The country opened up to another ‘new normal’ after an extended lockdown to tackle a severe surge of COVOD-19 that resulted in an unprecedented number of casualties. The government is staring right in the face of an economy in peril. Intermittent regulations and rules to mitigate anticipated downturns have only added to the apprehension and uncertainty among the people and the business community. In this background, the Central Bank of Sri Lanka (CBSL), being led again by its alumnus Ajith Nivard Cabraal is planning to steer the country’s economy through a six-month road map to focus on the critical issues threatening the economy with a to-do list.

By Jennifer Paldano Goonewardane.

The status

Pundits are wondering whether Sri Lanka would be the next Argentina. News space is full of stories of Sri Lanka’s economic woes amid the pandemic that has affected the island badly. They paint a very bleak future for Sri Lanka. Some think tanks have even predicted that as Sri Lanka’s foreign debt crisis worsens in 2021, the country may fail to meet its debt obligations in the future. Leading up to 2021, several rating agencies downgraded Sri Lanka’s sovereign credit ratings as reserves fell. S&P global ratings downgraded Sri Lanka’s sovereign credit ratings to negative. Moody’s downgraded Sri Lanka’s long-term foreign-currency issuer and senior unsecured ratings to CAA1 from B2. Fitch Ratings downgraded Sri Lanka’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to CCC from B. All these moves indicate concerns about Sri Lanka’s ability to fulfill foreign debt repayments. That helped fuel concerns that Sri Lanka will not be able to service $ 1.5 billion of debt due next year, as well as speculation that Colombo may turn to the IMF for support. But Sri Lanka is very firm on not going to the IMF for help.

Amid depleted foreign exchange reserves, the tourism industry was impacted hugely by the pandemic, generating a mere $ 2 million a month in 2021, accompanied by rising foreign exchange rates. The country is struggling to pay for imports, whose volume and value exceed those of its exports. Imports have been increasing tremendously. So far in 2021, exports indicate an increase of $ 7.9 billion, while imports outdo it by a $ 13.3 billion increase in value. Despite mounting concerns about the government’s ability to meet its debt service obligations, it managed to save face by paying $ 5.3 billion this year, consisting of forex capital repayments and forex interest payments. In this environment, government expenditure for 2021 has ballooned over its revenue.

The government turned to its South Asian and Asian neighbors for deals in currency swaps supplemented by borrowings from the World Bank and the ADB on concessionary terms. Since last year, the government has been curbing imports of automobiles and other non-essential items, requiring importers to obtain a special license or being banned altogether to reduce the outflow of forex. The prices of commodities and other goods have increased, especially the market price of goods banned from importing. Amid rising inflation, the government declared a food emergency to stabilize price increases in essential food items.Naysayers are warning that the country’s foreign debt will likely increase to $ 29 billion in the next five years.

The Road Map

Realizing that we cannot steer the economy too long through stop-gap measures, the six-month road map seems to be a decisive strategy containing a to-do list to help the economy rebound at least to a manageable level. The government partially blames the hostile environment in the country and negative sentiments among the people on ‘doomsday’ reporting fueled by the opposition and interested parties. However, it does admit that economic progress in the last decade has been slow, going by the country’s economic indicators. Of course, everyone would agree on the unprecedented impact of the pandemic in further weakening the economy, although economists also point to deeper structural issues having accelerated the decline.

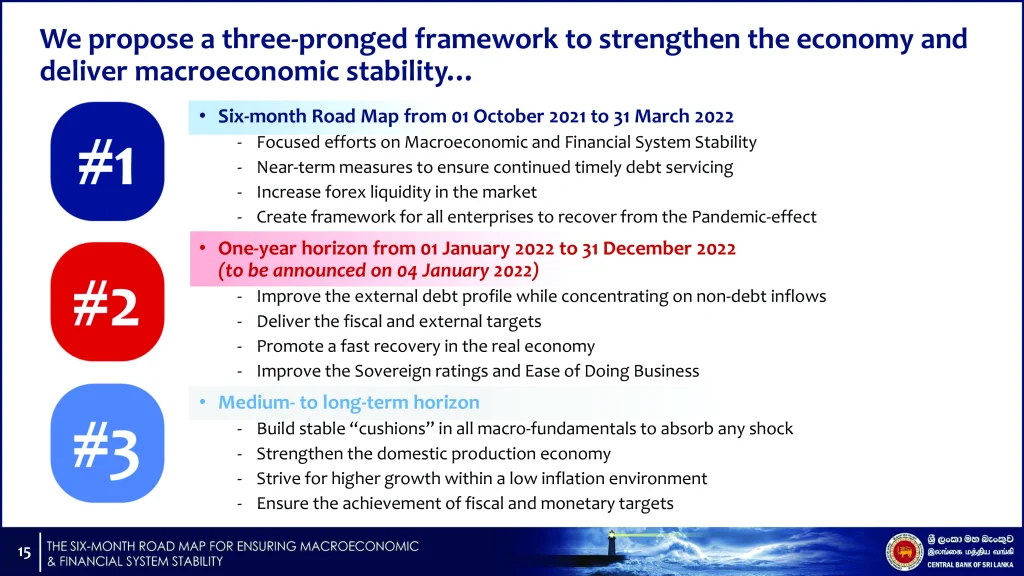

To strengthen the economy and deliver macroeconomic stability, the three-pronged framework drawn up by the CBSL is a six-month roadmap from October 1, 2021 to March 31, 2022. A one-year horizon will follow the initial framework from January 1, 2022 to December 31, 2022 and a medium to long-term horizon. The next six months will be the primary focus of the CBSL to take immediate steps to rectify the crisis in the external sector to usher in some stability. The quick actions that the government is confident would result in an economic rebound are centered on a solid thrust to manage the debt and forex challenges in the short term. The expected cash flows would augment recovery from a refreshed tourism industry. The increase in FDIs expected from the take-off of the Port City, industrial zone projects, and the sale of non-strategic and underutilized state assets is ongoing.

The critical issues identified by the CBSL are resolving debt and forex concerns, financial sector concerns, and macroeconomic stability concerns. In the short term of six months, the CBSL, through the proposed measures, hopes to enhance the Gross Official Reserves to cover a minimum of four months of imports. It also seeks to achieve a diversified Sri Lanka Development Bond (SLDB) investor base, stabilize exchange rates and interest rates, and reduce weekly treasury bill auctions to below 50 billion rupees. The Central Bank will aim at achieving a stronger balance sheet with improved Net Foreign Assets and Net Domestic Assets Ratio while stabilizing inflation at mid-single digits of four to six percent target range. With the pandemic and its impact on businesses and the challenges for domestic financial services, measures are underway to ensure a more robust banking and non-banking sector in 2021 and beyond. All these measures aim to achieve real GDP growth of around six percent in 2022.

The CBSL also announced the government’s short to medium-term target to secure $ one billion financing from foreign governments, including short-term currency swaps. It hopes to get $ 500 million in the next three months. A strategy hopefully will pay off as shortterm borrowings are regarded cheaper in comparison to long-term. The Central Bank has said it will continue to provide forex liquidity to the market to part-finance energy bills. However, it would reduce the dependence of State-Owned Business Enterprises (SOBEs) on borrowings from state-owned banks to fulfill financial requirements. In the future, SOBEs will have to look for auxiliary sources of borrowing outside their usual ambit of government banks. This rule would apply firmly to loss-making SOBEs that continue to be buttressed by government bank funding.

Managing the forex market

The stringent monitoring of the forex market will continue, with guidelines to the financial services institutions to deal with the import and export trade. Other mechanisms include attracting investments into government securities and reduce the debt around International Sovereign Bonds (ISBs). If high discounts prevail in the market, the Central Bank may consider buying back the ISBs maturing in January and July 2022 in their entirety. The CBSL will diversify its investor base in SLDBs by attracting foreign government and private institutions and eligible domestic investors by selling in parcels of $ 50 million and multiples of $ 50 million.

The CBSL focuses on strengthening the forex market through heightened monitoring. And its daggers are drawn in the direction of the export ecosystem. By setting up an International Transaction Reporting System (ITRS), operational from January 2022, the CBSL is giving the banking system the legitimacy to track the performance of export-oriented sectors, fund repatriations, and conversions. Simultaneously, the CBSL would direct the government to increase taxes on exporters’ profits from 14 percent to 28 percent. It’s crucial that while the government strives to attract FDIs through targeted investor forums and programs, and incentives, and new legislation, it should not contravene the assertions in the CBSL’s road map. The government is intensely promoting dedicated industrial zones for FDIs, encouraging at the same time domestic investment with foreign partnerships. Hopefully, any incongruent areas on export earnings will not affect or interrupt the investment environment the government is promising or confuse potential investors.

Further, the CBSL plans to stop exporters from saving US dollars and borrowing in rupees by converting export proceeds into Sri Lankan rupees after retaining any required forex for intermediate and investment inputs. Exporters will also need to convert accumulated forex deposits from export proceeds with banks to the local currency. The CBSL is hoping to encourage this by introducing dedicated non-interest-bearing foreign currency accounts for export proceeds. On an optimistic note, the CBSL also added that none of the stringent conditions targeting the export community would bear upon holders of personal foreign currency accounts. That is good given that the country has an expatriate community and hopes to attract many more to choose Sri Lanka to work and live in the future as the country opens up to responsible investment opportunities. In this light, the CBSL has listed in the to-do list the government’s focus on improving the business environment for domestic and foreign investors by considering all the factors impacting the ‘Doing Business’ environment.

In the meantime, the vehicle import businesses cannot expect much change in their current status. The CBSL announced that any future consideration to ease the ban would be subject to conditions that would allow the process only through forex earnings or FDI, with relevant government taxes paid in forex. The cash margin deposit requirement imposed on non-essential and non-urgent imports creating a great deal of furor at home, has been withdrawn. The CBSL also said that it allows banks to continue to facilitate essential imports. However, businesspeople struggle to obtain US dollars from banks to clear their consignments, whether their goods are vital or not, forcing some to turn to the purchase of dollars from informal market sources. This trend will hopefully change by an undertaking from the Central Bank to restore licenses of money changers. In January 2022, the CBSL intends to lift the ceiling on outward investment and migration allowances. It will continue to encourage banks to pay special incentives and interest payments for inward remittances and special deposit accounts to attract more forex into the country.

Attracting investment

While the most significant emphasis in this endeavor is to confront exporters to ensure mandatory conversion of export proceeds, the government is pushing harder to sell off non-strategic and under-utilized assets to earn an envisaged $ one billion. The much-plugged Port City is open for grabs. The government expects to attract record FDIs of great value and visibility into the country, given its commitment to providing special concessions and ease of doing business through the Colombo Port City Economic Commission Act. Further, the government is also pushing an investment portfolio of dedicated industrial zones and other opportunities for FDIs as immediate measures to increase its forex largess. Such an envisioned inflow, the CBSL hopes, will be bolstered by a business-friendly budget with detailed financing strategies and a tax structure for easy compliance.

Meanwhile, beginning in October 2021, the country will go head-on to attract investment into Sri Lanka by pitching to the Middle East and Asia on investment opportunities. Europe and the USA are also within sight, as evidenced by the government’s recent agreement to diversify its energy sector through a deal with a US-based energy infrastructure firm. The government is lunged in a situation where with the scaling down in imports, Sri Lanka’s engagement with Europe and the USA in terms of two-way trade has become somewhat skewed, which may require the government to adopt alternative means of circumventing this situation. Further, the CBSL hopes to attract investments into the equity market and into listed corporate debentures, which some economists warn are highly volatile means of forex earnings.

Supervising the financial services sector

In trying to strengthen, safeguard and bring discipline into the financial system in Sri Lanka so that it has integrity, the CBSL has an enormous challenge in dealing with the financial services sector market. That includes banking and non-banking institutions. With a comprehensive plan to deal with six failed finance companies, the CBSL will ensure that all licensed finance companies are listed in the Colombo Stock Exchange before September 30, 2022 while looking to infuse more capital into their portfolio through mergers and acquisitions.

The challenges to supervise banks in the new normal is enormous, acknowledges the CBSL. While the CBSL is always watchful of any ‘warning signs,’ responding the right way is easier said than done. The banking and non-banking players have to play an active role in managing the debt and forex issues by monitoring and screening forex flows and maintaining transparent transactions in forex. Based on the strength of the balance sheet of financial institutions, they are to mobilize fresh forex funding on competitive terms, targeted at $ 1.5 billion. But the potential long-term impact of the crisis on the banks is not ignored, stressing the need to adopt a forward-looking approach and an increased supervisory regime to prevent financial institutions from resorting to unwarranted risks that would destabilize the economy. The ongoing flexible measures followed by banks concerning capital, liquidity, moratoria, and reporting, while being allowed to continue, will eventually be undone on time. To usher stability to the financial system, regulations such as provisions on adequate levels of capital and liquidity buffers will continue.

Stakeholders to the rescue

The CBSL will be actively engaged in stringently controlling the financial market for the foreseeable future. It depends heavily on the identified group of stakeholders to deliver the envisaged economic rebound. It’s hoped that there would be new credit lines of $ 500 million through the banking sector in the quarter of October-December 2021, while the projection is for that value to soar to $ 1,000 million in the January-March quarter of 2022. Meanwhile, the forecast for forex deposits for the same periods is $ 300 million and $ 500 million, respectively. The government expects $ 300 million of inflows into the Port City and $ 200 million from the Colombo Stock Exchange in the January-March quarter of 2022. Similarly, export earnings for the rest of 2021 are estimated at $ 3,300 million, increasing to $ 3,600 million in the first three months of 2022. The potential in services export has been evident during the pandemic. Therefore, the projected earnings will increase from $ 1,000 million in the last three months of 2021 to $ 1,200 in January-March 2022. According to estimates, tourism earnings will remain low at $ 50 million for October-December of 2021. There is much optimism in the projection for 2022, with a forecasted $ 300 million in revenues for January-March 2022. According to forecasts, inward remittances will grow to $ 2,000 million in the first three months of 2022 from $ 1,800 million in the October-December quarter of 2021.

As the Central Bank declares an outcome-oriented strategy, one hopes that the measures outlined in the road map will pay off, while ad-hoc decisions will not ruin the country’s chances of recovering in the long-term. There seems to be a great deal that the government needs to do to attract foreign investors. Offering opportunities for investment is not enough. Investor confidence is what matters. In that regard, Sri Lanka can learn a lot from its Asian neighbors and realize that one has to walk the talk and not talk only. The road map spells for the first time a degree of rigorous effort on the part of the government to demonstrate its commitment to ride through the current crisis in one voice, unless, of course, someone utters something to the contrary soon. Through these measures and their positive spillover, the sovereign credit ratings will improve. And so will clarity regarding the internal business environment, thereby giving Sri Lanka the positive outlook, it requires to harness its tremendous investment potential to make it the “next miracle of Asia.”