finance Corporation (DFCC) to purchase the 40% stake in Commercial Bank held by Standard Chartered Bank. Commercial Bank favours the offer of DFCC, but the ultimate decision lies with Standard Chartered Bank, and the Monetary Board. This certainly is an interesting episode as a 40% stake in Commercial Bank will be a great boost to either DFCC or HNB’s future operations and profitability. The other takeover offer by Asia Capital of Vanik Inc., has not been taken seriously by investors, and the new offer of Rs 8 plus one Asia Capital share for each Vanik. share is expected to be rejected by the shareholders. of Vanik. But the attempt by Asia Capital to bring in three outside directors to Forbes Ceylon is a very positive move, as it appears that Forbes Ceylon since going public has not been performing up to expectations.

The corporate results expected to the released for the quarter ended December 31, will certainly show an improvement over the previous quarter. In the manufacturing sector, the crippling power shortages witnessed during the first two quarters were not prevalent in the last quarter. Therefore, we expect the ceramic sector and companies such as Ceylon Glass to record improved results. The plantation sector will also continue with its strong performance as prices of both tea and rubber remained at high levels throughout the last quarter. Tourism also saw improvements after a disastrous summer season, and indications are that if the current situation prevails the winter season will record only a 10% drop in comparison to the 1994/95 winter season, and far ahead of the last winter. Improved performance in the manufacturing sector and the overall economy will result in the banking sector also seeing better results. But in comparison to the last quarter of 1995 we can’t see much improvement in this sector as interest rates remained stable, and this deprived banks of excessive income from money market activities.

Market Outlook

The market continued to dip during most of 1996, but is expected to stabilise and record improvements of at least 15-20% during the first quarter of 1997. The All Share Index declined by 9% in 1996, after a decline of 33% in 1995. At current levels, the market is at a 55% discount from a high of 1378 for the ASI in February 1994. Therefore, the upside potential is tremendous and the market is expected to perform better in 1997, with turnover, volumes and indices expected to improve. This is based on the following assumptions:

1. Relative stability has emerged in the Indian subcontinent, and it is apparent that there is increased cooperation amongst the countries in the Indian subcontinent. This would result in overseas funds increasing their allocation to this region. India is expected to attract a bulk of these funds but Sri Lanka will benefit from both a trickle-down effect and some additional country allocations, although not of the magnitude witnessed in the first quarter of 1994.

2. The expected improvements in the macro economic and political outlook, with the government certain to carry on until its term expires although it is a coalition.

3. Corporate performance is expected to improve with the power crisis not expected to recur in 1997, tourism is expected to improve as we expect relative calm in the country, and plantation companies are expected to maintain their current profit levels mainly through improved efficiency although tea and rubber prices may decline moderately.

4. These factors will ensure strengthening of the loan portfolios of commercial and development banks and a greater demand for loans, which in turn will improve the performance of the banking sector.

5. Further, companies have in the last few years improved their efficiency by cutting down on excess fat and as a result have become lean and will record improved performance in the coming years.

6. The introduction of screen-based trading is expected to increase the market’s volume and turnover, as has been the experience in markets throughout the world.

We maintain our recommendation for investors to take a two year investment horizon, but we are confident that investors will realise short term capital gains in selected stocks in the banking & finance. manufacturing and food & beverages sectors. Tourism sector is another potential investment area, provided Colombo and the major tourist destinations remain calm during the coming months. We advise investors to watch for buying opportunities in the following stocks:

Banking and Finance – NDB, LOLC, DFCC,

Manufacturing -Ceramic Sector Lanka Ceramic, Royal Ceramic

Food and Beverages – Lion Brewery

Conglomerates – Aitken Spence, Hayleys