BUSINESS TODAY takes pleasure in presenting once again its choice of the TOP 10 Sri Lankan companies for the financial year 2006 – 2007. The Business Today TOP 10 is chosen based on a selection process devised and refined by Business Today. Companies identified by Business Today as its TOP 10, have amply justified their selection to the elite list more often than not, by out-performing those companies that had reigned as business champions in the past.

In the Year 2006 Sri Lanka achieved a GDP growth rate of over 7%. The achievement is commendable given the economic and political challenges faced by the country. Less than desirable security conditions and economic setbacks such as increasing oil prices, increasing interest rates, adverse inflationary conditions etc. was the backdrop in which the economy moved forward although falling short of target. A strong and resilient Sri Lanka private sector must be credited for its continuing role towards growing the economy, and the importance of the service sector led by Telecommunications, Transportation, Trade and the Finance sector must be acknowledged in the overall wealth creating process.

Business Today, true to its reputation as the Magazine of the Corporate World has since 1998 regularly conducted its own survey of top corporate performers and recognised and honoured the best of the best. The annual survey is strictly based on published financial information of private sector companies listed on the Colombo Stock Exchange. Continuing in its service of recognising and celebrating business excellence, Business Today is yet again pleased to present its TOP 10 performers for the year 2006-07.

As observed in the past, competition for a position in the TOP 10 ranking is intense and close ly contested. Those regularly securing a place in the list have done so through consistent performance, consolidation and growth. Some entered and exited the ranking due to inconsistency in performance and/or because of stronger contenders that emerged. The Business Today TOP 10 performers must be proud of their success whilst those aspiring for a place in the list, should feel inspired and encouraged by the more recent entrants. Companies that have been/or are in the Business Today TOP 10 know what it takes to excel, and would be determined to hold or improve their future places in the ranking.

Business Today is steadfastly and unreservedly committed to offering equal opportunity and a level playing field to all public quoted companies of acceptable and comparable size to seize a place in its ranking, the only other condition being that they rate high on the Business Today disclosed criteria.

Established financial criteria applied to select the TOP 10 are Sales Turnover, Growth in Sales Turnover, Profits, Growth in Profits, Return on Equity, Earnings per Share, Market Capitalisation, Value of Shares Transacted and Value Addition. A high and growing top line performance by companies although necessary is not sufficient to qualify as a top performer in the absence of profits.

As in the past, weights applied to the respective criteria are not disclosed for proprietary reasons. Business Today assures that weights were assigned to the above criteria after due consideration to significance of the criteria and ensuring all business sectors are equitably represented. Weights are applied uniformly without prejudice.

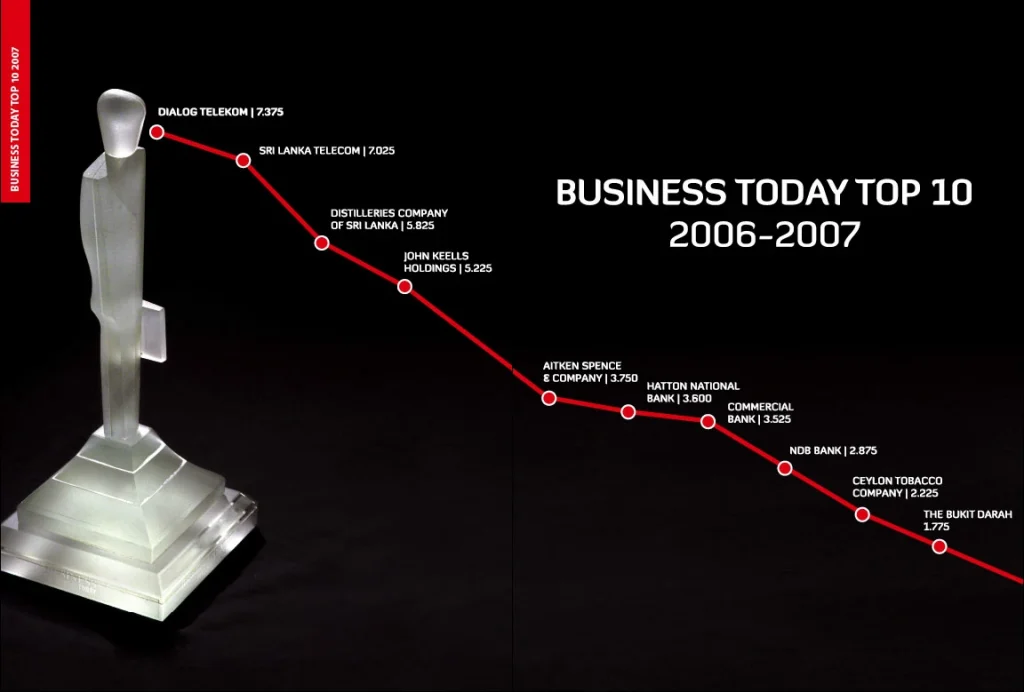

A clear and simple observation of the latest TOP 10 ranking is the superior performance of the top mobile and fixed line telecom operators. Their top two positions with scores well above other top companies is a reflection of their market attractiveness and above average growth levels. It is interesting to note that the third best company in the TOP 10 ranking too probably holds a lead position in the CDMA market.

The Finance and Banking sector which stood tall above other sectors as seen in earlier TOP 10 rankings moved down in the TOP 10 ranking later, due to, initially aggressive conglomerates, and then subsequently dominant telecom operators. Only knowing too well that the financial sector cannot be kept down for too long, it is not unrealistic to assume that the sector will return to higher positions in future TOP 10 rankings sooner than later.

A general TOP 10 observation over the years is the absence of companies in the manufacturing sector save Ceylon Tobacco Company and Distilleries Company. Distilleries has moved up the ranking in recent years after its acquisitions of Sri Lanka Insurance and Aitken Spence, two large players in the Services Sector. The Bukit Dhara Company, a relatively recent entrant in the rankings, derives a sizable portion of its profits from manufacturing and processing through its brewery operation in Sri Lanka, but more significantly its plantation and palm oil processing operations overseas. It is pertinent to mention that some of the other large manufacturers remain unquoted, hence unfortunately cannot be considered in the ranking due to inaccessibility of information in the public domain.

A worrying concern though is the relative performance of some top blue chips in the country that were the pride and glory of corporate Sri Lanka a decade ago. Caught up in tradition and unable to break away from a mindset probably embedded in a culture out of step with a world in which change, agility and convergence is the norm rather than the exception, these companies lag in enterprise. They however understand the meaning of success and have the capacity to recalibrate their Business GPS towards reclaiming their place, and we hope they would.

As a rule of thumb, the Business Today TOP 10 ranking could be viewed as a Vision Board of the Corporate World. A quick analysis over the years provides a general overview of the general business trends. Before introducing the latest TOP 10 companies, Business Today places on record its deep appreciation of and admiration for all companies and conglomerates that have nurtured and shaped the Sri Lanka business landscape.

Distilleries is an outstanding privatisation success story in its own right and subsequently went on to acquire yet another government owned organisation, the Sri Lanka Insurance Corporation and converted it to another success. The company is the top performer in the TOP 10 ranking of Sri Lankan ownership. At time of privatisation, just a distillery, today it is a large conglomerate with diverse interests spanning, beverage, plantations, financial services, telecommunications, manufacturing among many others. The company also owns the Aitken Spence Group, also securing a position in the TOP 10 ranking.

Dialog Telekom, the Business Today Top Company for the year 2006/07 holds a distinct position in Sri Lanka. Entering the mobile telephony industry behind three earlier entrants Dialog Telekom emerged as market leader by redefining the Sri Lanka mobile telephone market with good foresight and extraordinary courage. The success of the company could be primarily attributed to its visionary leadership supported by a reservoir of human talent, an entrepreneurial and success driven culture and the strong financial backing of Malaysia Telekom, parent company of Dialog Telekom, who believed and invested in the company despite volatile ground conditions.

Dialog Telekom could be considered fortunate to have entered the Sri Lanka telecom market at the right time, but due credit should be given to the company for leaping from fourth position to first by investing and introducing the appropriate technology, developing the market and consistently adding value, and in the process bringing pride to Sri Lanka by setting the trends for mobile telephony in the region.

As reported by the company, profits grew by 44% in 2006 – recording the highest profit among all publicly listed companies in the country. Pre tax profit was Rs.10.19 billion and Post tax profit was Rs.10.12 billion. The CEO in his review of operations stated, “Financial performance is but the final outcome of a well orchestrated and coordinated effort to deliver growth through innovation, efficiency, speed and customer centered business practices. Our efforts in 2006 spanned a wide spectrum of objectives driven by our vision to empower and enrich Sri Lankan lives and enterprises.”

By end of 2006 Dialog Telekom had increased its customer base to over three million, representing 60% of the mobile market then. With a view to positioning itself to benefit from communication convergence, the company completed four acquisitions during the year. Envisioning a market that knows no borders, Dialog Telekom embraces a corporate philosophy that seeks to create new and at times unseen markets, while paying equal emphasis to expanding.

Sri Lanka Telecom held its position at number two in the rankings closely trailing the top performer. A privatisation success story, the company has since privatisation experienced exceptional growth in both its top and bottom lines and is a key player in the Sri Lanka telecom industry.

The company recorded a turnover of Rs.40.7 billion, an improvement of nearly 25% over the previous year. Operating profits increased by 66%. Pre tax profit was Rs.9.2 billion and post tax profit was Rs.5.4 billion, thereby contributing Rs.3.8 billion as taxes to the government further to other levies amounting to Rs.2.7 billion.

Profitability allowed the company to invest Rs.11 billion in new and ongoing projects during 2006. Since privatisation, SLT prides itself of having a world-class network, and uses state of the art technology. SLT leads the Sri Lanka fixed telephony and Internet markets, and is at present expanding its mobile telephony business through its fully owned subsidiary, Mobitel, aggressively investing in the network, new technology and brand. In 2006, SLT established its first overseas subsidiary in Hong Kong, signalling its intent of connecting Asia with the rest of the world through Sri Lanka.

Distilleries Company, the Business Today TOP 10 winner last year secured third position in the 2006 ranking. Distilleries is an outstanding privatisation success story in its own right and subsequently went on to acquire yet another government owned organisation, the Sri Lanka Insurance Corporation and converted it to another success. The company is the top performer in the TOP 10 ranking of Sri Lankan ownership. At time of privatisation, just a distillery, today it is a large conglomerate with diverse interests spanning, beverage, plantations, financial services, telecommunications, manufacturing among many others. The company also owns the Aitken Spence Group, also a blue chip conglomerate securing a position in the TOP 10 ranking.

It is noteworthy, that the Distilleries Group owns and manages a telecommunications player arguably holding a dominant position in the CDMA sector of the overall telecommunications market. At time of acquisition, Lanka Bell, which was a slow and relatively passive company, is today, influenced by the entrepreneurial spirit of the Distilleries group culture, a thriving and aggressive player in the dynamic and competitive telecom sector.

Despite trying market conditions further intensified by increased regulation, the company recorded a consolidated profit of Rs.3.6 billion after minority interest.

John Keells Holdings, has consistently found a place in the Business Today TOP 10 ranking and is a previous winner. The conglomerate has over the years been the undisputed corporate benchmark in Sri Lanka and continues to hold that status. The group is known for its appetite and sense for growth sectors and must be credited for showing the way to other conglomerates and companies that now challenge the John Keells Group.

Charting a course of growth, based on a closely monitored portfolio of strategic investments and business priorities, in the year 2006, the company unveiled its new vision ‘Building businesses that are leaders in the region.’

The Group is structured around sectors that drive their respective business clusters. The sectors are Transportation, Leisure, Property, Consumer Food and Retail, Financial Services and Information Technology. In 2006 the transportation sector recorded growth in profitability. The Consumer Foods and Retail sector too posted substantial growth levels, but the other sectors performed at average or below average level.

John Keells Holdings reported a turnover of Rs.32.9 billion, a growth of 12% over the previous year. Profit before tax was Rs.4.8% billion and Profit after tax was Rs.3.5 billion.

The company has set its sights on large-scale industries such as energy, power and communications in addition to expanding present business sectors, towards ensuring it growth trajectory.

Aitken Spence moved up three places to number five in the rankings from its previous eighth position in the ranking. A part of the Distilleries Group that is in third position in this ranking, the Aitken Spence Group put up a commendable performance in the year to report a post tax profit of Rs.2.3 billion in the face of adverse conditions affecting its business.

Towards mitigating adverse conditions in the local tourism industry, the Aitken Spence Group, with a view to sustaining growth and stability, whilst not diluting interests in Sri Lanka expanded its cross-border operations by investing in potentially lucrative properties in India. The company continued growing its hospitality business in the Maldives.

The company also made strategic changes and alignments in its logistics business choosing to divest the Maritime transport operation, but added the Hapag Lloyd Shipping Agency, which hopefully would complement future profitability.

The power sector of the company also substantially helped in an overall improved performance. According to the company, the plantation business would diversify into palm oil processing with the export market in mind.

Hatton National Bank held its position at sixth place in the TOP 10 ranking. The Bank reported a post tax profit of Rs.2.27 billion in 2006 with net interest income being the chief contributor. HNB leads three financial institutions holding successive positions in the current ranking, and would do well to improve on this in the years to follow.

HNB returned to the TOP 10 ranking last year after a brief absence due to setbacks triggered by abnormal exposure levels in the past. Since recovering from the temporary setback the Bank has strengthened its asset base and built its market position with calculated aggression.In comparison to the competition, HNB is not perceived as tech savvy. This perhaps is a notion HNB would like to dispel by launching itself into the new world of banking by building ICT into its product offerings.

Commercial Bank, the Icon of modern banking in Sri Lanka dropped two places in the ranking to number seven. The bank returned a post tax profit of Rs.2 billion in 2006 compared to Rs.2.4 billion in the previous year. Notwithstanding a lesser than desired performance, Commercial Bank ended 2006 as the largest indigenous bank in the country, and market capitalisation was highest among all financial institutions in Sri Lanka. In December 2006 the bank opened its 150th branch, exceeding the target set for the year. The bank has 269 ATMs installed around the country for customer convenience.

The Bank strengthened its operations in Bangladesh opening two new branches taking the total number of branches there to seven. The number of ATMs installed in Bangladesh is eight.

As announced in its 2006 Annual Report the Bank’s new vision places a premium on having a strong international presence by 2011. Towards this end the Bank has already entered Bangladesh. The Indian market has been explored, but financial regulations in India have discouraged entry so far. The Middle Eastern markets are represented by Business Promotion Offices and these could be scaled up to full-fledged operations at a future point in time. Following markets with sizable Sri Lankan presence the Bank has also announced its plans of money remittance offices in Italy and Canada. Commercial Bank would obviously be inspired to venture overseas resulting from its resounding success in Bangladesh where out of its three year presence, for two consecutive years it was rated as the ‘Best Foreign Bank’ in that country.

As a lead player in the banking sphere Commercial Bank would in all likelihood endeavour to improve its performance. Given its DNA makeup it would not be surprising if Commercial Bank springs back soon to its true potential.

National Development Bank returned to the TOP 10 ranking in eighth place after a brief pause. The Bank underwent a restructure and consolidation exercise in the last few years and is once again making its presence felt.

The Bank made its comeback resulting from an 84% growth in profits. Profits from core banking business contributed to the healthy performance of the bank, but more significantly Capital Gains to the tune of Rs.1016 million was the main reason for the exceptional increase in profits. The Capital Gain was realised from the sale by Capital Investment and Development Company a subsidiary of NDB, of part of its holding in NDB Finance Lanka Ltd., the holding company of Eagle Insurance Co. Ltd. – to Aviva International Holdings Ltd.

The challenge for NDB though is to sustain the level of profitability in the next year. NDB is undoubtedly fully aware of this expectation and would possibly revisit its business strategy to reclaim its due place at a time and juncture where Development banks stretching themselves to compete in the general banking sphere are grappling to come to terms with reality.

Ceylon Tobacco Limited, a regular feature on the TOP 10 ranking is the only manufacturing based company to consistently find a place amongst the TOP 10. The company moved down the ranking to ninth place due to superior performance and growth levels recorded by companies from other sectors. It is perhaps difficult for Ceylon Tobacco to match growth rates of other companies in growth sectors, given the declining market for tobacco-based products due to increased anti-tobacco and alcohol campaigns and stringent regulation. The company was still able to post an after tax profit of Rs.1.5 billion after recovering some of its hitherto lost markets to the illicit tobacco trade. The Company also augmented its product offering with premium global brands.

In the year 2006 Ceylon Tobacco contributed Rs.35.4 billion in the form of taxes and levies to the National Exchequer. This represented about 83% of the company’s gross turnover and constituted around 7.6% of the country’s total revenue, and approximately 1.28% of the GDP.

As part of its CSR efforts, Ceylon Tobacco completed the reconstruction of 132 tsunami-affected houses in the Southern and Eastern provinces of the country from contributions by British American Tobacco, parent company of Ceylon Tobacco, and its employees across the world. A further 75 houses were being constructed in the northern provinc .

Ceylon Tobacco also embarked on its Sustainable Agriculture Development Programme, a project to align the Company’s association with grassroots communities and a key national priority, poverty alleviation. The ambition of the project is to touch 10,000 families by the year 2010.

Private enterprise is viewed by some groups with skewed ideology as profit seeking animals, but few pause to take cognizance of work carried out by many corporate entities towards uplifting society and communities. Although not mentioned in this review many of the TOP 10 companies voluntarily contribute substantially towards society. The CSR initiatives of Ceylon Tobacco are examples of socially responsible activities of a company under constant scrutiny. Business Today fervently hopes that all corporate entities would integrate CSR as part of the way they go about their business and help build a better future for our people.

The Bukit Dhara Company, once again secured a position amongst the Corporate elites of Sri Lanka on the Business Today TOP 10 ranking.

The Company has two main investment holdings, which contributed to its profitability – The Carson Cumberbatch & Co., and PT Agro Bukit, an oil palm plantation in Indonesia. The twin exposure provides the Bukit Group, the benefit of the diverse businesses of Carsons, which range from oil palm plantations to brewing, investment, real estate and leisure sectors in Indonesia, Malaysia, India and Sri Lanka.

Consolidated post tax profit of the Company was Rs.2.1 billion.

The Bukit Dhara Company, although publicly quoted remains a closely controlled company by its majority shareholders.

The Business Today TOP 10 companies have been selected on the basis of their financial performance by Keith Bernard and Shiron Gooneratne, with the assistance of KPMG Ford Rhodes, Thornton & Co.

Business Today thanks all those past and present voluntary contributors of the BT TOP 10 resource team for making the Business Today TOP 10 a reality.