January 18, 2023 Edith Muthoni

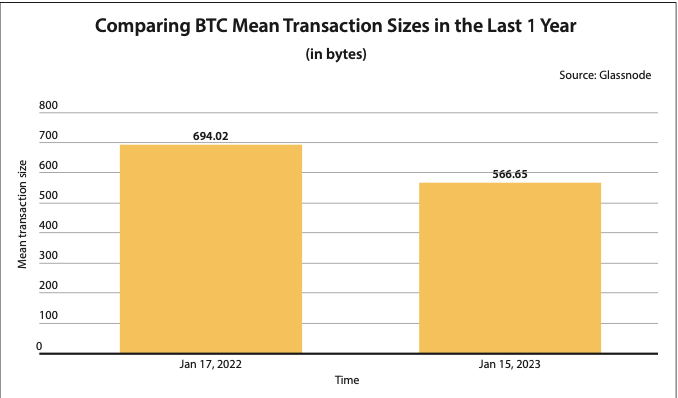

Bitcoin’s (BTC) mean transaction size has drastically declined since the start of the year. According to data from TradingPlatforms.com, the king crypto’s average transaction size fell from 694 bytes on January 17th, 2022, to just 567 bytes on January 15th, 2023 – its lowest point in the last 12 months.

Some leading lights in the cryptocurrency space see this drop in BTC mean transaction size as a welcome development. One of them is Edith Reads, TradingPlatforms investments lead. To her, BTC lovers should view this decrease positively as it suggests the premier crypto is pushing for scalability and efficiency in transactions.

“A declining mean transaction size for Bitcoin is indicative of its growing use as a currency, as opposed to an investment asset. This shift in use cases bodes well for long-term adoption and sustainability of cryptocurrency technology.”

Reads sees this move as one that could positively revolutionize Bitcoin, making it much more efficient and accessible for everyone. She believes the success of Bitcoin lies in its ability to keep innovating and expanding its reach – something that this drop in BTC’s mean transaction size can help achieve.

Importance of Bitcoin’s Mean Transaction Size

Bitcoin’s mean transaction size is an important metric because it can affect the overall scalability and performance of the network.

A higher mean transaction size can lead to increased congestion on the network as more transactions compete for block space. That can result in longer transaction confirmation times and higher fees for users.

On the other hand, a lower BTC mean transaction size can positively impact cost, speed, and scalability. That’s because lower transaction sizes allow for the processing of more transactions per block, potentially increasing the network’s throughput and reducing transaction fees. It also means less storage usage and less time for new nodes to sync with the network.

What’s Behind the Decline?

This decrease can be attributed to multiple factors. These include an expansion of the Bitcoin user base and users increasingly transferring smaller amounts of the currency between their wallets. Furthermore, Bitcoin’s scalability advancements have allowed the processing of more transactions in a shorter amount of time.

The adoption of SegWit, an upgrade to the Bitcoin protocol, allows for more efficient data storage. Moreover, the increased use of second-layer solutions, such as Lightning Network, allows for off-chain transactions that do not need storing on the blockchain. Similarly, lower transaction sizes can result from the adoption of bech32 addresses. These addresses are shorter than legacy Bitcoin addresses and can help to reduce the data required for a transaction.

Edith is a finance expert who has been writing and trading for years. She’s knowledgeable about stocks, cryptocurrencies, blockchain technology as well the latest fintech trends – all from an informed perspective that will help you make better decisions when it comes time to invest your money.