The Business Today TOP TWENTY FIVE Award Ceremony recognised the best corporates in Sri Lanka for their exceptional performance during the financial year 2012-2013.

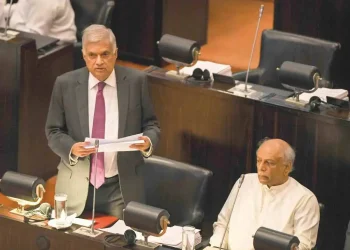

The event was held under the patronage of Nimal Siripala de Silva, Leader of the House and Minister of Irrigation and Water Resources Management as the Chief Guest, and Ranil Wickremesinghe, Leader of the Opposition as the Guest of Honour. The Guest Speaker at the event was Ajith Nivard Cabraal, Governor of the Central Bank of Sri Lanka. The award ceremony brought together a distinguished gathering of politicians, business fraternity and dignitaries.

Event and media coordination was by Glenda Parthipan, Emphasis. This included the concept, entertainment and decor for the evening.

Speeches and the Award Ceremony can be viewed at businesstoday.lk

BT Options: Reflects on the past while looking forward at the future

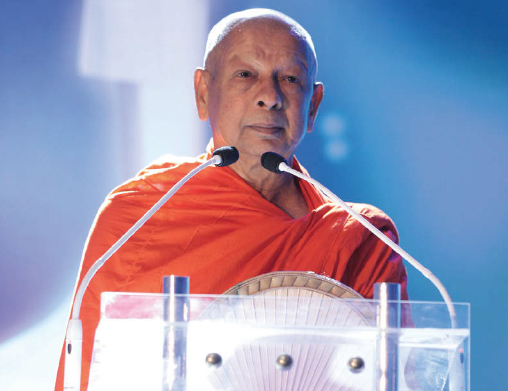

We are privileged to have amongst us, Ven Galaboda Gnanissara thero, the Chief Incumbent of Gangaramaya Temple, Ven Uduwe Dhammaloka Thero and Ven Kirinde Assaji thero. We are extremely grateful to Hon Nimal Siripala de Silva, Leader of the House and Minister of Irrigation and Water Resources Management for agreeing to be the Chief Guest for this evening, we are humbled by your kindness and appreciate your support. We also wish to thank Hon Ranil Wickremesinghe, Leader of the Opposition for accepting our invitation to be the guest of honour and Mr Ajith Nivard Cabraal, Governor of the Central Bank of Sri Lanka as the guest speaker for the evening.

We wish to thank His Excellency Mahinda Rajapaksa, Defence Secretary Gotabaya Rajapaksa, the three Armed Forces, Police, CDF and Military Intelligence for ending the 30 year long conflict. It is because of them that we are able to experience peace and freedom.

The year 2012-2013 reflected the resilience of the Sri Lankan economy, though growth slowed down and there were many challenges that were felt by all sections of the country.

The year also showed the need to take into account the effects of climate change and to be better prepared. While global economic conditions continue to be a concern for the country, stringent policies though at times were unpopular were necessary to ensure the stability of the country. The performance of the private sector too reflects its adaptability and resilience to face any situation.

Sri Lanka is a young economy of four years considering that the conflict ended in 2009. Therefore the private sector and the public sector have to work together. With the end of the 30 year long conflict, many opportunities have been created with new names as well as established blue chip companies entering new areas of business.

In the 1980s and 1990s we operated casinos under the direction of Richard Tuttle and Rakesh Wadwa, with 24 operations and unlimited entertainment.

Though casinos, gaming and entertainment have become a hot topic in the present day, casinos were operated in the past, where policies were not as favourable as today. Palm Beach, Le Casino, at the Meridian Roof Top, Star Dust, Casino Royale, Coral Casino at Coral Gardens Hikkaduwa, and Casino Airport at Airport Gardens Hotel were operated by us. Colombo By Night, was famous at that time for providing an all encompassing entertainment tour for guests. We sponsored shows of international musicians, such as Latoya Jackson and Kool and the Gang. Dancers and entertainers were brought down from Las Vegas. The exuberance of the industry was invigorating.

We have been part of an Apple environment, since 1988. And we were the first to open an Apple Store in Sri Lanka. We are considered expensive but everyone does come to BT Store for service and support, so do give us your business as well!

Explore Sri Lanka, our pioneering magazine, which was established in 1987 is going strong and today has a print run of 20,000 per month. With an extensive reach, Explore Sri Lanka is the only complimentary magazine to be published without any disruption for 26 years.

Business Today continues to feature notable personalities and thought provoking articles that gives a true reflection of the individual. We ensure that we give our best to everyone we interview.

BT Options has been publishing Serendib, the inflight magazine of SriLankan Airlines since 2010. At this time we would like to thank His Excellency Mahinda Rajapaksa and Mr Lalith Weeratunga for their efforts in bringing the production of the magazine to Sri Lanka Target magazine, which everyone thinks is funded by the government is completely funded by BT Options.

We have said this a few times, so hopefully we will start to get advertisements especially from the public sector institutions.

BT Options will be publishing a new magazine –Design– with the first issue to be out in January 2014. BT Options has shifted to a new office premises on Duplication Road.

We wish to thank Mr Kaleel Rahumathulla, the proprietor of the building for his cooperation. BT Active, is our lifestyle and health club, which is based on the concept of Virgin Active. Membership will be by invitation only. Young and fit we believe in working hard and playing harder. But our motto is work hard and party harder!

We stress that BT Options is not a media organisation nor a production house. Therefore the way we work is very different. We are pro Sri Lanka.

We have always been and always will be pro Sri Lanka. This is reflected in our publications as well as in all the work that we do.

Emphasis, the PR and Event Management Company headed by Glenda Parthipan, coordinated the opening of Dutch Hospital Square with the unique theme of Streets Alive at Dutch Hospital Square, the launch of the Sinhala translation of Gota’s War: The Crushing of Tamil Tiger Terrorism – Gotabayage Yuddhaya: Demala Koti Thrasthavadaye Aithihasika Parajaya and the launch of Chamal Rajapaksa, the biography of the honourable speaker. The concept and management of these events were done by Glenda. Even the event today, the Business Today TOP TWENTY FIVE awards was conceptualized and coordinated by Glenda.

We wish to take this opportunity to thank Dr P B Jayasundera, Secretary to the Treasury and Secretary Ministry of Finance and Planning for his continuous support and confidence in us. We also thank Mr S R Attygalle, Deputy Secretary to the Treasury and Mrs Shamalie Gunewardena, Director General Legal for always standing by us. We were proud to have produced the coffee table book “A Nation’s Journey, Sri Lanka’s Transformation To A Middle Income Economy”, for the Ministry of Finance and Planning, which detailed a historical analysis of the economic policy from preindependence to present day.

We will also be launching ‘The Call of Wild Sri Lanka’ a coffee table book on wildlife, which was produced in collaboration with Mr Priyantha Talwatte. We would also like to take the opportunity to show our gratitude to those who have supported us throughout the years. Mr Anselm Perera of Mlesna has advertised in Explore Sri Lanka from the very first issue in May 1987 and has been a great strength. We also like to express our gratitude to Mr Shanth Fernando of Paradise Road.

We wish to thank Mr Harry Jayawardena for supporting all our magazines throughout the years. We express our gratitude to Mr Nimal Welgama, too for his support. We would like to thank Mr Dinesh Weerakkody, who is today the Chairman of Commercial Bank and Mr Keith Bernard, Director of a public quoted company for conceptualising the Business Today ranking.

We would also like to thank Mr Shiron Gooneratne who was part of the Business Today Awards. We take this opportunity to thank Mr Suren Rajakarier of KPMG for his interest and dedication to the Business Today TOP TWENTY FIVE.

We take this opportunity to thank Mr Manilal Fernando for his support and guidance. We would also like to express our gratitude to Mr Niththi Murugesu and we wish to thank Mr Sagala Ratnayaka and Mr Thusitha Halloluwa. We apologies for any lapse in protocol. We thank all of you present here today in celebration of corporate excellence in Sri Lanka.

Ven Galboda Gnanissara Thero, Chief Incumbent of the Gangaramaya Temple

“Ven Galaboda Gnanissara thero, the Chief Incumbent of Gangaramaya Temple has been the steady force that guides us, being always there to give us advice and lift our spirits. We always look up to him. Podi Hamuduruwo always assures and gives us the strength whatever the obstacle or challenges that come our way. Podi Hamuduruwo words cannot express our appreciation.” BT Options

Ven Galaboda Gnanissara thero, the Chief Incumbent of Gangaramaya Temple

Since all have been extended a warm welcome specifically mentioning their names, I will not elaborate on that in my speech.There were many accounts on this venture initiated by Mr and Mrs Mathi Parthian.

Even though a member of the Sangha is addressing you represent ing the clergy, what is mirrored through this is the honour and respect Mathi has for all religions—Buddhism, Hinduism, Christianity and Islam.

2,500 years ago, Lord Buddha preached about the Four Elements–Fire, Water, Air and Earth scientifically. Without the earth we cannot survive. This warmth, the water, the air, fauna and flora and animals; all of them depend on the earth. Likewise, religious clergy is also essential to receive valuable advice and lessons from, to guide us and to bless us with positive vibes. Thus, whenever they are about to embark upon a business venture, Mr and Mrs Mathi Pathipan always sought religious and spiritual blessings.

Mr Mathi has never expected much. He always journeyed on, not faltering before the uncertainties of gain-loss, fame-disrepute and praise and blame. Therefore he has gained much strength in bringing immense pride to Sri Lanka, business-wise and also in the aspects of art, culture, language and literature. Like the earth is combined with warmth, air and water; he contributed towards these major aspects. Through his creations, he brought out the hidden splendour of everything from culinary to nature. This is the result of such a venture, where a distinguished assembly of the business world were moderately evaluated and introduced as the top 10, and then grew up to 25. I believe that it would be better if this grew up to 34, the vast development seen in today’s business sector being the reason for that.

We should not forget the past. Children who were born in this country were accused of being terrorists. Part of this country’s populace were blamed of terrorism. This is not distinctive only to our own country.

Business leaders, let us not forget the past. Let us not allow this country to be caught in the clutches of terrorism again. Let us preserve and protect the environment. Utilize your courage and the wealth you earn...

In Buddhist countries such as Thailand, Muslim countries such as Malayasia, even in countries such as Russia, young children were bulldozed over and brutally killed. Such brutality has been prevailing in many countries of the world.

In Japan, they pasted paper on windows instead of glass or metal. They didn’t need protection. The people in that country were disciplined according to their duties, traditions and customs and thus no brutality took place. But what has happened today? Japan no longer has that secure environment. Today they are in need of protective measures. There is terrorism and there are criminals. Likewise good places become bad and bad places become good. This is the nature of the world. We know what has been prevalent in the recent past of this country.

Amidst all this, HE The President focusing his attention on food and nourishment, solved the issue of fertilizer in order to make this country self-sufficient in terms of food production. He rescued the country from terrorism and the country is achieving development in food production. A while ago, I was discussing with Mr Harry Jayawardene, the policy adopted by HE The President regarding dairy products. Hence in context where there is development taking place in the country, we know that these companies, hospitals and schools will donate and contribute towards social welfare.

One time, I told Mr. Mathi of an innocent villager in Hambanthota who did not have a bicycle and all these companies—back then it was Top 10—took measures to provide bicycles to those villagers who were in need.

When Mr Ranil Wickramasinghe assumed duties as the Prime Minister, there was a stressing issue where people in Hambanthota did not have access to clean water.

Even at that time, with the help of these companies who came forth to assist, we constructed 18 tanks. Later, when HE The President realised the importance of this, he further developed these tanks by enhancing their water supply.

Today Hambanthota as one of the areas in the country where there are extremely dry climatic conditions, has transformed. We live in an era today, where this example from Hambanthota is spread throughout the island with development. I would like to make a request at this moment.

Business leaders, let us not forget the past. Let us not allow this country to be caught in the clutches of terrorism again. Let us preserve and protect the environment. Utilize your courage and the wealth you earn, to help Mr Mathi in his attempt to make this country prosperous, so that all people in this country are protected regardless of ethnic and racial differences. So that people can live in joy and harmony. I hope this country will reach greater heights of development.

Ajith Nivard Cabraal, Governor of the Central Bank of Sri Lanka

“As the Governor of the Central Bank of Sri Lanka, Mr Ajith Nivard Cabraal needs no introduction. He has had to make many difficult decisions to ensure fiscal and monetary stability of the country. He has always been positive and has the confidence in the economy even during challenging times. We have had the privilege to work closely with the Governor. He is always prompt and quick to give his feedback.” BT Options

First of all I must say thank you very much, to Mr and Mrs Parthipan for organising this grand event and also for specifically inviting me to speak to you and share my thoughts. You have mentioned me in your programme as the guest speaker, I am not quite sure as to what you expect from me as the guest speaker today, but let me start by first of all congratulating the winners, the top companies of our country who have contributed to our economy and continued to do so and have been showing excellence in their respective fields. I know it is not easy to reach the top, and if there is one more thing, which is more difficult than reaching the top it is maintaining the position and very modestly some speakers mentioned about how they have been retaining their positions. I don’t think they really want to drop their rankings, but nevertheless the challenge is difficult, and to maintain your position even after the challenges is even more difficult and I want to congratulate all of them.

If we did not diversify, Sri Lanka’s overall income streams over the last several years you would find that they would reach certain stagnation points. That is why the President in his wisdom, he put forward the Mahinda Chintana Vision for the Future…

Today we heard twelve business leaders speaking to you, talking about their companies very proudly and I believe they have every right to do so. So I was thinking, perhaps I should speak a few words about Sri Lanka incorporated, taking a cue from my friend Harry Jayewardane, as to what the government has also done in creating this enabling environment and also ensuring that Sri Lanka can retain its momentum in going forward.

And in so doing, I believe it is appropriate to use some of the business jargon, particularly the jargon that all of you are familiar with, in analysing Sri Lanka Incorporated. I believe I am reasonably qualified to do so, having worked in the private sector for 32 years of my life, and in the last 8 years I have been in the government—state sector—so I have a four to one ratio as far as my contribution to this country’s economy is concerned. So let me try and give you some assessment and analysis about how we could judge the government in relation to some of the analytical tools that you yourself use in your portfolios.

Let me begin by putting first the debt sustainability of the country. I know that it is a topic that has been considered and spoken of many times. But I would ask you, the old companies, if you look at the first twenty five they are all there and I don’t think there is a single company, which is without debt. You have share capital, which is your obligation to your shareholders, then you have loan capital, which is your obligation to your banks, then you have other creditors all of which are your obligations, which is your debt. As you grow, not only does your shareholdings grow, your debt also grows and therefore to keep a tab on your debt by using various ratios. I think that it is prudent, when I was in the private sector also I used it, now since public debt is managed by the Central bank we keep a close tab on that also, and the main instrument that we use is your debt to income ratio, your debt to asset ratios and debt to share capital ratios, which you monitor very closely. I can assure you ladies and gentlemen we do the same in relation to the management of debt, as far as Sri Lanka Incorporated is also concerned. If I were to go over a few figures— in year 2003, Sri Lanka’s debt to GDP ratio, which is the equivalent of your debt to income ratio, was as high as 105 percent. In the year 2005 it had come down to 91 percent. Over the last eight years not withstanding all the public investment and fixed cost it should travel on, you should understand that the debt to GDP ratio has come down to 78 percent.

Something has been done in order to make the country a lot more feasible and a lot more viable. And that is important for us to recognise, the same way that you in your companies assess your debt with various types of ratios, and give you the comfort that it has been done, in such a way we maintain Sri Lanka’s overall viability and I can assure you that it is not in any danger.

Let me look at how you also develop your companies with the diversification of your overall business models. You do that all the time. If you look at the top company, John Keells Holdings, each year they add on new types of businesses to their overall type of work. Their business model changes, that is the diversification I’m talking about. And when you grow you need to diversify, at various intervals, in order to make use of the new opportunities that are created in the business world. The same thing has to be done in the country as well.

If we did not diversify, Sri Lanka’s overall income streams over the last several years you would find that they would reach certain stagnation points. That is why the President in his wisdom, when he put forward the Mahinda Chintana Vision for the Future, spoke about five hubs, new creations within our country, which will be the new stars in our economy. All of us know about stars and cash cows. The stars have to be nurtured in order to develop into cash cows. So Sri Lanka has now started on new areas, which are the maritime, aviation, commercial, knowledge and Information Technology—the new stars, which will be the new cash cows as Sri Lanka grows into the next decade and beyond. So again a very important business strategy, that has been pursued by the government, and which will bear fruit as Sri Lanka matures. The third point that I want to talk to you about is getting the basics right.

All your companies, you have to make sure that your overall fundamentals are in order. You have to see that your business processes are sound, that you have your good human resource management techniques in place, that your accounting systems and IT systems are sound. And the equivalent of that in relation to a government, is the macro fundamentals. Over the last several years we have worked hard on the macro fundamentals and that is why today we enjoy those macro fundamentals which allow you to do your business without worry, about other areas that you used to worry about in the past. If your inflation is very

high, if your financial system is not stable, if you have labour difficulties and problems, you will be distracted from the normal businesses that you should run, and you’ll be worrying about those aspects which are under threat or in danger. The government in its enabling environment, has to give you that comfort by making sure that those types of fundamentals are sound and that is what has been done over the last several years.

The third point that I want to talk to you about is getting the basics right. All your companies, you have to make sure that your overall fundamentals are in order. You have to see that your business processes are sound, that you have your good human resource management techniques in place, that your accounting systems and IT systems are sound.

Another point that you look at and your shareholders look at is your earnings per share. If your earnings per share drops, your share value drops, your company will not be recognised as the TOP TWENTY FIVE, and you will probably not be in the same sound position that you are in today. So you keep a close tab on your earnings per share. In the same way the government and the overall economic managers have to ensure that the country’s per capita incomes are rising. We spoke earlier about

Sri Lanka moving towards a four thousand dollar per capita income. What were we doing? We were actually talking your language, we were talking about ensuring that the overall per capita incomes rise so that the country conditions would be brought up to a level that people can enjoy a good life and a good standard of living. As directors and as chairmen my dear friends, you also want to keep your shareholders happy. Several business leaders who spoke today said that you are keen to ensure that your shareholders are kept happy.

The equivalent of that in relation to the government is to keep the country’s shareholders’, every citizen in this country happy. Over the last several years, we have seen poverty reduced, have seen the regional disparities reducing, and those important signs of keeping your shareholders happy. If your shareholders are not happy, they don’t want to keep you happy, and then you worry, and that is why you keep the shareholders happy, and even from the government’s point of view it is imperative that the key shareholders and all those who work in our country are kept happy.

Let me also talk to you about another aspect, which is the company brand. All of you are very concerned about your brand. If you take everyone of those 25 companies, you know and we all know how much you work on the brand. Your brand eventually exercises every type of activity that you do, has a foundation on your image building. A country also needs to do that. A country also has to give itself a brand to ensure that the people who deal with the country will feel comfortable, will be keen to do business with that country, so how do we create a country brand? The brand of the country has to be done with good exposure and other people from other parts of the world coming to our country to see how we develop to see how our infrastructure has developed. These are all useful components of building a brand. I think the government, even recently taking the decision to organise CHOGM, which is an important event will create a new brand. Whether we like it or not, you have to understand that we did not have a great brand up until four years ago. We were known for the wrong reasons. The world recognised Sri Lanka, not for the great things that we have done. So we have to shake off that brand, we have to create a new brand. And I believe just like what you do in your own companies, building the brand, the country also needs to do that and that is what you see happening today and that is what we have seen happening for sometime as well.

My dear friends you concentrate on risk management in your numbers. You constantly look at your horizons to see whether there are impending risks, new threats to disturb your business. We do the same ourselves. The country’s risk needs to be also assessed at various times because the risks out there are huge. Everyday you see new threats looming. Not only in the political scenes of the world and not necessarily only for Sri Lanka. Today you see IT connecting each one, as a result of which threats can be transmitted very quickly. Those days, a particular threat took a long time to be transmitted, but today it is not so, it is immediate. So we have to keep a very close search light on, to ensure that Sri Lanka is kept free from threats and the economy is also made conducive for you to do business. My friends, at the same time we got to have procedures and processes in general to enforce. In the same way the government has budgets, our policy statements and road maps to ensure that we stay in line and we are progressing without any deviation from the original plans. And I also believe that all of you in your own companies take great pains to make your own infrastructure, your own company to be at a high level and high weight in order to make your stakeholders feel comfortable when they come to see you. A similar exercise should be carried out in the country to make it clean, to make it neat, to make it more conducive for people to come in. Today you see that it is happening. The government is not very different to that of the private sector.

Sri Lanka is on the threshold of a new era. We have set the platform for that new era and all of you are today poised to take Sri Lanka forward to the next level and the next era. I hope all of you will be up to the task and put your shoulder to the wheel in order to ensure that Sri Lanka will move to the next phase

We are approaching governance from the point of view of private sector values as well. In order to give you a great life for you to do business. Let me also reflect on what exactly takes place when Sri Lanka Incorporated has to go forward. We have to plan, we have to make sure that we reflect on what has taken place and we have to always to be a step ahead in order to ensure that our country can be safe and as well as economically sound.

Let me conclude by telling you the story of a Polish immigrant who was very wealthy at the time he was about to retire. He had educated his children. He had come to the US from Poland and worked hard and he has put his son through Harvard University. The son, after he qualified and came back to the business of the father, told the father after some time, “Papa, you are not running your business correctly. You don’t have sufficient accounts. You are not in a position to tell me exactly what your profit is. You do not have a very good handle on the business like what they have taught us at Harvard University.” The old man was a little puzzled and he told the son, “You know, today I have educated you at Harvard which has cost me about 500,000 dollars. Your sister has been put through one of the most prestigious ballet schools and I have spent a million dollars on her education. Your mother has all this jewellery and all this finery, which has cost me another 500,000 dollars. I have three cars, I have a cruise liner and I have also been enjoying life and that has given an asset base of around two and a half million dollars. When I add up all that and I deduct the 18 dollars that I had when I came from Poland to the US, that is my profit. I think that is enough for me and now you can build up on it. I think if you look at Sri Lanka in 2008 or in 2005 and you look at Sri Lanka today, you can assess for yourself what has been the mega changes that have taken place in our country. What has changed, what has improved and if you deduct from what you see today, what was available in 2005, that my friends would be the profit of our country and that is the profit which we are all going to enjoy. The only thing that we must now remember is that, that should not be our end, but that should be our beginning.

My dear friends Sri Lanka is on the threshold of a new era. We have set the platform for that new era and all of you are today poised to take Sri Lanka forward to the next level and the next era. I hope all of you will be up to the task and put your shoulder to the wheel in order to ensure that Sri Lanka will move to the next phase and with it we will all enjoy a much better life for all of us and for our children.

Hon Nimal Siripala De Silva, Leader of the House and Minister of Irrigation and Water Resources Management

The Chief Guest, Hon Nimal Siripala de Silva, Leader of the House and Minister of Irrigation and Water Resources Management is considered a pillar of strength in the current government. He celebrated 30 years in politics this year, having garnered the support of the people of Badulla and Borella where he has served tirelessly. He has not wavered from the principles and ethics that the Sri Lanka Freedom Party stands for. In a day and age where switching sides has become the norm, Hon Nimal Siripala De Silva believes that a person earns the position he holds. We have worked with the Minister since the 1990s and his confidence in us is encouraging. He is very clear with what he says, he is a veteran politician who should be emulated. BT Options

It is indeed a great pleasure and privilege for me this evening to be with you and share some of my thoughts with the business tycoons and magnates in Sri Lanka.

Mr Parthipan has organised this event for a long period of time and indeed I am grateful to him for bringing all these skills and professionalism to this event and making this a very memorable event in Sri Lanka for the year.

Indeed the audience here is the creme of the business society in Sri Lanka. We are delighted to be with you. As a minister of a government who has made so much, facilitated for the existence and movements of the private sector I am happy that the assistance given by our government by building infrastructure in this country to enable the private sector to move freely, in their business endeavours. You all have taken advantage of that, for the benefit of yourself and our country.

As said by many of the speakers, the government cannot depend only on 180,000 small tax payers in the country. The tax department goes behind them and then tries to squeeze them but the big money comes from you all. Therefore, for the existence of a government it is very necessary that there should be a very vibrant private sector. The private sector is the engine of growth, in the country. So that engine, has to be powerful, vibrant and fast moving. Therefore events of this nature—I don’t think, John Keells or Commercial Bank or any of these companies or CEOs or Presidents, the Board of Directors—need recognition from me or Mr Ranil Wickremesinghe.

We are politicians. We always look for recognition. When we go to the people they garland us, we ask for the manapa votes. But you all do not need that. But an event of this nature has a special significance. That is being recognised for a collective effort in an organisation. It is not only the CEO or the Chairman of the Board of Directors that make things happen.

There are people, from the labourer to the technician, the factory worker, there are a group of people who are involved in the process.

Therefore when we recognise the TOP TWENTY FIVE, we are recognising each and every worker who has been toiling hard to bring you profits, to make your share valuable. Therefore I plead with you, don’t forget them. Don’t discard them. Embrace them. And treat them properly. Because in Sri Lanka, we have 60,000 graduates without jobs.

Some are working in the private sector. When the government decided that all of them must be employed for a paltry salary of 10,000 to begin with, some people who were drawing 40-50,000 rupees in the private sector, left the private sector and came back. Did any of you in the private sector ask ‘why they are leaving us when we are giving so much of money?’ There is something lacking in the private sector. Private sector has done very well in certain areas. In areas such as social responsibility, have you done enough for the people of this country? Have you done enough for your own workers, have you done enough for the youth of this country – to stimulate them to come and work for you, keep them with you, to train them, to take on their English education, to have some classes or some area where continuous education is done. Those are the lapses, that is why people are a little bit frightened to come to you. Therefore it is very much needed, because all your profits, all your money, your shareholding, all those things are good, but at the same time we must see, have you fulfilled your social obligations. Therefore I would like to ask you, because I went through the criteria of selection. Is this the correct criteria?

Selection criteria includes, share turnover, revenue, profit after tax, return on equity, earnings per share, market capitalization and value addition. What about worker’s welfare, social responsibility, protection of the environment, has this company damaged the environment of our country, to what extent? Therefore are they eligible? You can think, what environmental disaster has my company made. Therefore selection criteria we will have to change.

Then I think we should be able to think, have I paid my tax, have I defaulted, have I bribed custom offices and got my things through, and thereby got better profits, and hampered the national economy. Therefore profit, shareholders and all these things, are not the main criteria. Sri Lanka will have to look for entrepreneurs, business people, business tycoons—we have no problem with you—who should be at the same time true to themselves. Today the Opposition Member of Parliament raised a question, Mr Ranil Wickremesinghe was there I think, at the time. He raised this particular question to the Minister of Finance and Planning that is, to please make the value of the national income consumed by 20 percent of the wealthiest persons in Sri Lanka and the value of the national income consumed by 20 percent out of the poorest persons in Sri Lanka known. I think the answer to this question is food for thought when you go back to your own companies. And the answer was given. According to that answer, 20 percent of the creme of the society, the wealthiest persons, probably including most of you all here consumed 4,200 billion rupees a year, last year, 20 percent of the poor people had consumed only 312 billion rupees. So you see the disparity. This is where the social unrest will occur. The war is over. Terrorism is over thanks to HE Mahinda Rajapaksa, and the Armed Forces. But we have a bigger challenge ahead, how we are going to push our poor people who are below the poverty line—it has come down—to the middle income group. This is where the private sector will have to play a role. The private sector has a greater responsibility to ensure this gap is not widened. It becomes more and more closer and push these people to the middle income level. That is the first social responsibility we expect from you all. Because you have the capacity, you have the knowledge, you have the professionalism to embark on your ventures and do that.

A country cannot strive, depend only on, 20, 25 or 100 business tycoons. The development of a country, even the US and many other countries, depend on the medium and small scale entrepreneurs. So that is where we have to think a lot, to what extent are we helping, the small and medium entrepreneurs. The government alone cannot do that. So you must ensure that SMEs are not being shrunk by you or pushed aside. Keep them in their business fields. That is an ongoing debate. I have heard from most of the people who I meet in Badulla, Bandarawela and many places in our own village areas say, Amathithuma pod minihata business ekak karanna beh, ada loku company thamai api okkoma paagagena inne (Minister today the small businessman can’t survive as we get trampled by big players).

I don’t know to what extent that is correct but I think there is some truth in that. So instead of saying you all are very good and all our business people are good, I must tell you, from a people’s perspective, I come from the people, my survivals depends on my voters, and the people in Sri Lanka. Some of them survived on the shareholders, or on the bankers, and my survival is within my people’s forum. It is my duty to bring this to your notice. Please think about that, help them, don’t think that, in Sinhala we say ‘Thaniyema Budu Wenawa’ (gathering wealth for oneself without thinking of others), don’t do that. Let all other samaneras and all that other people also come up to that position, that’s why I say the concept of social responsibility should extend to that.

To what extent business tycoons and companies have helped SME entrepreneurs and how many SMEs they have helped and brought them up? So those are the characteristics or the yard sticks, in which we can measure your performance. We need a new yardstick for the performance for all the business people. I must say at the same time our savings rate is only 23 percent, for a country to move forward we need as Mr Cabraal will agree, we need at least 35 percent investment, so we need more money. Our government has facilitated this, by opening the current account and you can borrow money from abroad, you can enter into partnership with foreign countries, and bring money here and therefore the private sector should, as said by Mr Harry Jayawardena, you should go global. It is very necessary not to restrict yourself here but go global and bring more investment opportunities to Sri Lanka. And at the same time I must also say that we need human resource development, don’t leave it out.

For example in Sri Lanka, due to the fault of our own education system, we have not produced enough technical personnel in this country. Now the government has changed the policy, and the technical education has been given priority but the private sector must help technical education. I remember when I was a young lawyer and the all-island organiser of the Sinhala Tharuna Sanvidanaya, I remember, Macwoods —M S Mendis—helped me to train 100 people, in vocational training in these institutions. Don’t leave this only to the government or only to the universities. Why don’t you use three percent of your profit, put that money for vocational training and get some apprentice to your own company, train them and build up a workforce in this country.

Therefore you should undertake this responsibility. These are some of the things you could sometimes forget, therefore I thought it was better for me to remind you. And at the same time I must say, private-public partnership is very important. Whenever I bring cabinet papers, every Friday, and we have the cabinet meeting on Thursday, I go through them. I stretch 2.5 percent of the total loan facility, to pay the bigger amounts for roads, some for water and mini infrastructure development.

That is a positive scenario which we see, and more and more should be encouraged, because you must become vibrant partners for infrastructure development of the country. Therefore I am sure that we will be able to work with you, our government is always prepared to work with the private sector. We don’t belong to the era where we say Danapathiya Banga Wewa (this was a slogan of the extreme Left against the Capitalist, which mean may the wealthy get lost!). No. We want Danapathiyas (the wealthy) but Danapathiyas should look after the other poor people in the country and they must be able to help them to elevate their lives. Therefore it is indeed a great pleasure for me and I thought I should air some of the grievances I had, in society. Therefore I am thankful to Mathi for giving me this opportunity.

Hon Ranil Wickremesinghe, Leader of the Opposition

“Hon Ranil Wickremesinghe, the Leader of the Opposition comes with years of experience in the political arena of Sri Lanka. He has been a key decision maker having been a cabinet minister as well as the prime minister of the country. His knowledge and ability to tackle any situation is indeed admirable.” BT Options

Mathi and Glenda as usual have to be congratulated for putting on a good show. If politics consists of bread and circuses, then you would do jolly well providing the circus. Now what puzzles me is why I am a regular fixture here. I am not one of the TOP TWENTY FIVE and I have no stake in them. Some how or the other Podi Hamuduruwo and I are both here regularly. Both from the Gangaramaya, one representing the Sangha and the other, the laity. I thought I am invited here as the only discordant voice. But I must say the Leader of the House also joined me but I don’t think he went as far as I am planning to go. But, then we are politicians. All of you the twenty five are fighting for different market shares, but both of us are fighting for the same market share and we are getting ready for the next round.

So I look at it in the way a politician does, and very much as he does. And being two members in Parliament, from morning to evening, day in and day out, maybe the training we got when we were in politics long ago. But I thought of raising here some of the questions that I hear on the economy, from the people. I thought I should share it with you. Those who are in the twenties, who come into the job market ask, what are the jobs for us? They want a good future, they want to know their job security. Those in their 30s and 40s who are married, trying to build a house, educate their children and to send them abroad, ask where are the jobs with good pay? When I ask this from you, the third group, the private sector, they ask where is the work force? And then the last lot, many others want to know, where are we going?

There are different views on this, but what I will say is quite different from what the Governor of the Central Bank has to say. But to talk of it I will have to partly rely on the Central Bank statistics though I must concede that I share many of the opinions that have been said by my colleague Dr Harsha De Silva. When you look at it, these questions, one dominant factor is the increasing reliance we are having on foreign remittances from migrant workers. In 2000 it was about 1.2 billion dollars and 2012 it was over six billion dollars. It is a five fold increase in a little less than one and half decades. That’s a big growth. In 2000 the largest foreign exchange earner was textiles and garments, which was about three billion and now its about four billion—a little bit more than that. That’s an increase of 25 percent. I would say a little bit more for the apparel garments, they have been affected by the financial crisis and the loss of the GSP. Then we have of course tea the perennial earner, which dug in about 1.4 billion dollars last year. Something that I have always advocated and something to play in, rubber primary and value added, which is now about one billion dollars. It is about four fold from what it was in 2000.

In my view we are stagnating in economic development and we have not moved to the next level. High technology. With the workforce that we have, we have not moved in there. We will not be able to go into the capital intensive industries, but there are new areas, both in the manufacturing and the service sector that we can.

So these are the main foreign exchange earners. For thousand of years we like many other countries exported agricultural products, grains, rice, spices, tea, rubber and coconut. In the 70s we decided that we should go for manufacturing goods and we started at the bottom of the ladder, which is the apparel. And, then we were earning more and more from it. At that time foreign remittences was just an add on and we thought something welcome after the conflict started in 1983. Its first impact that I realised in 1990 during the first Gulf War as Kuwait was invaded and hundreds and thousands of our workers came back, we found it difficult to replace the foreign remittances and President Premadasa sent me with Dr. A. S. Jayawardena to Japan to speak to the Japanese Government on getting additional aid to bridge over the difficult times and we thank the Government of Japan for the assistance they gave.

Today foreign remittances is a global phenomenon. Not only in Sri Lanka, many other countries rely on foreign remittances. China, India, Mexico, and the Phillipines are some of the main countries, which rely on foreign remittances. In India, China and Mexico, it is not the main source but one of the major sources. What have they done? They have used the foreign remittances to cushion the restructuring of the economy and provided savings, mobilising it to the next level of economic development.

At the time they benefitted from it, they were labour intensive, low wage enterprises as well as capital intensive semi-skilled wages. But this helped them go to the next stage of a skilled work force and higher wages and certainly having stabilised that many of them are moving into new technologies. China in the next decade or more, is aiming at getting a million robos. Now where are we going to be? India has both the low wage labour intensive as well as the new technology. Mexico has become the workshop for the United States and NAFTA. This is one example. The other of course is Philippines which focuses mainly on foreign remittances and they were successful in making their primary foreign exchange earner. But, there were pitfalls.

The World Bank warned somewhere about 2005 I remember that excellent performances of remittances contributed to the complacency in addressing low productive growth. Remittences should not distract the country from its huge potential of domestic investment and growth. At that time the Mexican administration said echoing this “the government will continue to look for ways to keep them home by aiming at a strong economy generating well paying jobs. 5, 6, 7 years down the road nothing happened and you find the present administration saying that they are different. From a government that treats their people as export commodity and a means of foreign exchange to a government that creates jobs at home. This is a country that focused mainly on foreign remittances now say they must no longer treat its people as an export commodity and means of foreign exchange and they have to create jobs at home. But many think they have gone too far down the road and will not be able to create those jobs and the economy may not be able to go to the next stage of development.

Now where are we? Are we following the India, China, Mexico model? Or are we going down the path of Philippines or what we call the Philippines trap. When you look at the structure of Sri Lanka’s economy and look at the manufacturing, there has been no major change up till today. Now you find textiles, garments and apparels dominate the manufacturing sector. Then food and beverages and chemical that is the bulk. That is where we are. Where are the electrical appliances?

Where are the manufacturing automotive components? Where are the other goods that you are manufacturing? Where are they? That’s not here. We are still in the same place. There are many reasons given. But the fact is that we are still in the same place. The Indian economy is not so, the Chinese economy is not so. Singapore is changing. Then we have the service sector expanding naturally, that’s why there are so many financial institutes in the TOP TWENTY FIVE. Most of them cater to the domestic market. So what we focus is mainly on the service sector in the domestic economy. You get the government focusing on the stock exchange. In my view, and many others hot money does not serve us in the long run and you get Information Technology, which has added about 400 million US dollars, which is good. But what have we got? We have an economy fueled by government spending. Till 2009, it was defence spending and for about two decades, whichever government was there defence took up lot of the resources except for about two to three years that is 2003, 2004 and 2005. And, now it is fuelled by construction so what is the end result? Financial resources that are required by the private sector both big and small, which are no longer available and are being mobilised to meet the government needs. This is one of the complaints. Then if you go to the financial institutions as the Minister said, all that are in the TOP TWENTY FIVE and many of the bigger people are better served than those who are in the medium and small sector. So this is one of the reasons. You will have others you will say, electricity prices, loss of competitiveness but we still have not got into the Philippines trap.

We need a ten year programme, a road map, to leap frog to the appropriate stage. Look at the markets. The markets of the world are changing. But you have to make the world a market. And you can do that in many ways.

We may be going on that road and still going down that road but we can still prevent it. But we in my view are stagnating in economic development and we have not moved to the next level. High technology; with the workforce that we have, we have not moved in there. We will not be able to go into the capital intensive industries, but there are new areas, both in the manufacturing and the service sector that we can. For instance in my view, IT and the knowledge industry should by now be earning about two billion dollars, not 400 million. So if you look at what our economy is, I am happy that we are getting six billion from foreign remittances. Apparel should have been at least six billion or more. We should have logged in at least 20 billion last year. We should have at least got over our balance of payment difficulties. We didn’t get there. And what is more alarming is if this trend continues, the corporates will cease to be the engines of growth. And your jobs will come from foreign employment, and the small and medium sectors but if they are getting squeezed out, you will have to look more and more at foreign employment.

Another thing is, if you look at some years, the annual foreign employment is equivalent to the age cohort that is looking for employment. That’s about 275,000. Some say its very good. Even the Sri Lankan job market. But that is not what is happening actually. It is having a—like in Phillipines —an adverse impact. Firstly as you get some skill, you move out, because there isn’t enough. Your income is not big enough. If you take this hotel, you can’t blame any of them. Any of the hotel sector. You work here you get employment you get a certificate and you can’t blame anyone going to Dubai or Maldives or anywhere else to earn some more. Then you are getting people who are skilled who are willing to go for semi skilled jobs. As people who have engineering capacity will do something else. You are getting this large brain drain, and when you are looking at those who are going in then you come to this big question.

The young people who are going and getting themselves educated abroad or getting themselves educated here are gong out in search of employment. They want to look for greener pastures. Those who haven’t gone yet are looking at how they can go to the Middle East or Italy or anywhere else to get employment. So all the young people are leaving this country. This is going to be a country for old men like some of us seated here. Do you want that to happen? Is our country like Singapore, Korea or maybe Denmark, Mr Harry Jayawardena knows this well, there is one resource and that’s our human resource. But we are luckier than Denmark and Korea. We are in the middle of the Indian Ocean. We have our location and our human resources and a very resilient nation. I don’t think any other nation would have gone through nearly three decades of war and two decades of breaking up capital, and still have a smile on our face, and still think we can pull through and be big players in the world. So what are we going to do? How do we stop that? There are different ways. Because you have to remember one thing there is a social cost in foreign employment. We see that not only in Sri Lanka, in many other countries as well, like in the Philippines, there is a social cost. Remember for those who go for a foreign employment, it’s a sacrifice made by them, for a betterfuture for themselves and the country. Are we giving it to them? I don’t think so. If you are a corporate entity, we are like an investment company where a lot of people are putting money away for the future, thinking that they can get it back with a good return. If you go down the Philippines road we are not going to do that. That is the question that I have to ask. I would differ from the Minister, I don’t expect all of you to be like Buddhas, as Ven Assaji was saying the other day, if you can be like Anatha Pindika (the chief lay disciple of Gautama Buddha who was very generous), its good enough—he lined the whole of Jethavanaramaya ground with gold coins for Lord Buddha—but I don’t think you are going to do that either. So we’ve got to realise that there is a certain direction that the political process has to be. This is where I think the Minister and I both agree that the primacy of politics takes over from the primacy of the markets. I think that is one thing that we have. We don’t subscribe to the view of primacy of markets.

We have to get foreign investments in. We have to get the technology and take that leap forward. So this is what we are looking at. That’s why we call it social market economy.

We have to think anew as to how we are going, where we are going, if we are to prevent falling into the Philippines trap. We need a ten year programme, a road map, to leap frog to the appropriate stage. Look at the markets. The markets of the world are changing. But you have to make the world a market. And you can do that in many ways. You may go for products like apparels where we are big players or you can go for niche markets, like some of you are doing. Whether you are sending out Dilmah tea, or running hotels in different parts of the world, running business, many of you are doing some small niche market venture, but look at it and today with all the new technology available, nanotechnology, biotechnology you name it, we can get there.

Let us take a look at what is needed in the next twenty years. Where do you want to go 20 years since? Look at their technology and how we go. And plan for the first ten years. If you make the first ten years, your next ten years and above will be no problem at all. Look at a higher investment in education and health. Investment by the government, we believe in the six percent, but investment by the private sector in different ways. How can you do it? Both have to do it. Education and training system and investment by the private sector are also essential, because education and training is life long. What we learn as we go in is not what we will know at the end of it. Then job creation.

We have to create enough jobs and at a level that will keep people back or those who have gone out will come and stay here at the next round. We have to do that. And there has to be a good renumeration. They are also stakeholders, they also want a return, they must all share in the wealth. To talk of the 20 percent the Minister was referring to, I should ask the question, the first top percent. The one percent. Anyway they all want a share in the country’s wealth. A social safety net, which is viable both in terms of the economy, we shouldn’t give what is more than what is required and in terms of the beneficiary, who we select them to be and good governance. All that is necessary, to get the investments in.

What we have here won’t do. We have to get foreign investments in. We have be a good renumeration. They are also stakeholders, they also want a return, they must all share in the wealth. To talk of the 20 percent the Minister was referring to, I should ask the question, the first top percent. The one percent. Anyway they all want a share in the country’s wealth.

A social safety net, which is viable both in terms of the economy, we shouldn’t give what is more than what is required and in terms of the beneficiary, who we select them to be and good governance. All that is necessary, to get the investments in.

What we have here won’t do. We have to get foreign investments in. We have be a good renumeration. They are also stakeholders, they also want a return, they must all share in the wealth. To talk of the 20 percent the Minister was referring to, I should ask the question, the first top percent. The one percent. Anyway they all want a share in the country’s wealth.

A social safety net, which is viable both in terms of the economy, we shouldn’t give what is more than what is required and in terms of the beneficiary, who we select them to be and good governance. All that is necessary, to get the investments in.

What we have here won’t do. We have to get foreign investments in. We have to get the technology and take that leap forward. So this is what we are looking at. That’s why we call it social market economy. And in different names, different ways. But it means everyone must be a stakeholder. All of them here. Everyone here must be a stakeholder. It is not only the TOP TWENTY FIVE or the few of us politicians, ministers and the opposition.

All of us have to be stakeholders. It also requires a change. It requires a consensus in the political players as to the economic policies, basic principles, for a decade or more. And the principles of good governance. But there has to be enough room for us, the main political parties to compete with each other, on the. margins, so that we can still compete for power.

But this is necessary, that is why we called for a social market on an EU model and next we looked at some constitutional changes. As one of those who introduced the 78 constitutional changes that were necessary at that time. The thinking was very polarized. As the Minister said, Danapathiya Banga Wewa. As President Jayawardena said, ‘We won the robber barons we will look at the social equity’. You need a system that could make the changes. We have to make the changes. Now in your system, where can you build a consensus, in politics but at the same time compete at the election to increase our market shares. That’s what we have looked at. I am not saying that you have to go back to what was there earlier.

I don’t say so. But as times change, the systems of government must change. So are we looking at politics first and then trying to fit the socio economic needs, or are we looking at a political framework taking into account the socio economic needs.

So I am looking at the problem from a different aspect, the Minister looked at it from another aspect, but this is what we have preached and I thought as the discordant voice here I should say these few words and thank all of you for having listened to me.

Chief Guest Nimal Siripala de Silva, Leader of the House and Minister of Irrigation and Water Resources Management and Iranganie de Silva being accompanied by Glenda and Mathi K Parthipan

Nimal Siripala de Silva, Leader of the House and Minister of Irrigation and Water Resources Management, Iranganie de Silva with Glenda and Mathi K Parthipan

Ranil Wickremesinghe, Leader of the Opposition, Prof Maithree Wickramasinghe with Glenda and Mathi K Parthipan

Ajith Nivard Cabraal, Governor of the Central Bank of Sri Lanka with Glenda and Mathi K Parthipan

Shadow Man Act

Dance performance to Udawuna Hiru Udawuna

Dance performance to Avadhi Wanna Avadhi Wanna