December 12, 2022 Elizabeth

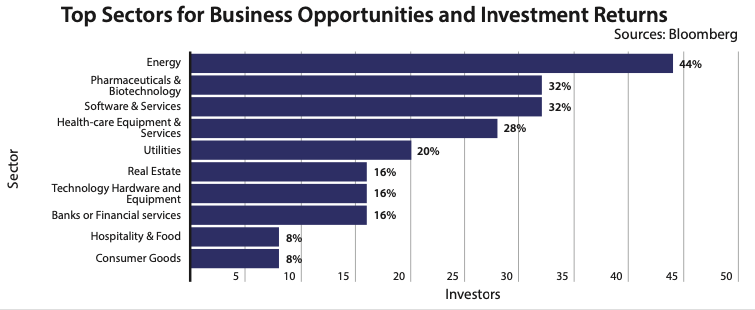

Energy stocks are becoming more and more appealing to the world’s super-rich. That’s according to a MoneyTransfers.com report citing data from a UBS Group AG survey. The survey indicated that 44% of the bank’s billionaire clients are bullish about investing in energy stocks in the upcoming five years.

Jonathan Merry, the CEO of MoneyTransfers, has weighed in on the latest energy stocks trends. He holds that energy stocks remain a strong source for investment growth prospects, especially those specialising in efficient energy utilization.

“With energy being such an essential commodity for our daily lives, energy stocks always remain attractive investments. In particular, those related to renewable energy projects, are the best investments to make. That’s due to their sustainability potential and strong outlook. While the sector may still have obstacles to overcome, such as inconsistent production and supply, those with a long-term approach stand to gain handsomely from investing in this area,” stated Jonathan Merrynone, CEO, MoneyTransfers.

According to Merry, investors should remain conscious of market trends, energy policies, and other pertinent information when investing in energy stocks. Investing in energy stocks can be a great way to diversify portfolios while making a solid financial return at the same time.

Why are Investors Betting on Energy Stocks?

There are a few reasons why super-rich investors may be betting on energy stocks. One reason is that the energy demand will continue increasing as the world population grows and economies continue to develop. Investing in energy stocks is a way to take advantage of the long- term growth potential of the sector.

Additionally, the energy sector is transitioning towards renewable forms of energy, such as solar and wind power. Investing in energy stocks can be a way to capitalize on this trend.

Finally, the Russia-Ukraine conflict has significantly impacted the energy industry, particularly regarding natural gas supplies. Russia is a major supplier of natural gas, and the conflict has disrupted the flow of this commodity, causing prices to rise.

This has led to increased investment in energy stocks by billionaire investors, as they see potential profits in the growing demand for energy and supply disruptions.

APAC Region is the most Attractive for Investments

Asia Pacific has emerged as the front-runner regarding business and investment opportunities. According to the UBS survey, 58% of the super-rich investors regard the region as the most attractive place for investing in the next five years.

This makes sense when you consider that some of the world’s largest companies, most powerful economies, and fastest-growing markets are located there. These factors have made the Asia Pacific region a hub for innovation, providing businesses and investors with countless opportunities to explore.

Moreover, current trends suggest that countries in this region will continue to invest in infrastructure and technology to help businesses operate more efficiently. The future looks bright for those willing to take advantage of the region’s offerings.