Rienzie T. Wijetilleke, Managing Director, Hatton National Bank

I wish to join my friends in congratulating Business To day’ for organizing this competition and selecting us as the 10 Top Companies which I feel very proud of. This type of competition I believe adds to the credibility of a company and also helps a company to improve its transparency. So I do hope that this type of competition will be continued and that there will be more companies joining in the competition and further success.

Hatton National Bank among the 200 odd companies listed in the Colombo Stock Exchange is the largest company with an asset base of over Rs 50 billion. Among all the financial institutions in this country except the 2 state banks, we hold the largest asset base, the largest deposit base of about 37 billion and an advance portfolio of about 26 billion. Our profits are the largest declared among the private commercial banks in this country.

During the last five years our assets, our deposits, our advances our profits have grown by 300%, and I believe that the year ’97 is also going to be an year of record performance for us.

We have been able to achieve this after careful planning over the last ten years with very carefully decided and monitored strategic decisions. We as a financial institution serve the population at large. I want to show that there are two segments, one, the corporate sector which I would call the urban population. They form according to Central Bank statistics about 30% of the population. This group want the best. They want electronic banking, they want credit cards, they want ATMs they want everything that is modern. And they are the people that give our hanks the turnover and obviously the profits. But they are very demanding. And they have of course a very great sensitivity to the rates so our margins our very thin.

On the other side we have the balance 70% of the rural population. That rural population is not interested in technology banking. They are people who until a few years ago were not considered bankable.

Hatton National Bank started serving that 70% also over the last ten years. They don’t add to our profitability very much and we have to spend a lot to maintain these branches that serve them but they bring in the deposits. Above all we believe that we have a social responsibility towards them if we are to see economic development in this country.

This village sector we have lent, apart from our commercial lending about 6.0 million over the last 8 years and we have maintained a recovery rate of 97%.

We have made them bankable, we identify their strength, we identify their requirements and we give them various other assistance, counseling, guidance, marketing ideas, basic accounting procedure. So this has been our success and I believe that every financial institution has an obligation to serve that

70% of the population if we are to see economic progress in the country. Over the last 10 years our bank has clearly identified the needs and maintained a good balance of services towards both these sectors and established a very good corporate as well as national image in the country.

We have made a strong commitment to participate in the economic growth of the country. During these years we have won several awards. It was only recently that we were awarded the SAARC award for the best Annual Report and Accounts. We have won the Annual Report award for the banking and finance sector over the last several years and we have also been the overall winner about twice.

Not only in business but even in sports we have excelled. We have victories in national as well as mercantile championships. Our success is attributed to a well focused and committed leadership working under a board of directors providing us with a visionary direction and managed by a corporate group who are emotionally involved in the management of the organization with an effective team.

Our bank places tremendous faith in its people. We have given the opportunity to our staff to be creative and to innovate. We have a clear understanding of the industry and our customers. The change in dimension and intense competition in the banking industry makes us constantly review our strategies particularly in corporate and business areas. I believe we have, over the last few years achieved a sustainable competitive advantage in our country.

As we approach the next century we will develop a very flexible organizational arrangement and ensure that we remain a leading financial institution in the country, poised to continue with a journey of prudent growth and strong commitment, at all times meeting our business and social responsibilities.

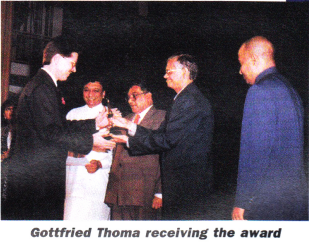

Gottfried Thoma, Chairman and Managing Director, CTC

Based on independent research more than 300,000 people in Sri Lanka either directly or indirectly derive a major part of their livelihood from working with CTC.

These people, we call them our stake holders, are of a very diverse nature. We have tobacco farmers in the out stations, we have transportation companies, we have wholesalers, retailers, our distributors and suppliers, our highly valued employees, they all have a major stake in the success of CTC. In financial terms our biggest stake holder is the Government of Sri Lanka which receives 82% of our turnover by way of taxes.

I am indeed very happy and highly honored to receive this prestigious award on behalf of all the employees and stake holders of Ceylon Tobacco Co. I also would like to take this opportunity to commend Business Today’ as an excellent business magazine and congratulate them in initiating the Top 10 awards in Sri Lanka. On behalf of CTC, I wish ‘Business Today’ every success in taking these awards forward on an annual basis.

We first started out by defining a new corporate vision. Our vision is something which is long term, a dream you want to go for. What we call it is very simple. We want to achieve total trade and consumer satisfaction through world class performance in all aspects of the business.

The word ‘all’ is underlined which means throughout the company. This simply means that we want to be among the best in the world at whatever we are doing. This vision which you might also call a corporate men- tal attitude will ensure that we will become highly competi tive in the marketplace and continue to be so.

We believe at CTC, as a leading multinational company spanning over 70 years of operation in Sri Lanka, that we must be geared to take on the challenges that lie ahead. Now after defining a new vision we focused on the key success factors. At CTC we very simply call it back to basic or back to basics. It covers 3 main areas. People, Products and Services. Any successful company in the world needs to have these three areas absolutely right.

Here we talk not only about quality but we equally talk about winning attitudes and behavior. It also fully includes constant and open communication with our staff at all levels and excellent industrial relations. For example we very openly say, the chairman is first to serve and not the first to be served. That goes throughout our board, it goes throughout our executive committee and applies for each and every manager down the line.

We all are here to serve our customers and not to service ourselves. We also recognize a very clear difference between leadership and management. Leadership or effectiveness means that we constantly ask ourselves, are we really doing the right thing?”.

CTC’s efforts were recognized when we were awarded the National Productivity Award for 1996. We have invested large sums of money in state-of-the-art technology thereby equip ping our people with the necessary means to manufacture high quality products.

Training and development continue to be a very high priority and is an ongoing process while the concept of continu-

ous improvement is applied across the company.

Just this month, CTC has been awarded a B rating in MRP 2 (Manufacturing Resource Planning).

These are indeed significant milestones towards achieving our vision of achieving world class performance in all aspects of the business. We are extremely confident of achieving our vision thereby meeting the challenges of the future. Those challenges of the future, not only include that we are highly competitive, that we streamline, that we think about the customer and the consumer, it also means that we fight in the marketplace.

I would like to give you a very small example of where the playing field is not a very level place. Our company pays basically Rs 3,000 per 1,000 cigarettes. If you keep in mind that we are producing more than 5 billion cigarettes multiply that by 3, you know what we are paying by way of excise.

What we increasingly face is not open competition, but is hidden competition which we can’t really attack. If you go out in many shops you can see smuggled cigarettes which come in and they don’t pay any taxes whatsoever. In our case 82% of our turnover goes for taxes.

We have seen the level field becoming less leveled by various manufacturers producing cigarettes in Sri Lanka also avoiding taxes. One of our major brands which is Bristol is selling for Rs 4 for one cigarette. Out of those Rs 4, Rs 3 go to the government. So there is Rs 1 left to manufacture high quality cigarettes, to pay distributors, to pay for depreciation for running the business and make a half way decent profit.

Now those illegally manufactured cigarettes here in Sri Lanka sell for half a rupee, one rupee and a rupee fifty, basically there is disadvantage of more or less 1 to 5.

The company can become highly competitive and go for world class standards but hopefully with a leveled playing field home market. We still continue to be very very confident and will steer towards becoming an exporter of high quality products at competitive prices. By doing that we also pledge continuity in our efforts to add value to the national economy and to the progress of the country.

Amitha Gooneratne, Managing Director, Commercial Bank

We are indeed very proud to have been selected to be Wamongst the Top 10 Companies in Sri Lanka. Commercial Bank has got a very long history and its ori- gins could be traced back to the year 1920 when a British bank opened a branch in Colombo, Fort. In the year 1957 Standard Chartered Bank which is a multinational bank acquired 100% interest of Eastern Bank and again in the year 1969 when a locally incorporated bank called Commercial Bank of Ceylon Ltd., took over the business undertakings of Eastern Bank.

We have also achieved another milestone just one month ago. When a major stake in Commercial Bank which was held by Standard Char- tered Bank was divested and was ac- quired by Development Finance Cor- poration of Ceylon. So DFCC has now become a major stake holder in Commercial Bank of Ceylon.

We are indeed extremely proud that our bank can be ranked as one of the strongest banks operating in Sri Lanka. In terms of capital adequacy the norms have been laid down by the Bank of International Settlements in Switzerland and in terms of those requirements Commercial Bank has the highest ratios of any private bank operating in Sri Lanka.

Primarily our success is due to a highly motivated and target oriented staff. At Commercial Bank our staff don’t accrue bonuses but they earn their bonuses because they have to achieve targets and as an employer we look after our staff extremely well and we are very conscious that they should be more than adequately remunerated.

Another factor of our success is, today we are one of the most technologically advanced banks operating in Sri Lanka. We have the largest online real time network of branches in Sri Lanka which are interconnected. We have got the largest Automated Teller Machine network in Sri Lanka spanning over 40 branches and we have pioneered several innovative products like Teller Banking and also Customer Access using personal computers on internet architecture.

I would like to thank the publishers of International Tourist Magazine for having organized this event and I wish the publishers further success in years to come.

Ranjit Fernando, Director/General Manager, NDB

May I congratulate Business Today’ for the initiative they have taken in organizing this event and for selecting the National Development Bank among the Top 10 Companies of 100 companies quoted in the Stock Exchange. M As all of you probably know, the National Development Bank is the only company among those companies which was government owned and which is now quoted in the Stock Exchange, since February ’93. I am therefore happy that within that short period we have not only been selected among the Top 10 but is the company in the Stock Exchange that earns the largest profit and is number two in market capitalization and also is the largest provider of term loans in the country.

This award is a tribute to the staff who have acted with dedication in bringing this company to this position.

In structuring the contest if you noticed that many of the companies or all 10 of the companies that are selected today are large groups, well run companies, that are apart from

this event motivated by the compulsions of the stock exchange itself to lead their companies in a manner of improving themselves year after year.

There are many other companies in the Stock Exchange which you might want to lay focus on so that you encourage them to come to the fore and seek recognition in the future. Five of these companies happen to be banks out of the 10 and many of the other companies are large conglomerates, diversified groups but many small companies quoted in the Stock Exchange have displayed leadership qualities, growth and other facets which you have recognized, which may need recognition in the future.

Sunil Mendis, Chairman, Hayleys

I thank ‘Business Today’ for the award presented to Hayleys this evening and for your invitation to say a few words.

I am some what uncomfortable with the theme you have given me, our company and its success. My colleagues and I feel, whatever Hayleys has achieved over 120 years, it must achieve more.

It is perhaps this dissatisfaction with leaving things as they are that has been the driving force in whatever we have achieved. Certainly this state of mind has consistently driven us to do more and demand more of our people. They have worked hard and have responded well to the call. Our group’s commit- ment to the development of its Hu man Resources has given our people the definite prospect of achieving their full potential. Our structuring of business activity, not only into dis- tinct profit centers but also into sepa rate corporate entities has given them a clear sense of identity.

Hayleys is today a vastly changed organization from the time I joined. We have transformed our- selves in the last 25 years and with this transformation has come sub- stantial growth.

Our businesses in activated carbon, rubber, shipping and related activity and coir products have consistently been the most significant contributors to our performance and growth. Heycarb is one of the world’s leaders in this field and Dipped Products is today one of the top 5 producers of rubber, non- medical gloves world wide.

Hayleys group account for 1.8% of Sri Lankan exports. As a group we have had the foresight or good fortune in most

cases to have picked the right areas to do business. We have almost always started small. Learnt our businesses thoroughly and grown our own technology and capability as we went along.

We have constantly reinvested in our core businesses. We have been willing to identify businesses in which we have had no competitive edge, acknowledging our mistakes in entering these and exited from these activities. We have also been quick to identify opportunities for adding value to the products we deal with.

We have been willing and able to make organizational changes, to out-source and sub contract to make our business processes more efficient and make better use of our assets.

Jagath Fernando, Director, John Keells Holdings

As you probably know John Keells Holdings is a public quoted company having the highest capitalization in the Colombo Stock Exchange. It has a history of nearly a 135 years but has A been a public quoted company only since 1984. It started as a partnership between some explanters dealing in tea and rubber.

It had been in the tea and rubber business until 1974 when the present party in power was then in power. At that time they decided to nationalize the tea plantations. That was what got John Keells out of its slumber and moved John Keells into a process of diversification and opened our eyes to the need to look wider.

We have since then grown and grown rapidly to what we are today. If we are to attribute some of the elements of our success we could put them down to a clear vision, a dynamic and decisive leadership, a young, professional and highly mo- tivated management team, our concern for the welfare of our staff, the diversification of the business we are in and our belief that we should be key players in every single one of those businesses. This has helped us to withstand the buffeting of the cyclical ups and downs of business.

We have been driven by our belief in the potential for growth of Sri Lanka’s economy. It has driven us to investing more and more within this country and we will continue to invest large sums in the belief that the growth of the country’s economy will enable us to grow with it. We also believe that by continuing to invest and being involved in significant areas of the country’s economy like being key players in the businesses we are engaged in, we as a company will be a significant contributor to the growth of the economy of this country. That is our goal and judging by the recent results published, in our last quarterly results we certainly are well on our way if we are not already there.

I would like to take this opportunity to congratulate Busi ness Today’ for their initiative and wish them all success in their endeavor.

Rajkumar Renganathan, Executive Director, Seylan Bank

are indeed happy to have been placed among the Top 10 companies selected from amongst 100 quoted companies. This achievement is significant since we have been in business for just over nine years. In fact we celebrate our 10th anniversary next year. We are perhaps the youngest business institution to be placed among the Top 10 companies.

I must pay a special tribute to the vision of our chairman Deshamanya Lalith Kotelawala for his able guidance and untiring efforts over the years. Its policy of recruitment devoid of cast, creed or religion, and promotion on merit have paid rich dividends.

Our success, I would attribute to the support provided by the members of our board of directors. The hard work of the senior management and staff of the bank, other stake holders who have provided us with their invaluable support and last but not least our customers from all over Sri Lanka.

In the short span of just over nine years the Seylan Bank has achieved several milestones. A deposit base of over 28

billion, loan portfolio of over 21.5 billion and a branch net- work of over 90 branches spread out all over Sri Lanka. We also believe that we have lived up to our motto of being the ‘Bank with a Heart’ with profit not being our only objective.

Let me thank the publishers of ‘Business Today’ for all the hard work that has gone into the evaluation and let me wish them every success in the future.

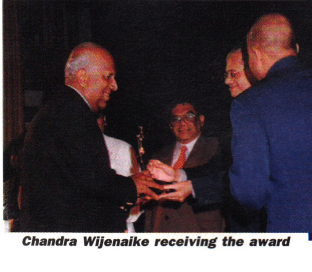

Chandra Wijenaike, Chairman, Central Finance

I talk on behalf of Central Finance and I think, of all the companies represented here this evening Central Finance is rather unique.

First and foremost it is a country bred company namely that its origins, its head office, is in Kandy. Its entire directorate has been born and bred in Kandy. It shows that in all parts of this island there are entrepreneurs, people who can attain the success we have achieved by following a regime of honesty, confidence and looking at larger horizons.

Central Finance is a company that started 40 years ago with a princely equity of a Rs 120,000. For the first 20 years it was dormant. The financial policies during that period were understandably not what they were in 1997.

In 1977 with a change to an open market economy Central Finance also participated in this new development concept.

In 1977 for instance the turnover of our company was a mere Rs 16 million. Today it exceeds Rs 4 billion. This deposit base was in the region of Rs 1.5 million. Today it exceeds five billion.

Our assets at that time were only Rs 3 million. Today they are over a billion. It all shows that with dedication and not necessarily qualifications and here I would like to point out that I myself was a planter by profession, my only experience with anything to do with something outside that range was one year I spent at the University reading for an Economics degree which I did not complete. It also indicates that you don’t have to be qualified, it only needs common sense and understanding of what’s going on around you.

This is the message that I would very much like to convey to people who are here today to see what Central Finance has achieved. Central Finance today is a well respected company. Its directors are all people of excellence both in performance and in integrity. Nothing has been ever said adversely about this company. We have regrated three public business companies apart from ten other companies which are subsidiaries of Central Finance.

The message that I wish to convey to you is that there is a great deal of opportunity. An opportunity that doesn’t need necessary qualifications, it does not need influence, it just needs hard work.

Once again I repeat, a company born and bred in Kandy, that has been our strength and that will always be our strength.

Dr V.P. Vittachi, Chairman, Distilleries Company of Sri Lanka

Five years have elapsed since we bought the controlling interests in the Distilleries Company. In those five years the turnover of the company more than doubled and was 8.6 billion rupees for the p year ended 31st March 1997.

In this five year period, the company paid the state 25.68 billion rupees as taxes. We have been able to achieve such impres- sive results by efficient management reward- ing the work done by our staff and minimiz. ing theft and corruption.

Motivation is the key to running a busi- ness efficiently. I myself spent 25 years of my life in the Ceylon Civil Service and would be the last to decry the public serv ice. But a civil servant works for a monthly salary which is forthcoming whether he pro- duces the results or not. He never develops ulcers in the stomach worrying about the consequences of some decision he makes.” But the man who puts his own money into a business has an entirely different orientation.

He lies awake at night figuring things out. In this sense he is always on the job. This is the essential difference between a state run enterprise and a privately owned business.

In conclusion I would appeal to the authorities to take a long hard look at the kassipu menace and the way the govemment’s taxation policy is helping the kassipu manufacturers. The kassipu manufacturer pays no tax. He sells a bottle at Rs 60 and it is all profit. Last year, the tax on Arrack was raised by 25%. The total tax from a bottle of Extra Special went up from Rs 109.22 to 137.15. the inordinate jump in the price directly resulted in a large number of drinkers of legal Arrack demoting themselves to the kassipu market. The sellers of illegal Arrack including kassipu have a Rs 137.15 tax advantage over us.

We pay close on 80% tax on each bottle. A bottle of Extra Special retailed at Rs 175 brings the company only Rs 47.85 as compared to the kassipu merchants’ profit of Rs 60. The tax on liquor has gone way beyond the point of diminishing returns. Increased taxation means not only diminished revenue but more and more drinkers are being forced to drink kassipu.

It is only the kassipu manufacturer that benefits. If taxes are brought to a level at which we can sell a bottle at a competitive price not only will drinkers turn to legal i.e. more hygienic liquor but the government will actually earn more revenue. This is a thought that is worth the serious attention of the authorities.

Prof. G.L. Peiris, Minister of Justice and Constitutional Affairs

This simple ceremony which has been organized for the 1st time by Business Today’ is a tribute to excellence in the private sector of Sri Lanka.

Business Today’ has identified 10 companies listed in the Colombo Stock Exchange, for their performance during the last year. These companies have been chosen on the basis of such criteria as turnover, profitability and the degree and quality of the expansion of their commercial activities. These 10 companies which have been identified embody, they encapsulate, creativity. vision, commitment, hard work, perseverance. These are among the attributes which account for the success of these 10 companies. The private sector of our country has done Sri Lanka proud. The private sector accounts for 75% of investment in this country. Their excellence manifests itself not only locally but on a global or international scale. Our companies are known for the opening of hotels in the Maldives, financial services which are now being

provided in Bangladesh, sports goods which are being exported to Australia and New Zealand, carbon related industries in South Africa, agricultural undertakings in India, computer software in the Arabian Gulf and so on.

I would like to share with you some brief thoughts about some other current problems in this country. Things which are very topical today and I would like very tentatively to suggest to you some pragmatic approaches to the solution of these problems and the participation I think is urgently required on the part of the private sector.

You would have read in the newspapers during the last couple of days about a very distressing phenomenon which is beginning to emerge again in our country. As somebody who has been closely associated with the University system, as somebody who has served that system for more than a quarter of a century, I am perennially conscious of the strains that are experienced by the youth of our land.

We now see some unmistakable signs of the resurgence of those problems in the university system. They are now beginning to attract attention again. They were always dormant. They had never disappeared from the body politic of this country. But they are now obtruding themselves on the public conscience in a very evident manner.

I think the future of our country depends to a large extent on the degree of success that we all achieve in containing these tensions in finding sensible, mundane, practical solutions to those problems. I do not think that this can be done by the government acting alone. There is a very vigorous part played by civil society in general, in this country and a very vibrant component of civil society is the private sector which has demonstrated by sheer dint of performance the quality of success that it can realistically aspire to.

Now I think it is very necessary for the private sector to have a social conscience. The representative of the Ceylinco Group said that private profit has not been the sole motivating force of the Ceylinco Group of companies. It is involved in a range of activities which are designed to bring a better life within reach of the people of our country

I think the social conscience of the private sector is something that is of urgent practical importance today. I would suggest to you that the social conscience must receive expression in the context of conditions prevailing in our country in the present time.

Primarily in respect of certain fields and first and foremost among those fields I would suggest to you for your kind consideration the training of youth with a view to ensuring their employability in this country.

Sri Lanka is justly proud of its human resources. Among all the countries of South Asia we have invested a very large proportion of our GDP in our human resources, health and education in particular. But we must remember that when we educate people we raise levels of expectation and if we fail to deliver, if the products of our university system are not able to find the kind of employment which they think is commensurate with the dignity they are entitled to, then you have the beginnings of a social holocaust.

That is exactly what this country witnessed on two horrendous occasions during the last two decades. Now I want to emphasize to you that that is not a thing of the past. It is not a closed chapter. It is very much there in our midst and what you have read in the newspapers today and yesterday bring that out. Turmoil, vicissitudes, upheavals which are again quite apparent in the university system of our country.

Rienzie Wijetilleke speaking for Hatton National Bank spoke of the bankable poor. He said until recently banks looked only at the affluent sections of the community. The poor were regarded as not worthy of credit. They could not be relied upon.

If you look at the report produced by Dr Vignaraja for the SAARC Poverty Alleviation Commission you will see that standards of integrity and honesty have been most remarkable among the least affluent sections of the people of the SAARC countries. There are no defaulters among them. There are certain social pressures not legal institutions, not legal sanctions, certain social pressures which combine to produce that result.

Now I want to suggest to you by parity of reasoning, drawing on what was said by Rienzie Wijetilleke that you need to adopt a similar attitude to the products of the local educational system. You need to involve yourselves much more in training programs which are intended to secure employment for these young people. I do not think that there is in any sense a real problem with regard to excellence in our educational system anymore than there is any problem with regard to excellence in the private sector. However there is a very acute problem with regard to relevance, utility, practicality in respect of the courses of instruction that are provided in institutions providing tertiary education in our country. You need to do your part to infuse into those educational programs certain elements which will ensure that those who are produced by the system can look forward to employment in the kinds of institutions over which you now have this stewardship. You must be ready to draw these people into employment so that they can live with a sense of dignity in their country.

It is no longer possible for the private sector to operate on the assumption that the basis of a viable recruitment policy is to write to the principals, the wardens, the heads of leading schools in this country, ask them to send lists of people who have qualified at the Advanced Level and then recruit people from the elitist section of society. That simply will not work. That is a recipe for social disaster.

Today the products of the educational system in our country need help from you. That was not the case when I was a student. University students generally came from the kind of social background which enabled them to have access to those who were in a position to offer them employment. That is no longer the case today. You have to build bridges, linkages between the university system, the educational system and the private sector which undoubtedly will be the main source of employment in the future.

You also need to involve yourselves much more in programs for self-employment. Inculcate in the products of our educational system certain values, certain habits, ways of thinking which will enable them to earn their living honestly and with integrity by embarking upon viable programs of self-employment.

If you neglect those duties, then it is not just a question of moral duties of ethical obligation, if you neglect these aspects of the community in which you live and work then it will be impossible for you to prosper in the future, because the social fabric itself will crumble. So I think that is something that you need to bear in mind. We are working indefatigably between the government on the one hand, the university system secondly and the private sector thirdly. To pool the resources of all these different institutions to establish integration, co-ordination with regard to training programs in order to render the educated youth in our country gainfully employable.

In my own mind I have no doubt whatsoever that the training of young people is the need of the hour. Whatever else we do, if we neglect that obligation then there will be a hiatus, a lacuna, an enormous void which would be impossible to fill in the years ahead. Now that void cannot be filled without a vigorous contribution by the private sector and I would earnestly appeal to you to give thought to those realities as you plan your priorities in the private sector for the future.

It is also necessary I think for that same reason for you to focus more on manufacturing, not only on training because it is by administering a fillip to the manufacturing sector that you will be able to provide opportunities for employment. Abundant incentives have now been made available to the private sector and it is for you now to respond creatively and imaginatively to those incentives as indeed you have done in the recent past.

There is just one other thought that I would like to share with you. This country is on the threshold of a great challenge. I think it is one of the historic epochs in the contemporary history of Sri Lanka. In the first few months of the new year 1998, you will see developments of a unique and unparalleled importance. We are engaged in an effort to restructure our political and our social institutions, the entire constitutional framework of the country, in order to alleviate tensions that exist in our midst. Do not forget I exalt you, that your achievements have been possible in an environment that is pervaded by the ferocity of a military conflict that is consuming all the energies of our country.

We are spending on military activity Rs 45,400 million approximately, representing 30% of the country’s revenue and 20% of the country’s total expenditure. This amounts approximately to 6.7% of the country’s GDP. This cannot go on forever and you most of all will be the beneficiaries of a situation in which we are able to put these tensions behind us and look forward to the future with confidence.

Now I want to say something to you in a spirit of candor. I am not finding fault with anybody, I wish to say however, that with a few exceptions, on the whole, the private sector has been somewhat reluctant to involve itself in these issues. You will recall that before the present government embarked upon its constitutional initiative, I invited many of the leaders of the private sector for a frank discussion about what could have been done. Some of you have responded magnificently by offering us your ideas, your insights, your suggestions about what ought to be done.

I have however noticed a certain spirit of inhibition. In most quarters there has been a certain desire to distance yourselves from these issues. I think there are two reasons for this. One is the natu ral unwillingness of the private sector to get involved in what is seen as the ramifications of party politics. There is a feeling that the private sector must remain aloof, detached from party politics. Involvement in party politics is dangerous. It is not healthy, it is not desirable for the private sector. I would agree with that. I think party politics is not the business of the private sector.

However, there is a certain core of national issues which transcend the thrust and parry of party politics. These are certain fundamental issues which concem the nation as a whole. It does not matter what is the complexion of the government in power. Blue or green. In either case these problems have to be sorted out if this country is to have a future.

Now if you are talking about that very limited category of problems which go to the very heart of the dilemma, the excruciatingly painful dilemma of Sri Lanka at the present time, then I would venture to suggest to you that there is no conceivable justification for a hands off policy, on the ground that you are approaching the field of partisan politics. It is not partisan politics. It is in every sense a national endeavor, a response to a national challenge. There is also the feeling that the greater decentralization of power means that the private sector may find it more difficult to engage in its activities with success. More officials to go to, more palms to oil, more delays more red tape. Now these are some of the inhibitions in the minds of the private sector. These do not necessarily have to happen. You should remember that the devolution of power is today part and parcel of the body politic of Sri Lanka. It was established in 1987 by the 13th amendment. You had these structures in place. You have officials. They have their perks. There is a wide measure of discretion that is given to provincial officers. It is necessary to rationalize that system. You should not feel that this is a system that is going to be expensive and that you will have to pay for that system.

Today there are officials on the ground who are drawing salaries, whose expenses have to be paid for by the state. How much responsibility is allocated to them? Are they justifying their existence? It is not the fault of the officials. It is the fault of the system. Now these are matters which I think the private sector has to address in earnest. Not in terms of philanthropy but in order to engender a certain environment in which they can continue to prosper in this country as they have been doing in the past.

I think several innovative suggestions have emerged from some of the observations that were made. Chandra Wijenaike spoke of regional initiatives, people who have made good from the different parts of the country. He said every director of Central Finance was born and bred in Kandy. I think that is a very important reflection. One must not think that everything big, everything worthwhile emanates from Colombo.

The need for balanced regional development is one of the most important things in our country. I would also agree very strongly with the remarks made by Ranjit Femando on behalf of the National Development Bank to the criteria that ought to be utilized in the future for the identification of the recipients of these awards. This is the first occasion you are having this ceremony but no doubt you will continue into the future on a regular basis. Now when you identify the people who are going to receive these honors in the years to come, I entirely agree with Ranjit Fernando that you must consider smaller people who may not have had the opportunities that are available to the large conglomerates, who may not have a history of a 135 years but who have made good with fewer resources, amidst more difficult conditions and grappling with challenges of greater magnitude.

So this is, I think all in all a very worthwhile exercise. It is not a question of pandering to vanity. It is a recognition of merit not only to enthuse and encourage the companies that received these awards this evening. I don’t really think that they need any encouragement of that sort but it is an attempt on the part of Business Today’ to hold up certain ideals, to hold up standards to be emulated by other companies in the private sector in the years to come and it is from that point of view that the word exercise can be described as something of national value and national importance.

I am particularly happy to have had the opportunity of sharing these brief thoughts with you and of associating myself with the proceedings on this occasion. I would warmly congratulate all those who received awards this evening. I would thank you very warmly and sincerely for the contribution that you have made to the economy of our country. I wish you well in the years ahead. I have no doubt that the same attributes that have made possible your success during the last year will ensure your success in the years to come and I would humbly request you to give your thought to some of the observations that I have made about the current condition of Sri Lankan society and what you in your different ways would be able to do to alleviate and mitigate the tensions which I have referred to.