July 30, 2024. Edith Muthoni.

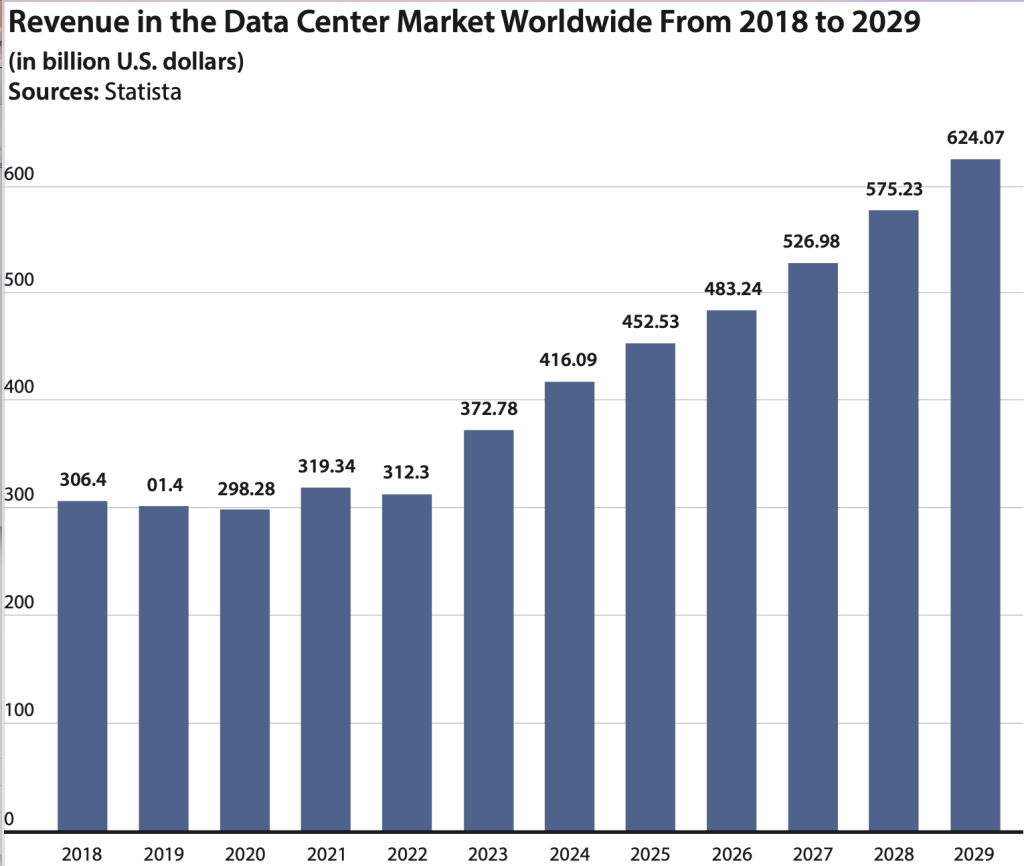

The data center industry is down for an impressive trajectory amid the ongoing surge in AI developments. According to Stocklytics. com, data center revenue will surpass USD 500 billion by 2027.

Edith Reads, a financial analyst at Stocklytics.com, highlights several key factors contributing to this growth. She states: The increasing adoption of multi- cloud solutions is driving the expansion of data centers. Network upgrades to support 5G are also contributing to this growth. Additionally, expansion initiatives by hyperscalers are playing a significant role. The rising demand from SMEs for enhanced data storage and processing capabilities further elevates revenue potential in the market.

Global Revenue in the Data Center Market

The data center market will experience remarkable growth from 2024 to 2029, increasing by over USD 208 billion and culminating in a 50 percent rise. Global data centers will generate around USD 416 billion in revenue by 2024, a 12 percent increase from 2023.

Furthermore, the market will scoop an impressive USD 452 billion in 2025, exceed 526 billion by the end of 2027, and reach an astounding USD 624 billion by 2029. These revenue projections align with the heightened demand for high- performance computing (HPC) enterprises and cloud network upgrades as businesses seek to enhance their server capabilities and improve data storage and processing. The United States currently leads the world in data centers, boasting over 5,300 facilities. Germany ranks second with 521 data centers, followed closely by the UK with 514, and China with 449, highlighting the industry’s significant progress.

Addressing Concerns in the Expanding Data Center Market

The data center industry faces a significant power crunch amid the growing demand for AI technologies. In the U.S. alone, data centers consumed nearly 17 gigawatts of electricity in 2022, and this number is projected to more than double to 35 gigawatts by 2030.

Many power providers struggle to upgrade their transmission networks to meet the surging demand for electricity. This results in extended construction timelines for data centers—delays of 24 to 72 months due to power supply issues. This situation underscores the urgent need for alternative energy sources, preferably renewable and cost-effective, to sustain data centers.

While progress toward adopting energy-efficient infrastructure models for data centers is gradual, some enterprises are actively working to cut emissions and explore alternative power sources. For instance, some data centers are utilizing hydrogen power cells for battery backup and eco-diesel fuel, as Microsoft has implemented in its generators for its cloud region in Sweden.

Additionally, Samsung’s new Dongtan IDC leverages external wind and cooler climates instead of traditional air conditioning, aiming to save 21,443 tons of greenhouse gas emissions by 2035, highlighting subtle efforts of data center developers to reduce electricity consumption.

Edith is a fintech expert and a trader with over 10 years of industry experience. She is knowledgeable about blockchain, NFTs, Cryptocurrencies, and stocks – all from an informed perspective that will help you make better decisions when it comes time to invest your money.