1 Commercial Bank of Ceylon 27.600

2 LOLC Holdings 26.950

3 Hatton National Bank 26.550

4 Sampath Bank 25.500

5 Dialog Axiata 24.750

6 Ceylinco Insurance 23.950

7 John Keells Holdings 23.450

8 Sri Lanka Telecom 21.050

9 National Development Bank 19.100

10 Melstacorp 17.500

11 Vallibel One 17.100

12 Overseas Realty 16.450

13 Nestlé Lanka 16.300

14 Central Finance Company 16.200

15 Nations Trust Bank 16.050

16 Seylan Bank 15.650

17 CT Holdings 13.900

18 People’s Leasing and Finance 13.700

19 Hayleys 11.400

20 DFCC Bank 11.100

21 Teejay Lanka 10.900

22 Chevron Lubricants Lanka 10.850

23 Tokyo Cement 9.350

24 Citizens Development Business Finance 7.700

25 Commercial Credit and Finance 7.650

26 Dilmah Ceylon Tea Company 7.300

27 Hemas Holdings 7.050

28 Richard Pieris and Company 6.300

29 Pan Asia Banking Corporation 5.850

30 First Capital Holdings 4.400

Corporate Performance in a Challenging Environment

The financial year 2019-2020 can be considered as one of the most challenging periods for corporate Sri Lanka with the companies being selected for their performance during the financial year 2019-2020. The main factors that impacted the performance of the economy was political instability and insecurity that hindered growth. The country and corporate sector have weathered many storms in the past, therefore, in this uncertain environment corporate Sri Lanka forged ahead.

The beginning of 2019 saw promise with the economy gradually gathering momentum. A vibrant tourism season was expected with visitors arriving in Sri Lanka during months that were traditionally considered ‘off season’ as well. Destinations such as Arugambay started to see an influx of visitors from all over the world. However, with the Easter Sunday attack the entire country and the economic machinery came to a standstill. The tourism and hospitality industries were deeply affected.

Political fault lines were further exacerbated and vulnerabilities in the economy became more apparent. The resultant instability caused an economic slowdown. It is in such an environment that corporate Sri Lanka had to perform, continuously realigning and re-adjusting their strategies. Businesses were affected drastically and banks and financial institutions were instructed to provide moratoriums and debt relief to customers. This affected the bottom line of the companies in this sector. Furthermore, the leisure, hospitality, tourism and entertainment sectors were severely affected as tourist arrivals were low and the domestic market too were cautious in their spending. Yet, Melstacorp, headed by the dynamic business leader Harry Jayawardena, was able to retain its position in the Business Today TOP 30 2019-2020 even though its main Leisure Sector was severely hampered by the instability of the environment.

The uncertainty and the slowdown of the economy that was faced in Sri Lanka during the first half of 2019 improved towards the latter part of the year. Tourism showed a positive increase with greater vitality in performance in the hospitality and leisure sectors. Export as well as other industries showed growth and promise. Confidence grew with the victory of President Gotabaya Rajapaksa and a sense of stability was felt in economic, political and social spheres. Through his manifesto ‘Saubagyaye Dekma’, key areas were identified for development, which would enable economic growth. Furthermore, importance was yet again given to National Security, thus enabling a conducive environment for development.

With Prime Minister Mahinda Rajapaksa heading the Government, it provided the much needed confidence to the people that the country would begin to see development and greater economic activity as it had done during the period of 2005-2014. As the Sri Lanka Podujana Peramuna under the direction and guidance of Basil Rajapaksa gathered popularity, and enabled for the first time in the history of the country a resounding majority in Parliament. Having Basil Rajapaksa to spearhead economic activity also provided the much needed stability and confidence to the people.

The Business Today TOP 30 2018-2019 was held in January 2020 under the patronage of Prime Minister Mahinda Rajapaksa and former Minister Basil Rajapaksa was a Special Guest on this occasion. The event reaffirmed the positive sentiments of the country and the private sector on the return of a Rajapaksa led Government.

With the Sri Lanka Podujana Peramuna winning the Parliamentary elections with a resounding majority providing the much needed stability in the legislature that transcended to the economy as well. Furthermore, with the passing of the 20th Amendment in Parliament with a historical 2/3 majority enabled a strong footing for the Government and the Executive thereby providing the ability to make strong decisions on behalf of the country to ensure stability and security in all spheres.

While initially Sri Lanka was not affected as much as the other countries globally by the COVID-19 pandemic, it gradually started to take its toll. The country faced a lockdown and emerged successfully in curtailing the spread of the virus, however, a second wave of the pandemic has hit the country with new clusters emerging. We are confident that the country will be able to overcome the spread of the virus and bring back a sense of normalcy to Sri Lanka.

Corporate Sri Lanka has weathered many storms. And, during a period of a global pandemic they have continued to function and perform albeit in a limited manner, showing their resilience and positive attitude. The Banking sector continued to perform giving a sense of financial stability to the country. Large conglomerates with established businesses in diversified sectors adjusted and re-aligned their strategies so that there would be continuous growth, and thereby stability of the organizations were ensured.

Business Today TOP 30 2019-2020 sees movements in the ranking with seasoned players securing a position in the ranking as well as the entrance of companies for the first time into the list. In a challenging environment such as today, it is indeed encouraging to see new players making their mark in the corporate world. Commercial Bank of Ceylon secures the number one position after 19 years, having previously held the number one position for the financial year 2000/2001. The Bank has continuously been in the Business Today TOP Corporate ranking at various positions over the years maintaining its consistency in performance as the the largest private sector bank in Sri Lanka. The strength, aptitude and experience of Dharma Dheerasinghe, Chairman and the astute and forward thinking leadership of S Renganathan, CEO have driven Commercial Bank of Ceylon to greater heights with considerable growth.

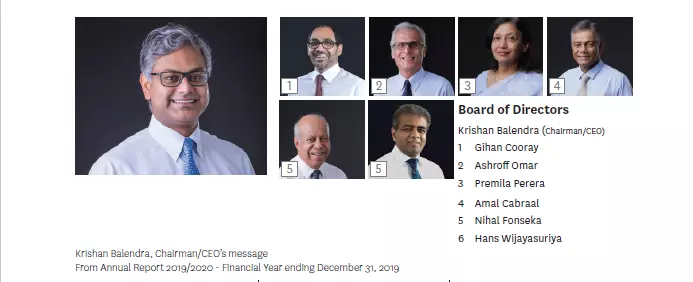

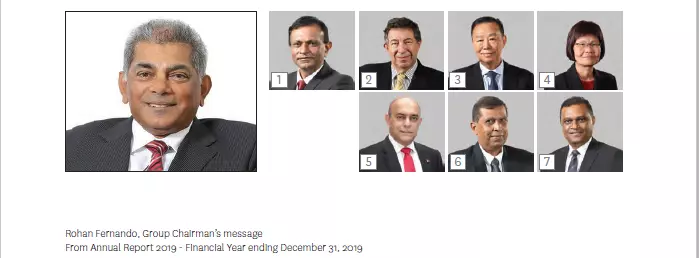

Sri Lanka Telecom, ranks at number eight in the Business Today TOP 30 2019-2020 having climbed up the ranking from 15 last year. The telecommunication giant of Sri Lanka is seeing a dynamic attitude in leadership where new thinking and innovation have provided impetus for the Group to grow under the visionary thinking of Rohan Fernando, Chairman and Lalith Seneviratne, Group CEO.

Merrill J Fernando, Founder/Chairman of Dilmah Ceylon Tea Company, completed 70 years in the Ceylon Tea industry and also celebrated his 90th birthday. His fighting spirit has always ensured that the country’s interests are protected. Merrill J Fernando believes that in business it is also essential to help others. Therefore, through Merrill J Fernando Charitable Foundation many people are supported and given a second chance in life.

Overseas Realty entered the Business Today TOP 30 for the first time at number 12. In a fluctuating property market, Overseas Realty was able to secure higher earnings on its rentals. Tokyo Cement re-entered the Business Today TOP 30 at number 23. It is always encouraging when companies perform well to re-enter the rankings. Tokyo Cement not only recorded a profitable year, but they also consolidated their position as the largest cement manufacturer in Sri Lanka, both in capacity and market share. First Capital Holdings entered the Business Today TOP 30 for the first time at number 30.

The ‘new normal’ has taught many lessons and we continue to learn as the situation evolves. Innovation and new thinking are a must for an organization to grow. As the external environment changes the private sector should adapt and evolve. They should also be proactive and be prepared because the world is unpredictable. This should be the approach of the Government as well. Action must be taken not as a reaction but in preparedness.

Due to the pandemic situation Business Today may be required to revise its criteria when performing the analysis for the financial year 2020-2021. It is our hope that Sri Lanka will be soon able to, as it did so successfully before, manage and curtail the spread of the COVID-19 pandemic so that the country’s economy would continue to grow enabling stability and security for all.

The Business Today TOP 30 is based on published information of companies listed in the Colombo Stock Exchange and social considerations. The companies have been selected on the basis of their performance recorded during the financial year ending December 31, 2019 and March 31, 2020 with the assistance of KPMG Sri Lanka.

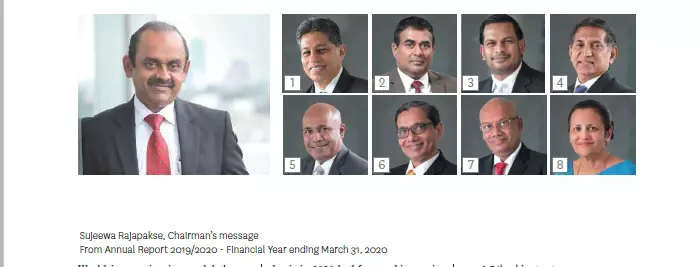

1. Commercial Bank of Ceylon

Board Of Directors

S Renganathan (Managing Director/CEO)

1 K G D D Dheerasinghe (Chairman)

2 M P Jayawardena

3 K Sripavan

4 T L B Hurulle

5 L D Niyangoda

6 S C U Manatunge

7 S Swarnajothi

8 K Dharmasiri

9 Prof A K W Jayawardane

10 N T M S Cooray

A challenging year

There is no getting around it: 2019 was a difficult year for the Bank, as it was for the entire country. The fallout from the 21/4 Easter Sunday attacks compounded an already vulnerable macroeconomic situation, and a large measure of the Bank’s resources and attention were directed towards recovery and consolidation. In the context of depressed economic growth, an unfavourable credit environment, escalating non-performing assets, and the rising impairment charges, the Bank registered a marginally lower profitability than the previous year. The Bank’s profit after all taxes for the year was Rs 17.025 Bn, as against Rs 17.544 Bn in 2018.

The Commercial Bank Group ended 2019 with two performance milestones. Deposits surpassed Rupees One Trillion mark and gross income exceeded Rs 150 Bn. A detailed analysis of our performance is given in the Financial Review.

Prudence in the face of adversity

As the Bank approached its centennial, we drew confidence from our history of sustained performance through the waxing and waning of Sri Lanka’s economic fortunes. The Bank has maintained, for the entirety of its tenure, an impeccable reputation for compliance, a reputation that is hardwon and well-deserved. Following this ethos in 2019, the Bank held fast to its fundamentals: a disciplined and focused approach to growth while conforming to best in class risk management and corporate governance practices, as well as the sector’s broader regulatory framework. Our commitment to a prudent approach goes above and beyond nominal adherence to the myriad compliance requirements or accounting standards. For us, prudence means ending the precise balance between maximizing revenue and profitability in the present without undermining the Bank’s capacity to deliver value to all its stakeholders in the medium to longterm. This balance was felt important during meagre times, when the imperatives and pressures of the moment can cloud a judicious, futureoriented vision. In this respect, our funding, liquidity, and financial capital management played a crucial role. This year, in an environment inhospitable to credit expansion, the Bank strategically invested excess liquidity in both LKR and FCY Government Securities. Similarly, the modest increase in Risk Weighted Assets meant that the Bank was able to efficiently manage its capital to facilitate the expected growth rebound in 2020. Our capital adequacy ratios were once again well in excess of regulatory minimums. Adopting this prudent approach is precisely what has allowed the Bank to deliver value year-over-year and earn the trust of over 3.5 million customers as Sri Lanka’s largest private sector bank with the highest market capitalization in the Bank, Finance and Insurance sector. As testament to our efforts during difficult times, our team was encouraged to receive the recognition of being best bank in Sri Lanka for 2019 by both ‘Global Finance’ and ‘The Banker’, redirecting a broad consensus of our position at the summit of the country’s financial landscape.

Renewing our social license

As a Domestic Systemically Important Bank (D-SIB), the Bank has a responsibility to promote the safety, soundness, and stability of the financial system of the country. Moreover, as an institution entrusted with the fiduciary duty of accepting and deploying vast sums of uncollateralized public funds, the Bank understands that its sustainability rests on the ongoing acceptance and approval of our business by all the stakeholders. We believe that this ‘social license to operate’, unlike regulatory licenses, cannot be applied for or self-awarded, but must be earned and constantly renewed by demonstrating the Bank’s commitment to ensuring productive outcomes for the society and the environment at large. The Bank, as a selfcontained institution, has a relatively limited environmental footprint; but, as a financial intermediary with a wide national reach, has a crucial role to play as an influencer and driver of sustainability. A thorough assessment was conducted to align our core business with the UN SDGs and strengthened our partnerships with private, public, nongovernmental, governmental and international organizations, to drive our green banking programs in view of our goal of increasing the green funded portfolio to 5% of the Bank’s total loan book by 2030. A concerted effort was also made to adopt our Social and Environmental Management System (SEMS) framework throughout our operations. Without limiting the evaluation to credit facilities above Rs 100 million, this year, we broadened our scope to inculcate a SEMS perspective in all our lending activities. This was especially important in our efforts at targeting SMEs, micro enterprises, and women entrepreneurs as distinct customer segments with specific banking needs.

The power of digital

While our growth efforts this year were curtailed, we forged ahead with our digital strategy, creating an infrastructure that will help facilitate our growth in future. Digital innovations are transforming economies and financial ecosystems. Customers are demanding banking that is simple, functional, reliable, and seamless. New opportunities for business growth abound – as do new risks to data security and compliance, among others. To harness the power of new technologies, during 2019, the Bank adopted a strategy of viewing digital innovation as a Transformation Change Agent – a catalyst that will redefine the relationship between the two stakeholders that are at the heart of our business model: our customers and employees. Aimed at making a tangible difference in the lives of our customers, this year, we adopted a focused approach to driving our digital adoption initiatives and are extremely well positioned to cross 30% digital penetration by mid 2020. While the year’s economic challenges derailed our efforts at implementing our new customized banking platform, Combank Digital, before the end of the year, we hope to launch it by March 2020. Notably, our Flash Digital Banking App showed encouraging growth during 2019 following our rollout of the Sinhala and the Tamil versions of the App, making it Sri Lanka’s first trilingual mobile digital banking platform. It enables customer onboarding to financial planning and all other services required by a retail customer and represents the unique and imaginative possibilities of digital innovation. On the surface, the presentation and full digital banking functionality of the App is designed to appeal to Generation Y and Z customers. Precisely because of its functionality, it is a powerful tool for

providing immediate banking services to other under-banked and unbanked segments of the market, and for promoting financial inclusion and digital adoption throughout Sri Lanka.

Helping us help our customers

The technological improvements during 2019 to our internal operations – largely unseen by the customer – are just as important as a change agent. We conceptualize this approach as helping us help our customers, i.e. centralizing, digitizing, and automating our backoffice operations to allow us to redeploy staff and resources towards sales and Customer Relationship Management. One of the most important initiatives this year was enhancing the SME value proposition by realigning SME sales strategy and centralization of credit evaluation and approval process with the assistance of a global consultancy firm, deploying dedicated SME officers in branches and serving SME customers at their doorstep. Business process re-engineering in our imports and exports divisions and the card center, introducing Robotic Process Automation (RPA) for a variety of functions, standardizing service proposition across the branch network were among a host of other initiatives. In this respect, we view enhancing productivity and profitability and supporting employee well-being as symbiotic goals. New digital improvements boost the Bank’s operational efficiency while enhancing the working experience of employees by delegating repetitive, mundane tasks to RPAs and making work flows more streamlined and intuitive. This, in turn, alleviates the pressure on staff through a more streamlined distribution of workloads, reducing employee stress and fatigue while promoting a better work-life balance. Accordingly, integrated thinking is being promoted at all levels of the Bank. While there will always be trade-offs between different capital allocations in our business model, integrated thinking has the power to reduce the friction between the different imperatives of maximizing profits, catering to customers, and prioritizing our employees.

Towards a banking group

During the year, we initiated various strategies to derive more contribution from our subsidiaries and seconded some of our senior staff as the MD, CEO, COO of such companies. These initiatives enabled the Bank to inculcate best practices, effect cultural changes, strengthen governance frameworks and improve systems and procedures. We expanded our footprint by opening two branches each in Sri Lanka and in Myanmar. We increased the stake in Commercial Insurance Brokers (Pvt) Ltd, and made it a subsidiary with a view to better serve our customers in future. We are confident of reaping the benefits of these initiatives in future.

A thank you to our stakeholders

It goes without saying that our relationships with the stakeholders are the defining factor in our success. I extend my sincere appreciation to the Chairman and the Board of Directors for their invaluable advice and guidance. I also thank the capable management team and all our members of the Commercial Bank family in Sri Lanka, Bangladesh, Italy, Maldives, Myanmar and other overseas locations including those seconded at these operations, for their commitment and dedication. I also extend my heartfelt gratitude to our customers for their loyal patronage and to our shareholders for their unwavering support for the Bank. Moreover, I wish to recognize and underscore the vital role played by the banking and financial services regulatory authorities and other stakeholders in Sri Lanka, Bangladesh, Italy, Maldives, and Myanmar for their support and cooperation. These relationships will be even more important as we forge ahead into the uncertainties of 2020. While we are eager to see our own growth and profitability rebound, our status as a D-SIB also comes with added responsibility. How the Bank, the banking sector, and the country as a whole responded to the difficulties of 2019 will have ramifications throughout our society at large. We at Commercial Bank look forward to the challenge of being a catalyst for broad-based inclusive, economic growth in 2020 and beyond by consistently doing what we do best: delivering optimum value to our stakeholders.

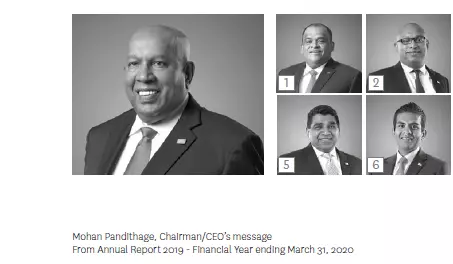

2. LOLC Holdings

Board of Directors

Kapila Jayawardena (Group Managing Director/CEO)

1 Ishara Nanayakkara (Deputy Chairman)

2 Kalsha Amarasinghe

3 Conrad Dias

4 Ravi Fernando

5 M D D Pieris

The financial year 2019/20 was a test of LOLC Holdings PLC’s resilience as despite a massive downturn of the economy the Group went on to record a Profit Before Tax (PBT) of Rs 27.1 Bn (including results from assets held for sale – PRASAC Micro Finance Institution in Cambodia) as compared to Rs 26.8 Bn in 2018/19. A satisfactory growth in deposits was recorded with the deposit book reaching Rs 221 Bn in the year under review, in contrast with Rs 193 Bn (excluding PRASAC results) recorded in the prior year, despite challenging macro-economic conditions. Total Assets grew to Rs 1.34 Tn as compared to Rs 1.04 Tn in the previous year. Equity attributable to shareholders soared from Rs 86.05 Bn in the previous year to reach Rs 92.53 Bn in the year under consideration. These solid numbers were a rare occurrence in a year that saw profitability eroding for many entities.

OPERATING CONDITIONS

Sri Lanka’s economy contracted during the year to record GDP growth of 2.3% in 2019, compared to a growth of 3.3% in 2018. The Easter Sunday attacks in April 2019 had a severe impact on the tourism sector and their adverse spill over effects were felt across the economy, worsening the sluggish growth of the economy and further dampening business confidence. Growth of credit to the private sector decelerated sharply, driven by subdued economic activity and weak business confidence, affecting the performance of the financial sector.

PERFORMANCE OF LOLC’S LOCAL OPERATIONS

Considering the global nature of LOLC Holdings, the Group is fortunately not reliant on macro factors in any single country. Much like the previous year, the lack of opportunity for stronger growth in the domestic market was offset by an exceptional performance by LOLC’s international operations. While LOLC’s financial services arm recorded growth despite the gloom in the rest of the industry, witnessing an increase in Non-Performing Loans, we performed better than peers to end the year under review as the most profitable listed entity. Diversification into overseas markets sustained profitability levels as 80% of the group’s top-line and bottom-line is accrued from global operations. The only dark cloud on the horizon for LOLC was its leisure arm, which could not perform as expected due to the terrorist attacks, political uncertainty in the lead up to the presidential elections and the outbreak of the global pandemic thereafter, which has brought tourism to a halt globally. The Group’s leisure portfolio in Sri Lanka is now made up of 5 operational resort hotels with the commissioning of 172 roomed Sheraton Kosgoda Turtle Beach Resort during 4Q of FY19/20. The Riverina Hotel development project in Beruwala is currently underway, which once completed will be one of the largest five-star resorts in the country. The Group made a bold move to tap into the Maldives leisure sector over the last few years, securing some of the most sought-after properties in Male as well as other atolls in the Maldives, assuring an even more diversified leisure portfolio. The Nasandhura Mixed Development project in Male is expected to be operational soon and will be the largest mixed development project in the Maldives. The resort hotel with 100 keys in Bodufinolhu atoll is planned to be opened by early 2021. During the year under consideration, the Group remained agile and leveraged on lower interest rates seen in the latter part of the year to manage treasury operations astutely with calculated risk in short-term borrowing and lending for longer tenures. On the deposit side, innovative products were launched to grow the deposit base, strongly backed by the trusted LOLC credentials. The Group’s insurance arm continued to perform strongly through the year under review, carving out substantial new business outside of the group, which reflects that the positioning and value proposition are well aligned to the needs of the market. LOLC Life Assurance and LOLC General Insurance demonstrated an impressive performance during the year by recording Rs 1.5 Bn PBT in comparison to a loss of Rs 175 Mn recorded in the preceding year. Apart from being the most profitable entity, LOLC is also leading Sri Lankan corporates when it comes to technology and innovation as we have launched several digital initiatives in our financial services business creating significant value to our customers, bringing them closer in all transactions. Improved resource efficiency is achieved through digital solutions that facilitate remote operations. In the non-financial services segment, the Browns Group of Companies underwent digitalization to improve delivery channels and customer service. In spite of the challenging and unexpected external shocks, LOLC Finance PLC (LOFC) sustained its market leadership position amongst the Non-Banking Financial Institutions (NBFIs) with an asset base of Rs 192 Bn, a portfolio of Rs 134 Bn and deposits of Rs 99 Bn. The company posted Rs 3.8 Bn Profit After Tax (PAT) in the year under review. As the leading impact lender, LOFC holds the largest pool of Development Finance Institutions (DFIs), guiding their respective development goals for Sri Lanka. The funding lines and the wide array of technical assistance provided by these DFIs through LOFC have transformed the grassroots of the economy. Continuing the Group’s legacy of expanding strategic international alliances, LOFC signed a loan agreement with Swedfund, the Swedish Government’s Development Finance Institution to promote financial inclusion and gender equality. Attesting the Group’s good business practices, LOLC Micro Credit Limited (now merged with LOFC) became the 1st Sri Lankan MFI to be awarded the Client Protection Principles Certification from the SMART Campaign (a global initiative, which exists to ensure strong client protection practices in the microfinance industry). Commercial Leasing and Finance PLC (CLC) has been instrumental in driving the Group’s vision of financial inclusion in the country as a leading credit supplier. The company has also established strong relationships with a wide range of FDIs to promote their development missions in the country. In the year under review, CLC managed to protect its portfolio and the profit signature by recording a PAT growth of 29% YoY to Rs 1.5 Bn despite challenging macro-economic situations.

The company holds a Rs 69.6 Bn asset base and Rs 24.9 Bn deposits as at FY2019/20. LOLC Development Finance PLC, formerly k nown a s BRAC L anka PLC, made a strong recovery in the year under review by recording Rs 176 Mn PBT from a loss of Rs 140 Mn in the last year following the alignment of its business strategies on restructuring the inherited SME portfolio. The company has been able to reduce its credit loss provisioning by 35% through the implementation of prudent strategies to improve collection and recoveries. The company holds a Rs 18.4 Bn asset base and Rs 2.6 Bn deposits as at FY2019/20. Seylan Bank, an associate of the LOLC Group, also contributed Rs 1.3 Bn to the Group’s profits. The Group holds its footprint in the local plantation sector through Maturata and Gal Oya plantations, where the business focus lies in the value addition of cinnamon products and sugarcane cultivation. LOLC could also reap the benefits of having market leaders like Agstar Fertilizers and Browns with agricultural supplies and equipment to complement the value chain. The Group exited from its healthcare assets due to the challenging regulatory environment of the sector by disposing Browns Hospital in Ragama for a consideration of Rs 1.6 Bn.

PERFORMANCE OF GLOBAL GROUP OPERATIONS

As for our performance in global markets, LOLC achieved the privileged position of having its group company, LOLC Cambodia PLC, achieve billion dollars in assets within a mere six years of entering the Cambodian market. LOLC is making a difference in the Micro and SME landscape by deploying best practices in customer protection, customer experience, risk management and the application of digital technology. Our spirit of entrepreneurship continues to define our growth as we make forays into Africa and explore investment opportunities in India – emerging markets with large populations, which provide fertile ground for our micro finance services. In the last quarter of 2019/20, LOLC received regulatory approval from the National Bank of Cambodia and the Financial Services Commission of Korea to sell the company’s 70% shareholding in PRASAC Micro Finance Institution in Cambodia for US$ 603 Mn. This is a landmark transaction not only for LOLC, but also for the country as it surpasses any private sector foreign transaction carried out in the history of Sri Lanka.

FUTURE OUTLOOK

As a Group, we remain confident about local business growth and expansion no sooner economic and political stability is achieved in the country. The short to medium-term prospects for the leisure business will remain under pressure due to the challenges posed by the pandemic. Our foray into new markets such as Malaysia, India, Africa, Vietnam and South America are in their embryonic stages. The Group will continue to focus on the SME and Micro lending sectors and look to harness the dividends from its overseas investments and continue to empower more entrepreneurs in Sri Lanka and across the shores through our unique microfinance model. The COVID-19 fallout, which will be seen in 2020 and beyond will be the biggest challenge for the management but we have charted turbulent waters in the past and are confident of navigating the year ahead.

APPRECIATION

I would like to place on record my gratitude to the Deputy Chairman and the Board of Directors for their unstinted support. I would also like to thank the regulators, shareholders, funding partners, business associates and customers for standing by the LOLC Group. The staff across the Group has demonst rated t heir commitment and loyalty by working towards making LOLC the most profitable entity.

3. Hatton National Bank

Board of Directors

Jonathan Alles (Managing Director/CEO)

1 Dinesh Weerakkody (Chairman)

2 Amal Cabraal

3 A N de Silva

4 Madu Ratnayake

5 Asoka Pieris

6 Dr L R Karunaratne

7 R S Captain

8 Dr Prasad Samarasinghe

9 Palitha Pelpola

10 P R Saldin

11 Dr Harsha Cabral

12 D Soosaipillai

13 Damien Fernando

Dear Shareholders, 2019 was a year in which Hatton National Bank PLC devoted considerable resources in ‘Framing the Future’. This was necessary as we needed our systems and people aligned to delight customers in the fourth industrial era characterized by disruptive technologies shaping the way we live and work. Inspired by our beginnings in the central hills of Ceylon in 1888 and the transformational journey set out under our ambitious road map, to reach the top, we dubbed it ‘Project Everest’ in May 2018. It has proved an apt analogy as the forces that shaped our business landscape were as uncertain and impactful as the mighty forces of nature on the mountain top. Leadership, confidence, passion, discipline, and teamwork emerged as the critical success factors as we delivered multiple projects and made tough calls in recalibrating strategy to adapt to the forces at play. While the impact of many projects will become visible only next year, early signs of success serve to re-energize our team to deliver the remaining tasks, creating a ‘future ready organization’.

Managing Performance

High levels of uncertainty, a convergence of risks factors and the terror attacks on Easter Sunday combined to paint a bleak business landscape in 2019, necessitating a prudent revision of aggressive growth plans referred to in my 2018 message. Making the right choices became a key imperative and our strengthened analytical capabilities enabled us to seek opportunities that were a right fit with our long-term strategic priorities. Within these operating conditions, HNB Group delivered a balanced performance with a Profit After Tax of Rs 15.0 Bn, and a strong balance sheet with capital adequacy ratios above industry average and regulatory requirements. Net Interest Income increased by 5% for the Group as the Bank exercised a cautious approach towards loan growth and the interest rates declined during the year with the introduction of the deposit rate cap in April 2019, which was subsequently replaced by the lending rate cap in September 2019. Net Fee & Commission Income, which accounts for 15.3% of Net Operating Income, declined by 1.2% for the Group and 4.3% for the Bank as measures to curtail imports of motor vehicles and non-essential consumer goods impacted trade volumes. Consequently, Net Operating Income remained almost flat at Rs 65.1 Bn reflecting our recalibrated prudent growth strategy.

Impairment charges were curtailed to Rs 9.7 Bn by the Bank despite industry wide increase witnessed and accounted for 84.5% of the Group’s credit cost. At Group level the impact from HNB Finance pushed the total impairment to Rs 11.4 Bn due to stresses on its operating model. The success at Bank level was achieved through implementation of the new branch operating model, which facilitated specialization, stronger focus on recoveries and increased rigor of credit monitoring processes. However, in compliance with CBSL directions the Bank classified an exposure of Rs 12.9 Bn to a State Owned Entity, as stage 3, due to an overdue of Rs 1.4 Bn. The full outstanding including interest relating to this exposure is secured by Treasury guarantees. This resulted in the NPA ratio increasing to 5.91% as at end of December 2019. Without this exposure the NPA ratio would have been 4.34%. Increase in Operating Expenses by 12.9% to Rs 36.4 Bn reflect positioning of the Group for growth as a future fit financial powerhouse and an increased claims ratio in our insurance business. Operating Profit before taxes for the Group declined by 13.2% to Rs 28.7 Bn attributable to lower earnings and higher costs to support the transformation. The introduction of the debt repayment levy of 7% on the VAT base in October 2018 for banks resulted in the total effective tax rate of approximately 58% for the industry until end of 3Q 2019. Nevertheless, the regulation issued by the Inland Revenue Department removing the tax applicable on SLDBs in February 2020, with retrospect effect from April 2018 and the relatively lower earnings, resulted in the total taxes for the period reducing by 2% for the Group. Accordingly, Group Taxation was Rs 13.8 Bn and amounted to 48.2% of Profit Before VAT and Tax. Balance sheet growth also moderated during the year as Total Assets increased by a cautious 4.2%. This was largely attributable to growth in investments as the Bank loan book remained flat as we adopted a selective growth strategy in response to the business environment. Total Deposits improved marginally by 2.1% for the Group, while the Bank also raised Rs 10 Bn by way of a Basel III Compliant-Tier 2 Debenture. Equity increased by 9.6% due to retained earnings, strengthening the financial position of the Group. Accordingly, the Core capital and Total Capital ratios stood at 14.7% and 18.1% respectively for the Group, above regulatory requirements, industry average and the Bank’s risk appetite.

Creating a Future Ready Organization

Creating a future ready organization was a key goal in 2019 and it relied on every vertical head delivering on initiatives entrusted to them on time. A new reporting structure, redefining our brand, developing our people and investing in technology were key initiatives that were delivered during the year as explained below.

Geared for Growth

During the year, it became apparent that we need an organization structure that is fit for the organization that we are building. After much deliberation, we launched our future fit structure on January 1, 2020. Operations vertical, which is the core of business ensures that the Bank is on a strong platform in terms of risks management and compliance and on this platform, the Bank would be driving business growth under the two verticals – Retail Banking and Wholesale Banking. Thereon the focus would be on business transformation including IT and Digital to ensure that the Bank is future ready.

Making Banking Enjoyable

Our brand has evolved over decades into a strong franchise that has won recognition both locally and internationally using wide ranging criteria that covered various aspects and overall excellence. In 2019, HNB was awarded the ‘Strongest Sri Lankan Bank by Balance Sheet’ by the prestigious Asian Banker Magazine while Euromoney Magazine named us the ‘Best Bank in Sri Lanka’. In addition to this, business verticals also received recognition for their specializations, which are set out in this report, reflecting the HNB spirit as we seek to push boundaries and shape the future of banking in Sri Lanka.

Framing our future also meant that we had to redefine our brand to reflect the new brand proposition, clearlyarticulating the key aspects that combine to differentiate HNB as we pursue our aspirations to be the leading private commercial bank by the year 2020. My Team and I are excited about where the journey can take us as we reimagine the future of banking.

Teamwork

We have worked as a team to deliver the transformation goals of Project Everest and maintain focus on delivering results in what proved to be a challenging year. I am honored to lead this team through our journey as we test each other’s mettle, forge strong bonds and rely on each other in innumerable ways to achieve common goals. Our training and disciplined approach to accomplishing tasks has proven to be our strength as we delivered transformation that impacted everyone of us. Communication was key and a dedicated working group ensured that everyone was updated on initiatives and progress through multiple channels including structured meetings, newsletters, intranet and our own TV channel.

Over the years, HNB has invested in building capabilities of our team and creating a positive culture that supports realization of career aspirations. A Talent Fitment exercise ensured that we had people in the roles that were best suited to their talents, which was supported by the implementation of a Role Based Training framework. We continued our Leadership Programs to develop a strong pipeline of leaders facilitating succession. These were on top of our regular training activities delivered both face to face and through e-learning, which supported advancement of technical knowledge. Being named Best Employer Brand at the Sri Lanka Best Employer Brand Awards in 2019 and included in the Top Workplaces in Asia at the Asia Corporate and Sustainability Awards and similar accolades prove that we have truly built a great place to work for a happy and bright team.

Delivering Digital Banking

This is the pivot for the bank of the future. Investing in game changing technologies that will disrupt banking as we know it and making banking more enjoyable for customers is the end goal. Our investments in digital capital in 2019 amounted to approximately Rs 1 Bn, which illustrates our commitment to delivering on our vision. A team of IT professionals headed by the Chief Technology & Digital Officer ensure that we adopt cutting-edge technology at an early stage to stay ahead of the curve. Launch of SOLO, the payment app in 2019, was a step forward in our journey. Currently, the Bank is in the process of upgrading the Core Banking system and the Loan Origination system while also implementing a digital layer, which will enable the Bank to improve customer experience through collaborations. IT Governance and cyber security were strengthened and will remain key focus areas. We will continue to invest in this key pillar to realize our vision of making banking enjoyable.

Agenda for 2020

At the top of the agenda is the deliverables of Project Everest. My team is fully committed to delivering these goals and we anticipate completion by the first half of 2021. Forecasts for 2020 point to a recovery of economic growth as fiscal and monetary policy measures announced are implemented. This is expected to provide opportunities for growth within the country as we nurture entrepreneurs to pursue their visions. We will also look beyond our shores for lucrative opportunities for growth with due diligence to ensure alignment with the Bank’s long-term strategy. HNB Assurance and HNB Finance are also positioned for growth and we are encouraged by the strengthened balance sheets and risk management capability, which provide a strong launching pad for growth. ,

Appreciations

Like the journey to Everest, the performance set out in this report required co-ordinated teamwork. I thank the Board for their rigorous oversight of performance and constructive challenge of views, which was key to delivering performance and key milestones in the transformation journey. I extend my sincere appreciation of the work done by the HNB Team who has given of themselves unreservedly to deliver commendable results in an extremely challenging year. I also wish to thank the officials of the Central Bank of Sri Lanka for their assistance in facilitating compliance with regulations. I thank our loyal customers across all our business segments, who have been enthusiastic supporters of our innovations and provided honest feedback of our service standards. This has strengthened our customer value proposition, which has enabled us to differentiate ourselves as we aspire to re-imagine banking. My sincere appreciation to our business partners, who play an important part in enabling us to deliver services to our customers. I thank our shareholders for their continued confidence in a challenging year, as we ‘frame our future’.

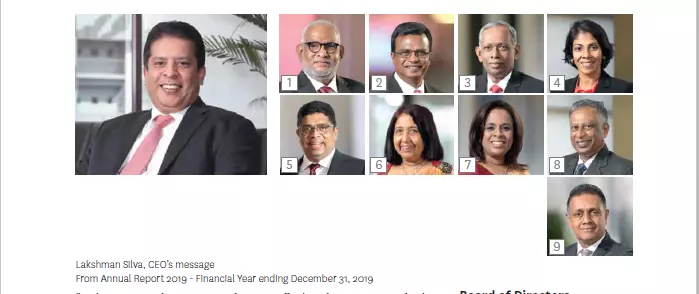

4. Sampath Bank

Board of Directors

Nanda Fernando (Managing Director)

1 Prof Malik Ranasinghe (Chairman)

2 Saumya Amarasekera

3 Sanjiva Senanayake

4 Dhara Wijayatilake

5 Annika Senanayake

6 Ranil Pathirana

7 Rushanka Silva

8 Dilip de S Wijeyeratne

9 Aroshi Nanayakkara

10 Dr Sanjiva Weerawarana

11 Deshal de Mel

As a nation we entered 2019 with a great deal of optimism, which is why it was impossible to come to terms with the cataclysmic impact of the Easter Sunday attacks that would once again thrust our country into dark times. As the entire country reeled in shock, the economy took a heavy toll in the months that followed the April 21st attacks with many key sectors such as tourism, leisure and transport facing the brunt of the impact. Furthermore given the heightened uncertainty surrounding the November 2019 election, it is no surprise that Sri Lanka’s growth forecasts were downgraded with GDP projected to grow by a modest 2.7% in 2019. Amidst this backdrop, the demand for credit too fell sharply. After a rapid expansion during the past three years, we stepped back from the aggressive growth path we had been pursuing and declared 2019 to be a year of consolidation where we would focus extensively on seven key areas:

Credit Quality Management

Having made a conscious decision to scale back on aggressive lending activities in 2019, in light of the weak credit demand, we then turned our attention towards managing credit quality. Taking a holistic approach, we looked at strengthening credit quality management from both the pre-credit and post-credit perspectives. From the pre-credit angle, the key priority was to improve the first line of defense to ensure adequate customer profiling and comprehensive credit evaluation is carried out. This was coupled with extensive training for all front-line and administrative credit officers to reinforce the importance of adhering to the Bank’s credit policy and other protocols to safeguard loan quality.

At the same time, special emphasis was placed on strenghtening our credit card risk management program, which led to several policy-level changes being implemented to take cognisance of internal business developments as well as external changes rising from the immediate operating environment. Meanwhile we moved ahead with plans to revise our risk rating models to support compliance with SLFRS 9 requirements. Taking the first step in this regard we sought the assistance of an international expert to carry out the model validation study. The findings of the study, which we received in the early part of 2019 are now in the process of being incorporated. We also increased the involvement of our risk team in the post-credit monitoring mechanisms, by granting them the authority to initiate watch listing of customers. A series of investments were also made to beef up the Recoveries Department, among them a new delinquency monitoring system to ensure proactive follow up right from initial stage of default/non-payment. New AI-based predictive analysis software was also installed to examine the repayment patterns of existing customers and detect early warning signals.

Alternative Markets

Challenged by the drop in credit demand along with our own conservative approach towards lending, we were compelled to look elsewhere for potential opportunities, which led us to focus on developing offshore lending activities through our FCBU segment. We focused largely on direct lending to large local corporates looking to invest overseas, which enabled Sampath Bank to expand its reach in the Indian subcontinent and the wider Asian region as well as to penetrate a number of new territories in the African region. In testimony to our efforts, I am pleased to note that the FCBU’s offshore lending portfolio registered year on year growth of 8.3% in 2019.

Digital Excellence

As you may be aware, for some years now we have been working on the fundamental premise that digitization is the key to delivering simple, fast and convenient banking to our customers. Since we began this digital journey in 2015, we have invested heavily in expanding, redesigning and strengthening our technology foundation with the aim of completely transforming Sampath Bank’s front-end and back-end operations. Continuing to change the way customers bank with us and pursue their financial goals, we launched the WePay mobile wallet in 2019. As the name itself suggests, the WePay mobile wallet creates a seamless digital platform that allows users to make payments to hundreds of registered merchants across the country through their smart phone. We also appointed over 170 ‘MY BANK agents’ and granted the authority to perform routine banking services with the help of POS terminal, which is digitally connected to the Sampath Bank core banking system. Meanwhile, as part of an aggressive effort to increase the number of customers opting for digital solutions, we began setting up dedicated digital banking areas at selected branches. Thank to these efforts we find more and more customers migrating to digital channels with over 94% of our routine transactions now being performed digitally. Admittedly the awards and accolades we continue to receive further affirm Sampath Bank’s leadership in the digital banking space. In 2019, Sampath Bank made history by clinching an impressive eight awards at the Lanka- Pay Technnovation Awards, including the highly-coveted ‘Most Innovative Bank of the Year 2019’. We have continued to leverage on digital technology to streamline internal workflow systems and simplify our administrative processes with the help of automation and artificial intelligence. Some of the key initiatives implemented in 2019 included the digitization of the customer on-boarding procedure, the FD issuance process and the loan disbursement at the Central Credit Processing Unit (CCPU). These efforts along with the numerous initiatives implemented over the years have created more dynamic and efficient ways of working, which has enabled the Bank to benefit from significant cost savings. In fact I am proud to announce that Sampath Bank’s cost-to income ratio has shownhealthier results in 2019 and 2018 by registering 36.9% and 35.9% respectively, compared to 42.3% in 2017.

Stable Results

I am pleased to report that notwithstanding the challenging environment, Sampath Bank registered stable results for the year ended 31st December 2019. The Bank’s gross income increased from Rs 115.3 Bn reported in 2018 to Rs 118.9 Bn in 2019, a growth of 3.1% driven mainly by fund-based income, net gains from trading and fee & commission income. The Bank’s Net Interest Margin too improved from 4.41% in 2018 to 4.46% in 2019. Regrettably however, our nonperforming 10 loan ratio increased from 3.69% recorded in 0 2018 to 6.37%, as customers who were thrown into crisis following the Easter Sunday attacks began defaulting or delaying repayments. A similar scenario was observed across the industry causing the Banking industry NPLs to rise to 4.7% as at 31st December 2019 from 3.4% at the end of 2018. The heavy tax burden too continued to add to our stress. Sampath Bank’s total tax expenses for 2019 amounted to Rs 11.1 Bn, of which about 20% or Rs 2.2 Bn was attributed to the Debt Repayment Levy (DRL) introduced by the Government in the last quarter of 2018. Seeing the obvious impact on our business, I welcome the proposed decision by the Government to abolish the DRL with effect from January 2020. A culmination of these factors meant Sampath Bank’s Profit before Tax (PBT) for 2019 dropped to Rs 15.5 Bn from Rs 18.3 Bn reported in the previous year, a decline of 15.5%. Profit after Tax (PAT) too declined by 8.2% from Rs 12.1 Bn to Rs 11.2 Bn.

Capital Planning

We continued to remain proactive in our capital raising activities underscoring our efforts to strengthen the Bank’s capital position in line with the Basel III Capital Standards, which were introduced by the CBSL with effect from 1st July 2017. Accordingly, we raised Rs 7 Bn by way of a Basel III Compliant Debenture in February 2019, enabling the Bank to boost its Tier II capital position. In addition, we also added Rs 12.1 Bn to our Tier I capital by way of a Rights Issue in June 2019. I am indeed pleased to note that, thanks to these efforts, Sampath Bank’s Common Equity Tier I, Total Tier I and Total Capital Adequacy ratios stood at 14.22%, 14.22% and 18.12% respectively as at 31st December 2019, well above the regulatory minimum and also notably ahead of industry peers. Further reinforcing our commitment to comply with the Basel III guidelines, our Capital Management Process was revamped and a three-year (2020 – 2022) Capital Management Plan was rolled out at the end of 2019. With this Capital Management Plan we expect to avoid the need for any ad-hoc capital raising activities and to implement a more disciplined approach to support the needs of the business over time and also take into account any impeding regulatory requirements. And in order to ensure capital management activities are carried out more holistically in the future, the new Capital Management Plan was integrated with the Internal Capital Adequacy Assessment Process (ICAAP) as well as the Bank’s Strategic Plan.

Sustainability

For the past decade or so, our focus on sustainability has always gone hand in hand with our business. Staying true to our core competencies, we continue to focus on financially empowering communities by providing them with tools to improve their financial knowledge and spearhead their journey towards gaining access to affordable financial services. By taking this strategic approach towards sustainability, we are looking to position Sampath Bank as an inclusive financial institution with the capacity to contribute to the socioeconomic development of the country. We reinforce this premise through our flagship ‘Sampath Saviya’ Entrepreneurship Development Pro gram series.

In 2019, we broadened the scope of Sampath Saviya program with the intention of reaching out to specific target groups such as MSMEs, youth entrepreneurs, war widows and pensioners. The feedback we received from the participants at these programs is very encouraging, which proves we are on track to fulfiling our sustainability mandate.

Gearing up for the Future

With competitive and regulatory pressures on the rise and numerous other complexities affecting our operating environment, we decided to take a deep dive into our business and critically re-evaluate Sampath Bank’s readiness to face the next decade and beyond. The entire month of September was dedicated towards this exercise with a series of intense brain storming sessions and several focused group sessions held with the participation of corporate management and members of the senior management teams. I too was personally involved in many of these sessions, which gave me a broader perspective of the areas we should focus on going forward. After much introspection, and active debate, we developed the Triple Transformation 2020 (TT20) agenda, which marks the beginning of a long-term transformative journey to reform three core areas; Business, Technology and People. The TT20 agenda comprises of 24 strategic levers – 12 Business based, 6 technology based and 5 people based levers that aim to create a solid foundation for the Bank to move forward over the next three to five years.

Looking Ahead

Looking ahead, I believe the next twelve months will be a crucial period for the Sri Lankan economy. After a very challenging year, it is important that the economy gradually settles into a steady growth pace over the coming months in order to set the tone for the next few years. The recovery of key sectors such as tourism and leisure will be vital in order to increase economic activity and boost investor confidence. Moreover interest rates will need to remain on a downward trend, if a revival in private sector credit demand is to materialise. While it is obvious that we are not in a position to control the impacts arising out of the external environment, there is a lot we can do to become more resilient to these forces, which is why I feel our decision to consolidate was a timely move that provided the opportunity to strengthen our own defences. And as we roll out our TT20 program over the next few months, we will remain heavily focused on shaping up the three core areas (Business, Technology and People) to ensure we have the strongest Business initiatives, most efficient Technology and the best in class team that will put Sampath Bank on track to lead the way to a new era of banking in Sri Lanka.

Appreciations

To conclude, I would like to thank the millions of Sampath Bank customers across Sri Lanka for placing their trust in us. You remain the purpose we are driven to evolve and grow. Accordingly, we remain committed to our ‘Purpose’ as to ‘why’ we exist and that is the reason why, we enable people to manage their money. I take this opportunity to convey my sincere appreciation to our Corporate Management as well as all members of Team Sampath who have proven beyond doubt that they are our greatest asset. A special word of thanks also to Chairman and my colleagues on the Board for their steadfast support, commitment and conscientious stewardship of the Bank. I would like to express my gratitude to the officials at the Central Bank of Sri Lanka, Securities and Exchange Commission, Colombo Stock Exchange, and the Ministry of Finance for their corporation and support throughout the year. And finally to our loyal shareholders and other stakeholders, while thanking you for being part of our journey so far, I assure you that Sampath Bank aims not just to meet but rather exceed your expectations in the years to come.

5. Dialog Axiata

Board of Directors

Supun Weerasinghe (Group Chief Executive Officer)

1 Datuk Azzat Kamaludin (Chairman)

2 Dr Hans Wijayasuriya

3 Mohamed V Muhsin

4 James Maclaurin

5 Mahesh Amalean

6 Willem Lucas Timmermans

7 Mohd Izzaddin Idris

8 Vivek Sood

9 David Lau Nai Pek

10 Dr Nik Ramlah Nik Mahmood

Dear shareholders,

It is with pleasure, I present to you another year of commendable performance of your Company delivered amidst multiple challenges ranging from economic, climate impacts to security concerns. I join the Chairman, Board and extend my sympathies on behalf of the entire Dialog family, to those affected by the unfortunate Easter Sunday tragedy, which marked one of our darkest hours in Sri Lanka’s post-war history. While the tragedy has impacted the entire nation including our own operations, we were able to overcome these challenges with the support of our dedicated team at Dialog, our loyal customer base, our partners, the Sri Lankan Government and the regulatory authorities. We will continue to give back to our society and play our part in supporting our nation to recover from this tragedy. While we have dealt with many challenges over the years, at the time of writing, undoubtedly the most disruptive has been the global outbreak of COVID-19. Amidst the crises, our incredible Dialog team rose to the challenge to ensure that Sri Lanka stays connected and safe during the period whilst fully supporting the tireless efforts of the Government’s fight against COVID-19 pandemic in the country. I wish to commend the team’s efforts throughout the year 2019 to expand our business, grow our revenues, serve our customers, rescale our cost structures and deliver a solid performance, while navigating through a difficult 2019. I believe that these lessons learnt will hold us in good stead as we reset and reimagine all facets of our business and redefine our approach to thrive in the ‘new norm’. PERFORMANCE OVERVIEW Dialog Axiata PLC recorded consolidated revenue of Rs 116.8 Bn, which represents a 7% YoY growth, which was accompanied by growth in our subscriber base, adoption of Broadband services and usage growth. The growth in the top line, widening of our product portfolio as well as cost rationalization initiatives resulted in a combined Group Earnings Before Interest, Tax, Depreciation & Amortization (EBITDA) of Rs 46.7 Bn, which represents a 7% YoY growth in FY 2019. The Group EBITDA Margin reached 40% in FY 2019, representing a Supun Weerasinghe (Group Chief Executive Officer) 1 Datuk Azzat Kamaludin (Chairman) 2 Dr Hans Wijayasuriya 3 Mohamed V Muhsin 4 James Maclaurin 5 Mahesh Amalean 6 Willem Lucas Timmermans 7 Mohd Izzaddin Idris 8 Vivek Sood 9 David Lau Nai Pek 10 Dr Nik Ramlah Nik Mahmood 2.2 percentage points (PP) improvement compared to the previous year.

In addition to the above, reduction in Finance Expenses and the drop in forex losses owing to a stable exchange rate relative to the previous year resulted in a 43% YoY growth in Net Profit After Tax (NPAT) amounting to Rs 10.7 Bn for FY 2019.

DIVIDENDS TO SHAREHOLDERS

Given your Company’s commendable performance in FY 2019, I am pleased to announce that the Board of Directors has recommended a total dividend payment of Rs 4.3 Bn, which translates to a dividend of 53 cents per share. This corresponds to an increase of 43% compared to 2018 and a dividend payout of 40% consistent with the payout for the previous period.

CONTRIBUTIONS TO THE GOVERNMENT OF SRI LANKA

Dialog continues to remain a significant contributor to the Government of Sri Lanka, remitting a total of Rs 33.6 Bn to state finances in FY 2019. Recognizing the pivotal role of digital and connectivity technologies, which supports the transformation of Sri Lanka into a ‘future-ready’ economy, the Government saw fit to provide a relief to end consumers with a reduction in consumer taxes towards the end of 2019, which resulted in a reduction in the contribution of consumption taxes, which amounted to Rs 22.3 Bn in FY 2019. I am pleased to report that your company paid Rs 11.0 Bn in direct taxes to the Government of Sri Lanka, which represents a 20.2% increase YoY. We continue to be the largest contributor of Foreign Direct Investment (FDI), investing approximately Rs 28.6 Bn in 2019, which represents 20.7% of Sri Lanka’s FDI for the year. Dialog, along with our valued investors, holds the distinguished position as the #1 FDI in the country with a total investment of USD 2.7 Bn since inception showcasing the trust and confidence placed in the Government and people of Sri Lanka. During the year under review, the Government of Sri Lanka identified the importance of creating a technologybased society and proposed several macro-economic, institutional and regulatory reforms to promote digital entrepreneurship and inclusivity.

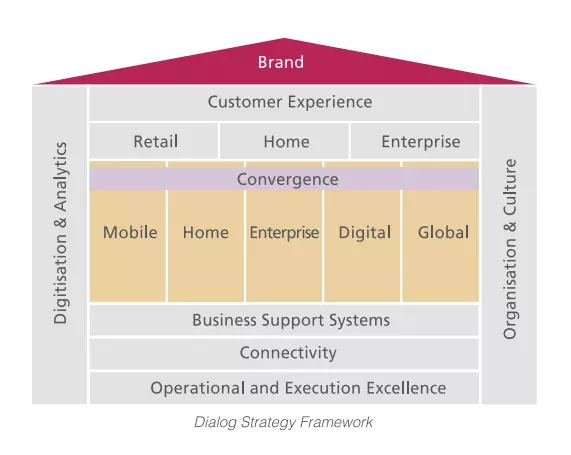

OUR STRATEGY, BUILDING VALUE AT THE CORE

At the pinnacle of the Dialog strategy remains the Dialog Brand, Customer Experience and Service Excellence, which is espoused in our ‘Service from the Heart’ core value. The Go to Market focus encapsulates our defined approach to serving the Consumer, Home and Enterprise customer segments.

SERVICE FROM THE HEART

As we consistently strive to be a consumer champion, our dedication towards delivering on our core value

‘Service from the Heart’, places customer experience and service delivery excellence at the centre of Dialog’s work ethic and corporate ethos. The Primary customer experience goal of Dialog has been to provide personalized experiences throughout the customer journey, encompassing all touchpoints and the entire customer lifecycle. This translated into not only simplifying and digitalizing our manual processes and channels but doing so with a segmented and hyper-personalized approach. Every phase of the customer journey from Awareness to Consideration, Order to Activate, Usage to Bill, Bill to Cash, and Trouble to Resolve had to be assessed and human-centric digital platforms were developed to serve our customers. Dialog also identified that there was a requirement to meet customers in spaces where much of their digital lives were spent. This meant enabling services such as Facebook Messenger as fully functional customer service channels, alongside personalized customer service interactions serving across all channels, including social media, to create a consistent, omnichannel experience for all customers, even for those without smartphones (via SMS or USSD). We are witnessing a shift in customer inquiries from traditional to digital, as evidenced by the 9.8 Mn inquiries we received on digital channels in 2019. Furthermore, MyDialog App, which provides our users with complete control of over 350 Dialog services surpassed the 4 Mn download mark during the period under review, illustrating the value addition made to users through accessibility, innovation and convenience.

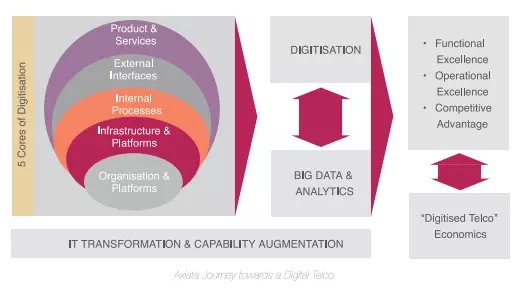

BUILDING THE NEXT GENERATION DIGITAL TELCO

Dialog continues to accelerate its digital transformation programme, which was launched in 2017 to ensure we remain relevant to our customer and continue to deliver world-class digital experiences at an affordable price. In this regard, your Company made significant headway in digitizing the customer experience throughout its journeys encompassing all touchpoints and the entire customer lifecycle. The digitization drive has brought in significant cost savings to the Group while simultaneously delivering superior customer experience. These actions have led to 100% automation of distribution channel activations, 72% automation of kiosk transactions, top 80% automation of the manual processes, and 50% of all payments being automated, leading to an overall 1.6% upliftment of EBITDA. Furthermore, the company’s new MyDialog digital self-care app is the most downloaded telecom app in Sri Lanka, with more than 4.5 million downloads and a rating of 4.4 on the Play Store. Digitisation of the retail space has been a key focus area during 2019, with ‘Retail Hub’ enabling our 25,000 strong retail partners to the Retail Hub digital platform to perform key operations previously done manually. In the most progressive way to automate the onboarding process, Dialog introduced ‘Dialog Retail Hub’, a secure and fully standards-compliant platform that is future-ready to provide a complete digital customer experience. Retail Hub is Sri Lanka’s first-ever true end-toend Digital Customer Onboarding Platform that transformed and fully automated the retail landscape, thus digitising the most critical Customer Channel interface for Dialog and providing customers with a positive onboarding experience. We will continue to accelerate digitisation across all dimensions of our business, including upskilling our team with digital skills and leveraging the power of analytics to complete the transformation to a digital telco.

Enterprise Business

Dialog Strengthened its Enterprise Business via the establishment of Connectivity, Collaboration, Business Networking, Security & Surveillance, Cloud & Co-location and IoT platforms. Recognising the changing demands of businesses and to further strengthen our Enterprise portfolio, we established a dedicated Enterprise business unit for our business customers to support them in their digital transformation journeys and become a reliable partner by offering technical expertise, advanced solutions, best-in-class services and converged technologies. This is further supplemented by Dialog’s TIER III Data Centre extending the very latest in hosting and co-location services alongside a suite of Cloud services to Sri Lanka’s Enterprise and Public sectors and the Company’s adoption of a multi-cloud strategy, which offers enterprise customers critical capability in today’s new digital economy by adopting different cloud services and features from multiple service providers.

Dialog also launched Sri Lanka’s first fully managed Software Defined Networking (SDN) platform – FlexNet, thereby providing a cloud-ready platform for businesses to manage their connectivity and networks. Looking ahead at the future of Enterprise offerings, we aim to facilitate Sri Lankan Enterprises with world-class solutions across multiple domains of digital transformation including but not limited to Cloud, IoT, AI and Advanced Connectivity.

SEGMENTAL REVIEW

Mobile Dialog Axiata PLC, which comprises of Mobile, International, Tele Infrastructure and Digital Services continued to reaffirm the many awards and recognitions it was bestowed with during the year, by strengthening its position as the market leader, where we recorded a subscriber base of 14.9 Mn by the end of FY 2019, which represents an approximate 9% growth over 2018. The mobile business contributed to a lion’s share of Revenue and EBITDA, accounting for 71% and 76% of Group performance in FY 2019 respectively. Revenue for the Segment stood at Rs 82.6 Bn in FY 2019 which is a 2% dip, primarily due to the realignment of the International wholesale business to Dialog Broadband Network (DBN); a fully owned subsidiary of the group. In contrast, the segment recorded an EBITDA of Rs 35.5Bn and NPAT of Rs 11.6Bn over the same period, which represents a growth of 17% and 165% respectively.

Fixed Broadband

In line with the Company’s vision of delivering affordable and accessible world-class internet services to all Sri Lankans, Dialog Broadband Networks (DBN) recorded a revenue of Rs 28.1 Bn for FY 2019, representing a 64% YoY growth and a 24% contribution to the group’s top-line performance. The revenue growth has been driven by an increase in data consumption, where during the period under review, we announced a range of ground-breaking per-day Home Broadband packages enabling customers to enjoy the lowest data rates ever brought to market. The wide range of per-day home broadband packages provides cost-effective solutions to data usage across diverse segments and caters to their usage requirements.

International Business

Dialog’s voice roaming was expanded to reach 230 destinations while our LTE roaming footprint was expanded to 142 countries globally. We expanded our wholesale voice aggregation business and strengthened Sri Lanka as a regional hub for data connectivity. Furthermore, Dialog signed a partnership agreement with Ooredoo (Ooredoo Maldives PLC) and Dhiraagu (Dhivehi Raajjeyge Gulhun PLC) Maldives to lay a submarine cable system between Sri Lanka and Maldives to become a regional carrier and serve IP requirements of the region. Our efforts in International business resulted in an EBITDA of Rs. 9.2Bn, which adjusting for a one-off gain recognised in FY 2018 amounts to an 11% YoY growth in FY 2019. However, NPAT for the segment declined and stood at Rs 411 Mn by the end of the period.

Television

Our continuous commitment to enhancing the entertainment experience of our loyal viewers savour endeavours recognised when Dialog Television reached 1.4 Mn households across the nation, representing a robust 26% growth in our subscriber base. The revenue of Dialog Television Group (DTV), which includes the Digital Pay Television business of the group followed a similar trajectory with a 17% YoY growth for FY 2019 amounting to Rs 8.8 Bn and we are happy to report a 31% YoY improvement in DTV’s EBITDA amounting to Rs 2.4 Bn and a narrowing of the segments net loss to Rs 541 Mn. Dialog Television’s broadcast services have been migrated to a new satellite with the aim of delivering an improved broadcast experience.

Digital services

Dialog has strengthened its presence in the digital space and has focused its efforts on a limited portfolio of services that can leverage the core business of the Company. During the year 2019, Dialog exited from the e-commerce space, with the integration of WoW.lk with Kaymu Lanka (Pvt) Ltd. Digital Services Business will in the main, focus on fintech, wherein Dialog will work towards digitising micropayments/ lending/savings, to extend affordable financial services to the consumers at the base of the pyramid.

Our focus on fintech through Dialog Finance, eZ Cash and Genie has been a key contributor in advancing digital connectivity and enabling cutting-edge Financial Technology (fintech) to deliver a suite of products and services thereby expanding financial inclusion in Sri Lanka. IdeaMart, our developer ecosystem, launched an award-winning innovative product – APPMAKER – an Android application creation solution, successfully hosted Google I/O Extended for the 4TH consecutive year, and launched the ‘Ideamart for Women’ initiative with a vision of empowering the Sri Lankan female developer community. Joining the ranks of these innovative digital services are Doc990 – Sri Lanka’s fastest growing online Doctor consultation platform, Guru.lk – the largest digital education platform of its kind in the market, InsureTech – first of its kind solution in Sri Lanka offering exclusive value-added micro-insurance services to over 4.5 Mn customers, InsureMe – Dialog’s Digital presence in the broker model providing customers with the ease of buying an insurance policy by comparing with different underwriters, and 444 – Sri Lanka’s largest location-based booking platform. In 2019, Dialog gained global recognition for its affordable and purposebuilt IoT solutions for industries in emerging markets at the GLOTEL awards and led the way in the IoT front with its award- winning initiatives including IoT enabled smart-grid solution to introduce Prepaid Electricity Metering & SMART Infrastructure monitoring & Automation in Sri Lanka. Dialog also partnered with the Health Informatics Society of Sri Lanka (HISSL), to establish a ‘Digital Health Innovation Laboratory’, the first of its kind in the country, to incubate innovative digital solutions for the healthcare sector.

IT PLATFORMS/BUSINESS SUPPORT SYSTEMS

We continue to transform the IT infrastructure for future-ready agile IT by modernizing and containerizing legacy core, while scaling up and enabling the BSS ecosystem to support Enterprise Business with stepping out and increasing cloud infrastructure footprint. The ‘API-ification’ of Dialog’s legacy BSS was another critical step towards our transformation to a Digital Telco. Legacy BSS is in the process of being replaced gradually, wherever possible, as part of a migration to a cloudnative and microservice architecture. By fronting legacy BSS with APIs, Dialog can accelerate upper layer, customer experience-related development using APIs, while continuing to work around and then replace legacy platforms with cloud-native components. Dialog has continued to improve its skill with consolidating multiple systems into one, as with its CRM infrastructure, which had disparate systems for each business unit. Similarly, customer data had to be consolidated to one data lake to support Analytics and AI efforts.

CONNECTIVITY

We will continue to lead in the connectivity space where we invest continuously on new technology applications to be future-ready in all aspects of operations and be ready for 5G technology rollout in the next few years. We are currently reaching the last phases of transiting 2G and 3G subscribers to 4G technology. We continued to invest in Fibre connectivity and work with the Government to ensure that the rollout takes place in a viable and cost-effective manner. We added 329 4G sites to our mobile network, expanding mobile 4G population coverage to 92% whist continuously adding capacity to maintain data experience at an average speed of 5Mbps.

OPERATIONAL EXCELLENCE

Dialog has an aggressive Cost Rescaling (CRS) program, which has been running for the last few years and has facilitated greater operational excellence and support towards bottomline improvement in the year 2019, which was a challenging year given the unfavourable externalities.

ORGANIZATIONAL TRANSFORMATION & CULTURE

Our 3,000-strong team consists of steadfast individuals responsible for leapfrogging competition and exceeding expectations. Hence, it is of the utmost importance that we retain highly skilled employees in Sri Lanka to sustain current business ecosystems, which enable Dialog. Dialog Axiata Digital Jam 2019 is one such platform, which saw our employees compete in a wide array of challenges for a multitude of different prizes in the spirit of friendly competition. Additionally, employees have the chance to hone their analytical and critical thinking skills through the elearning portal, Lynda, where a total of 89,180 training hours was recorded in conjunction with the LinkedIn training offered. Perceptive to the needs of employees in our increasingly digitized landscape, we trained 54 highly talented individuals in the field of data science. The launch of our ‘Agile’ program saw the training of 2,255 employees through the use of classrooms and LinkedIn amounting to a total of 6,725 training hours. Our senior leadership team is responsible for heading strategic planning, growing our market and innovation administration, driving budgetary execution, fortifying our brand image and acquiring the highest skilled employees our labour market produces. The Sustainability Report for 2019 discusses the contribution of our people towards driving your Company forward. Implementing this degree of successful change across the entire organization while remaining nimble and improving both customer experience and bottomline continues to be a tremendous challenge. Change had to be driven across the Company and involved substantial investments in up-skilling existing talent and hiring new digital skills.

CORPORATE SUSTAINABILITY

The tragic events on Easter Sunday 2019 marked a period our nation was faced with one of the most perilous of challenges in its post-war history. Despite the tragedy, the eagerness demonstrated by Sri Lankans, corporates, and those around the world to help those most in need and give them the necessary strength to overcome adversities created a new sense of hope. With their generous support, the ‘Rally to Care’ initiative by Dialog Foundation established a fund amounting to Rs 116.69 Mn. Dialog Foundation, along with our partners and the whole-hearted support of our employees, launched many programs to enable immediate-term out-patient support for victims of physical disability and trauma, and psychosocial rehabilitation for the affected families by setting up the Life Healing Centre in Katuwapitiya. Rally to Care also facilitated longterm educational support through the ‘Shilpa Diriya’ program with the Archdiocese of Colombo, where 185 affected children in Katuwapitiya and 102 affected children in Kochchikade were awarded long-term scholarships. Furthermore, 66 affected children in Batticaloa were also granted long-term scholarships by the Rally to Care initiative. Accordingly, the Rally to Care Initiative has granted 353 scholarships to children affected by Easter Sunday incidents and will ensure they receive financial support to complete their school education. The scholarships will continue to be available to these students until they reach the age of 19.

Strengthening Local Livelihoods and Businesses