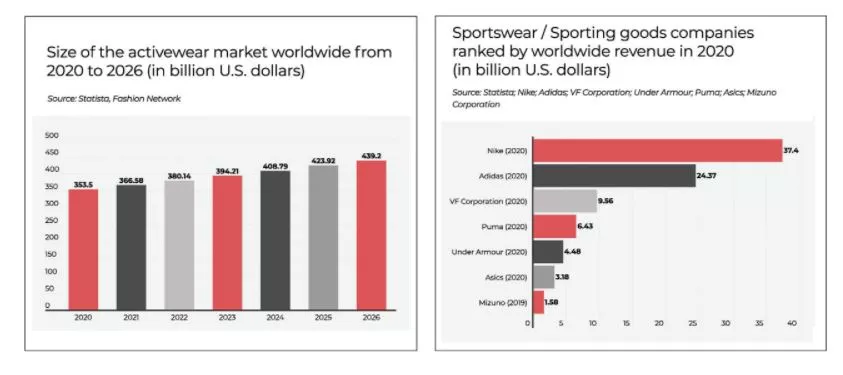

The global activewear industry, comprising several product categories like footwear, sportswear, swimwear, and yoga wear, has grown steadily over the last half- decade. In 2021, the entire sector is expected to hit a USD 366.6 billion value, up from USD 353.5 billion a year ago. According to data presented by 123scommesse.it, the increasing trend is set to continue in the following years, with the global activewear market reaching over USD 400 billion value by 2024.

The United States the Largest Market, Women`s Activewear the Fastest-Growing Segment

Due to the COVID-19 pandemic, the day- to-day lives of the average consumer changed considerably. As working from home became the new normal, many sought more comfortable clothing, like athleisure. This was additionally fueled by the rise in outdoor activities as bars and restaurants shut down.

In 2020, the global activewear industry hit USD 353.5 billion value, revealed Statista and Fashion Network data. This year, revenues of the entire sector are expected to rise by four percent YoY to USD 366.6 billion. By 2024, revenues are forecast to jump by another USD 42 billion and continue rising to USD 440 billion by 2026.

The United States is the largest market in the global activewear industry, expected to generate USD 113.4 billion in revenue this year, up from USD 105.1 billion in 2020.

The Statista survey also revealed that women’s activewear is one of the fastest- growing segments of the activewear market. Between 2017 and 2020, revenues of the women’s activewear market grew by 25 percent to over USD 148.7 billion. By 2025, this figure is set to touch almost USD 217 billion.

Nike the Biggest Market Player, Followed by Adidas and VF Corporation

Nike was the largest sporting goods company worldwide by revenue in 2020. Last year, the US sportswear giant generated over USD 37 billion in revenue.

A large proportion of Nike’s income comes from footwear, and revenue in this segment amounted to USD 23 billion in 2020, compared to 1$3.67bn generated by Adidas in the same sector.

The European sportswear giant ranked as the second-largest player in the activewear market with USD 24 billion in revenue last year. However, Asia-Pacific was the biggest market for Adidas in 2020, with 33 percent of their net sales coming from this region, compared to 27 percent in Europe and 24 percent in North America.

The two sports apparel companies also have the largest market cap worldwide, outperforming other brands like Under Armour. With USD 9.56 billion in revenue in 2020, VF Corporation represented the third-largest company in the activewear industry.

Puma and Under Armour followed with USD 6.4 billion and USD 4.5 billion in revenue, respectively.