January 24, 2023 Justinas Baltrusaitis

The European banking sector is showing resilience and adaptability, having faced its fair share of challenging ranging from escalating geopolitical tensions and a harsh economic climate. The resilience has been highlighted by the sector’s ability to defy market conditions and record growth in total assets.

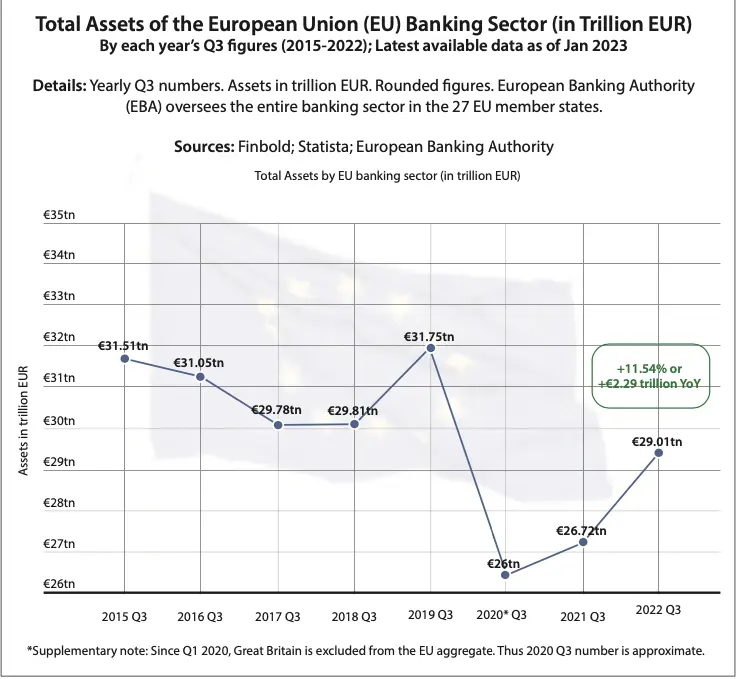

According to data acquired by Finbold as of January 23, banks across the European Union (EU) member states as of Q3 2022 accounted for assets worth €29.01 trillion, representing a year-over- year (YoY) growth of 11.54% or €2.29 trillion from the €26.72 trillion recorded in Q3 2021.

Notably, the number of assets recorded a sharp drop between 2019 and 2020 in the wake of the pandemic. During Q3 2020, the EU banking sector assets stood at €26 trillion, a drop of about 15% from 2019’s figure of €31.75 trillion.

However, this period also coincided with a phase when assets held by Great Britain banks were removed from the EU aggregate, thus Q3 2020 figure is an estimation. Elsewhere, the value of assets peaked in Q3 2019, representing a YoY growth of over 6% from €29.81 trillion.

EU Banking Sector Defies Market Uncertainty

The growth in assets correlated with the rising geopolitical tensions following Russia’s invasion of Ukraine, a scenario that has made Europe strategically vulnerable. Indeed, the banks were at the forefront of helping regulators impose economic sanctions on Russia. Therefore, banks’ had to adhere, considering exposure to Russia in the wake of sanctions came with reputational and legal risk, a scenario that could have automatically affected asset growth.

Fortunes of the banking space were further complicated by Europe’s reliance on Russia’s energy supply, a factor that could have affected the quality of different banking products such as credit. However, asset quality has likely improved following energy volatility, with the EU cutting dependence on Russia. Overall, resilience in the banking sector has emerged despite the full effects of the war yet to be determined. In this case, the crisis may intensify the pressure on asset quality.

Elsewhere, the ongoing invasion of Ukraine by Russia has also played a role in increasing operational risks for banks in the EU. For instance, the war has led to heightened cyber risks. It could have easily been assumed that costs might impact the general assets.

Interestingly, the growth in the EU banking sector has also emerged amid prevailing inflationary pressures and monetary policy tightening, which resulted in a general economic slowdown. Notably, across 2022, these elements contributed to increased fears of recession, potentially affecting the banking sector’s credit risk and loan growth.

On the other hand, the high-interest rate environment might have positively influenced the banks as it may have contributed to increased profitability. However, this could lead to defaults by borrowers. In this line, analysts have suggested that banks may encounter inflationary growth at the onset of the crisis.

Effects of the Pandemic

Besides the geopolitical tensions, the banking sector is still attempting to recover from the effects of the pandemic. Indeed, a further drop in assets was contained due to central banks injecting support measures to counter the economic effects of the health crisis. Interestingly, the pandemic results could also have played a crucial role in the ability of banks to record increased assets.

The pandemic triggered a wave of digitization. With more consumers turning to online and mobile banking platforms, banks have been able to expand their reach and offer a broader range of services. This has led to increased competition and innovation in the banking sector, which has benefited both banks and consumers.

With recession concerns accelerating in most European countries, banks might be operating in uncertainty. At the same time, with the geopolitical tensions still escalating, only time will tell how the banking space will be affected.

Justin crafts insightful data-driven stories on finance, banking, and digital assets. His reports were cited by many influential outlets globally like Forbes, Financial Times, CNBC, Bloomberg, Business Insider, Nasdaq.com, Investing.com, and Reuters, among others.