Celebrating the Victories of an Economy in Recovery

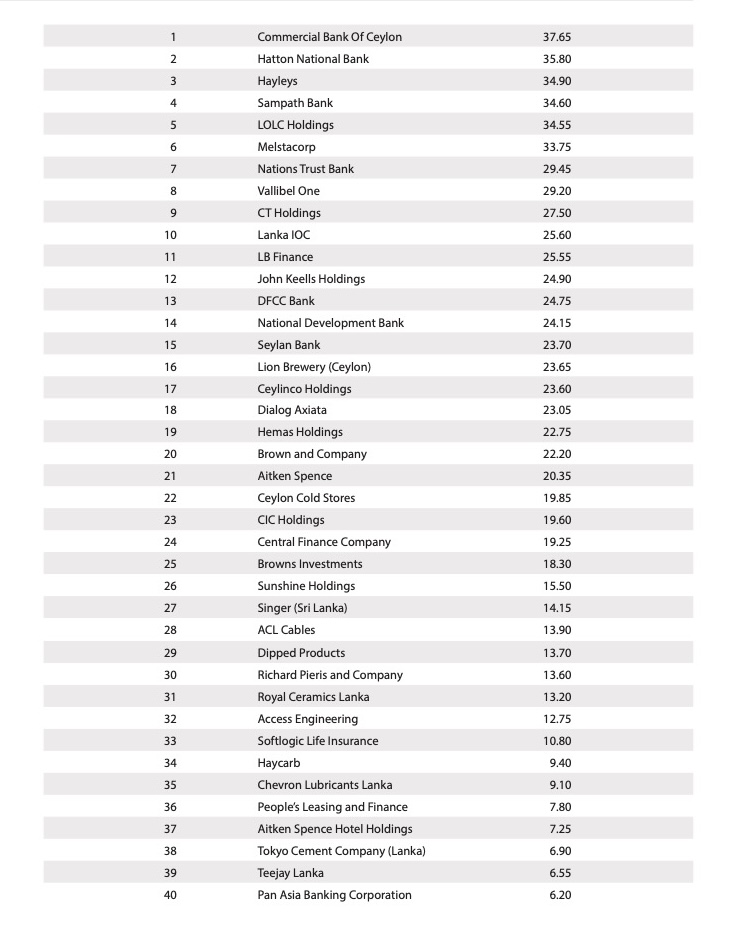

The Business Today TOP 40 for 2024/25 celebrates the resilience, adaptability, and innovation of Sri Lankan corporates amid a steadily improving economic landscape. The past year marked a pivotal turning point in the country’s economic trajectory— driven by macroeconomic stabilization, thoughtful policy realignment, and the gradual restoration of consumer and business confidence.

This year’s winners exemplify how renewed economic stability can translate into stronger performance, empowering organizations with greater clarity, confidence, optimism about the road ahead. Their achievements underscore a collective determination to pursue growth, strengthen competitiveness, and contribute meaningfully to Sri Lanka’s ongoing recovery and future progress.

Words Jennifer Paldano Goonewardane.

Corporate Performance in a Recovering Economy

This year’s Business Today TOP 40 comes at a pivotal moment, as the country moves onto a new trajectory marked by stronger performance across key sectors. The achievements of these corporates reflect Sri Lanka’s renewed economic momentum and stand as evidence of the nation’s progress. It is a testament not only to political commitment but also to the dynamism of the corporate sector, which has rebounded impressively from crisis. From the 2022 economic crisis to 2024/2025, Sri Lanka has made significant progress. From a near-total downfall of a historical default, the island is riding a wave of recovery. From double-digit inflation tapering down to single digits, the period that Sri Lanka has passed through has witnessed many changes, including leadership changes and power transitions. The fact that Colombo responded well to the IMF-led recommendations, with positive outcomes in meeting fiscal and monetary reform targets, resulted in three consecutive reviews and disbursements.

Continuous IMF funding led to an upgrade from default ratings, strengthening the country’s ability to access debt when required. The progress achieved enabled revisions to tax thresholds, offering much-needed relief to lower-income groups, while the resumption of motor vehicle imports has significantly boosted tax revenue and overall import activity. Although challenging at times, the IMF-led program is gradually transforming the macroeconomic environment.

With the new government adhering to the reform path, GDP grew by 4.5 percent in 2024, with optimistic forecasts for 2025. The World Bank and the IMF project growth rates of 4.6 percent and 4.2 percent, respectively, while the Central Bank of Sri Lanka estimates a 4.5 percent expansion. However, external demand conditions and global geo-economic shifts remain important variables. As Sri Lanka works to maintain the momentum of economic stabilization, the possibility of emerging external shocks remains a concern. However, throughout 2024 and 2025, both the government and the corporate sector successfully navigated a challenging landscape marked by tariffs, rising costs, geopolitical tensions, inflationary pressures, and financial market volatility.

A Tale of Cautious Optimism

Across the Business Today TOP 40, corporates shared a common view: the outlook for the future is one of cautious optimism, supported by improving macroeconomic stability, ongoing structural reforms, and strengthening investor confidence. Their positive performance across diversified sectors was driven by moderating inflation, falling interest rates, and a more stable foreign exchange environment. Following four years of extreme volatility, the collective sentiment was one of relief as Sri Lanka made steady progress toward economic stabilization. The numbers also suggest a promising trajectory. Thus, Sri Lankan corporates entered 2024/25 with renewed hope after years of navigating downturns with remarkable resilience and adaptability. The operating period was shaped by an improving economic climate, supported by external debt restructuring and the continued implementation of structural reforms—both of which were essential to the nation’s path to recovery. Sri Lanka’s leading corporates have responded to an economy on the mend, demonstrating agility, discipline, and renewed confidence across all major sectors. As macroeconomic stability improved, companies used the recovery period to recalibrate strategy, consolidate strengths, and re-energize growth.

Financial Sector

The financial services sector has made significant strides amid an economy in recovery. Four banks feature within the top ten of the BT TOP 40, and seven appear within the top twenty—each demonstrating strong performance and heightened resilience. Their profitability has been driven largely by higher net interest income, reduced impairment charges as customer credit quality improved, and effective asset–liability management in a declining interest rate environment. Despite elevated NPLs, defaults, and moratoria stemming from the pandemic and subsequent economic crisis, the sector has benefited from improving macroeconomic conditions, which are further supported by proactive recovery efforts.

Banks themselves acknowledge their turnaround. The sector maintained strong liquidity in both the rupee and the dollar during the year under review, while private sector credit expanded in line with rising economic activity. Asset quality improved, with stable funding and liquidity ratios by the third quarter of 2024, positioning banks for future credit growth. Increased digital transaction volumes—driven by continued customer migration to digital channels—also helped optimize operating costs. The sector further gained from reversals of provisions made in prior years for International Sovereign Bonds. As a result, most private-sector bank share prices rose notably after the elections and ratings upgrades, allowing investors to realize strong capital gains.

While the banking sector is now better equipped to support the country’s post-crisis recovery, the Central Bank maintains vigilant oversight to safeguard financial system stability—an effort that will depend on fiscal transparency and steady progress in debt restructuring, as emphasized by the Treasury.

Manufacturing and Industry

Manufacturers benefited from improved input availability and lower cost pressures. Several corporations expanded their capacities, upgraded their technology, and optimized their supply chains to regain competitiveness. Sectors such as ceramics, apparel, and diversified manufacturing reported stronger export demand and improved margins, reflecting the broader recovery in global markets.

Export Sector

Export-oriented companies adapted to shifting global conditions by innovating their products, diversifying their markets, and adopting leaner operating models. Tea, apparel, rubber, and specialized manufacturing companies reported steady demand and healthier earnings, thanks to exchange rate stability and improved shipping timelines.

Consumer Goods and FMCG

FMCG and consumer-focused companies experienced a renewed surge in demand as household spending gradually recovered. Many leveraged brand strength, expanded distribution networks, and introduced value-driven product lines to cater to evolving consumer sentiment. Cost discipline and supply chain stabilization improved margins across the sector.

Construction and Real Estate

With access to imported materials improving and investor sentiment gradually returning, construction, engineering, and real estate players began to see the beginnings of a rebound. Companies focused on completing stalled projects, strengthening order books, and adopting more efficient building technologies to manage costs in a still-cautious market.

Diversified Conglomerates and Other Key Sectors

Conglomerates demonstrated resilience through portfolio balancing, operational restructuring, and strategic investments in high-growth areas. Leisure and hospitality, though still recovering, benefited from the tourism revival. Energy and utilities players advanced sustainability initiatives and efficiency improvements as demand normalized.

The Passing of a Corporate Titan

It is fair to say that Harry Jayewardena was a larger-than-life figure in Sri Lanka’s corporate world, and his passing in February 2025 leaves a significant void in the country’s business landscape. An extraordinary leader, his visionary drive and transformative influence shaped several of Sri Lanka’s top conglomerates.

As Chairman of several leading companies including conglomerates, Jayewardena demonstrated exceptional business insight, steadfast commitment, and audacious leadership. He took the Melstacorp Group to new heights, securing its place as one of the nation’s most respected and diversified conglomerates. His leadership is regarded as personal and principled, fostering a culture of accountability, discipline, and meticulous attention to detail. His strategic investment philosophy delivered strong, sustainable value, setting a benchmark for corporate excellence.

Beyond his corporate achievements, he was a cherished friend who supported BT Options unfailingly, attending every TOP 40 awards ceremony and championing efforts to recognize Sri Lankan corporates. His legacy will continue to guide his successors as they navigate the evolving business environment of Sri Lanka.

The late Harry Jayawardena, a visionary with a lasting impact on Sri Lankan business.

Conclusion

Some corporates that appeared in previous editions of the TOP 40 did not make the list this year. This does not reflect weak performance; rather, it underscores how others capitalized more swiftly and effectively on a recovering economy. In an improved operating environment, several corporates demonstrated exceptional agility and dynamism—leveraging new opportunities, responding quickly to changing conditions, and steering their businesses toward significantly stronger results. It is a classic case of “making hay while the sun shines,” showcasing how those that adapted most decisively to the renewed economic trajectory were able to harness its advantages and secure their place in the TOP 40.

Across the board, the Business Today’s TOP 40 corporates capitalized on a more stable macroeconomic environment with renewed strategy, operational discipline, and confidence. Their performance reflects not only sector-specific recovery but also a broader resurgence of corporate momentum—an encouraging sign of Sri Lanka’s ongoing economic revival.

1. Commercial Bank of Ceylon

Crowning the Business Today TOP 40 list, Commercial Bank of Ceylon stands as a beacon of resilience and renewal after a defining year. Twenty-twenty-four was marked by transformation and tenacity—a period that tested the Bank’s strength yet ultimately set the stage for sustainable, long-term growth.

Sanath Manatunge, Managing Director/CEO describes 2024 as a year of navigating through turbulent tides. Having weathered those challenges, the Bank now moves forward with renewed confidence, for tified fundamentals, and a clear vision for the future. Throughout the year, Commercial Bank reinforced its leadership across key business segments, driving strategic initiatives that solidified its reputation as Sri Lanka’s most resilient and customer-centric financial institution. Its focus remained unwavering— expanding operations, deepening customer engagement, and creating inclusive financial solutions that empower growth.

The year also marked a record-breaking financial performance, with Sharhan Muhseen, Chairman noting that the Bank delivered the highest profits in its history. He attributed this success to a disciplined focus on efficiency, digital innovation, and customer-centered transformation. These strengths enabled the Bank not only to navigate a volatile environment but also to strengthen its market position and make meaningful contributions to national and regional economic progress.

Among the year’s milestones were a successful equity capital infusion of 22.54 billion rupees through a rights issue and the raising of 20 billion rupees in Tier II capital via a debenture issue— moves that bolstered capital adequacy and paved the way for future expansion. Lending reached historic highs, with the loan book expanding by 221.34 billion rupees, while Group net interest income rose 36.71 percent to 118.13 billion rupees, reflecting strong balance sheet management and a robust CASA base.

Looking ahead, Commercial Bank’s focus remains firmly set on regional expansion, digital leadership, and sustainable finance. Building on its success in Bangladesh, the Bank is eyeing new markets and pioneering AI-driven, personalized banking experiences. With its unwavering commitment to climate finance and renewable energy, Commercial Bank continues to redefine what responsible, future-ready banking looks like in Sri Lanka and beyond.

2. Hatton National Bank

Securing second place in the Business Today TOP 40, Hatton National Bank (HNB) emerged as a leading force in Sri Lanka’s evolving financial landscape. The year 2024 marked a period of renewed optimism and economic revival—conditions that HNB skillfully harnessed to drive exceptional growth and performance.

Damith Pallewatte, Managing Director/CEO described 2024 as a turning point for Sri Lanka’s economy, with inflation remaining contained, the rupee appreciating against the US dollar, and interest rates easing— conditions that stimulated credit growth and improved debt serviceability. Within this promising environment, HNB’s focus remained firmly on sustainable growth through responsible lending, low-cost deposit mobilization, enhancing asset quality, and expanding non-interest income. Importantly, Pallewatte emphasized that HNB’s strategy was not only about business growth but also about fulfilling its responsibility to support the nation’s path to economic recovery.

Nihal Jayawardene (PC), Chairman noted that the improving macroeconomic climate provided the momentum for business confidence and sectoral expansion. Backed by a solid capital base, strong liquidity, and a digital-first strategy, HNB swiftly capitalized on new opportunities, positioning itself as a dynamic and forward-thinking institution.

Looking to the future, HNB’s management remains optimistic. With the economy poised for accelerated growth, the Bank is preparing to lead the next phase of transformation through innovation, collaboration, and digital empowerment. Plans are underway to partner with fintechs to enhance customer platforms and build next-generation digital ecosystems that redefine traditional banking experiences. As part of its long-term vision, HNB is exploring regional expansion opportunities while recognizing the immense potential of Port City Colombo as a future financial hub.

As it navigates this era of transformation, HNB remains steadfast in its mission—to foster financial inclusion, enhance business agility, and make a meaningful contribution to Sri Lanka’s socio-economic resurgence. Guided by its rich heritage as a Domestic Systemically Important Bank, HNB continues to lead from the front— shaping the nation’s financial future and inspiring confidence for generations to come.

3. Hayleys

Claiming third place in the Business Today TOP 40 awards, Hayleys once again reaffirmed its stature as Sri Lanka’s leading diversified conglomerate, with business interests spanning 12 industry sectors across 17 countries. From eco solutions and hand protection to logistics, retail, and renewable energy, Hayleys continues to define excellence through innovation, resilience, and sustainable value creation.

Mohan Pandithage, Chairman and Chief Executive attributes the Group’s enduring success to a strategic dual approach—a clear long-term roadmap complemented by a robust operational framework that ensures continual progress toward its goals. Guided by this disciplined strategy, Hayleys continued to build a resilient, future-ready portfolio by diversifying its global footprint, broadening customer segments, and fostering a strong culture of innovation and customer-centric value creation.

In 2024/25, the Group achieved its highest-ever consolidated revenue of 492.2 billion rupees, a 13 percent year-on-year increase—an outstanding performance despite the challenges posed by a stronger Sri Lankan rupee impacting export-oriented sectors. The Consumer and Retail and Transportation and Logistics sectors led the way, each contributing 22 percent to overall revenue, while export-focused segments such as Hand Protection, Textiles, and Purification continued to demonstrate remarkable resilience. The strong performance of domestic businesses further underscored the effectiveness of Hayleys’ diversification strategy in navigating headwinds and seizing opportunities.

Pandithage emphasized that the Group’s success stems from its culture of deliberate diligence and integrity—a philosophy that values precision over haste and depth over assumption. This mindset has been the quiet yet powerful force behind Hayleys’ progress in digitalization, innovation, people development, and ESG integration.

As global markets evolve at an unprecedented pace, Hayleys views disruption not as a challenge but as an invitation—to rethink, reinvent, and create shared value. With its strong foundation, visionary leadership, and unrelenting pursuit of excellence, Hayleys continues to shape industries, empower communities, and drive forward Sri Lanka’s journey of economic transformation.

4. Sampath Bank

Emerging fourth in the Business Today TOP 40 awards, Sampath Bank marked a defining year in 2024, achieving the highest profit after tax (PAT) in its history. This remarkable performance was driven by stable net interest margins, reduced impairment charges, and provision reversals following the restructuring of International Sovereign Bonds by the Government of Sri Lanka. Strong deposit growth expanded the balance sheet, while renewed business confidence in the latter part of the year fueled credit growth across key sectors.

Ayodhya Iddawela Perera, who was the Managing Director/CEO during the reporting period, reflected that the Bank had turned uncertainty into opportunity—leveraging its legacy of technological innovation and customer-centric strategy to craft a sustainable path forward. She emphasized that sustainability remains central to the Bank’s business model, ensuring that growth is both responsible and resilient as Sampath enters a new era of progress.

A key catalyst for growth was the Bank’s commitment to reviving and empowering businesses amid economic recovery. The establishment of the Business Revival Unit exemplified this mission—providing financial guidance and management tools to help enterprises overcome liquidity challenges. The initiative successfully stabilized over 74 businesses, enabling them to return to regular repayment schedules and sustainable operations.

Meanwhile, the Board undertook a comprehensive review of the Bank’s legacy and business model to realign its strategy with the demands of the future—building on its inherent strengths while enhancing value for all stakeholders. The outcome of these deliberations is a clear strategic focus on accelerating growth within the Corporate and High Net Worth segments, through strengthened and differentiated value propositions. In turn, this focus will empower the Bank to extend and enrich its SME value chains, creating resilient ecosystems that connect entrepreneurs and farmers to markets, finance, and opportunity— fostering inclusive, sustainable growth across every layer of the economy.

Harsha Amarasekera, Chairman affirmed that Sampath Bank’s strong profitability, liquidity, and capital adequacy provide a solid foundation for transformation—one that will further enhance its value proposition and drive long-term stakeholder growth. With confidence, purpose, and innovation at its core, Sampath Bank continues to chart a dynamic course in Sri Lanka’s financial landscape.

5. LOLC Holdings

Securing fifth place, LOLC Holdings continues to demonstrate remarkable agility in an ever-changing global landscape. Embracing volatility as an inherent aspect of business, the Group has built its success on geographic and sectoral diversification—spanning financial services, agriculture and plantations, leisure, trading and manufacturing, research and innovation, technology, and strategic investments—a model that has consistently fortified its resilience and sustained growth. Kapila Jayawardena, Group Managing Director/CEO, noted that this breadth of diversification enabled LOLC to navigate economic headwinds with confidence, leveraging its global reach to seize new opportunities.

Ishara Nanayakkara, Executive Chairman highlighted that the year under review was shaped by a new era of macroeconomic stability, currency appreciation, and structural reform in Sri Lanka. Against this backdrop, LOLC recorded one of the strongest financial performances in its history, reaffirming its position as Sri Lanka’s largest and most globally diversified conglomerate.

Within the Group, LOLC Finance reinforced its market leadership by driving financial inclusion, expanding its digital ecosystem, and maintaining robust asset quality. The trading arm saw renewed momentum with the lifting of import restrictions, while the manufacturing division faced intensified competition but responded with agility and innovation. A notable highlight was the Group’s entry into the affordable New Energy Vehicle (NEV) market, signaling its commitment to sustainable mobility solutions. Meanwhile, plantation operations achieved stable yields through operational efficiency, climate-resilient practices, and reforestation initiatives. The leisure sector—spanning Sri Lanka, the Maldives, and Mauritius—benefited from the revival of regional tourism, unlocking new avenues for expansion.

As LOLC moves into its next chapter, its vision remains anchored in inclusive growth, global relevance, and sustainability. The Group continues to strengthen its inclusive finance model while deepening its presence across various real economy sectors, including agriculture, manufacturing, trading, leisure, and innovation. With its bold outlook and future-ready mindset, LOLC stands as a global Sri Lankan success story—one that continues to redefine the boundaries of enterprise and impact.

6. Melstacorp

Ranked sixth in the Business Today TOP 40 awards, Melstacorp stands as one of Sri Lanka’s most diversified and respected conglomerates, with business interests spanning beverages, plantations, telecommunications, insurance, power generation, textiles, leisure, logistics, BPO, construction support services, and healthcare.

Until recently, the Group was led by the late Deshamanya Harry Jayawardena, a towering figure in Sri Lanka’s corporate landscape whose visionary leadership transformed Melstacorp into a powerhouse of enterprise and innovation. As Chairman, he exemplified courage, foresight, and an unyielding pursuit of excellence— qualities that continue to shape the Group’s culture and direction. Succeeding him, Hasitha S. Jayawardena, the new Chairman, has pledged to uphold and advance his father’s enduring legacy. He emphasized his commitment to preserving the Group’s core principles while fostering innovation and strategic clarity to propel Melstacorp into its next era of growth.

The leadership transition was marked by a decisive realignment of portfolios. The Group streamlined its operations by discontinuing underperforming subsidiaries, including Lanka Bell, Texpro Industries, and Melsta Laboratories, while divesting its stake in Melsta GAMA. These strategic moves, according to Hasitha Jayawardena, were designed to sharpen focus on high-potential sectors capable of delivering sustainable, long-term value.

Melstacorp concluded the financial year with a robust and encouraging performance. Growth was driven primarily by the beverage, tourism, maritime and logistics, and plantation sectors, supported by improving contributions from strategic investments and services. The Distilleries Company of Sri Lanka (DCSL) remained the Group’s largest revenue contributor, with gains stemming from strong volume recovery, effective pricing strategies, and innovative product development.

Entering a new chapter, Melstacorp approaches the future with cautious optimism and disciplined execution. A strengthened balance sheet, leaner operations, and a more focused business portfolio have positioned the Group for renewed expansion. The recently completed restructuring initiatives—beyond cost efficiency— were strategic steps toward achieving organizational agility, capital optimization, and aligning long-term growth.

Looking ahead, Melstacorp’s strategy is anchored in embedding sustainability (ESG principles) and digital transformation deep within its value creation process—ensuring that innovation, responsibility, and resilience remain at the heart of its continued success.

7. Nations Trust Bank

Securing seventh place in the Business Today TOP 40, Nations Trust Bank emerged from 2024 as a testament to its strategic focus and resilience. The Bank recorded an impressive 46.5 percent year-on-year growth in Profit After Tax, despite muted credit growth and a challenging election-year backdrop. This stellar performance was underpinned by disciplined cost management, prudent lending, and strategic investments that strengthened the Bank’s foundation for sustainable growth.

Operational profits expanded and Net Interest Income held steady amid margin pressures, while the Bank maintained strong fundamentals with a Capital Adequacy Ratio well above the 12.5 percent regulatory threshold and a Liquidity Coverage Ratio of 320.6 percent, reflecting exceptional liquidity management.

Hemantha Gunetilleke, Chief Executive Officer credited the Bank’s success to the deep strategic work initiated during the pandemic and financial crises—transforming its business model, optimizing balance sheet management, and embedding efficiency across operations. These measures not only stabilized performance but also positioned the Bank to seize new opportunities with agility and confidence.

Throughout 2024, the Bank remained committed to inclusive growth— supporting vulnerable businesses with moratoria, advisory services, and partnerships with multilateral agencies to empower women entrepreneurs and SMEs. Sherin Cader, Chairperson affirmed that Nations Trust Bank is poised for focused expansion aligned with national growth priorities, maintaining a firm commitment to responsible lending, strong governance, and ESG integration as Sri Lanka transitions to a low-carbon future.

With clarity of purpose, disciplined execution, and a steadfast commitment to sustainability, Nations Trust Bank continues to chart a course of enduring progress and meaningful impact.

8. Vallibel One

Ranked eighth in the Business Today TOP 40, Vallibel One demonstrated resilience and foresight across its six key sectors—lifestyle, finance, consumer, leisure, aluminium, and investment. In a year defined by shifting economic tides, the Group delivered a strong performance, reinforcing its operational foundations through agility, innovation, and disciplined execution.

Dhammika Perera, Chairman observed that, amid an evolving landscape, Vallibel One leveraged the strength of its diversified portfolio to navigate complexities and capitalize on emerging opportunities. Dinusha Bhaskaran, Managing Director echoed this sentiment, emphasizing the Group’s unwavering commitment to long-term value creation anchored in diversif ication, discipline, and excellence.

While consumer-driven segments such as lifestyle and finance faced headwinds from subdued demand and cautious spending, the aluminium, consumer, and investment sectors outperformed, cushioning the overall impact. The lifestyle arm adapted swiftly, refining its product mix and enhancing value propositions to resonate with evolving customer preferences, while the finance sector focused on cost optimization and efficiency to sustain profitability.

The aluminium business capitalized on Sri Lanka’s renewable energy push, supplying solar structures and introducing product innovations that strengthened its market leadership. The consumer segment benefited from steady demand for essentials, emphasizing value-driven innovation and cost efficiency to stay aligned with shifting consumer behaviors.

Beyond domestic markets, Vallibel One continued its regional expansion across East Africa and South Asia, diversifying income streams and unlocking new growth frontiers. Through disciplined cost management, process excellence, and a steadfast focus on sustainability, the Group delivered a resilient financial performance.

Perera expressed confidence in the Group’s ability to create enduring value, guided by its core principles of diversification, discipline, innovation, and integrity. Bhaskaran added that Vallibel One is well poised to capitalize on future opportunities through strategic investments, digital transformation, and sustainability-led growth—continuing its journey as one of Sri Lanka’s most dynamic and future-ready conglomerates.

9. CT Holdings

CT Holdings, at ninth place, has continued to demonstrate resilience and growth amid the multiple crises Sri Lanka has faced in recent years. With a dynamic portfolio spanning retail, FMCG, restaurants, real estate, and entertainment, the Group remains one of the country’s most diversified and enduring business entities.

Ranjit Page, Deputy Chairman and Managing Director remarked that the Group’s strong performance underscores the wisdom of its long-term strategy and investment philosophy, which is anchored in resilience, innovation, and market leadership. He noted that several of CT Holdings’ brands have achieved dominant market positions within a remarkably short period, reflecting both consumer trust and operational excellence.

The Group’s success in the year under review was largely driven by its Cargills Retail, FMCG, and Restaurant sectors, which together contributed over 99 percent of the turnover and profitability. Retail remains the powerhouse of the Group, delivering consistent returns and reaffirming its proven model for scalability and community impact. The FMCG arm posted a robust performance across dairy, beverages, culinary products, and confectionery, despite challenges such as the 18 percent VAT on locally produced dairy products. Meanwhile, the Restaurants sector achieved a 13.7 percent revenue growth, supported by strong same-store sales and network expansion.

While the entertainment and real estate sectors continued to grapple with prolonged recovery cycles and shifting market dynamics, CT Holdings remains committed to optimizing these segments for the long term. Cargills Bank marked its third consecutive year of profitability, a testament to prudent management and strategic alignment within the Group.

Louis Page, Chairman expressed optimism about the path ahead, noting that rising consumer confidence and economic recovery present new opportunities for growth. The Group will focus its capital investments on expanding its retail and restaurant footprint, while modernizing its iconic Majestic City complex to meet the evolving needs of a new generation of consumers.

CT Holdings continues to define itself through resilience, innovation, and a deep connection to Sri Lankan life— building not just businesses, but brands that endure.

10. Lanka IOC

In tenth position in the Business Today TOP 40, Lanka IOC continued its journey of evolution and adaptation, maintaining a healthy financial per formance amid a rapidly transforming energy landscape. Dipak Das, Managing Director described the year as one of resilience, innovation, and strategic agility—driven by disciplined cost management and a diversified portfolio spanning lubricants, bunkering, petrochemicals, and bitumen, which collectively cushioned volatility in core fuel operations.

The company recorded a commendable five percent topline growth, with all major business segments—auto fuel, bunkering, and lubricants—contributing to the upturn. Lanka IOC’s expansion initiatives in recent years have translated into incremental volumes, while the lubricant segment has delivered a strong ten percent revenue growth, despite intense competition. The bunkering business benefited from increased vessel movements in regional ports and a dynamic pricing strategy, while the petrochemical portfolio achieved a remarkable fourfold surge in volumes, powered by the introduction of new PROPEL-grade products.

A milestone in gender empowerment, Sri Lanka’s first all-women-operated, fully automated retail outlet, launched by Lanka IOC in 2023, continued to perform exceptionally well through 2024—symbolizing the company’s progressive vision for inclusivity and innovation.

Satish Kumar Vaduguri, who was Chairman during the reporting period, emphasized that as global economies accelerate their energy transition— investing in renewables, biofuels, and electric mobility—Sri Lanka too is charting its course toward a diversified national energy mix. In this context, Lanka IOC remains a dependable partner in the nation’s energy evolution, aligning closely with both national priorities and global sustainability goals.

Looking ahead, Lanka IOC is poised to gradually transition toward a low-carbon future, guided by its parent company’s expertise in cleaner energy solutions. With a focus on renewable energy, green fuels, and technology-driven efficiency, the company aims to remain competitive, future-ready, and deeply committed to powering Sri Lanka’s progress in the years ahead.

11. LB Finance

Ranked eleventh in the Business Today TOP 40, LB Finance (LBF)—with over five decades of experience— continues to lead Sri Lanka’s financial services landscape, empowering individuals, enterprises, and communities to grow with confidence. The year under review marked a defining chapter for the institution, as it delivered its highest-ever profit after tax (PAT), alongside significant asset growth and strengthened portfolio quality.

Sumith Adhihetty, who was the Managing Director during the reporting period, attributed this stellar performance to a remarkable turnaround in asset quality, with the company moving from an impairment charge of 373.23 million rupees to a net impairment reversal of 256.23 million— an improvement exceeding 168 percent. This transformation reflects proactive risk management, rigorous credit monitoring, and efficient recovery mechanisms that substantially reduced non-performing advances.

G. A. R. D. Prasanna, Chairman credited these achievements to disciplined strategy execution, a robust balance sheet, and decisive investments in technology and customer experience. The company’s Non-Performing Loan (NPL) ratio fell to a historic low of 2.25 percent, underscoring its operational resilience and commitment to excellence amid competitive pressures.

The year also saw strategic expansion, with new branches extending LBF’s reach across the island—reinforcing its position as Sri Lanka’s largest financial institution in terms of branch network.

Looking ahead, LBF’s strategic focus is clear: to cement its leadership as a technology-dr i ven financial powerhouse. Harnessing Fintech and AI, the company aims to elevate operational efficiency and customer engagement while expanding its Microfinance and Small Business Loan portfolios, developing new financial verticals, and deepening ESG integration.

As the economy continues to recover, LBF stands poised to seize new opportunities—guided by its strong network, skilled teams, and pioneering spirit—to shape the next era of inclusive and innovative finance in Sri Lanka.

12. John Keells Holdings

In twelfth place in the Business Today TOP 40, John Keells Holdings (JKH) stands at a defining juncture—where vision meets realization and ambition charts the road ahead. The year under review marked the launch of two landmark ventures set to reshape Sri Lanka’s economic landscape: the City of Dreams Sri Lanka integrated resort and the West Container Terminal at the Port of Colombo. These projects, monumental in both scale and significance, are poised to drive trade, tourism, and investment—solidifying the nation’s status as a regional hub for leisure and logistics.

The Group’s financial performance aligned with expectations, driven by its consumer-centric businesses, which demonstrated steady momentum throughout the year. While Group EBITDA reflected pre-opening and operational expenses related to City of Dreams Sri Lanka, strong contributions from Consumer Foods, Retail, and Financial Services offset these transitional costs.

The Consumer Foods sector delivered exceptional growth in both Beverages and Confectionery, buoyed by volume expansion and margin improvement. The Supermarket chain recorded robust performance, with same-store sales up 14.2 percent, supported by heightened customer activity. In the transport and logistics segment, South Asia Gateway Terminals (SAGT) saw higher profitability, driven by a 14 percent volume increase and a stronger cargo mix, while Lanka Marine Services achieved a 15 percent rise in volumes despite competitive margin pressures.

JKH also entered the New Energy Vehicle (NEV) market through JKCG Auto, exceeding expectations with a surge in bookings for its BYD range— signaling the Group’s agility in embracing next-generation opportunities. Meanwhile, the Property sector saw improved profitability, led by sales at Cinnamon Life, VIMAN, and Rajawella Holdings’ real estate projects. The Resorts sector benefited from Sri Lanka’s tourism resurgence, though partially offset by lower contributions from Maldivian and Colombo hotels.

Krishan Balendra, Chairman affirmed that JKH is moving into the future with renewed confidence as its transformational investments begin to bear fruit. With socio-economic stability returning and investor sentiment improving, he emphasized that the Group stands ready to accelerate growth and help steer Sri Lanka’s next era of economic resurgence.

13. DFCC Bank

DFCC Bank has been ranked thirteenth in the Business Today TOP 40. The Bank capitalized on Sri Lanka’s economic revival in 2024, marking a year of exceptional progress and performance. Under the leadership of Jegan Durairatnam, Chairman and Thimal Perera, CEO, the Bank achieved its highest-ever Profit After Tax (PAT) of 8.3 billion rupees, reflecting strong financial discipline, strategic foresight, and sustainable growth.

DFCC’s success was driven by strategic investments in high-yield government securities, robust deposit growth, and an expanding asset base. Its focused approach to fee-based income also strengthened non-funded earnings. A decline in impairment provisions, supported by positive macroeconomic trends and diligent recovery efforts, further enhanced profitability and balance sheet resilience.

A defining milestone in its sustainability journey was the issuance of Sri Lanka’s first-ever Green Bond, listed on both the Colombo Stock Exchange and the Luxembourg Green Exchange—a pioneering achievement that underscores DFCC’s leadership in ESG finance and its commitment to responsible banking. The Bank’s strengthened stability was further validated when Fitch Ratings upgraded its national Long-Term Rating to A(lka) with a stable outlook in early 2025.

Chairman Durairatnam emphasized DFCC’s successful transformation from a traditional development finance institution into a dynamic, full-service commercial bank, redefining its role in Sri Lanka’s financial sector. CEO Perera reiterated that DFCC’s focus on innovation, technology, and talent continues to shape its evolution as a trusted partner in corporate, retail, and SME banking—advancing sustainability, customer experience, and the nation’s economic progress.

14. National Development Bank

Ranked fourteenth, National Development Bank (NDB) continued to reaffirm its role as a catalyst of national progress, championing entrepreneurship, exports, and sustainable growth. With a legacy spanning over four decades, NDB has been instrumental in empowering small and medium-sized enterprises (SMEs) — the backbone of Sri Lanka’s economy — through tailored financial solutions, advisory support, and strategic partnerships that enable businesses to thrive and expand.

Under the leadership of Sriyan Cooray, Chairman and Kelum Edirisinghe, Director/CEO, NDB focused on three core areas during the year — expanding net interest margins, driving transactional growth, and strengthening portfolio quality. These efforts translated into robust financial performance and enhanced profitability, reflecting disciplined execution and prudent risk management. The Bank also deepened its engagement with key sectors such as SMEs and exports, aligning its efforts with the nation’s broader economic agenda. Strategic collaborations with the National Enterprise Development Authority (NEDA), the Export Development Board (EDB), the International Finance Corporation (IFC), and the Asian Development Bank (ADB) further strengthened NDB’s role as a development enabler, enhancing the competitiveness and resilience of local enterprises.

Chairman Cooray emphasized that maintaining financial system stability remains central to NDB’s mission. The continued focus on governance, risk management, and operational excellence has reinforced the Bank’s resilience to external shocks while strengthening its position in Sri Lanka’s evolving financial landscape.

Encouraged by signs of economic recovery, NDB remains forward-looking—poised to leverage emerging opportunities through strategic balance sheet management, digital innovation, and capital optimization. With a strong foundation and a purpose-driven vision, NDB continues to champion inclusive growth and make meaningful contributions to Sri Lanka’s journey toward sustained prosperity.

15. Seylan Bank

In fifteenth place in the Business Today TOP 40, Seylan Bank turned 2024 into a year of strategy, resilience, and record-breaking performance — much like a game of Scrabble, played with precision and foresight, building momentum letter by letter.

Under the leadership of Justice Buwaneka Aluwihare PC, Chairman and Ramesh Jayasekara, Director/CEO, the Bank recorded its highest-ever Profit After Tax in its 36-year history — a remarkable feat achieved amid a challenging investment climate shaped by the lingering impact of the 2022 economic downturn. Jayasekara observed that although the year began with high interest rates and inflationary pressures, the latter half saw welcome reversals. Through strategic refinements and timely adaptations, Seylan ensured its offerings remained relevant, competitive, and customer-centric, thereby sustaining growth and reinforcing resilience.

Key strategic priorities—enhancing customer satisfaction, deepening banking relationships, and driving sustainable growth—yielded tangible results. The Bank’s Trade Finance business surged by 80 percent in 2024, emerging as a key source of fee income. Growth in CASA was driven by innovations such as Internet Payment Gateways (IPGs), POS terminal deployments, and the expansion of Cash Recycle Machines (CRMs), thereby strengthening both merchant and customer convenience. Focused recovery efforts also paid off, with the Net Impaired Loan ratio improving sharply to 2.10 percent from 3.85 percent in the previous year. The Bank continued to make significant headway in digital adoption and penetration.

The Chairman noted that despite subdued domestic demand and cautious investor sentiment, Seylan Bank’s proactive strategies and operational agility translated into exceptional results. Looking ahead, management remains optimistic about Sri Lanka’s economic trajectory, anticipating stronger growth, increased credit demand, and renewed investor confidence in 2025.

With a focus on policy consistency, innovation, and stakeholder value creation, Seylan Bank is poised to build on its strong foundation, continuing its journey as a trusted, future-ready financial partner that drives growth and stability in Sri Lanka’s evolving economy.

16. Lion Brewery (Ceylon)

In sixteenth place in the Business Today TOP 40 awards, Lion Brewery (Ceylon) navigated 2025 with measured confidence, steady progress, and a clear commi tment to long- term transformation. Guided by a vision that looks beyond immediate challenges, the Company continued to strengthen strategic governance and advance its 2030 roadmap—one built on innovation, resilience, and responsible growth.

Over the year, Lion sharpened its focus on expanding consumer choice through a more differentiated product portfolio. Rajiv Meewakkala, Director/ CEO noted that multiple excise duty hikes had weighed heavily on affordability. In response, the Company intensif ied its drive towards innovation—introducing new flavors and SKU formats that cater to evolving preferences while offering accessible price points without compromising quality. This strategy enables Lion to broaden its consumer base, stimulate volume growth, and remain competitive in a demanding economic environment.

Meewakkala also highlighted improved regulatory accessibility, a development that helps curb unregulated trade and ensures consumers receive safe, high-quality products. The issuance of new licenses in underserved regions, he said, was a welcome move. The Company further acknowledged the Government’s assurance to align future excise increases with inflation as progress, while reiterating the need for long-term consistency and transparency to support stable industry pricing and cost management.

Amal Cabraal, Chairman affirmed Lion’s dedication to sustainable, long-horizon growth. The year marked several defining milestones, including the commissioning of the Innovation Brewery and the refinement of an export strategy—initiatives that strengthen its global presence and enrich its product offerings. The Innovation Brewery is expected to elevate exports from 15 percent to 20 percent of total volume, reinforcing Lion’s footprint in high-potential markets. To drive this ambition, the Company has streamlined its focus to 17 key export destinations across Africa, the Middle East, and South Asia.

These advancements underscore the pillars of Lion’s 2030 Long-Term Plan: innovation, efficiency, and premiumisation—cornerstones that will continue to shape its value creation journey in the years ahead.

17. Ceylinco Holdings

Ranked seventeenth, Ceylinco Holdings’s journey in 2024 stands as a testament to resilience, foresight, and an unwavering spirit of progress. Despite a turbulent economic backdrop, the Group continued to forge new pathways, guided by a diversified portfolio spanning insurance, power generation, education, and healthcare. With strategic clarity and purposeful expansion, Ceylinco has strengthened the foundations of long-term value creation.

Ajith Gunawardena, Executive Chairman/CEO noted that although higher corporate taxes, elevated operating costs, and a lower interest-rate environment posed challenges, the Group successfully navigated these pressures. Strong contributions from insurance, education, and power and energy operations led to a solid financial performance.

Gunawardena attributed this resilience to strategic insight and the strength of its subsidiaries, which continued to sharpen their competitive edges while delivering enhanced customer service. Despite intense industry competition and the prolonged vehicle import ban, the general insurance business remained robust— positioning itself to benefit from the recent relaxation of motor import restrictions.

Looking ahead, Ceylinco Holdings remains optimistic. Gunawardena highlighted the significant growth potential in the insurance sector, buoyed by rising demand for health insurance, retirement plans, and investment products, particularly among the country’s aging population and the expanding non-pensioned private sector workforce. Eased motor import regulations are also expected to drive growth in non-life insurance, encouraging tailored product development and competitive pricing.

The outlook for renewable energy is equally encouraging. The new Electricity Act has set the stage for accelerated adoption of renewable energy, creating a promising landscape that the Group is keen to explore in the short to medium term.

In education, demand across primary, secondary, and tertiary levels continues to climb, reinforcing the sector’s trajectory of expansion. Ceylinco plans to further strengthen its academic standards and broaden its offerings, while increasing the integration of digital platforms to enhance accessibility and elevate learning experiences for both youth and adults.

With its diversified strengths and forward-looking strategy, Ceylinco Holdings moves into the future with confidence—rooted in resilience and driven by an ambition to shape meaningful, long-term value.

18. Dialog Axiata

In a year defined by resilience, restructuring, and recovery, Dialog Axiata delivered a strong all-round performance, securing eighteenth place in the Business Today TOP 40 awards. The year’s most transformative milestone was the acquisition and amalgamation of Bharti Airtel Lanka, through which Dialog absorbed nearly three million Airtel mobile customers. This strategic move expanded its subscriber base to over 20 million, firmly reinforcing its position as Sri Lanka’s largest mobile network.

Reflecting on this landmark merger, Supun Weerasinghe, Group Chief Executive expressed confidence that the combined entity would set new industry benchmarks in service excellence and digital innovation, cementing Dialog’s status as the market’s unequivocal leader.

Weerasinghe underscored that Dialog’s return to profitability is anchored in a decisive, multi-year cost transformation program. Over 2023 and 2024, the Group undertook sweeping measures to streamline operations, reset its cost base, and embed financial discipline. In 2024, these efforts accelerated further, with Group-wide efficiency improvements, structural reforms, and tighter cost containment. The results have been striking: a comprehensive turnaround in profitability and a leaner, more agile organization equipped to sustain long-term gains. Dialog has now instilled a culture of continuous cost optimization—ensuring efficiency, healthy margins, and stronger cash flows as it ventures into new growth areas.

Strengthening the balance sheet was another critical focus in 2024. The Group strategically reduced its USD-denominated debt, significantly lowering its net foreign currency exposure. It refinanced short-term facilities, secured longer-tenor funding, and enhanced its financial risk management practices—all aimed at improving liquidity and shielding the business from external volatility. These measures, Weerasinghe noted, have fortified Dialog’s financial foundation, improved its debt maturity profile, and safeguarded profitability against macroeconomic fluctuations.

Weerasinghe affirmed that Dialog enters the new financial year as a more resilient, innovative, and future-ready enterprise. With a clear roadmap for the next phase of Sri Lanka’s digital evolution, Dialog aims to expand world-class 5G connectivity, accelerate digital transactions, and advance the technological backbone of the modern economy. Its purpose remains unchanged: to empower and enrich the lives of Sri Lankans and to continue leading the nation toward a digitally inclusive and prosperous future.

19. Hemas Holdings

Securing the nineteenth position in the Business Today TOP 40 awards, Hemas Holdings marked a strong rebound in 2024/25, delivering record earnings with a 31.9 percent year-on-year growth. This performance signals the Group’s resilience and its ability to navigate shifting market conditions with agility and strategic clarity.

Group revenue saw a modest three percent decline, largely due to strategic price adjustments implemented by both the Consumer Brands and Healthcare sectors in response to the strengthening rupee and evolving market dynamics. Cautious consumer spending and calibrated pricing within key consumer categories also contributed to the dip. Conversely, the Healthcare sector recorded a standout year, supported by regulatory improvements such as the government’s transparent pricing mechanism for essential medicines and a more equitable pharmaceutical procurement process, which boosted profitability across all healthcare businesses.

Despite top-line pressures, Hemas strengthened its bottom line through continued efficiency improvements, supply chain optimization, and favorable foreign exchange movements, resulting in enhanced profitability margins.

Husein Esufally, Chairman noted that while the first half of the year was shaped by lingering macroeconomic pressures, the latter half brought renewed optimism, supported by improving political stability following national elections and encouraging economic indicators.

The acting CEO during the reporting period highlighted that Hemas is now laying the groundwork for its next phase of growth. With core businesses generating strong cash flows and a reinforced balance sheet, the Group is well-positioned to invest in strategic opportunities. A key priority remains expanding its foreign exchange earnings footprint—through export-led growth, strategic international acquisitions, strengthened partnerships, and deeper expansion in Bangladesh. Simultaneously, Hemas is exploring both organic and inorganic investments in areas where it holds a strong competitive advantage and long-term scalability.

The Group aims to accelerate sustainable growth by entering larger emerging markets, expanding into adjacent sectors, and driving technology-led transformation. Whether through acquisitions, strategic alliances, or new market entry, Hemas remains steadfast in its commitment to shaping a future defined by innovation, resilience, and sustainable value creation.

20. Brown and Company

Brown and Company stands as one of Sri Lanka’s most historic corporate institutions—rooted in a 19th-century colonial legacy that has evolved into a dynamic and diversified conglomerate. Ranked twentieth in the Business Today TOP 40 awards, today, under the leadership of Ishara Nanayakkara, Executive Chairman, Browns oversees a vibrant por t folio spanning agribusiness and plantations, agriculture and heavy equipment, automotive and hardware, engineering and construction, leisure and entertainment, pharmaceuticals, and consumer and industrial engineering solutions.

In 2024/25, the Group continued to navigate an environment of shifting market conditions with bold strategies, strengthening its position as a key player in multiple sectors. Browns noted that Sri Lanka’s economic growth trajectory—one of the fastest in South Asia in recent years—has created both challenges and opportunities. Operating in such a climate demands agility, and the Company has leveraged its extensive footprint, Group synergies, and commitment to developing local talent to turn market pressures into competitive advantages.

While the year demanded careful management of input costs, import restrictions, and fluctuating demand across several sectors, Browns maintained operational resilience. Its agriculture and heavy equipment businesses benefited from renewed activity in the construction and farming sectors, while its plantations and agribusiness operations continued to contribute steadily, supported by improved productivity measures. The pharmaceuticals and healthcare distribution arm also recorded healthy progress, reflecting rising domestic demand for trusted medical supplies and the Group’s strong logistics capabilities.

The leisure and entertainment segment continued to adapt to evolving travel patterns, focusing on curated guest experiences, brand repositioning, and operational efficiencies. Meanwhile, the Company’s engineering and power solutions businesses strengthened their pipelines through infrastructure-related opportunities emerging across the country.

Management noted that though the operating environment remains challenging, Browns’ diversified model and long-standing brand equity provide a natural hedge against volatility. Its competitive position continues to open pathways for growth. The Group is also placing greater emphasis on digital adoption, sustainable business practices, and strengthening customer touchpoints in line with its long-term strategy.

Looking forward, Browns sees more opportunity. With its extensive portfolio, proven resilience, and heritage of trusted service, the Company is poised to support and benefit from Sri Lanka’s continued development.

21. Aitken Spence

Aitken Spence, ranked twenty-first in the Business Today TOP 40 awards, entered the year under review with both pride and poignancy following the passing of its iconic Chairman, Harry Jayawardena. A towering figure in Sri Lanka’s corporate landscape, he leaves behind a legacy defined by entrepreneurial courage, transformative leadership, and enduring impact. His vision continues to illuminate the path ahead for the Group.

Stasshani Jayawardena, Executive Chairperson his successor, paid tribute to his wisdom and foresight, acknowledging the influence of his guidance as she steps into her new role with clarity of purpose and conviction.

Despite the emotional transition at the helm of this 156-year-old conglomerate, Aitken Spence delivered a strong performance amid improving economic conditions marked by low inflation, favorable interest rates, and a strengthening rupee. The resurgence of Sri Lanka’s tourism industry was a major catalyst, with rising arrivals pushing both occupancy and room rates upward. Recovering demand also boosted export and import volumes, supported by renewed consumer and investor confidence.

Tourism emerged as the Group’s largest contributor to revenue and profit before tax, recording a remarkable 59.5 percent growth, largely driven by the strong performance of Sri Lankan hotels and the destination management segment. Maritime and Freight Logistics reinforced its strategic relevance as the second-largest profit contributor. The Strategic Investments sector also reported notable improvements: printing and packaging benefitted from local FMCG demand, power generation saw gains through improved collections and reversals of old provisions, and plantations maintained resilience despite wage pressures and rising input costs. However, progress in these areas was tempered by underperformance in the apparel segment, which is currently undergoing a strategic shift in its product offering. The Services sector posted a year-on-year decline, although property development, insurance, and the launch of Port City BPO—which created nearly 2,000 new jobs—provided steady support.

Dr. Parakrama Dissanayake, Deputy Chairman and Managing Director noted that the Group is accelerating a transformative journey centered on strategic agility, operational excellence, and future-readiness. A structured transformation framework now guides all business segments in alignment with the Group’s long-term vision. Looking ahead, Aitken Spence is actively exploring new investments and regional partnerships, including opportunities in the Maritime and Freight Logistics sector in Bangladesh and Sri Lanka, all of which will undergo rigorous evaluation in light of evolving global and domestic conditions.

22. Ceylon Cold Stores

Ceylon Cold Stores (CCS), ranked twenty-second, delivered a strong year marked by impressive growth across both its Manufacturing and Supermarket segments. Benefiting from a recovering economy and a more stable political climate—underpinned by deflation, lower interest rates, a strengthening rupee, and reduced energy costs— consumer confidence returned, driving higher demand and improved activity across the Group. Operating in the beverages, confectionery, and supermarket sectors, CCS reported a notable 74 percent increase in Profit After Tax, a result of focused strategy execution supported by favorable macroeconomic fundamentals.

The Manufacturing Sector posted robust revenue growth, fueled by double-digit volume expansion in both Beverages and Confectionery. The momentum was strengthened by new product launches, a reliable distribution network, and rising consumer spending. The Supermarket business also delivered strong results, with revenue growth driven by a double-digit increase in same-store sales, reflecting higher foot traffic across outlets.

Krishan Balendra, Chairman noted that while the Group remains vigilant of external risks—particularly currency volatility and its effects on imported inputs—the outlook for consumer-driven businesses is highly encouraging. Stabilizing inflation and exchange rates are expected to ease input cost pressures, while improving consumer sentiment is likely to sustain demand.

Looking ahead, the Beverages segment is expected to maintain its upward trajectory, with the CSD range driving near-term performance and the non-CSD portfolio gradually increasing its contribution through strategic realignment. Confectionery volumes are poised to rise alongside the broader economic recovery, supported by low market penetration and recent growth momentum. Manufacturing will continue to invest in capacity enhancements and expand into adjacent categories.

The Supermarket segment is well-positioned for another strong year in 2025/26, backed by steady consumer traffic, a strengthening economic environment, and initiatives aimed at elevating customer engagement. Key priorities include expanding the prepared-food range, growing the outlet network, advancing an omnichannel approach through improved delivery platforms, and elevating the shopping experience both in-store and beyond.

23. CIC Holdings

Ranked twenty-third, CIC Holdings stands as one of Sri Lanka’s most diversified conglomerates, with strong footholds in agriculture, healthcare, industrial solutions, and livestock. Aroshan Seresinhe, Group CEO, noted that all five business segments delivered resilient performances despite a challenging operating environment. The Crop Solutions sector remained the Group’s powerhouse, contributing 40 percent of revenue as demand for agri-inputs strengthened alongside the gradual revival of the agriculture sector. The Health and Personal Care segment accounted for 22 percent of revenue, driven by robust growth in pharmaceuticals and medical devices and supported by an expanded portfolio designed to offer broader price points. The Livestock Solutions sector also delivered solid results, recording a ten percent increase and contributing 21 percent to the Group’s revenue, driven by improving demand and capacity expansion. Both the Agri-produce and Industrial Solutions sectors posted year-on-year revenue growth as market conditions improved.

Seresinhe emphasized that operational efficiency and cost optimization remained top priorities amidst sustained margin pressures. Strengthening working capital management—especially through tighter inventory control—was crucial for maintaining liquidity, particularly in areas that relied on government payments. The regularization of these payments, along with improved credit terms from global principals amid economic stabilization, significantly eased cash flow constraints.

To unlock new avenues for growth, CIC is reimagining how its strongest brands can evolve to meet the emerging needs of consumers. Going forward, the Group’s “Envisioning” strategy will guide its next phase of transformative expansion. A key focus will be on strengthening its presence along the agricultural value chain, including value-added opportunities in areas such as agri-processing. CIC also aims to broaden its export footprint, capitalizing on rising global demand for authentic, wellness-driven, and sustainably produced goods.

Seresinhe highlighted innovation as a critical engine for future growth. The Group plans to further build its research and development capabilities and foster a culture that encourages bold thinking, experimentation, and breakthrough ideas to drive long-term value.

Harsha Amarasekera, Chairman commended CIC’s ability to perform strongly—even in periods of economic strain—attributing its success to resilience, agility, and prudent diversification, qualities he believes will be essential as the Group pursues growth in the years ahead.

24. Central Finance Company

Central Finance Company (CF), ranked twenty-fourth, navigated the year under review with a blend of resilience, discipline, and renewed momentum. Against the backdrop of an improving economy, CF demonstrated its ability to adapt quickly and execute with precision—delivering strong progress across all core business lines.

Kapila Gunaratne, Managing Director/ CEO noted that the recovering economic landscape provided both clarity and confidence, enabling CF to position itself for sustained growth as its core customer markets strengthened. Arjun Fernando, Chairman echoed this optimism, describing the year as one of exceptional advancement. He highlighted the loan book’s impressive 31.86 percent expansion—almost four times the previous year’s growth—as a testament to CF’s well-calibrated and disciplined credit expansion strategy, aimed at reinforcing its leadership in the NBFI sector.

Within its lending operations, CF capitalized on rising credit appetite through an assertive expansion drive, while remaining prudent in its risk selection. The company reassessed higher-risk asset classes and tightened screening criteria to minimize future collection risks. This disciplined approach was complemented by enhanced recovery initiatives, reducing the NPL ratio to 2.76 percent by March 2025, down significantly from 7.05 percent the previous year.

Following successive policy rate cuts by the Central Bank, CF adopted a selective approach to deposit mobilization. Rather than chasing rapid growth, the focus shif ted to consolidating its existing deposit base and deepening customer relationships, resulting in a commendable term deposit renewal ratio of 85 percent despite the low-interest environment.

The Vehicle Hire business also performed creditably, overcoming import restrictions and market pressures by concentrating on priority segments, strengthening client relationships, and diversifying its offerings—ultimately meeting its revenue targets.

A notable milestone during the year was Fitch Ratings’ upgrade of CF’s National Long-Term Rating to ‘A(lka)’ from ‘A-(lka)’, with a Stable Outlook. Following the recalibration of Sri Lanka’s national rating scale, this upgrade positioned CF as the highest-rated standalone finance leasing company under Fitch’s Sri Lankan coverage.

As they move forward, Gunaratne emphasized CF’s commitment to controlled, quality-driven credit growth. With key domestic sectors, such as tourism, agriculture, and MSMEs, projected to gain momentum, CF aims to expand its operational capacity, deepen its market presence, and capture emerging opportunities to strengthen its position across these vital segments.

25. Browns Investments

In twenty-fifth place, Browns Investments (BI)—the strategic investment arm of the Browns Group and a key subsidiary of the LOLC Group—continued to strengthen its presence across high-growth sectors, including plantations and agriculture, leisure and hospitality, construction, and real estate. Led by Ishara Nanayakkara, Executive Chairman the company remains anchored to a long-term investment philosophy that balances opportunity with disciplined risk management.

BI’s diversified portfolio enables it to navigate shifting market conditions with agility while creating sustainable value for its stakeholders. During the year under review, the company reinforced its foothold in core business verticals through selective acquisitions and operational enhancements, underscoring its role as a catalyst for growth within both the LOLC Group and the national economy.

A defining highlight was Browns Plantations’ emergence as the world’s largest tea exporter following the landmark acquisition of Lipton Teas and Infusions’ estates in Kenya, Rwanda, and Tanzania. This historic move lifted the company’s annual export capacity to nearly 100 million kilograms, firmly positioning it as a global tea powerhouse.

The leisure segment recorded its most profitable year to date, benefiting from the sharp rebound in global travel driven by pent-up demand and rising consumer confidence. Almost all properties posted strong financial and operational results, supported by a lean workforce model , targeted refurbishments, strengthened technology adoption, and continual service enhancements. Sustainability remained central to its operations, with impactful conservation and community initiatives integrated across the portfolio.

Meanwhile, the Engineering & Construction sector demonstrated resilience amid challenging conditions through disciplined cost control and steadfast project execution. Sierra Cables, a key asset within the sector, delivered record revenues driven by strong export performance and a strengthened local retail presence.

Collectively, these business segments highlight the Group’s remarkable resilience and versatility, reinforcing its commitment to building sustainable value wherever it operates.

26. Sunshine Holdings

Sunshine Holdings, a diversified conglomerate with operations in Healthcare, Agribusiness, and Consumer Goods, secured the twenty-sixth position in the Business Today TOP 40 awards. Amal Cabraal, Chairman noted that the Group delivered strong results during the year under review, with revenue and profitability rising on the back of disciplined execution, brand-led value creation, and prudent cost management. All three core segments contributed meaningfully, with Healthcare remaining the primary driver of revenue and earnings, while Consumer Goods sustained momentum through resilient brands and export growth. Agribusiness, though challenged by input cost volatility and regulatory constraints, continued to demonstrate operational discipline and resilience.

Shyam Sathasivam, Group CEO attributed the year’s performance to thoughtful leadership transitions, long-term investments, and a deliberate effort to embed resilience across the Group. Sunshine, he emphasized, did not merely respond to shifting market conditions—it acted with conviction, leveraged its strengths, and laid new foundations for scale, stability, and synergy.

The Healthcare segment once again led the Group, accounting for over 60 percent of consolidated revenue. Sunshine Healthcare Lanka reinforced its position as Sri Lanka’s third-largest pharmaceutical distributor. A significant milestone was the USD 11 million equity infusion from the International Finance Corporation (IFC), which reaffirmed the business’s credibility and strengthened its mission to enhance healthcare access nationwide.

The Consumer Goods segment delivered steady performance despite inflationary pressures, VAT adjustments, and evolving purchasing behaviors, while Agribusiness managed to maintain stable returns amid global commodity volatility and operational challenges.

Sathasivam outlined three strategic priorities for the next two to three years. First, scaling the Healthcare business by expanding categories, accelerating domestic manufacturing, and leveraging the IFC partnership. Second, driving deeper innovation within Consumer Goods, particularly in wellness-oriented categories and digital engagement. Third, transforming Agribusiness into a high-value, ESG-aligned export engine focused on spices, essential oils, and traceable commodities. Concurrently, Sunshine will continue investing in leadership, talent development, and digital capabilities to stay competitive in an evolving landscape.

Sathasivam affirmed that while proud of the Group’s achievements, he expressed even greater enthusiasm for the opportunities ahead.

27. Singer (Sri Lanka)

Occupying the twenty-seventh position in the Business Today TOP 40, Singer Sri Lanka—one of the country’s oldest and most trusted consumer durables brands with a legacy spanning 148 years—has staged a remarkable resurgence.

After navigating a challenging economic period, the Company witnessed a strong market rebound. Consumers initially struggled with higher prices, but as the exchange rate stabilized and interest rates eased, Singer leveraged improved supplier terms to lower prices and restore affordability. With stronger product availability and an expanded portfolio, the brand is steadily reclaiming market share. Throughout this process, Singer remained committed to a renewal strategy it believed would anchor long-term success, and is now confidently transitioning back to its scale-driven “be big” model.

Mahesh Wijewardene, Group Managing Director credits the Company’s renewed growth trajectory to a smart strategy, a resilient brand, and a dedicated team. Singer delivered a profit after tax of 4.18 billion rupees— an extraordinary turnaround from the previous year’s loss of 91 million. He attributes this performance to favorable macroeconomic conditions, pent-up demand following the easing of import restrictions, improved foreign exchange liquidity, and the ability to pass on cost benefits to customers.

Mohan Pandithage, Chairman notes that the year’s performance reflects bold realignments across portfolios, customer touchpoints, and processes. Singer’s comeback, he emphasizes, is rooted in crafting strong value propositions for diverse customer segments and driving change with precision—emerging as a leaner, faster, and more agile organization ready for sustained growth.

28. ACL Cables

Ranked twenty-eighth in this year’s Business Today TOP 40, ACL Cables— Sri Lanka’s largest cable manufacturer— delivered its strongest financial performance to date. U. G. Madanayake, Chairman announced a record profit after tax of 5.4 billion rupees, crediting the Group’s disciplined cost management and ability to seize emerging market opportunities. He attributed this exceptional performance to the powerful synergy of operational excellence, strategic innovation, and a deeply committed workforce. Streamlined manufacturing, strengthened supply chains, and efficiency-driven processes enabled ACL to enhance quality while cutting lead times. He emphasized that the unwavering dedication and agility of the team remain the foundation of ACL’s continued success.

Suren Madanayake, Managing Director echoed these sentiments, noting that Sri Lanka’s economic stabilization, rising investor confidence, and ongoing reforms have created an environment in which demand for high-performance cables has surged across the residential, commercial, and industrial sectors. ACL capitalized on this momentum, reinforcing its industry leadership through foresight and continuous innovation.

Key milestones during the year included the launch of the Super PVC Range, engineered with advanced technologies to set new standards in safety and energy efficiency, particularly in the retail market. The Company also expanded its presence across domestic and export markets, strengthening its reputation as a trusted global supplier. Another significant achievement was the successful listing of Cable Solutions, an ACL subsidiary, on the Colombo Stock Exchange in July 2024, marking a new chapter in the Group’s growth story.

The Chairman expressed strong confidence in ACL’s future trajectory. With a clear strategic roadmap and the support of a resurgent national economy, ACL Cables is poised to reach new heights and continue delivering exceptional value to all stakeholders.

29. Dipped Products

In twenty-ninth place in this year’s Business Today TOP 40, Dipped Products PLC (DPL) stands among the world’s leading manufacturers of protective handwear, commanding about five percent of global demand for natural and synthetic latex-based household and industrial gloves. With a portfolio of more than 750 supported, unsupported, and disposable glove variants serving household, industrial, and medical needs, DPL exports to over 70 countries worldwide.

Under the leadership of Mohan Pandithage, Chairman and Pushpika Janadheera, Managing Director, the Company navigated a year defined by volatility and complexity. A sharp decline in Sri Lanka’s natural latex production, coupled with a global supply shortfall, drove raw material prices upward. Meanwhile, the appreciation of the Sri Lankan rupee eroded competitiveness and squeezed margins.

Despite these pressures, DPL delivered a year of noteworthy progress. Strong demand for its specialized industrial products—reinforced by shifting global sourcing patterns amid geopolitical changes—helped sustain momentum. Their strategic emphasis on high-value, specialty gloves enabled strong capacity utilization and operational stability throughout the year.

Looking ahead, the leadership acknowledged that evolving global trade policies, including potential US tariffs, will continue to reshape competitive dynamics. In response, DPL plans to invest strategically, evaluate new geographic opportunities, and strengthen its core manufacturing operations in Sri Lanka and Thailand.

As the Company charts its path forward, its growth strategy remains anchored in global expansion, continuous product innovation, operational excellence, and an unwaver ing commitment to sustainability and long-term resilience.

30. Richard Pieris and Company

Ranked thirtieth in the Business Today TOP 40, Richard Pieris and Company, led by Dr. Sena Yaddehige, Chairman, CEO, and Managing Director, capitalized on the tailwinds of an improving economy, recording stronger consumer demand and robust performance across its diversified portfolio.

The Group reported a Profit Before Tax of seven billion rupees—a remarkable 220 percent increase year-on-year. Dr. Yaddehige noted that each business segment continued to strengthen its footing, supported by declining interest rates, stabilizing borrowing costs, and improved cash flow, all of which contributed meaningfully to overall profitability.

All sectors delivered notable results. The Plantation segment emerged as the Group’s largest profit contributor with an operating profit of 4.8 billion rupees. The Retail division, a core pillar of the Group, reported an operating profit of 1.9 billion rupees. Meanwhile, the Plastic, Furniture, and Electronics sector posted a significant turnaround, generating 1.4 billion rupees—up 133 percent—on revenue of 10.5 billion rupees. The Tyre sector also performed steadily, reporting an operating profit of 727 million rupees on revenue of 5.4 billion rupees.