Giving Lessons in Dexterity and Resilience

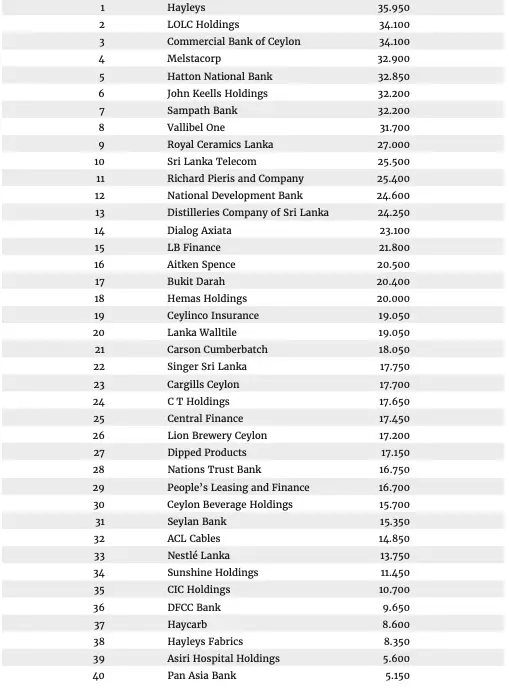

Business Today TOP 40 2021-2022 recognizes the top corporate performers who reported positive financial growth amidst the turbulent situation of the country. Analyzing the diverse portfolios provides a broader picture of profits and risks undertaken by these corporates as they worked with resilience, passion, and dedication while gracefully embracing the challenges.

Words: Jennifer Paldano Goonewardane.

The 40 corporates that have made it to Business Today’s Top 40 ranking have reported positive growth, some posting history-making profits and double-digit growth. In contrast, some others saw their numbers boosted by their subsidiaries making exponential profits. All in all, amid a dynamic operating environment, specific sectors experienced windfalls in business, with rising prices bolstering the value of their products. While 2021 experienced a heady period of COVID-19 variants, business sectors of the 40 corporates show remarkable growth spurred by many industries bouncing back to pre-pandemic level operations with increased demand for their products and services. Businesses like leisure and import-dependent sectors felt the impact of the pandemic and price volatility. However, the corporates managed to circumvent the downsides in some subsidiaries with their profitable businesses.

However, the reality of 2023 and beyond is more than COVID-19 and the pandemic. As observed by many, we are entering a different global order, a global order rife with so many complex dynamics, conflicts, and the cold war era style politics and frosty relationships and bitter rivalries creating crates of uncertainties as we look to the future. But the silver lining is that corporates have always collected their strengths, explored the depths of human capability and resilience, brainstormed, sacrificed, negotiated, and compromised to ensure a win-win outcome for all. Unless otherwise, only if one explores the unexplored terrains in business can the unchartered paths be cleared to pass through.

Then moving forward, the corporates are necessarily considering impending risks as international financial agencies warn of a global recession and its impact on countries, which Sri Lanka will have to navigate through. The IMF is predicting a slowing of global growth by 2.7 percent in 2023, with the agency claiming that there will be two consecutive quarters of negative growth, while the three largest economies, namely the US, China, and the European Union, are slowing down too. The war in Ukraine compounds the situation, causing a severe fallout felt by Europe and spilling over to other regions.

Sri Lanka has to be vigilant of external environmental developments. Many corporates have opined on external factors and their impact on diversified businesses in their reporting years. In the future, the significant risk factors that companies have identified and are trying to mitigate are associated with the existing uncertainties, which are most likely to continue. The companies predict that the significant risks they want to overcome are associated with liquidity, payment delays, defaults, inadequate forex reserves, adverse movements in the exchange rate, and high-interest rates. Added to that are the country’s economic environment risks, which they hope will taper as the government is involved in multilateral debt negotiations with creditor countries and successfully obtains IMF assistance.

The corporates observe the economy rebounding somewhat, more gradually, one could say, easing out of the 2020 pandemic-induced contraction. The disruptions to supply chains were unprecedented in the early stages of the pandemic. Even as Sri Lanka was getting the hang of operating in a challenging environment, it was not spared from the external challenges to supply chains as thepandemic raged to different degrees in different parts of the world. That automatically drove commodity prices impacting Sri Lanka and its domestic commodity prices, which in 2021 ultimately gave way to a rising trend in inflation, speeding up to 12.1 percent by the end of the year.

As corporates celebrate their rankings in the Business Today Top 40, a significant feature is observable in the reporting period. The benefits of the 2019 tax cuts seem to have accrued to the corporates. In the aftermath of the tax cuts, economists said that the tax stimulus would boost corporate profitability besides economic growth. The intended outcome of the tax cuts was to free disposable income and drive money circulation and spur economic growth. That also meant that state revenue got reduced, and the pandemic exploded into that equation, which increased government expenditure and worsened budget shortfalls. The expected outcome of the tax cuts did not materialize as the pandemic pushed many sectors and scenarios helter-skelter and put the government’s development agenda in jeopardy. Sri Lanka already had a tax-poor and pervasive tax-evading regimen where tax contribution to the GDP was a mere two percent.

As was pointed out, notwithstanding the pandemic fallout, the corporates have harvested the benefits of the fiscal stimulus demonstrated in their numbers. At the same time, as the corporates gained from the government-led stimulus of cut-down taxes, whether they passed on its benefits to consumers requires an independent review. Some corporates have contributed considerably to state coffers through taxes, depending on the business segment. And so, among the many criteria considered for the 40 positions, the contribution of the top businesses to the exchequer is taken into account as it is their bounden duty to generate country revenue as responsible corporate citizens.

The 40 corporates extensively highlight the challenges in the operating environment in the reporting period, which is a fair enough lament. It is admirable how each business has harnessed its collective strengths to introduce the best fit that surpasses the external environment’s limitations. Technology has been a game changer for businesses for seamless operations and connectivity. That way, their businesses could keep communication lines open between their networks and suppliers to ensure uninterrupted operations spanning the globe. Moreover, manufacturing businesses continued unabated, even in challenging situations of restricted movement. Such dynamism spilled over to benefit Sri Lankans. They had to experience the limiting circumstances of the first wave in 2020. They witnessed the difference in 2021 with an extensive landscape of possibilities to carry out their daily transactions and other requirements through the connectivity boon.

In their reviews and messages, Sri Lanka’s business leaders appeal for policy stability, consistency, and implementation based on systematic analysis. Fair fiscal policies underscore the sentiments of business leaders. Moreover, they highlight the importance of an enabling environment to attract investors and build investor confidence by establishing the rule of law, discipline, and an equal playing field. At crossroads, now seems to be the time for a concerted effort to introduce structural reforms and imbue fiscal discipline.

That brings us to the critical subject of policymaking and structural reforms. Sri Lanka has been lacking in following policy decisions for a long time. While wanting a steady and committed national policy framework, they have often been done sporadically without long-term vision and focused merely on the short- term, inconsistent or failing to address the pertinent problems. As we live in a new economic landscape, the pressing need is to have appropriate responses from policymakers lest they lose the opportunity to make critical changes and endanger the situation further. Structural, vis-a-vis progressive reforms, are long overdue on several crucial agendas to rein in public sector spending and enhance efficiency and productivity in state institutions. Creating an enabling business environment through a strict trade policy for local and foreign investment, expanding the export sector, and spurring inclusive growth should also be on the agenda.

If Sri Lanka successfully introduces structural reforms for its greater good and long-term prosperity, it will have much work to do on many fronts.

Singapore’s Deputy Prime Minister and Minister of Finance Lawrence Wong, speaking at the Forbes Global CEO Conference, described his country as a “high trust society.” He opined that the small space called Singapore was a nation borne out of nothing but continues to harness the strength of human resources by developing human capital to its fullest potential. Their mantra is simple. Trusting one another, working together, and keeping the faith. Sri Lanka certainly can learn from that.

In Sri Lanka, the country and corporate can do much to raise the bar on trust to increase visibility and credibility. The country has learned a bitter lesson. The government is trying to implement a solid fiscal consolidation plan through revenue and expenditure rationalization measures as a first step. That should go hand in hand with robust, stable, and consistent structural reforms, even if it is a bitter pill to swallow in the short- term. Savvy leadership will push for growth-supportive reforms, not just stop-gap measures. It is time for policymakers to take forceful macroeconomic policy action to support growth, lest Sri Lanka’s recovery remains elusive.

But for now, the top corporates in the Business Today Top 40 list demonstrate hope for the country and the people, that they have the agility to respond to the unexpected and come out, often a bit bruised but wiser to lead the development trajectory into the coming years.

1 Hayleys PLC

What a year it has been for Hayleys. Hayleys Group has recorded spectacular results in the year under review, a first in a history that spans a colonial legacy of 144 years. Emerging yet again in the top slot of the Business Today Top 40, the Group has recorded pre-tax earnings of 35.72 billion rupees, an 86 percent increase over the previous year.

But to emerge with good bottom lines, Hayleys had a leading mantra. Understanding the power of motivated teams, all worked through pandemic-induced obstacles to come out stronger than before. That proved the Company’s greatest strength, as a tried and tested team went into 2021/2022 with a will to win.

To the 35.72 billion rupees, PBT transportation and logistics contributed 30 percent, while consumer, retail, and hand protection contributed 16 percent and 14 percent, respectively. All sectors recorded increased PBT except for the leisure sector. Textiles, transportation and logistics, and eco solutions recorded increases of 337 percent, 238 percent, and 132 percent, respectively. The remarkable results are a testament to prudent leadership and strategizing that successfully harnessed the strengths across its multiple verticals to navigate a challenging year.

Hayleys PLC is a pivotal contributor to the country’s socioeconomic progress, which is noteworthy when Sri Lanka is at its nadir in forex reserves. Foreign exchange earnings during 2021/2022 increased by 45 percent to US$ 615.98 million, 4.2 percent of the country’s total exports during the same period. Additionally, the Group received dividends of US$ 6.24 million from its overseas subsidiaries during the year, boosting foreign exchange inflows to the country.

The Group’s outlook for the country is fluid. However, the Group is resorting to strategizing and planning the conditions for necessary growth in all its business sectors. At the same time, the Group’s plans within each business sector are primarily aligned with the country’s needs to drive export growth. The Group is buoyant and confident despite the headwinds. Its robust governance mechanisms are crucial to navigating the challenges ahead, and the past three years have helped it to sharpen its collective skills.

2 LOLC Holdings PLC

In second place in the Business Today Top 40 rankings, LOLC Holdings PLC’s clear-cut vision and strong management team were the key pillars of success in 2021/2022. A committed staff, loyal customers, and global and international funding partners supported the Group’s growth. LOLC’s diversification from being primarily a financial services organization to manufacturing, leisure, construction, trading, agriculture and plantations, renewable energy, and critical investments in cutting- edge technology (such as graphene and rice fortification) and the geographic diversification to 20 countries provided a hedge against any challenges.

LOLC Group emerged as the most profitable corporate entity in Sri Lanka in 2021/2022 amid the challenging business conditions that prevailed in Sri Lanka and globally. The Group describes its performance as outstanding, recording a PBT of 83.6 billion rupees and a PAT of 77.6 billion rupees, making this the highest profit ever earned by a listed company in Sri Lanka. The Group’s financial services sector reported a PBT of 46.2 billion rupees, accounting for 55 percent of the Group’s total PBT.

Giving wing to its global ambitions in the financial services sector, LOLC is consolidating its position in the MSME space with its overseas operations.

While the LOLC Group remains rooted in Sri Lanka, it is now a global conglomerate helping it to mitigate risk through geographic and sector diversification. The Group considers its international expansion as the reason for maintaining its status as the most profitable entity in Sri Lanka for the fourth consecutive time. In generating higher value from newly acquired businesses, the Group adopts aggressive business restructuring, centralizing shared services at all levels and creating strong business models.

The Group is moving on a positive trajectory into the future, asserting to continue consolidating its global presence. The management opines that the reason for LOLC’s stakeholder value creation year after year is its steadfast evaluation of economic trends and tailoring its business to suit emerging developments.

3 Commercial Bank of Ceylon PLC

On a mission to uplift the national economy by playing a significant role in the post-pandemic recovery process, Commercial Bank of Ceylon PLC is ranked three in the BusinessToday Top 40.

With an emphasis on controlling operational expenses and preventing any possible deterioration in its cost-to- income ratio and profitability, the Commercial Bank ended 2021 with solid growth by aligning its business with its strategic pillars of prudent growth and operational excellence. The PBT of the Group swelled by 34.4 percent to 32 billion rupees in 2021 from 24 billion rupees in the previous reporting period.

The Bank heeded government calls to offer moratoriums to businesses. It restructured 25 percent of the total portfolio of advances through proactive communication and close staff monitoring. The Bank successfully maintained a low non-performing loan ratio of 1.44 percent, reflecting the high asset quality possessed by the Bank and the success of the initiatives implemented to support customers’ navigating through a complex operating context.

4 Melstacorp PLC

Veteran entrepreneur Harry Jayawardena’s Melstacorp PLC has emerged in fourth place in the Business Today Top 40 rankings. His diversified conglomerate encompasses beverages, plantations, insurance, telecommunications, Aitken Spence, automobile servicing, power generation, BPO solutions, business solutions, leisure, IT, cement packing, dyeing and printing fabric, media buying and creative services, hospitals, laboratory services, pharmaceuticals.

Mr. Jayawardena attributes the improved performance to the contribution of all sectors and critical segments of his diversified conglomerate.

Melstacorp PLC recorded an increase in the Group PBT of 26,863 million rupees in 2021/2022 compared to 9,390 million rupees in the previous financial year. Its diversified sector subsidiary Aitken Spence PLC which recorded an all- time high net profit of 12.2 billion rupees, and DCSL, which recorded eight billion rupees in net profit, contributed to the performance. Its financial sector subsidiary Continental Insurance also made a notable contribution, which surpassed the one billion rupees threshold in PBT.

The Group’s plantation subsidiaries increased production marginally and recorded an enhanced revenue of 7.1 billion rupees compared to 6.4 billion rupees the previous year. The maritime and freight logistics sector recorded its highest pre-tax earnings of 4.9 billion rupees, supported by a growing presence across the entire value chain. The tourism sector recovered from the lockdowns and uncertainties of the first three quarters to deliver a solid fourth quarter, enabling this geographically diverse sector to record 2.5 billion rupees in pre-tax earnings. The Group rapidly expanded its reach and footprint in the healthcare sector by providing healthcare services. Melsta Hospital Ragama delivered a turnaround in its performance to record a profit by overcoming various challenges.

The Group will pursue a strategy of divesting loss-making companies and overcoming challenges posed by the external environment as it moves ahead.

5 Hatton National Bank PLC

In what has been termed a fragile recovery, the Hatton National Bank recorded a PBT of 19.8 billion rupees in 2021, a 31.5 percent increase from the PBT reported in 2020. Emerging in fifth place in the Business Today Top 40 rankings, the Bank’s impressive performance in 2021 is a feather in the cap for Managing Director and CEO Jonathan Alles. They had focused on protecting the interests of shareholders, supporting customers, and showing solidarity with communities while ensuring the well-being of their employees.

The reporting year experienced rising COVID infections and variants and intermittent lockdowns. The Bank took stock of the impact of such uncertainties on its clients, encompassing all segments of society. Consequently, allocating resources to respond effectively to competitive threats, regulatory measures, and stakeholder concerns became a priority that will remain a significant focus in the immediate term.

While its near-term plans get underway, HNB rose to the occasion in the 2021 reporting year as the government called upon financial institutions to help their diverse customers to navigate a challenging environment. HNB was quick to provide cash flow support, lower the cost of lending, offer new types of lending to marginal borrowers, and help customers do their banking digitally.

For HNB, the imperative future course impinges on looking ahead positively and capitalizing on opportunities while aligning its plans with the country’s economic growth.

Hence, the Bank is strengthening its efforts to encourage Sri Lankans living overseas to place funds with it. The Bank has continued to support impacted clients with debt moratoria and working capital funding while managing the impact on revenues and its balance sheet. The revival of business post-moratorium has been a critical concern. It has reduced the affected portfolio considerably to nine percent of the total portfolio from over 40 percent at the beginning of the pandemic.

Predicting a boom, HNB will continue its strong engagement in retail banking, leveraging its knowledge, reach, and strong customer value proposition, to drive growth. The Bank will continue to expand SMEs and microfinance portfolios making significant value propositions. The Wholesale Banking Group will continue to support priority sectors of the economy as it continues its commitment to playing a pivotal role in the country’s economic resurgence. Its focus on always being future-ready will see the Bank supporting onboarding clients and enabling growth in digital transactions as it enhances capabilities, solutions, and platforms to provide a more significant experience to customers.

6 John Keells Holdings PLC

John Keells Holdings PLC, with business interests in transportation, consumer goods, IT, retail, leisure, property, and financial services, is in sixth place in the Business Today Top 40 rankings.

With an investment philosophy based on a positive outlook, bold approach, commitment to delivery, and flexibility to change, JKH reported remarkable performance for the 2021/2022 reporting period. Group revenue increased by 71 percent to 218.07 billion rupees, while recurring Group EBITDA increased by 152 percent to 39.26 billion rupees, displaying the strong recovery momentum of the businesses. The recurring Group PBT increased by 599 percent to 24.43 billion rupees. According to the Group, the turnaround in the Group’s leisure businesses, the revenue recognition at ‘Cinnamon Life,’ and improved performance across all other business verticals drove significant profit growth.

The Group’s port business recorded an increase in profitability driven by volume growth and additional revenues. Its bunkering business recorded increased profitability driven by higher margins because of global fuel prices and volumes.

The retail industry recorded a promising performance, with same-store sales growth driving profitability in the supermarket business. In contrast, the office automation business recorded a substantial increase in mobile phone volumes, although the depreciation of the rupees impacted the PBT.

The consumer foods business continued its strong recovery momentum, with all segments recording double-digit growth in volumes reaching pre-pandemic levels.

The Group reports that its plantation services sector recorded a decline in profitability primarily due to lower volumes driven by the prolonged fertilizer shortage following the import ban on agrochemicals.

JKH’s businesses witnessed a strong recovery during the year, with performance reaching pre-pandemic levels faster than anticipated. The Group continues to operate on solid fundamentals stressing the need for good governance in the corporates and the nation. That discipline, JKH believes, should go hand in hand with transparency, accountability, ethical conduct, and respect for the rule of law while embracing diversity, inclusivity, and social responsibility. As a responsible corporate with a heritage of operating in Sri Lanka for over 150 years, JKH vows to continue to play its role and contribute towards enabling the economy’s recovery at this pivotal juncture, leveraging on the ‘Strength of Fundamentals.’

7 Sampath Bank

Led by Managing Director Nanda Fernando, Sampath Bank is seventh in the Business Today Top 40 rankings, having reported a PBT of 16.8 billion rupees in 2021, up by 50.7 percent against 11.2 billion in 2020.

The Bank’s based its growth strategies for 2021 on seizing opportunities presented by the low-interest rate environment, with particular emphasis on driving credit growth across the SME sector and in green financing. It responded to the heightened demand for working capital from SMEs keen to restart their operations after the COVID-induced hiatus in economic activity. Its green lending activities gained further momentum in 2021 with government stimulus to increase the proportion of renewable energy.

The Bank focused on strengthening its risk fundamentals in an unpredictable operating environment while continuously monitoring the credit risks of its loan portfolio. The Bank’s cost reduction strategies delivered results, as demonstrated by the improvement of 820 basis points in the cost-to-income ratio from 43.5 percent in 2020 to 35.3 percent in 2021.

Sampath Bank’s trade-related operations gathered momentum in 2021, prioritizing the needs of the import sector, especially importers of foods and pharmaceuticals. The Bank also exploited the recovery in export demand in mid-2021, catering to the working capital and CAPEX requirements of export industries through tailor-made pre-shipment financing solutions. Meanwhile, the Bank augmented its fee-based income, supported in particular by the broad-based diversification of its digital channel architecture.

The management asserts that driven by a vision of being an inclusive, accessible, and modern financial services model, the Bank is well-positioned to support the country and customers during uncertain times. Of significance is that the Bank went ahead with its Transformation 2020 (TT2020) agenda – the strategic blueprint for transforming its business and unlocking a new era of growth for the Bank.

Based on past lessons, Sampath Bank navigated the year successfully and will apply them in deploying operational strategies to facilitate more convenient and safer access to financial services. It will use enhanced efficiency and productivity to build a sustainable and resilient business model, able to withstand external shocks with minimum consequences.

8 Vallibel One PLC

With 55 subsidiaries in its portfolio, Dhammika Perera-led Vallibel One has emerged eighth in the Business Today Top 40 rankings.

As the Group’s lifestyle and finance sector contributed 76 percent of the revenue in 2021/2022, the Group’s PBT reached 27,849 million rupees, recording a commendable 24 percent increase.

The Group’s lifestyle sector, with a PBT of 13 billion rupees, has a prominent market presence, with the tile segment accounting for 71 percent of the market share and the bath ware segment holding 39 percent.

The Group’s finance sector recorded a PBT of 11.7 billion rupees for the year against a challenging environment due to the run-on effect from continuous moratoriums that had been in effect since 2019. However, a lower interest rate environment at the year’s commencement supported margins, while gold loans remained among the highest-performing segments. The Group undertook prudent policy management and a short to medium-term approach to strategy development to generate profitability within a limited growth environment and meet stakeholder needs consistently.

The aluminum sector reported a PBT of 0.5 billion rupees, impacted by fluctuations on a global and local scale.

The Group’s plantation sector relied on solid policies and strategies, enabling it to overcome constraints and record a PBT of 0.06 billion rupees.

The Group’s leisure sector has faced considerable challenges year-on-year, further exacerbated in 2021 by the third wave of the COVID-19 pandemic that hindered the industry’s anticipated recovery. Nevertheless, the sector recorded a PBT of .007 billion rupees in the year under review.

The segments within the consumer sector felt the implications of COVID-19, which recorded a PBT of 0.3 billion rupees.

The investment and other sectors comprise the long and short-term investments of the Group, in addition to its packaging, mining, insurance brokering, travel, and transport segments that recorded a PBT of 6.4 billion rupees which were all impacted by external factors in the macroeconomic environment.

According to Dhammika Perera, the Group’s companies responding swiftly to the ever-changing environment allowed it to weather the storms of the reporting year. They relied on their inherently dynamic, agile structures to realign operations to maximize value and minimize risk. The Group’s enhanced risk management

processes and holistic perspective enabled it to anticipate and respond to change while making prudent investment decisions regarding capacity and process development, product innovation, brand building, employee health and safety, and quality control. Group-wide efforts to improve cost structures through product rationalization, responsible consumption and process efficiencies improved profitability while enabling sustainable returns.

9 Royal Ceramics Lanka PLC

Royal Ceramics Lanka PLC sustained its growth momentum delivering topline growth of 28 percent to record 57.5 billion rupees and profit growth of 63 percent, amounting to 13.7 billion rupees. In ninth place in the Business Today Top 40 rankings, Royal Ceramics Lanka PLC, another diversified company led by Dhammika Perera and a management team led by Managing Director Aravinda Perera is celebrating a notable performance for 2021/2022, the highest in its entire history for the second consecutive year.

All sectors of the Group contributed positively to the bottom line while recording profit growth. Consistent investment in expansion combined with productivity andsustainability initiatives enabled lean cost profiles, shorter lead times, and focused improvements in quality which were critical to realize our strategic goals.

According to Dhammika Perera, the Group’s key business – the manufacture of tiles and bath ware has saved the country over US$ 8.5 million in foreign exchange as estimated by the dollar value sold by the Group.

In moving with its plans, the Group evaluated its strategic goals. Developing export markets will prioritize aligning with the country’s needs. The successful foray into exports by Lanka Tiles and bath ware paves the way for other Group companies to follow, leveraging networks and learning to drive success.

Dhammika Perera says that the collective wisdom of the Board and the Group’s senior leadership made it possible to stretch its strategies to seize opportunities and introduce additional safeguards to sustain the diverse businesses. The management will continue to monitor the operating environment as risk levels remain elevated due to the country’s situation.

10 Sri Lanka Telecom PLC

Ranked 10th in the Business Today Top 40, asset-rich Sri Lanka Telecom Group, led by Chairman Rohan Fernando and Group CEO Lalith Seneviratne, delivered a remarkable performance in 2021. Under their stewardship, the Group recorded a growth of 32 percent with a Group PBT of 12.9 billion rupees compared to the 9.7 billion rupees reported previously. The Group recorded a topline growth of 12.3 percent, with 102.3 billion rupees in revenue boosted by 16 percent growth in fixed telephony operations.

Similarly, the Company delivered a strong performance during 2021, recording revenue growth of 16.0 percent to 59.81 billion rupees and PBT of 5.0 billion rupees, a 12 percent growth. Its ability to swiftly cater to the unprecedented demand for connectivity and speed surge, as reflected by the strong growth in broadband and data services, led to its stellar performance.

Sri Lanka Telecom upheld the country’s trust by providing uninterrupted service and supporting the migration of thousands of businesses and people to digital platforms in 2021.

Moreover, a commitment to drive growth without corruption and waste in an inclusive manner supported the SLT Group to overcome significant challenges in 2021 and increase the efficiency of its operations. Key to its performance was foreseeing the evolution of technology before it transformed and being future- ready in terms of infrastructure development for modern technology.

As SLT transforms itself into a technology company to broaden the customer value propositions for different customer segments, its commitment to invest in technology expansion remains robust. Priority will see an increase in the 4G network beyond 40 percent and the activation of 5G in 2022. Developing its fiber network and investment in the SEA-ME-WE 6, the undersea cable project, is vital to improving global connectivity.

11 Richard Pieris and Company PLC

With core business in retail, tyre, plastics, furniture and electronics, rubber, plantation, financial services, and other sectors, Richard Pieris and Company is ranked 11th in the Business Today Top 40.

The Group posted revenue of 68 billion rupees, followed by a PBT of 10 billion rupees for 2021/2022. The substantial revenue and profit outcomes are significant, as they are the highest-ever recorded figures in the Group’s operational history. Furthermore, the management reports that most of the business sectors within the Group remained resilient during the reporting period.

The plantation sector was the highest contributor to the Group’s operating profit through product diversification and value-addition, which drove growth despite the challenges during the year. The management attributes the record results to its focused attention on core business and the selective expansion of strategic business ventures. Moreover, the Group’s simultaneous attention to effective cost management also strengthened performance, underscored by agility and the ability to adapt to a rapidly changing local and global environment.

The Group proudly claims to be a key stakeholder in fueling the economy. It exports to more than 40 countries as a direct and indirect exporter. And its focus on penetrating newer markets abroad will further the country’s interests. The Group will continue consolidating its existing ones, thereby heeding and contributing to the government’s call to expand its reach to increase forex earnings for the country.

12 National Development Bank PLC

The National Development Bank PLC, led by its then Chairman Eshana de Silva and Chief Executive Dimantha Seneviratne, navigated 2021 to accelerate solutions and sharpen competitive strengths.

The Group recorded an operating profit before tax of 10,308 million rupees in 2021, a 12 percent increase from the 9,206 million rupees reported in the previous year. The Group targeted lending to priority sectors of the economy, including exports, local manufacturing, and agriculture.

Under an altered landscape, NDB accelerated digitalization to drive better customer service, reduce complexity and optimize the operating model, pioneering several digital solutions.

The management hopes that the resumption of economic activity, with policy thrust towards developing exporters and the gradual recovery of tourism activities, provide reasons for optimism that the country will successfully overcome the inevitable stresses that will arise in the short term.

As a socio-economically impactful Bank, NDB is determined to support the country’s recovery through developing exporters, supporting customers following the expiry ofmoratoria, and directing lending toward critical sectors of the economy. Key focus areas include driving its remittance inflows through partnerships offering a holistic value proposition to exporters through ecosystem partnerships, market access, and advisory services, and increasing focus on renewable energy, in line with the country’s aspirations to reduce dependence on fossil-fuel- based power. In this regard, the Bank considers its engagement with the Development Finance Corporation, USA, for a US$ 75 million funding will auger well for its future aspirations, especially in making inclusive propositions by deploying such funds to uplift SMEs and women-led businesses.

13 Distilleries Company of Sri Lanka PLC

The 2021/2022 financial year has proven to be one of high spirits and celebration for the Distilleries Company of Sri Lanka, recording a turnover of 107 billion rupees with significant gains in profit compared to the last reporting year. With acentury-old legacy, DCSL, under the stewardship of Harry Jayawardena, continues to add a hefty sum to the state coffers by way of the nature of its business.

With a diverse product portfolio to fulfill the various requirements of different social segments, the DCSL, which has emerged 13th in the Business Today Top 40 rankings, states that customers are its priority. It continues to research, innovate and add value to its products, ensuring that when customers buy the DCSL brand, they receive products of the highest quality, manufactured to the highest international standards. The company prides itself on a consistent policy ofuncompromising quality that has built unwavering trust in its products.

In its attempt to drive excellence and quality in its business, the Group is vocal about tackling the illegal trade in alcohol and lobbying for price reductions in locally produced ethanol. Overcoming hurdles to the trade is vital for the Group as it will help boost sales of legally produced taxpaid alcohol products. A healthy operating environment, the Group believes, will help tackle the illicit industry thriving in an unaffordable price regime. The company is conscious of the impact of such trends on its sales and the greater danger it poses to health, society, and the economy, especially its effects on state revenue, calling upon the government to take remedial action to reverse the industry downslide.

14 Dialog Axiata PLC

Dialog Axiata PLC’s key businesses, mobile, tele- infrastructure, and digital services performed remarkably and contributed to 64 percent of the Group revenue in 2021.

While the consolidated Group revenue for 2021 was 141.9 billion rupees, on the back of rigorous cost management initiatives and the utilization of a range of strategic and operational levers, the Group EBITDA was recorded at 58.8 billion rupees for the period, a growth of 16 percent. Revenue of the mobile segment grew by 10 percent, earning 90.9 billion rupees for 2021, driven by growth in both data and voice segments, while recording an EBITDA of 40.5 billion rupees representing an increase of 7 percent. The fixed broadband business witnessed strong revenue growth of 44.8 billion rupees, up by 39 percent, led by the company’s efforts to deliver affordable and accessible internet services to Sri Lankan homes and businesses. Dialog Television continued to strengthen its market leadership position in the digital pay television space with a growth of 22 percent to reach 10.6 billion rupees in the financial year. On the back of relatively modest exchange rate depreciation and efficient cost control initiatives carried out during the year, DTV EBITDA recorded a growth of 49 percent at 3.7 billion rupees for 2021.

The pandemic drove digital transformation and altered the digital landscape for good. In 2021, as the pandemic took many unexpected turns of surging infections and variants, the Dialog team led by Group CEO Supun Weerasinghe continued to provide creative and innovative solutions for Sri Lankans. As Digital adoption continues to accelerate, Dialog continues installing new technologies and solutions to improve customer experience and significantly deliver a leap in efficiency. In the year under review, the leadership accelerated the digital transformation agenda to empower its teams to serve customers faster while improving operational efficiency.

Among the other highlights is Dialog’s investment of approximately 31.7 billion rupees in 2021 to develop connectivity infrastructure in the country and ensure that customers continue to get quality and consistent services. As a result, the Group continued to be the largest FDI in the country, with a total investment of USD 3.0billion since its inception.

In fulfilling its mission to accelerate the pace of digital inclusion across the length and breadth of Sri Lanka, including expanding coverage to deep rural communities, Dialog invested in connectivity infrastructure, focusing on 4G upgrades and coverage expansion. The company plans its 5G footprint no sooner than the TRCSL allocates the 5G spectrum for commercial use.

15 LB Finance PLC

With a 15th position ranking, LB Finance PLC claims that solid governance and stewardship have remained critical success factors throughout its journey, demonstrated through its results for 2021/2022. The PBT for the reporting year shows an increase of 27.98 percent, 11,910 million rupees, compared to the 9,306 rupees in the previous reporting year.

The management observed that the double-digit growth across all its significant portfolios resulted from adopting multiple strategies combining both market penetration and market development approaches. The collective increase in LBF’s lending activities saw its asset base cross the 164.36 billion rupees mark.

Stringent yield management to bolster net interest margins helped its asset base grow. The company also tightened recoveries to drive a sizable reduction in NPLs, augmenting its bottom and further reinforcing its balance sheet.

A strict policy to maintain healthy capital and liquidity ratios was crucial to maintaining a solid balance sheet. The management ensured that LBF remained well capitalized and sufficiently liquid throughout the year, with strict control exercised to ensure its deposit mobilization activities matched its funding requirements.

As it moves ahead following a successful operating year, LBF focuses more on managing short-term downside risks. Looking beyond, LBF will be vigilant of evolving conditions, using astute leadership to navigate circumstances to ensure its long- term growth prospects are intact.

16 Aitken Spence PLC

Following a strategy to invest in priority sectors that generate foreign exchange for the country, Aitken Spence PLC has successfully overturned what was a not-so- favorable previous financial year into a record-making 2021/2022 financial year. From a pre-tax loss of 2.8 billion rupees in 2020/2021, the company recorded pre-tax earnings of 14.2 billion rupees for 2021/2022, the highest profit in the Group’s history.

With a vast footprint in 16 segments that include tourism, maritime and freight logistics, power generation, apparel, printing and packaging, and other services, Chairman Harry Jayawardene asserts that the key to delivering such formidable results was the sectoral and geographic diversity of the Group. Their businesses are spread across eight countries, allowing their teams to identify opportunities, optimize resource allocation, and leverage group synergies to navigate the reporting year. Globally, when the pandemic-induced challenges to the maritime and freight logistics industry had been a talking point, the Group’s maritime and freight logistics sector recorded its highest pre-tax earnings of 4.9 billion rupees. That result is attributable to the transformational business operations that ensured its broad presence across the entire value chain resulting in a combined effort to make it successfully sail through.

The larger-than-life tycoon of Sri Lanka’s business landscape, Jayewardene, in his usual remarkable and tenacious demeanor, speaks of a code that guided their work in a challenging year. Their approach, he proclaims, is “if we do not risk anything, we risk even more,” which guided the Group to make bold decisions to move early and seize the available opportunities.

The progressive that he is, he looks forward to a “Sri Lankan movement” of progress, where competent individuals will occupy decision-making slots in the country. The Group has shown that it has the recipe for good performance, progress, and resilience of institutions, by emerging 16th in the Business Today Top 40.

As the Group looks to partner in the country’s economic revival, it will focus on broadening its sectoral and geographical spread while steering operations in a tight fiscal policy environment. The company plans to move ahead cautiously as a responsible conglomerate, ensuring that its plans are thought through for their impact on the country, its actions warranting the country’s greater good and its recovery. In that sense, the Group’s investments that derive or are pegged to foreign currency hold in good stead, especially as it looks to continue its strategic push to invest in projects that derive forex revenue from helping boost the country’s reserves.

17 Bukit Darah PLC

With businesses in Sri Lanka, Indonesia, Malaysia, Singapore, India, and Mauritius in beverage, plantations, oils, fats, leisure, portfolio and asset management, real estate, management services, and investment holdings, Bukit Darah PLC has emerged in 17th position in the Business Today Top 40. Although the 2021/2022 financial year was challenging for business expansion, the Group recorded a PBT of 22.3 billion rupees compared to 14.3 billion rupees in 2020/2021. The Group reports that its revenue and profitimproved by 49 percent and 54 percent over the corresponding financial year, as a significant part of its investments is outside Sri Lanka. The agriculture commodity supercycle positively impacted its oil palm plantations and oils and fats sectors.

The global crude palm oil prices surged. So did the global demand for chocolate, ice cream, confectionery, and bakery products that had recovered from pandemic levels,resulting in a windfall revenue from the oil palm segment emerging as the highest contributor to Group revenue, with a contribution of 38 percent amounting to 65.4 billion rupees for the year.

The Group reports that the performance of these two sectors and the beverage sector’s export business expansion shielded the Group to some extent from the following rupee depreciation. The beverage segment emerged as the second highest contributor to Group revenue with a contribution of 35 percent, an increase of 18 percent to reach 60.4 billion rupees spurred by its robust movement in the export market.

As was the trend in a challenging year of operations, the Group’s leisure sector continued to be heavily affected by the repercussions of the pandemic, with intermittent lockdowns leading to subdue tourist arrivals.

The management is hopeful that broad-based policy action and structural reforms in Sri Lanka will address the ongoing macroeconomic concerns and drive the economy toward growth in the long run.

18 Hemas Holdings PLC

Hemas Holdings PLC ranked 18th in the Business Today Top 40, executed its strategic initiatives effectively while adapting its portfolio to changing market conditions despite a challenging reporting period.

Spurred on by its purpose of creating opportunities for healthful living, each business focused on core businesses and new within the core, internationalization, adjacencies, and efficiency and productivity to unlock growth and value.

According to the Group, during the year under review, the consumer brands sector endeavored to build purpose-led solid brands while concentrating on a value proposition to increase market share. The Group’s healthcare sector ensured its market leadership position in the pharmaceutical distribution business Pharmaceuticals manufacturing scaled up its operations to become a leader in the private market branded generics segment. Expansion in specialties was a strategic priority for Hemas hospitals. The mobility sector continued to aim for operational excellence and internal value capturing. Prioritizing internationalization saw the Group laying a solid platform to accelerate its international footprint while increasing its focus on exports.

For Hemas Holdings, the 2021/2022 financial year produced strong results, notwithstanding the challenges. The Group’s solid performance demonstrates its indomitable spirit and the payoff of a focused strategy during the pandemic and after.

Group revenue at 78.8 billion rupees reflected a 22.2 percent improvement from the 64.5 billion rupees recorded in the previous year with a PBT of 6,648 million rupees in the reporting period compared to the 5,670 million rupees during the last financial year. The Group’s performance on the profit front was mixed. Improvements across all revenue streams saw the cumulativerevenue of the hospital segment increase by double-digit compared to the previous year and an overall increase in profitability.

While hospitals delivered solid bottom-line results supported by higher footfall and increased occupancy, the consumer brands sector came under margin pressure due to the high cost of imported raw materials.

The Group maintains a strong balance sheet because of its prudent management of a low gearing ratio and strong operating cash flows throughout the past year.

The near-term outlook indicates that the Group’s operating environment will continue under pressure.

Amid this backdrop, Hemas Holdings, guided by its purpose and underpinned by financial stability, will focus on strengthening its leading position in all core markets while being agile to respond to the external environment.

19 Ceylinco Insurance PLC

Ceylinco Insurance PLC has had two good years of performance, with the 2021 financial year recording impressive profits. Ironically, the insurance industry has emerged as a succor to relieve businesses and people of unprecedented and unpredictable times.

Of course, this did not make the insurance industry foolproof as the general insurance industry felt the impact of lockdowns and mobility restrictions, business interruptions, affecting people’s affordability, thereby impacting the industry. Despite the ban on vehicle imports and its effect on motor insurance, with the sagacious leadership of Executive Chairman and Chief Operating Officer Ajith R Gunawardena, Ceylinco Insurance read the economic headwinds to adjust its sails accordingly.

As a pioneering entity in multiple sectors covering general and life Insurance, hydropower, education, and healthcare, Ceylinco Insurance has emerged in 19th position in the Business Today Top 40 rankings. Ceylinco Insurance PLC achieved a PBT of 12.6 billion rupees, recording a six percent growth. Meanwhile, total Group turnover reached 60.6 billion rupees to mark an increase of 4.7 billion rupees, with a gain of 8.4 percent compared with 2020. The team at the Group led by Chief Executive Ajith R Gunawardena is a testament to rising above circumstances to carry out seamless operations to achieve impressive growth in the period under review.

Meanwhile, in the insurance sector, PBT was 1.7 billion rupees. Ceylinco Life Insurance recorded a premium income of 25.5 billion rupees, with a growth of 15.8 percent yearly. The power and energy sector of the Group, comprising hydropower plants and solar power projects, recorded a total revenue of 1,029 million rupees. With the increasing demand for renewable energy growing, the future of the power sector lookspromising and encouraging. The total income of the education sector companies stands at 3.2 billion rupees. The two prime institutions in the higher education sector in Sri Lanka, ICBT and ANC, were proactive, providing online facilities for students at the very outset. They continued their admirable efforts during the pandemic using efficient online tools to attract new students. Both ICBT and ANC command market leadership, amounting to well above 50 percent of the higher education market in Sri Lanka. Together, their subsidiaries have a student base of over 15,000.

The Group achieved exceptional growth amidst the volatile 2021 and remains optimistic as the strategic sectors in which it operates will continue to see rising demand.

20 Lanka Walltile PLC

In 20th position in the Business Today Top 40 rankings, 2021 for Lanka Walltiles was a year of recovery as global output increased to 5.8 percent, albeit from a lower base after the contraction of 3.1 percent in 2020. Demand increased despite the impact of a prolonged pandemic, creating growth opportunities.

As the previous year, the Group’s tiles sector’s mandate was to meet domestic demand and increase value addition while maximizing capacity utilization and driving production efficiencies. The Group achieved it through product portfolio consolidation with fewer changes in production runs and the introduction of mosaic tiles to the market. Its packaging business had to cope with soaring raw material prices and foreign currency liquidity by increasing the value addition to customers, maximizing production efficiencies, and passing on price increases in raw materials. Plantations benefited from optimistic tea, rubber, and palm oil prices, although the ban on agrochemicals and fertilizer resulted in lower yields. The aluminium sector’s value addition and recycling strategies supported top-line growth and margin growth.

The Group’s tiles and associated products reported a PBT of 7,397 million rupees, packaging a PBT of 713 million rupees, aluminium a PBT of 551 million rupees, and plantations a PBT of 67 million rupees.

Lanka Walltiles Group increased revenue by 35 percent to 39.85 billion rupees primarily due to revenue growth of the aluminium and packaging sectors which recorded revenue growth of 88 percent and 53 percent, respectively. The tiles sector supported that growth by accounting for 60 percent of revenue and recorded a 23 percent increase. Notably, exports increased 36 percent during the year to 1,412 million rupees compared to 1,035 million rupees in the previous year.

21 Carson Cumberbatch PLC

At number 21 is Carson Cumberbatch PLC. The Group operates plantations, oils and fats, beverage, leisure, real estate, portfolio, and asset management and management services spread across Sri Lanka, Indonesia, Malaysia, Singapore, India, and Mauritius. The Group had a mixed bag of results across its business sectors. The Group recorded a profit before tax of 22.4 billion rupees for 2021/2022, a 56 percent growth compared to the previous financial year. The palm oil, oil, fats, and beverage sectors emerged as the best revenue-generating businesses in volatile operations.

The oil palm plantations sector benefited from the uptick in global Crude Palm Oil (CPO) prices, recording ten-year high achievements in CPO production to accomplish operational efficiencies even amid an inflationary environment, successfully garnering a revenue of 65.4 billion rupees. Moreover, as the new normal set in, so did manufacturing and production, with global demand for confectionery and bakery products recovering from pandemic levels. Hence, the sector had to increase production to meet the heightened demand making a windfall in profit after tax and an impressive revenue of 43.1 billion rupees.

Domestic constraints had prevented revenue expansions in the beverage sector in Sri Lanka. However, the beverage segment contributed 22 percent of the Group’s operating profit in 2021/2022, indicating an increase of 1.4 billion rupees over the comparable period. The 46 percent expansion to a thriving export trade brought in a revenue of 60.4 billion rupees, aided by the appreciation of the US dollar against the rupee.

Multiple factors impacted the leisure sector as the Group could not make good of its hotel portfolio as infections, lockdowns, and low tourist arrivals resulted in subdued operations.

The Group is vigilant in its forward march, especially the shocks likely from the domestic front. In the short term, the Group is confident that political and economic stability will help its businesses navigate the potential impacts of high inflation, lower disposable incomes, supply chain roadblocks, and heightened uncertainty.

22 Singer Sri Lanka PLC

Singer Sri Lanka PLC is ranked 22nd in the Business Today Top 40. The Group successfully delivered a year of record growth and profitability. Notwithstanding the impact of the economic crisis on the consumer durables industry, the Group and the Company recorded impressive results. The Group PBT for 2021/2022 was 5,536 million rupees, up by 45 percent from 3,818 million rupees the previous year. Meanwhile, the Company PBT for 2021/2022 was 5,044 million rupees, a stupendous 91.9 percent growth from the last period’s 2,629million rupees. According to the management, the positive growth trajectory in the reporting year, when its operations continued unabated amid many disruptions and difficulties, is attributable to the Group’s ability to prevail in the face of extraordinary pressure. Conducting smooth operations was challenging, with supply chain disruptions occurring in the year’s second half. The Group responded by adopting proactive measures to ensure product availability across the network through inventory optimization, continuous engagement with suppliers, and strengthening the effectiveness of distribution and logistics.

23 Cargills Ceylon PLC

In an impactful 2021/2022 financial year amid pandemic- driven lockdowns, Cargills Ceylon PLC has emerged in the 23rd position in the Business Today Top 40 rankings.

With a PBT of 5.8 billion rupees, the Group’s FMCG business emerged as the primary contributor to its bottom line with a revenue of 37.8 billion rupees, an increase of 26 percent to the previous reporting period.

The Group reported accelerated consumer spending in September 2021, continuing until the end of the financial year. Operations in the Group’s restaurant and real estate sector had their unique dynamics. Its fast-food franchise KFC recorded a strong recovery compared to the TGIF restaurant, as dine-ins were somewhat subdued and hampered due to lockdowns and a rise in COVID infections. Compared with the previous financial year, the Group’s restaurant business revenue grew by 72 percent, recording 5.9 billion rupees in revenue for the current financial year.

Cognizant of its role in supporting the economy’s recovery, Cargills also confronts the challenge of rising costs which makes regular price revision an inevitability. However, it is exploring avenues to reduce the transfer of rising costs onto the consumer, improving productivity, and reducing wastage, which is crucial in the short term. As the market experiences sharp increases in imported consumables, the Group is exploring transitioning to cheaper substitutes and alternative foods locally, primarily through a concerted effort to spur growth in locally sourced raw materials and produce. This Cargills views as a step in the right direction and a long-term strategy towards navigating the country towards achieving food security.

24 C T Holdings PLC

In 24th place in the Business Today Top 40 ranking, C T Holdings PLC is a diversified Group operating in retail and wholesale distribution, FMCG, restaurants, real estate, entertainment, and banking and financial services.

The Group’s businesses delivered strong results during the reporting period of 2021/2022 by posting revenue of 136.9 billion rupees, a growth of 21 percent, and a PBT of 5.5 billion rupees, a 26 percent growth. The retail and wholesale distribution and FMCG segments contributed 95 percent of Group revenue.

As a fillip to the government’s efforts to accelerate economic recovery, the Group is planning on investing to boost its local networks of raw material suppliers and agricultural producers, which it considers to be a key element in ensuring the long-term food security of the country. Reiterating its confidence in the country’s recovery, the Group made capital investments of 7.7 billion rupees,demonstrating its commitment to uplifting communities across Sri Lanka and serving its customers.

25 Central Finance PLC

At 25th position in the Business Today Top 40 rankings, the Central Finance Company as a Non-Banking Financial Institution (NBFI) has performed well, reflecting the general trend in the financial services industry despite subdued economic activities.

Overall, CF notes that the financial services industry’s commendable performance led to an increase in the asset base of the NBFI sector by 6.1 percent compared to the 2.2 percent contraction in 2020. During the year under review, CF had to rethink its businessmodels, explore new business opportunities created by the pandemic and redesign its processes and procedures to improve efficiency and competitiveness. That led the Group to invest in technology and upgrade IT infrastructure while prioritizing the prudent management of increased risk in the financial year under review.

The NBFIs sector recorded a considerable improvement in terms of credit growth and profitability on an overall basis. The increase in the loans and advances portfolio drove sector expansion, accounting for the bulk of the sector’s total assets. CF’s strategy had been to focus intensely on recoveries rather than on aggressive lending, which paid off during the 2021/2022 financial year with a PBT of 7.5 billion rupees compared to 5.1 billion rupees the previous year. The PBT was 9.6 billion rupees at the Group level compared to 6.8 billion rupees in the last reporting period. The Group’s subsidiaries and associate companies contributed to the growth momentum, the Nation’s Trust Bank delivering its highest- ever profit in its operating history. Prudent financial management, astute strategies, careful monitoring of risks, and solid hands-on operations management supported its strong performance.

CF expects restricted economic activity in the near term to slow down credit growth. Its robust risk and governance frameworks protect against harmful exposure to risky assets. The Group will prioritize managing the interest rate risk, given its proclivity to impact net interest margins. Meanwhile, it will maintain its status as a well- capitalized company with strong liquidity credentials.

26 Lion Brewery Ceylon PLC

In 26th place in the Business Today Top 40 rankings, Lion Brewery Ceylon PLC, in a challenging 2021/2022, delivered a PBT of 5.5 billion rupees compared to the 4.2 billion rupees last reporting year, on a turnover of 58.6 billion rupees versus 49.8 billion rupees in the previous year. The Company states that the sharp appreciation of the US dollar in March 2022 resulted in a substantial exchange gain in the PBT.

The Company’s operational costs had risen significantly due to peripheral factors in the local and global operating environment. Therefore, the Company had to offset them by resorting to price revisions to the extent possible. However, the pace at which cost escalations occurred was more significant than what the consumer could bare. As such, the Company’s operating margins declined in the year.

There was a renewed focus on strengthening the brand portfolio. Wanting to transform the stout segment into a premium one, Lion Brewery introduced a new international brand while relaunching another one, creating renewed customer enthusiasm. They aligned with the overall business strategy of creating a broader premium segment in Sri Lanka by offering choices and range to consumers. The Company will adopt the same approach in other segments within the market.

The Company’s export business had performed well, recording a growth of 45 percent over the previous year. The management said that income from exports helped overcome the foreign exchange challenges during the year. The rising price of raw materials and freight costs challenged export profitability. However, the Company sees its international business arm exporting to around 26 countries, offering further promise and potential for growth in the coming years and hence will receive due focus.

27 Dipped Products PLC

At 27th position in the Business Today Top 40 rankings, Dipped Products PLC is a manufacturer of protective hand-wear, serving close to five percent of the global demand for natural and synthetic-latex- based household and industrial gloves. The Group offers an array of sustainably manufactured gloves sold in over 70 countries, with five manufacturing facilities in Sri Lanka and Thailand. The other subsidiaries of the Group include tea and rubber plantations.

Spurred by the demand in the hand protection segment, the Group’s consolidated turnover increased by 19 percent to 55.29 billion rupees in 2021/2022. The heavy demand for gloves, coupled with new customer acquisition and the launch of innovative products facilitating a volume growth of 10 percent, supported strong performance. However, the hand protection sector recorded a 10 percent decline in PBT, primarily due to cost escalations and moderation of prices compared with the record highs of 2021/2022.

Meanwhile, the plantation sector recorded a nine percent growth in revenue, upheld by strong pricing for both tea and rubber and the quality focus of both plantation companies. Thus, the plantation sector delivered record profitability, with PBT increasing by 63 percent to 2.80 billion rupees during the year. The Group’s consolidated PBT increased by six percent to 7.60 billion rupees.

28 Nations Trust Bank PLC

At 28th position in the Business Today Top 40 ranking, the Nation’s Trust Bank delivered the highest profits in its operating history during the year under review, a record-high PBT of 8.42 billion rupees, a 39 percent increase.

Although the Sri Lankan economy rebounded in early 2021, the management contends that the results demonstrate its ability to adapt and thrive in extraordinarily challenging circumstances. Accordingly, the Group’s foresight in identifying and proactively responding to emerging risks and opportunities through timely interventions underpinned its success. Moreover, the Bank had focused on de-risking the portfolio, preserving credit quality, and relentlessly pursuing operational efficiencies.

Quick responses to the environmental dynamics supported the Bank’s outstanding performance. NTB focused on maintaining portfolio quality and profitability through selective lending, delivery of customer- centric solutions through a lifecycle proposition, and a relationship- driven approach. Digitization of external and internal customer processes and implementation of a hybrid working model also led to its remarkable performance. NTB notes that a reduction in the effective tax rate during the year also led to a 65 percent increase in profit.

NTB is upbeat about navigating the future despite the apparent volatilities because of its strong foundation of many years. It will focus on resilience and sustainability by prioritizing credit quality, margin management, return-focused lending, and financial stability.

29 People’s Leasing and Finance PLC

In line with the NBFI sector’s strong performance in the financial year, People’s Leasing and Finance PLC, led by Chief Executive Shamindra Marcellin, has secured the 29th position, recording a profit of 4.82 billion rupees, reflecting a decline of 13.90 percent over the previous year. While People’s Leasing recorded the highest profit in its history, amounting to 4.66 billion rupees, an increase of 15.52 percent from a year earlier, the increased claims ratio of its largest subsidiary, People’s Insurance, impacted the Group’s earnings. People’s Leasing Fleet Management Ltd. and People’s Micro-Commerce Ltd. also recorded the highest profits in their history.

Risk management continues to be a key area of focus for People’s Leasing, which invested heavily in this vertical. Understanding credit risk, especially its potential developments that could impact business, to identify early warning signs is vital to the management. Key risk areas strengthened during the period included credit risk, which is the most significant exposure for the Group, operational risk, ICT risk, and Group risk.

The Group’s plans focus on consolidating its footprint and expanding its virtual presence, taking it into a new era of scalability and efficiency. The Group will review its product portfolio and promote products relevant to the country’s circumstances and in line with the Group’s risk appetite. Recoveries contributed significantly to this year’s profits; hence, the management will continue to focus on this vital area to drive profitability and asset quality. Additionally, it will continue to focus on strengthening credit processes as well.

Moving forward, the immediate need that management is bent on following is a trajectory of restrained growth, a proactive approach to managing credit risk, and building resilience through capitalization and liquidity underpinned by responsive and responsible leadership.

30 Ceylon Beverage Holdings PLC

Ceylon Beverage Holdings operates in a thriving landscape, although the last two years didn’t exempt it from experiencing some of the pitfalls of the pandemic and the economic crisis. The operating environment is challenging, claims the Company, where a balanced and sensible approach to the industry by the government and the regulators is essential to harness its strength, especially when it can generate immense revenue for the state by way of taxes.

The industry has had to contend with multiple economic factors during the year under review. Apart from domestic factors, and despite rising global commodity prices, including the input costs of critical materials, cans, and malt, the Group delivered a PBT of 5.9 billion rupees in 2021/2022 compared to 4.3 billion rupees in the last financial year.

Key to this performance is the growth in the Company’s export business which had grown by 45 percent in the year under review. The Company was able to overcome the forex challenges of the financial year from its export income.

In the future, CBH will focus on transforming its export business. Already exporting to 26 countries, CBH is making a strategic move to add resources and management focus to its export trade as it signals to become a key growth pillar of the business. CBH has aligned its annual execution plans with the defined strategic purpose. Further, operational excellence and intelligent cost management will feature prominently in CBH’s business agenda.

31 Seylan Bank PLC

The year under review has been challenging yet successful for Seylan Bank, which has emerged in 31st place in the Business Today Top 40 rankings. In 2021, the Bank reported one of the best performances in its 34-year history. A key reason for this was the new approach established through its revived corporate strategy. It focuses on five key strategic objectives to build and sustain the business.

The Bank recorded a robust growth of 46.62 percent in PBT of 6.0 billion rupees in 2021 compared to 4.1 billion rupees in 2020. The main contribution to higher profit came from net interest income, fee income, other income, and managing the cost despite a significant increase in impairment charges.

Some of Seylan Bank’s critical focus areas for enhancement in the short term are more robust credit evaluation processes and a further improvement in turnaround time for credit approvals leading to better credit quality, portfolio growth, and customer satisfaction. The Bank acknowledges the criticality of continuous innovation in maintaining its competitive advantage and will emphasize this aspect in its strategic imperatives. Seylan Bank hopes to enhance its green banking solutions, offer equal opportunities to all, and promote financial inclusion across all segments of the economy.

32 ACL Cables PLC

At number 32 in the Business Today TOP 40, it’s been a “fabulous year” for ACL Cables. The home-grown manufacturer of cables, electrical switches, sockets and breakers, ceiling fans, and accessories is celebrating a golden milestone in its history by recording the highest growth and highest profit, significant amid tight economic and business conditions.

The 56 percent increase in Group revenue of 35.3 billion rupees and the 49 percent increase in Company turnover of 19.5 billion rupees for 2021/2022 compared to its previous year’s performance have helped it remain buoyant. ACL’s largest customer, the Ceylon Electricity Board, has been a fillip factor in keeping its numbers up.

When businesses shuddered at the thought of making price revisions to their products, expecting a setback, ACL Cables made good of the headwind to increase its turnover. The Company had to make price revisions in the face of copper and aluminium price increases and the rupee’s depreciation against the US dollar, which amplified its turnover, positively spilling over to the Group’s export business.

ACL has commended the government’s efforts to change course from an adverse pandemic that dominated 2020, especially introducing favorable policies for the construction industry, where it operates as a sub-sector. As low-interest rates generated massive demand for real estate, housing, and project construction activities, ACL, as a supplier of building materials, leveraged the opportunity, which reflected in Group revenue and net profits.

ACL Cables proudly flaunts its indigenous pedigree and its great strides as a fully-owned Sri Lankan entity. It has lauded the restrictions on imports as an impetus to local businesses that resulted in sales boosts in an even playing field.

ACL is cognizant of the challenges before it. However, having learned hard in the past two years and navigated through tailspins, ACL has its future course organized – to strengthen its distribution network and improve international market penetration. Expanding its footprint outside Sri Lanka is a long-term strategy to help ease the pressure of accessing forex to import inputs, with new markets in South Asia being a priority, and expanding the outreach in its current global market space.

Like every business, the ACL team is watching the changeability of economic activity. It takes a cautious approach to investment based on financial performance, ready to revisit, revive and adjust its business plans.

33 Nestlé Lanka PLC

Food and beverage manufacturer Nestle Lanka is ranked 33rd in the Business Today Top 40. It was able to steer a challenging 2021 by unlocking opportunities, which enabled it to achieve positive results augmented by its export and out-of-home businesses.

The Company contends that the pandemic posed many challenges. However, as a food and drink processing company, it continued undeterred by working diligently through a solid network of suppliers, distributors, and other partners, especially its employees’ commitment, who ensured sustained operations through rising infections and lockdowns. That, in turn, drove the Company to deliver growth and profitability in 2021, recording a PBT of 6,147 million rupees compared to the 4,264 million rupees in the previousfinancial year.

The Company is committed to extending its footprint as a force for good. Innovating its portfolio to meet nutritional requirements, inspiriting consumers to lead healthier lives, impacting communities, and responsible stewardship of resources will be a focus as Nestle Lanka continues its priority on balanced and sustainable growth.

34 Sunshine Holdings PLC

Sunshine Holdings is 34th in the Business Today Top 40 rankings with its healthcare, consumer goods, and agribusiness portfolio. The Group recorded a PBT of 5.6 billion rupees in the reporting year of 2021/2022 compared to 3.3 billion rupees made previously.

The Group’s growth is despite notable impediments to its healthcare and consumer goods sectors. The Group’s healthcare sector recorded a 37.1 percent growth in revenue over 2021/22, delivering a PAT of 1,070 million rupees, an increase of 29.9 percent over the previous year. The consumer goods sector recorded a 13.2 percent growth in revenue, delivering a profit after tax of 479 million rupees, an increase of 2.7 percent over the previous year. Its agribusiness benefitted from higher palm oil prices.

The Group overcame challenges to its import-dependent businesses by acquiring an export business. The Group has leveraged Sunshine Tea to support its import- dependent healthcare business. Thinking strategically and resourcefully, Sunshine Holdings hopes to navigate the future by selecting initiatives to help it remain resilient.

The Group is focusing on implementing its long-term vision and an investor-friendly governance framework to build confidence and attract leading global equity firms to redirect investments toward Sri Lanka and support the country in improving its depleting foreign reserves. It is confident that it will continue to create and deliver value to all stakeholders.

35 CIC Holdings PLC

At number 35 in the Business Today Top 40 rankings, CIC Holdings PLC is a well-known name in the agribusiness sector.

In a very tumultuous period for agribusinesses, CIC’s highly diversified portfolio of products proved to be the saving grace in navigating the Group to record positive results. Because some subsidiaries made good yields, they helped the Group sidestep the losses incurred by its agrochemical and fertilizer businesses.

Of significance is the Group’s resilience amid the agrochemical ban in April 2021, aggravated by the dollar liquidity crisis in the latter of 2021, challenging its import-oriented businesses. The Group’s export verticals, such as the herbal healthcare segment, had helped circumvent the fallout from the ban and the dollar liquidity. Notwithstanding the drop in profitability of the agribusiness division, the Group was able to post its best-ever results as its feed, poultry, and herbal segments declared their best-ever results. Meanwhile, CIC’s pharmaceutical business, industrial solutions, and CISCO contributed to the overall growth of the Group’s profitability.

Based on the strength of the diversity of products and markets, the Group weathered the storm to record a revenue of 41.76 billion rupees in 2021/2022, 12 percent higher than the previous year.

The Group is somewhat wary of making realistic economic forecasts predicting a looming solvency crisis in the near term compounded by the fallout from the Russia-Ukraine conflict and its impact on oil and gas prices and food supplies. Given the uncertainties of multiple scenarios, the CIC Group is navigating a course that would make it proactive and a future- ready business resilient through the upheavals, consolidated with investment in innovation and ongoing strategic realignment of business models in response to market dynamics.

36 DFCC Bank PLC

The overarching objective of DFCC Bank PLC, led by Chairman J Durairatnam and Chief Executive Thimal Perera in 2021, was to energize and accelerate economic revival. In the 36th position in the Business Today Top 40, despite the formidable challenges of 2021, the year has been one of the best in terms of profitability for DFCC. The Bank’s performance is a testament to the sector’s remarkable ability to flourish during turbulent times. That outcome, with a PBT of 4,859 million rupees in 2021 compared to 3,944 million rupees in 2020, results from prudent cost management, a strategic approach to productivity enhancement, and lower interest rates.

As circumstances would demand, the Bank accelerated its digital journey through the new core banking system advancing its digital capabilities with Non-Face to Face (NF2F) onboarding, allowing even overseas customers to open accounts from home. Technology advancement was one of the built-in features of the Bank’s “Vision 2025”, along with expansions in banking products and customer preferences. The management put this strategic vision to the test during the pandemic and the resultant changes in the working environment.