People’s Bank announced the results for its year ended December 31, 2022, with total consolidated gross revenues, total operating income, and pre-tax profit amounting to 391.2 billion rupees, 130.0 billion rupees, and 26.7 billion rupees, respectively.

Primarily reflecting an extraordinarily high-interest rate environment that prevailed – consolidated interest income rose by 58 percent during the year under review to reach 351.4 billion rupees. The interest expenses soared by 107.5 percent to 260.4 billion rupees, reflecting the faster pace of repricing of term deposits relative to loans.

As typically seen throughout the industry, most term deposits at People’s Bank have 12 months or less maturities. In addition, given that preserving and protecting its most vulnerable customer segments – the Bank and Group shouldered much of the interest cost increases- either by delaying or deferring any repricing of their loans. These collectively saw Consolidated Net Interest Margins slip by six percent to 91.0 billion rupees.

The Group’s non-funded income accounted for 30 percent of its total operating income during 2022 aided by an 81.1 percent increase in consolidated net fees and the extraordinary impact arising from the rupee devaluation. Excluding any one-off fee increases on a Bank standalone basis, growth was still strong at 26.1 percent, ultimately showcasing the Bank’s ongoing effort to consistently and systematically improve its non- funded income sources year-on- year, more so in a highly volatile interest rate environment. Reflecting high inflationary pressures during the year under review, which peaked at close to 70 percent, total consolidated operating expenses rose by 16.8 percent to 59.0 billion (2021: 50.5 billion rupees); reflecting prudent cost control and efficiency improvements as exercised at every instance so reasonably possible.

This compares well with most peers. As a result, the Bank and Group successfully maintained its cost-to-income ratios at close to 2021 levels despite many limiting circumstances.

Total consolidated customers deposits grew by 13 percent to reach 2,450.1 billion rupees whilst consolidated net loans contracted by 3.8 percent to 1,915.8 billion rupees reflecting the Bank’s and Group’s diligent approach to credit growth more so in a contracting macro- economic context, amongst other factors. Total consolidated assets crossed 3.0 trillion rupees to reach 3,133.1 billion rupees, expanding by 10.6 percent from the end 2021.

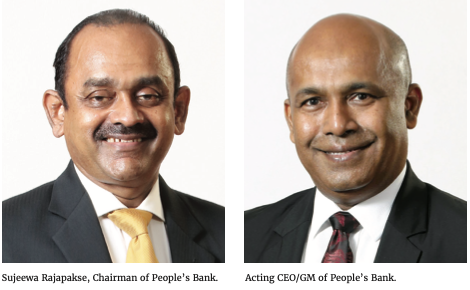

Sujeewa Rajapakse, Chairman of People’s Bank, stated: “From a macro-economic perspective, 2022 was the culmination of economic stresses and stress events over the last several years. It was a year that saw the country’s external reserve position falling to a level previously unseen. The rupee devalues by close to 80 percent; inflation soars to nearly 70 percent; policy rates increase in a manner unprecedented given curbing inflationary pressures. This resulted in the country’s credit rating falling to a historic low and the economy contracting by close to 11.0 percent, which is the deepest seen since independence. 2022 was, therefore not a year where the top-line or bottom line was the prime focus but safeguarding customer interests in their absolute time of need, strengthening liquidity and the overall risk management and the governance framework of the Institution for its long-term sustainability was and where improving efficiency and productivity at every instance possible was at the core of all conversations and decisions. All these considered, including the added burden shouldered as a responsible State Institution – we are pleased with our 2022 results both on a quantitative and, more importantly, a qualitative front. Looking forward – and as demonstrated over the last three years – we remain committed to serving the country at every possible instance and meeting every reasonable expectation of all our stakeholders while taking requisite steps to strengthen every aspect of the Bank’s overall operations.

I take the opportunity to thank my fellow Board Members for their guidance and wise counsel, the retired and incumbent CEO/ GM and the entire Management Team for their leadership, and the staff at all levels for their tireless efforts. Notably, a big thank you to our valued customers for their continued trust and confidence in the Institution.”

Clive Fonseka, Acting CEO/GM of People’s Bank, stated, “Like any Institution deep-rooted in the country’s economic well-being, in line with the country’s fortunes, 2022 was also a year of lows for the Institution. However, what defines us is our ability to immediately impose stop gaps and emerge stronger by systematically resolving such limiting circumstances. Looking at 2022 – our success remains in our contribution to the country in its time of absolute need, the interest loss and cost absorbed for the long-term well-being of our most vulnerable customers, and our ability to strengthen the various aspects of the Bank’s business in these trying times. Our way forward is clear. Looking ahead, we will endeavor to further strengthen our foreign currency operations, including developing our 900-plus global counterparty relationships, further strengthening our deposit franchise be local currency and foreign currency, exercising extra- vigilance in credit expansion with a focus on creating greater diversity in our exposures and, equally important in these times, ensure close monitoring of over-dues and continue to drive cost and efficiency improvements at every instance so possible including by way of further technology adoption. We look forward!”