December 21, 2023. Justinas Baltrusaitis.

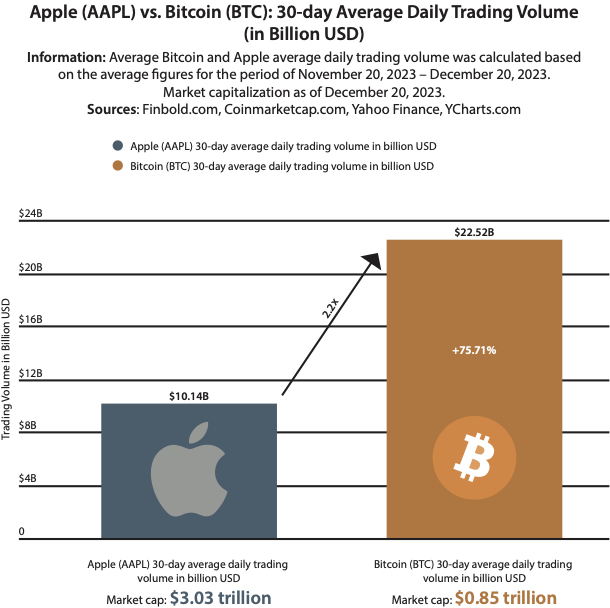

Bitcoin (BTC) has concluded the year positively, overcoming the earlier suppression of the maiden cryptocurrency’s valuation due to wider economic conditions, such as rising interest rates. The notable uptick in the flagship digital asset’s performance becomes evident when comparing Bitcoin against traditional investments, notably the tech giant Apple (NASDAQ: AAPL), particularly in daily trading volume. In this line, according to data acquired by Finbold, from November 20, 2023, to December 20, 2023, Bitcoin recorded an average daily trading volume of $22.52 billion, while Apple stood at least two times lower at $10.14 billion, marking a percentage difference of 75.71%. The variance between the two asset classes is more evident when comparing their market capitalization. As of December 20, Apple commanded a market cap of $3.03 trillion, at least three times higher than that of Bitcoin, standing at $850 million.

Investors often perceive traditional stocks like Apple as relatively stable. On the other hand, Bitcoin’s price volatility and the inherent uncertainties associated with the cryptocurrency market may lead to varied risk perceptions among investors.

How Bitcoin dwarfed Apple in trading volume

It’s worth noting that Bitcoin’s trading volume coincided with a phase where the crypto emerged from the consolidation that defined its 2023 price movement. In early December, Bitcoin reached its annual peak, surpassing $44,000, driven mainly by anticipation surrounding the potential approval of a spot exchange-traded fund (ETF) by United States regulators, with giant players such as investment firm BlackRock Inc. (NYSE: BLK) being on the frontline.The speculated decision, expected in early 2024, is poised to catalyze Bitcoin’s rally, potentially drawing increased institutional interest and a surge in trading volume. In the meantime, the Bitcoin gains have partly stalled, but the crypto continues to trade above the $40,000 support zone.With the recent price gains, it can be inferred that some investors sought to profit from the rally. At the same time, the fear of missing out (FOMO) might have set in, given the prevailing consensus that Bitcoin is poised for its next all-time high, and the recent gains are mainly viewed as the foundation for the gains. However, despite these expectations, Bitcoin’s price has failed to surpass the $45,000 mark.Furthermore, the trading volume underscores Bitcoin’s resilience, positioning the asset as an alternative investment to traditional options like gold, often considered a perennial hedge against inflation. In a highly speculative cryptocurrency market, the fact that Bitcoin surpassed Apple’s trading volume signifies that the asset cannot be dismissed merely as a market spectator. This trend contributes to higher trading volumes than assets many investors deem safer for long-term investments, such as Apple.

The difference between Apple and Bitcoin

Undoubtedly, the two products belong to different asset classes, with Apple backed by tangible products and Bitcoin classified as a virtual investment. Notably, Bitcoin holds an edge over Apple that could influence trading volume. In this case, the tech giant’s stock only trades five days a week, whereas the crypto is traded 24/7. Furthermore, Bitcoin and the general cryptocurrency market often attract speculative trading, leading to higher volatility and increased volumes. In contrast, traditional stocks like Apple experience more controlled and regulated trading, potentially constraining daily volumes. Apple has also experienced positive momentum, mainly trading in the green zone over the past month. The stock has rallied, aligning with the broader market’s upward trend as the year ends. This overall market surge is fueled by anticipation that the Federal Reserve might soon lower interest rates as inflation cools off. Furthermore, the difference between the two can be seen as a sign of Bitcoin’s maturity. Investors often perceive traditional stocks like Apple as relatively stable. On the other hand, Bitcoin’s price volatility and the inherent uncertainties associated with the cryptocurrency market may lead to varied risk perceptions among investors.Considering that Bitcoin is showing dominance despite the existing discrepancy in risk perception points to more trust in the digital asset.In general, the dominance of Bitcoin in daily trading volume compared to Apple suggests a possible shift within the financial landscape. Whether this trend continues or traditional markets find a way to adapt, only time will tell. What is certain, however, is that the rise of cryptocurrencies is partly reshaping the way investors perceive and engage with finance.

Justin crafts insightful data-driven stories on finance, banking, and digital assets. His reports were cited by many influential outlets globally like Forbes, Financial Times, CNBC, Bloomberg, Business Insider, Nasdaq.com, Investing.com, Reuters, among others.