Using a stock’s price-to-earnings (P/E) ratio is one of the quickest ways to learn whether a company is overvalued or undervalued. If a company’s stock is undervalued, it may be a good investment based on the current price. If it is overvalued, then investor should consider whether the company’s growth prospects justify the stock price.

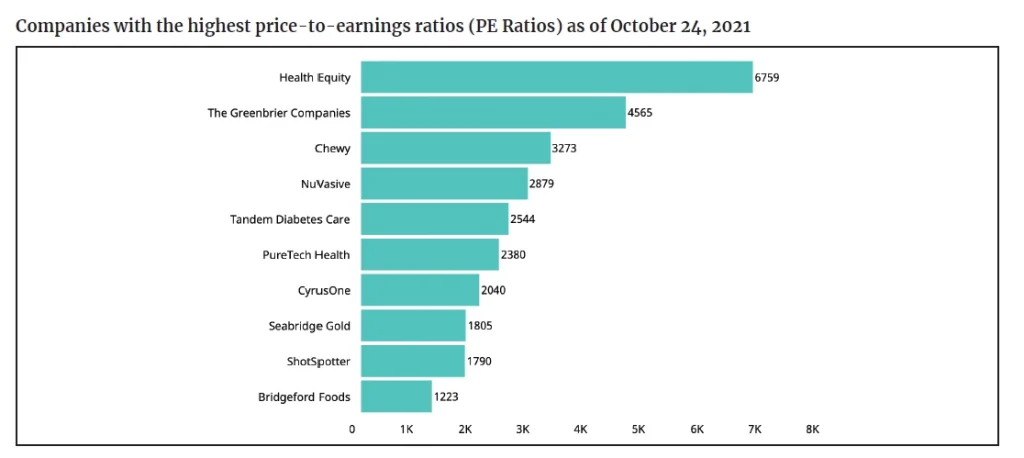

According to data presented by StockApps.com, Tesla has the highest PE ratio among the world’s top ten companies by market cap. Last week, the price-to-earnings ratio of the tech giant hit 473 or seven times more than the second-ranked Amazon.

By Jastra Kranjec.

Tesla’s PE Ratio Almost Halved in a Year

The PE ratio is calculated as a stock’s current share price divided by earnings per share in the last twelve months. A high PE ratio could mean a company’s stock is overpriced or that investors are expecting high growth rates in the future. On the other hand, a low PE can indicate either that a company may be undervalued or that it is doing exceptionally well relative to its past trends.

Although Tesla has the highest price-to-earnings ratio among the world’s ten largest companies, the YCharts data showed its PE ratio almost halved in the past year.

In October 2020, the PE ratio of the tech giant stood at around 875. By the end of the year, this figure jumped to over 1,300. In January, Tesla’s PE ratio hit an all-time high of 1,401 and then dropped to 680 by the end of June. Statistics show the company’s price-per-earnings ratio more than halved in the following week, falling to around 350 in the first days of July.

Although this value jumped to 473 over the past three months, that is still 45% less than the PE ratio measured in October 2020.

Far below Tesla, Amazon ranked as the company with the second-highest PE ratio among the top ten. The price-per-earnings ratio of the eCommerce giant stood at 58.1 last week, significantly down from 95.8 a year ago. As the company with the third-largest PE ratio among the top ten, Microsoft saw its PE ratio slightly increase from 35.5 to 37.4 during the last year.

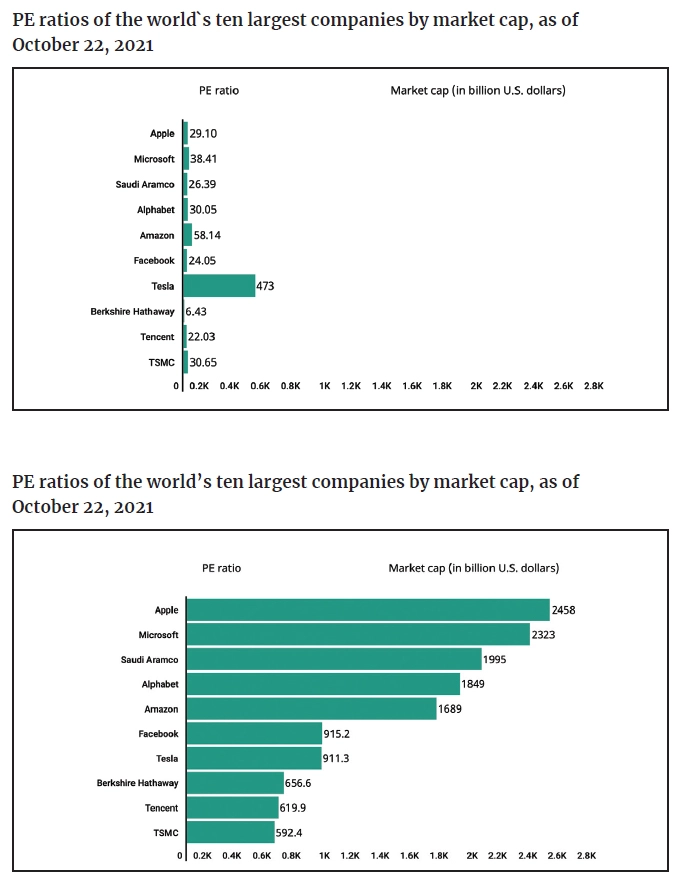

Health Equity the Company with the Highest PE Ratio Globally, 6,759 as of Last Week

Although Tesla has convincingly the highest price-to-earnings ratio among the top ten companies, the tech giant ranked on the thirty-eight place of the global PE ratio list. According to MarketBeat data, HealthEquity has the highest PE ratio globally. Last week, the price-to-earnings ratio of the US health care company stood at 6,759 or fourteen times more than Tesla.

The US transportation manufacturing corporation, The Greenbrier Companies ranked second, with a PE ratio of 4,565.

American online retailer of pet food, Chewy, and medical devices manufacturers NuVasive and Tandem Diabetes Care close the top five list, with PE ratios of 3,273, 2,879 and 2,544, respectively.