The National Savings Bank (NSB) has unveiled its audited financial results for the year ended December 31, 2024. NSB reported a remarkable 126 percent increase in Profit After Tax (PAT), soaring to 16.29 billion rupees from 7.22 billion rupees in 2023.

Dr Harsha Cabral PC, Chairman, NSB, stated, “NSB’s financial success in 2024 underscores the strength of our strategic vision, disciplined execution, and unwavering dedication to our customers and stakeholders. Despite a challenging macroeconomic environment, we have demonstrated resilience, achieved record profitability while maintained a strong balance sheet and a stable risk profile. Our commitment to sustainable growth, prudent governance, and financial inclusivity continues to drive our long-term success. As we look ahead, we will further strengthen our role as a key pillar of Sri Lanka’s financial sector, ensuring that we create lasting value for the nation and its people.”

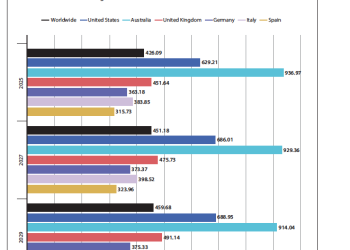

Net interest income grew significantly by 146 percent to 72.78 billion rupees in 2023, despite a 10 percent decline in interest income due to lower yields from accommodative monetary policy. This growth was supported by a 34 percent reduction in interest expenses to 130.97 billion rupees.

“By recalibrating our deposit strategies and capitalizing on favourable rate environments, we have significantly strengthened our interest margins,” said Shashi Kandambi, GM/CEO, NSB. “The Bank’s ability to optimize its asset-liability mix and enhance operational efficiencies has been instrumental in achieving this milestone, reaffirming its commitment to sustainable growth and value creation”, Kandambi further asserted.

NSB saw a 37 percent increase in net fee and commission income (1.75 billion rupees) and strong trading gains (912 million rupees), leading to a 122 percent rise in total operating income to 76.34 billion rupees in 2024. Despite economic challenges, NSB increased impairment charges by 163 percent to 11.21 billion rupees, raising the Impaired Loans (Stage 3) ratio to 5.18 percent, while maintaining a strong Impairment Coverage Ratio of 44.5 percent. The bank’s net income rose 116 percent to 65.1 billion rupees, driven by significant gains in net interest income and trading operations. Operating profit after VAT and SSCL increased sixfold to 35.78 billion rupees, reflecting operational efficiency and financial discipline.The Bank’s Profit Before Tax (PBT) surged to 26.43 billion rupees, a remarkable 516 percent increase.

The Cost to Income ratio improved significantly from 71.59 percent to 38.72 percent, showcasing enhanced operational efficiency. With income tax expenses at 10.15 billion rupees, the Profit After Tax (PAT) reached 16.29 billion rupees. The Bank contributed a total of 19.49 billion rupees in taxes and levies, highlighting its role in supporting the national economy. NSB increased its total assets to 1.75 trillion rupees, a 3.9 percent growth. This included a one percent rise in loans and advances to 532.38 billion rupees and a notable 10 percent increase in strategic investments, totaling 1.04 trillion rupees. By the end of financial year 2024, the Bank’s deposits grew by five percent to 1.56 trillion rupees, consolidating its funding leadership. The Bank reported strong financial performance, highlighted by a significant rise in the Net Interest Margin (NIM) to 4.23 percent. The Return on Assets (ROA) before Taxes increased substantially to 1.54 percent while the after-tax Return on Equity (ROE) rose from 9.36 percent. This positive trajectory was further supported by a significant accumulation of retained earnings, which nearly doubled to reach 28.46 billion rupees.

Shashi Kandambi, GM/CEO, NSB stated, NSB’s financial achievements in 2024 reflect our resilience and strategic vision. Despite a complex economic landscape, we’ve strengthened our foundation, expanded services, and enhanced stakeholder value through prudent risk management and innovation. Our focus on sustainability and inclusivity drives our strategy, with green finance initiatives supporting renewable projects and advancing digital banking to empower underserved communities. With a strong capital position and clear direction, NSB is well-equipped to contribute to Sri Lanka’s economic resurgence while remaining a trusted partner in the nation’s financial well-being.