The Bank of Ceylon (BOC) has shown remarkable strength in H1 2025, highlighting its important role in our national economy. With a Profit Before Tax (PBT) of 59.4 billion rupees, their success reflects not only financial resilience but also a genuine commitment to facing challenges.

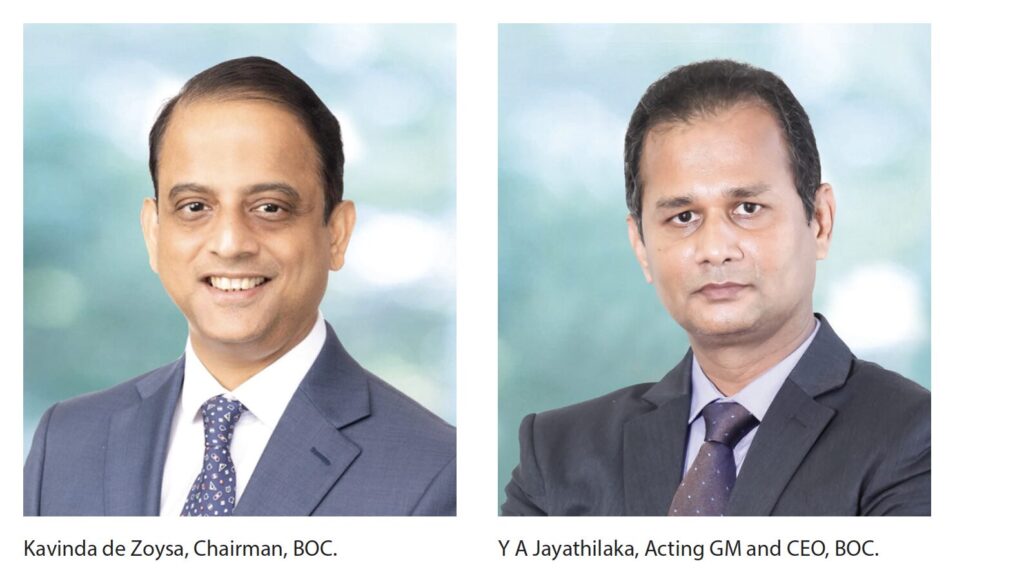

Kavinda de Zoysa, Chairman, BOC stated, “Building on 86 years of trusted service and our strong performance in the first half of 2025, we remain dedicated to reinforcing our leadership in Sri Lanka’s banking sector. Amid an improving and progressively resilient economic environment, our continued focus on operational excellence, customer-centric innovation, and prudent risk management has enabled us to maintain robust profitability and improved capital strength. We are committed to delivering superior customer service, advancing our digital transformation agenda, and launching new digital services and sustainable banking initiatives to meet the evolving needs of our customers. As we look ahead, we remain steadfast in our commitment to sustainable growth, inclusive economic development, and investing in our people to drive long-term success.”

BOC reported robust financial results with a Profit Before Tax (PBT) of 59.4 billion rupees, driven by a 79 percent increase in net interest income (NII), which reached 102.7 billion rupees. Interest income rose 15 percent to 244.8 billion rupees, while interest expenses declined nine percent to 142.1 billion rupees, enhancing the net interest margin. Non-fund-based income also contributed, with net fee and commission income up nine percent to 10.9 billion rupees, propelled by higher transaction volumes in card services, retail banking, and remittances. The growth reflects BOC’s commitment to innovation and customer-centric service. Operating income increased by 75 percent to 120.3 billion rupees, with operating expenses rising only nine percent to 33.6 billion rupees, resulting in a cost-to-income ratio of 31.24 percent. Operating profit before taxes reached 75.1 billion rupees. After taxes and income tax expenses totaling 39.1 billion rupees, the Bank’s Profit After Tax was 35.9 billion rupees. BOC’s strong growth and expense management highlight its strategic execution and significant contribution of 39.1 billion rupees in taxes to the national economy.

Y. A. Jayathilaka, Acting GM/ CEO said, “As Bank of Ceylon celebrates its 86th anniversary, we take pride in our legacy of trust and resilience. Since 1939, we have supported our customers, empowered businesses, and fostered community growth across Sri Lanka. Our strong performance in 1H 2025 reflects our enduring spirit. We are committed to innovation, sustainability, and creating opportunities for all Sri Lankans, continuing to be the steadfast ‘Bankers to the Nation’ and enriching the lives we touch.”

In 1H 2025, BOC maintained proactive credit risk management amid economic challenges, recognizing a 12 billion rupee impairment charge on loans and advances. The Stage 3 loan ratio was 7.13 percent, with expected improvements from SOE restructuring. The Stage 3 provision coverage ratio stood strong at 54.39 percent, reflecting the Bank’s commitment to conservative provisioning and effective risk mitigation.

As of June 30, 2025, BOC’s total assets reached 5.3 trillion rupees driven by government securities investments. Gross loans and advances rose to 2.5 trillion rupees, reflecting muted credit demand, while deposits grew by five percent to 4.4 trillion rupees, indicating strong customer confidence.

BOC reported solid KPIs, with a Return on Assets (ROA) before tax of 2.31 percent and a Return on Equity (ROE) after tax of 22.78 percent.

The net interest margin improved to 4.00. The bank’s capital base was strong, with a Common Equity Tier 1 ratio of 12.27 percent and a Total Capital Ratio of 17.37 percent, surpassing Basel III requirements. Liquidity coverage ratios were robust at 306.00 percent for local currency and 273.14 percent overall. In 1H 2025, BOC raised 15 billion rupees through Basel III-compliant Tier 2 debentures.