July 21, 2025. Paul Hoffman.

With Donald Trump announcing a USD 92 billion investment in energy and AI infrastructure, and SoftBank, OpenAI, and Oracle investing USD 100 billion in the initial phase of the ‘Stargate’ project, I am reaching out to share our latest analysis of venture capital-backed AI startups and the largest funding rounds so far this year.

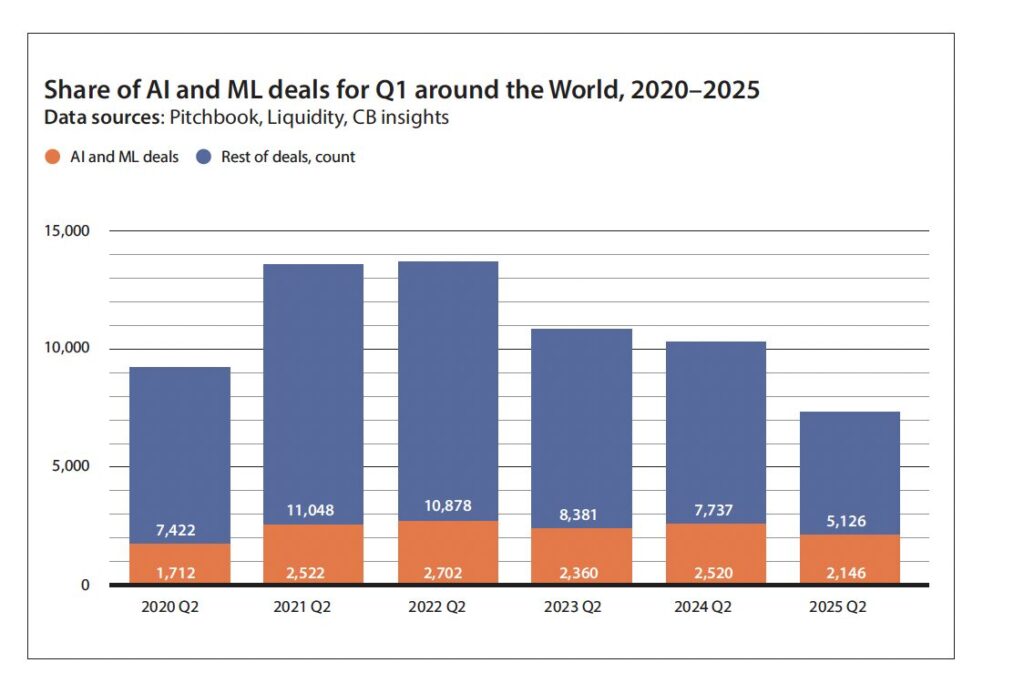

The most recent figures reveal that in the second quarter of 2025, the number of venture capital deals fell to a nine-year low of 7,272. Of those, 2,146 or roughly 29.5 percent were investments in artificial intelligence startups.

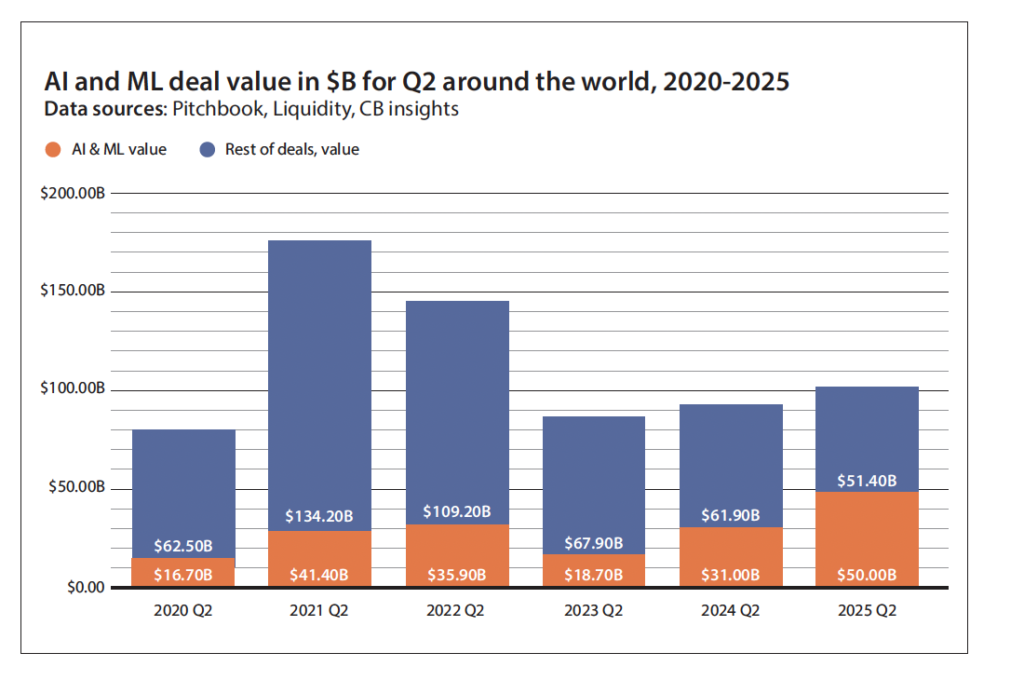

This number of AI-focused deals (less than a third of all), however, raised approximately USD 50 billion in funding or around half (49.2 percent) of the entire venture capital investment for the quarter.

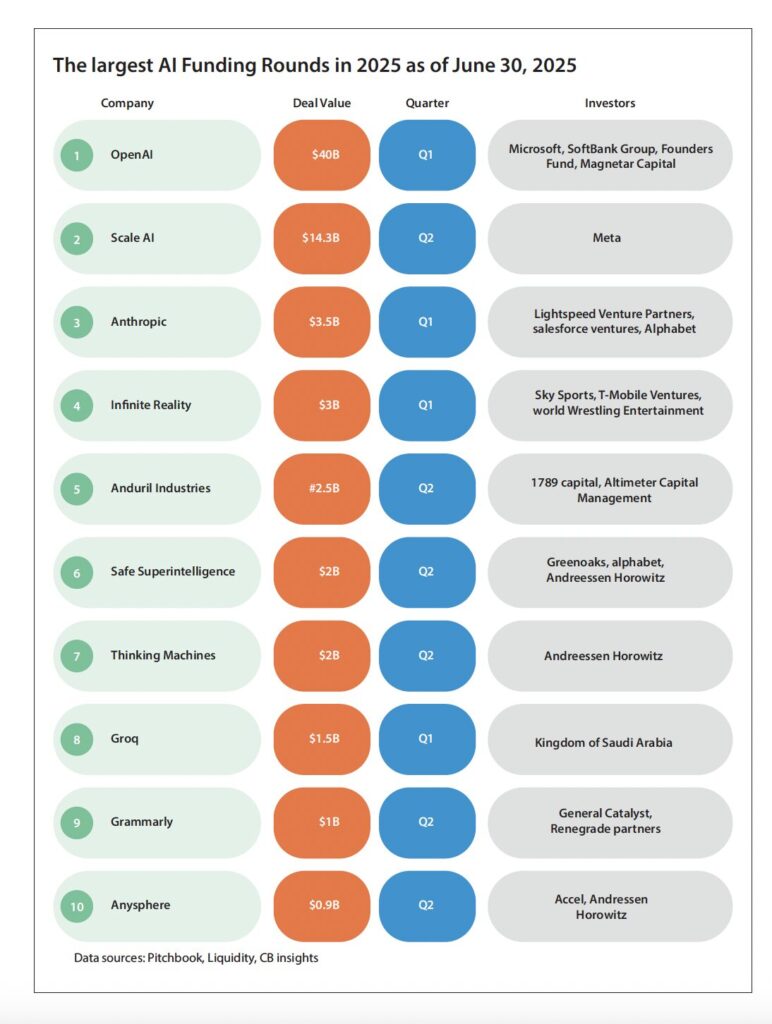

Here are the biggest AI funding rounds so far this year:

OpenAI – USD 40B

Scale AI – USD 14.3B

Anthropic – USD 3.5B

Infinite Reality – USD 3B

Anduril Industries – USD 2.5B

Safe Superintelligence – USD 2B

Thinking Machines – USD 2B

Groq – USD 1.5B

Grammarly – USD 1.1B

Anysphere – USD 0.9B

Software as a Service (SaaS) firms started drawing in the most money, which changed in 2024 when artificial intelligence and machine learning (AI & ML) startups gained traction following the unprecedented success of OpenAI’s ChatGPT.

Other facts and figures from our research

- There were only 7,272 venture capital deals in the second quarter of 2025, the lowest count since Q3 of 2016, when VC firms invested in 7,264 startups. Nine years ago, the combined funding for these startups totalled USD 43.1 billion; in Q2 2025, this amount ballooned to USD 101.5 billion.

- In the second quarter of 2025, AI startups attracted USD 50 billion in venture capital funding, a 30.6 percent drop from Q1’s historic high of USD 71.9 billion. The number of AI-focused deals also plummeted from 2,689 in the first three months of the year, they fell to 2,146 in Q2.

- Since the beginning of the year, venture capital firms have invested a total of USD 229.9 billion in startups in an estimated 16,565 deals. Of those, AI-focused funding reached USD 121.9 billion in roughly 4,835 deals.

- Meta’s USD 14.3 billion bid in Scale AI was the largest AI investment this quarter, and the second highest this year after OpenAI managed to secure USD 40 billion from the likes of Softbank, Microsoft, the Founders Fund, and Magnetar Capital.

Between 2015 and 2018, the sector attracting the largest funding from venture capital firms was Technology, Media, and Telecommunications (TMT). Then, Software as a Service (SaaS) firms started drawing in the most money, which changed in 2024 when artificial intelligence and machine learning (AI & ML) startups gained traction following the unprecedented success of OpenAI’s ChatGPT.

This is how much venture capital firms invested in startups and the number of deals completed in the first half of 2025:

-

AI and Machine Learning – USD 121.9 billion in 4,835 deals

-

SaaS – USD 107 billion in 3,861 deals

-

Big Data – USD 74.50 billion in 1,049 deals

-

Cloudtech and DevOps – USD 45.60 billion in 296 deals

-

Fintech – USD 23.70 billion in 1,778 deals

-

Manufacturing- USD 19.20 billion in 2,087 deals

-

Life Sciences – USD 19.10 billion in 1,282 deals

-

Healthtech – USD 18.50 billion in 1,504

-

Mobile- USD 16.90 billion in 1,374 deals

-

Cleantech – USD 14.60 billion in 1,318 deals

-

Robotics and Drones – USD 13.70 billion in 627 deals

-

Technology, Media and Telecommunications – USD 10.80 billion in 477 deals

-

Climate Tech – USD 10.60billion in 744 deals

-

Lifestyles of Health and Sustainability (LOHAS) and Wellness – USD 8.30 billion in 1,106 deals

-

Advanced Manufacturing – USD 7.70 billion in 560 deals

-

Mobility Tech – USD 7.60 billion in 273 deals

-

Cryptocurrency/ Blockchain – USD 7.30 billion in 748 deals.