It goes without saying that the contribution of banks towards the developments in the Information Technology field is a most outstanding one. If you care to ask the experts in the 25 year-old computer industry in our country, they will tell you that this statement is particularly relevant to us. In Sri Lanka, banks were not only the first major group of organisations to introduce computers into their day-to-day operations, but also the only group of organisations which were willing to invest in the latest in information technology, inspite of the high costs. In the case of most of the developed countries, the academic and research organisations also played a major role in the earliest developments in this field, but what we observed here is, banks and the rest of the financial institutions taking precedence over all the others. The relics of this automating revolution like the dinosaur mini-computers and the huge barrel-sized hard disks can be seen in some of our major banks even today.

The introduction of the computer system into banks when the technology was still at its primitive stage had done both good and bad. It might have made things easy for the customers and the banking staff, but the price paid for this was quite high. For instance, at the time that most of our banks installed their islandwide networks, we were still a few years ahead of the Information Super Highway or what is popularly known as the Internet. All the banks settled for their own data communication networks and in this process duplication in some steps was inevitable. Because each of them had to spend massive amounts individually, the installation as well as the maintenance costs of these wide area networks were quite considerable. Then, Internet entered the scene. With this, everything took on a dramatic change of course.

It is understandable why two or more banks do not want to share the same communication network, but Internet is an exception. It belongs to no one. It is universal. So, the use of Internet for banking and financial purposes should not be very different from

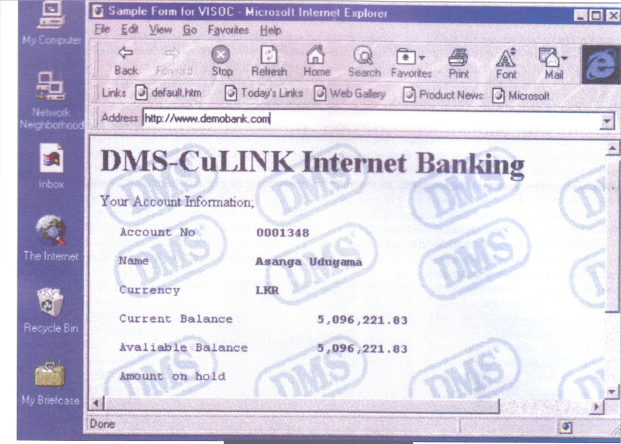

using the same telecommunication network for telephone conversations. Milinda Vitharana is one of the first persons who realised that. As the Group Manager Financial Services Products Support at DMS Software Engineering (Pvt) Ltd., he could not afford to miss this rare opportunity. Milinda, a Computer Engineering graduate from the prestigious Birla Institute of Technology in India, had been working with his team for two long years to develop a software system for banks that will utilise the full Internet facilities instead of using proprietary data communication networks. This system, named as DMS-CuLink which is the first of its kind in the island, was scheduled to be released in the first week of January. It should be available in the market at the time of reading this article.

What made DMS take this pioneering step? To quote Udaya Kosgallana, Manager for Financial Services Industry Products. Verbatim, “the need to incorporate a multitude of data bases and operating system environments has been a product vision since the inception of the product range. The new software system, he adds. functions as an ancillary system of DMS-CuProbe (Customer Product- Oriented Banking Environment), a software system for Commercial and Investment Banking Operations developed in the mid-eighties with the banking expertise of the Colombo Branch of an International Bank.

It is not exactly an exaggeration to say that this attempt pioneers in this field, in an area broader than Sri Lanka. Even if we look at the international scenario, the history of Internet Banking (“Net Banking”) is not a very long one. The September 1996 issue of the Chartered Banker provides a very informative piece on Internet Banking Systems and All these uses according to it, the Security First Network Bank in the US is the first bank to operate fully on the Internet. This bank which launched its operations in October 1995, is a joint venture between three specialised information technology companies and three banks. In the United Kingdom, the Barclay Bank is doing pioneering work in this field. A majority of the prominent banks in the UK already use the Internet for advertising purposes, but this bank has gone a step further to provide a service over the Internet which is termed as a Virtual Shopping Mall. Customers can buy goods in this shopping mall by quoting the numbers of any credit or debit card.

From the customers’ point of view, an Internet banking system will only be an extension of the Tele banking systems and the so called PC-banking systems like Hexagon, which some of our local banks have been using for quite some time now. Somehow, these PC-Banking systems can hardly compete with the vast pool of Internet resources ready to be utilised at will.

The major drawback the non-Internet based PC-Banking Systems have, is their proprietary factor. All these systems can only be used to communicate with the financial institutions who use them. For instance, the popular Hexagon system may let you draw money from an account you have in a bank which uses the system, but you cannot go one step further by sending it to a leasing company as a monthly instalment. This is because your leasing company might not be using a system compatible with Hexagon. An Internet system also may not allow you to do a transaction like this in such a simple way just at this very moment. but most definitely you can expect internet banking and financial packages to provide you the opportunity of doing all the monetary transaction you want to do without ever leaving your executive chair within the next five year’s time.

This trend does not mean the end of the presently used non-standardised PC-Banking systems. It will, on the other hand, most certainly force the vendors of these systems to come up with new Internet versions of the same systems. Perhaps, keeping this in mind, the Hongkong and Shanghai Bank Corporation (IISBC), the international bank that developed and has utilised Hexagon since 1985, joined with the global software giant Microsoft last year to develop a financial and accounting software package named as Personal Hexagon. This will be a perfect cross between the HSBC’s Hexagon’ and Microsoft’s prevalent accounting system Microsoft Money. This software package, at present, does not use the Internet protocol, but with the rapid expansion rate of the Internet worldwide, we can fairly assume that the day when we will actually see this happening will not be that far away.

Nevertheless, this tendency does mean that the days of Automatic Teller Machines (ATMs) are numbered. Ovum, a marketing and financial research company in the US gives them another ten years. Since Internet Banking Systems allow a person to do direct and complete transactions with the financial institutions, eliminating the necessity of physical cash as an intermediary agent, (like withdrawing money from the bank account and settling a hospital bill with a few key strokes), the ATMs will become entirely useless.

Many concepts come to stage hand-in-hand with Internet Banking. Digital-Cash (popularly known as digicash’) is one such concept. It is widely used in all the electronic banking systems. Internet Banking Systems do not get the credit for introducing this concept but they most certainly get it for taking it a step ahead. Digicash is the digital equivalent of a traveller’s cheque.

Users can buy these notes’ from a bank and encash them for valid notes when the need arises. The only difference is that this whole process is a completely paperless one. In other words, when I say ‘notes’ it does not mean paper notes. Then comes Digicredit. Just as cash and credit coexist in today’s business climate, both can exist in the digital world as well. Digital credit is similar to the credit systems used in the business world. The main difference lies in the incorporation of digital time stamps and digital signatures that build auditability and accountability into the system and replace the paper trail that will no longer be there.

Depending on the vendor, an Internet Banking System may offer various features but basically they support the same financial functions. With the use of such a system financial institutions can offer customers twentyfour-hour access to current and savings accounts. give them the ability to make transfers between the accounts and obtain balance information and review interim statement information. With Inter-Bank Transfer capability, access to the customers’ funds in other accounts at other financial institutions is also offered as an added feature. One of the most interesting facilities an advanced

Internet Banking System offers, is the online electronic cheque writing capability. (Of course, it might be too much to expect that from CuLink at this initial stage). With such a system, the paver creates a voucher record that contains a description of the transaction, the names of the receiver and the payer, the date and time of the transaction, and the amount to be paid. The receiver can submit the voucher to a clearing system and have legal grounds for collecting the payment.

A digital signature can also be used to prove the identity of a person. You are mistaken if you think this digital signature is less secure, in fact, it is actually the opposite.

Digitally signed instructions use a technique called ‘Public Key Cryptography to generate a digital signature. This signature essentially proves that a particular person is in possession of an individual private key which created the instructions in the first place. The key is generated by the individual who wishes to use it and there is no need for that key to ever go out of its original user’s hands. The user’s Bank, Travel Agent, Insurance Company or suppliers dealing with requests on the basis of the digital instruction, never need to see the private key. Nor, does anyone else.

So where exactly do we stand? Or to rephrase the question, out of the hundreds and thousands of financial services what are the special ones offered by the DMS- CuLink? I haven’t had firsthand experience with the system yet, but according to a press release issued by the DMS, which puts everything in a nut shell, the system mainly enables customers of a financial organisation to obtain upto the minute information and also, verify account balances, enquire on cheque collections, place standing orders, issue stop payments, pay utility bills etc. So far only the pros of an Internet Banking System were discussed, but there are cons too. Its major flaw is the security or rather the lack of it. Internet empowers you to do things in easier and faster ways but you cannot always expect it to protect your money for you. The amount of money financial institutions lose due to computer crimes is rising a rapid rare. Understandably, no exact figures are available, because the victims are usully reluctant to admit embarrassing rips in security.

However, Byte, an international computer magazine estimates more than two thousand million US dollars will electronically disappear only from the US Banks, annually. This is actually the estimate for 1994, when Internet was not widely used for financial purposes. However, when data start to travel in less private paths, this figure can be expected to augment exponentially.

Anyway, this should not prevent you from keeping your faith in Internet Banking Systems. After all. how to prevent anybody robbing your money from your bank account is your banker’s problem, so there is no need to worry (provided you are not banker yourself!). The good news is that this problem is not a new one and the system developers have come up with one thousand and one ways to prevent any possible hacker (a computer criminal) disappearing with your hard earned money. The most popular techniques are the Internet Firewalls and Electronic Encryption but there are many similar lesser-known methods. Well, if you are still not convinced about placing your bets on this new technique, consider this possibility. A bug in the computer network in a British bank, which prefers to remain anonymous for obvious reasons, once did false transactions which resulted in the depositing of two billion pounds in the bank’s customers’ accounts. Well, one day it can happen to your bank too!