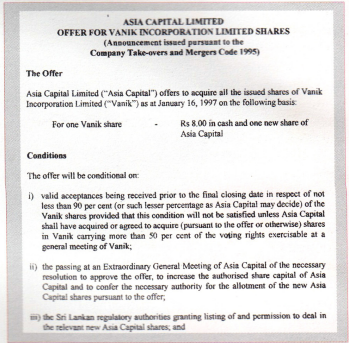

The corporate war between Asia capital Ltd., (ACL) and Vanik Incorporation which is nearing its second month, took a new turn with ACL making a fresh offer to purchase Vanik on January 16, 1997. The new offer saw a reduction in ACL’s offer price. According to the new offer ACL offers a price of Rs 8/- plus one new ACL share for one Vanik share. The previous offer stood at Rs 10/- plus one ACL share for one Vanik share. However, this new offer contains the all important condition that would enable the registration of Vanik shares transferable to ACL pursuant to the offer. The previous offer was not recognised by the Securities and Exchange Commission of Sri Lanka (SEC) due to the non-inclusion of the above condition, effectively rendering that offer invalid. Meanwhile, a statement issued by ACL stated that ACL had met the Director General (DG) of the SEC, Kumar Paul, and he clarified certain issues. It also goes on to state that the Director General of the Colombo Stock Exchange (CSE) has set out clearly his observation on the Articles of Association of Vanik in relation to the offer by ACL.

The statement goes thus: “The Director General, SEC and the Director General, CSE agree that there is an apparent contradiction in the Articles of Association of Vanik but that they are unable to rule on Articles of Association of Vanik. Asia Capital considers that, by virtue of Article 38 of the Articles of Association of Vanik (which restricts registration of transfers of Vanik shares), there’s a self-evident restriction on the free transfer of Vanik shares and consequently Vanik does not comply with Sri Lankan securities legislation. In addition, Asia Capital considers that the proviso set out in Article 38 is defective in law.

The Director General, SEC, has advised that resolution of this matter may be had through legal review of the validity of Article 38. Asia Capital will continue to examine this option.

The Director General, SEC, has also advised that in order for the offer by Asia Capital to be successful – without the necessity of legal review, Asia Capital should amend its offer to include a condition which will enable the registration of the transfer of Vanik shares to Asia Capital pursuant to the offer.”

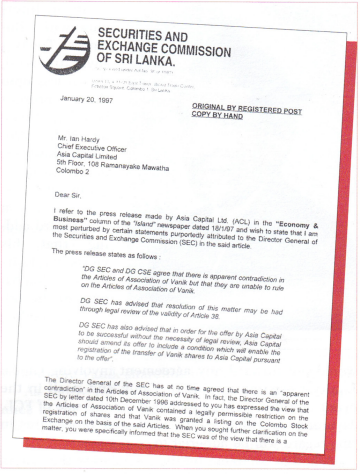

This statement published in a leading newspaper on January 18th, caused a furore in SEC and CSE circles. A letter sent to lan Hardy, Chief Executive Officer (CEO) of ACL by Kumar Paul, DG, SEC states that this is a “gross misrepresentation and distortion of facts”. In his letter, Paul states “The Director General of the SEC has at no time agreed that there is an “apparent contradiction” in the Articles of Association of Vanik. In fact, the Director General of the SEC by letter dated December 10, 1996, addressed to you, has expressed the view that the Articles of Association of Vanik contained a legally permissible restriction on the registration of shares and that Vanik was granted a listing on the Colombo Stock Exchange on the basis of the said Articles. When you sought further clarification on the matter, you were specifically informed that the SEC was of the view that there is a distinction between the transfer of shares and the registration of shares and that free transferability did not necessarily include free registration. Paul’s letter goes on to state, “Your attention is also drawn to the letter dated 19th November 1996 from the Director General of the SEC to the Chief Executive Officer of ACL, which clearly stated that the Articles of Association of Vanik Incorporation Ltd., would have to be amended if the offer made by Asia Capital is to be implemented. At no time has the SEC expressed any interest in the “success” of your offer or advised you on this aspect. You will note that the above positions which are confirmed by correspondence, vastly differ to those contained in your press release and tantamounts to a gross misrepresentation and distortion of facts.”

In his reply to Paul on January 20, 1997, Hardy states that the ACL statement “does appear to reflect accurately our correspondence and conversation with the SEC and CSE”. While accepting the fact that the use of the word “successful” may be open to misinterpretation, ACL states that “the SEC has at no time inferred or indicated any interest in the outcome of our offer and, in our experience, has been totally unpartisan in its approach in this matter”. Hardy apologises for any difficulties that the ACL statement may have caused Paul and assures that ACL by way of this statement did not wish to cause any discomfort or embarrassment to the SEC or Paul, personally. ACL has however stood its ground in this potentially explosive confrontation. In a letter dated December 10, 1996 to ACL, the CSE states that it does not have in place a mechanism to interpret the meaning of the articles of association of a listed company or the order of precedence of seemingly conflicting articles. The CSE admits that such a interpretation, if made, will not have the force of law. It adds that the CSE listing rules do provide that fully paid up shares shall be free from restriction on transfer but appear to be silent on the restriction on registration of transfers.

Meanwhile, in a related development ACL has requisitioned an extraordinary general meeting of Forbes Ceylon Ltd., (FCL) to appoint 3 independent directors. ACL states that there has been little development in the business of FCL and that FCL has no directors independent of the major shareholders of FCL and its group or of those who do not provide services for the group.

The 3 names proposed are:-

1. Kingsley Fernando, former Deputy General Manager of DFCC. He is also a former director of Lanka Tiles Ltd., Swedeshi Industrial Works Ltd.

2. U H Palihakara, former President of the Institute of Chartered Accountants of Sri Lanka and The Chartered Institute of Management Accountants. He is also a former member of the SEC and was Deputy General Manager of DFCC. Currently he is consultant to the Asian Development Bank.

3. Gamini Wikramanayake, former President of ICASL. He is also the former Chairman of the Bank of Ceylon. Presently, he acts as a business consultant.

ACL states that Ajith Jayaratne, acting Chairman, FCL, had personally indicated his personal support to the move to appoint independent directors at the last Annual General Meeting.

ACL has proposed the names of three eminent Sri Lankan businessmen who it feels will significantly benefit FCL. It states that they have no conflict of interest in relation to FCL and are impartial.

In an interview with “Business Today”, Jayaratne said, that it was upto the present board to decide on ACL’s proposal. However, he refused to comment on his personal view in this regard adding that his views would be made known only to the Board. Responding to a question on whether FCL would put forward any agreement involving Global Equity Corporation (GEC), Vanik and itself in the event of a deal being concluded for the sale of FCL. Jayaratne said that all the necessary procedures in this regard will be adhered to.

Asked to comment on the speculation that Vanik was planning to sell its lease book and some assets to FCL and get FCL to pay for it and use the cash to buy FCL, Jayaratne while refusing to comment on the exact nature of the deal, said that it was highly unlikely Vanik would try to cheat FCL, as ultimately this would be tantamount to cheating itself, because Vanik then would be FCL’s new owner. Asked to comment on how difficult it was for him to be Chairman of CSE, acting Chairman of FCL and a Director at Vanik all at the same time, he said this situation though purely accidental, placed him in a rather unique position to safeguard the interests of all the parties concerned.

Meanwhile, in an interview with “Business Today”, Ian Hardy, CEO of ACL said that GEC should be made aware of the opportunities available in Sri Lanka. It is in this context that ACL has made the move to appoint three independent directors to FCL. He added that corporate governance in Sri Lanka should be looked into. Hardy was keen to state “there must be no bad blood between GEC and Asia Capital”. When asked to comment on the reduction of the offer price, Hardy justified it on the grounds of the reduction in Vanik’s share price. Surprisingly, Hardy added, that he was “concerned the price was too high”. It seems ACL is not all to keen about going to courts to resolve this matter. ACL says that it does not want to deviate from its focus.

In an interview with “Business Today”, Justin Meegoda, President and CEO of Vanik, said that his company had referred ACL’s new offer to its lawyers for legal advice. According to Vanik’s lawyers, the new offer has several defects, Meegoda said. However, he declined to elaborate on the nature of these defects. He said that despite this the board has decided to put the ACL offer to Vanik’s shareholders who number around 15,000. Meegoda said that he was “confident the Vanik shareholders would reject it”. He added that the offer price by ACL was an “insult” to the Vanik shareholders. Meegoda has called this offer a “non- sense”. A rejection of the ACL offer by the shareholders of Vanik will effectively stop ACL’s attempts to prevent it acquiring FCL dead on its tracks, Vanik says.

Meegoda said that this offer was an attempt by ACL to “frustrate” Vanik’s negotiation with GEC over the purchase of FCL. He went on to add that this was aimed at “distracting” Vanik from its banking function. “We don’t want to be distracted”, Meegoda said. If ACL’s offers to purchase Vanik were delay tactics, they certainly have worked, for the Vanik CEO him self admitted that negotiations with GEC have been delayed due to ACL’s actions.

When asked to comment on the nature of the deal to purchase FCL and speculation about Vanik selling its leasebooks and some other assets to FCL and use that cash to buy FCL, Meegoda said that no definite agreement has been reached. However, Meegoda said that he did not see a problem in Vanik selling its securitised leases to the investing arms of FCL such as Forbes Capital. He added that such a transaction would be independent of FCL. Vanik will offer a tax free return of 20-22% for such investments. In contrast, treasury bills give only a return of around 18% which is taxable. Meegoda said that in the case of default Vanik would replace that lease with a new lease. Such an investment is risk-free for the investors, said Meegoda, adding that Vanik would be taking the risks. This is an internationally accepted method of financing, Meegoda said.

Commenting on ACL’s move to include three non- executive directors on the FCL board, Meegoda said that this was aimed at “further frustrating” Vanik’s negotiations with GEC. He added that if ACL was concerned about FCL performance they should have made this proposal long ago. The Vanik CEO rejected speculation that Vanik was planning to buy 51% of GEC. He added that GEC was only willing to sell the 2 private companies. He was referring to the 2 private companies which together have controlling interest of FCL.

When asked about the Two Million Rupees advance paid by FCL tied up in an Indian Coffee deal, that went badly wrong. Meegoda said that Vanik considers that debt to be good. However, he added that if and when a definitive deal was conluded, Vanik would reconsider its position on this. If Vanik considers this debt to be bad it would result in a reduction of the offer price and provisions for this would be included in the agreement with GEC, Meegoda said. Meanwhile, according to FCL sources, the Indian company in question has agreed to pay back the advance.

Meanwhile, Vanik has decided to take a decisive step and circulate the new ACL offer among its shareholders on January 24, 1997. Meegoda told “Business Today that Vanik would inform its shareholders about a general meeting on January 29, 1997, and get their approval to proceed with negotiations to pur- chase FCL. This move will be strategic, as an affirmative vote would enable it to proceed with the FCL negotiations. Under Rule 34 of the Company Takeovers and Mergers Code, a Company must obtain permissin from its shareholders to buy or sell assets or engage in a major transaction, if the board has reason to believe that a bona fide offer to takeover the company is imminent. This may very well be Vanik’s trump card.

The applicability of Rule 31 of the Takeovers and Mergers code has been one of the sticky points in the ACL-Vanik tussle. In a letter to the Director General, SEC, Kumar Paul, ACL’s CEO queries the applicability of Rule 31 in the event of ACL acquiring FCL under the following circumstances:-

(a) ACL purchasing 100% of Forbes and Walkers Securities Ltd., (FWSL) from GEC.

(b) ACL purchasing 100% of Forbes and Walkers international (FWI) and 100% of Forbes and Walkers Ltd. (FWL) from FWSL.

In both (a) and (b) mentioned above, “taken together with ACL’s present holding, the ultimate effect would be the control in excess of 61% of the issued capital of FCL by ACL”, the letter states. Currently, ACL has a 11.4% stake in FCL.

The current ownership structure of FCL is as follows. FWSL, a company incorporated outside Sri Lanka owns 100% of FWL and 100% of FWI, also incorporated outside Sri Lanka, which in turn owns 50 million and 70 million of FCL shares respectively. At the apex of this structure is the GEC.

In his reply, Paul states that ACL would be required to make a mandatory offer in terms of Rule 31 of the code to the shareholders of FCL, if it were to pursue either course of action i.e., (a) and (b). This is a significant development. It is learnt that Vanik too has made a simillar request to the SEC. At the time of writing, according to Meegoda, the SEC is yet to respond to Vanik’s request.

The financial community’s response to ACL’s new offer has been characterised by a lack of interest. ACL’s reduction of the offer price came in for sharp criticism

together with a measure of disbelief from many analysts. Merchants banks are expected to do well in 1997, thanks to the government’s privatisation programme and the expected increase in capital expenditure by the private sector due to the in-provided by the 1997 budget. In this context, the ACL offer gives too little to the Vanik shareholders, analysts charge.

As Hardy rightly pointed out, corporate governance in Sri Lanka should be looked into. Meegoda’s stance that the management should be independent of the shareholders too deserves merit. In this case, a clearly defined relationship between the management and the shareholders must be put into place. It is high time the regulatory authorities took a good hard look at the concept of good corporate governance. The SEC itself in recent months has come under fire for alleged conflict of interest. Senior sources inside the SEC privately admit that it is time that persons independent of the industry be appointed to the council of the SEC. They added that all developed markets have gone through the process, where industry-related professionals played a key role in the running of the regulatory bodies and later as the markets developed, gave way to professional administrators.

The Takeovers and Mergers Code too is expected to undergo changes. However, it is too premature to speculate on the nature of these changes. Many feel that the code needs a dose of flexibility to make it more user-friendly. The SEC too, it is understood, favours such an approach.

Though this corporate war has generated a good deal of controversy, it has also made both the regulators and the financial community, take a good, hard look at Sri Lanka’s financial regulations. Calls for re- view of the Takeovers and Mergers Code and the concept of corporate governance in Sri Lanka are among the many positive outcomes of this clash. Perhaps one of the most important outcomes is the corporate sector’s increased willingness to use mergers and acquistions to grow, rather than rely solely on organic growth, especially at times of uncertain economic conditions.