“The income statement of a Company may be likened to a bikini – what it reveals is interesting, but what it conceals is vital…”

By Suren Rajakarier

The above may sound like a statement out of a ‘Dilbert’ joke book, but it has a serious meaning! That is why globally accounting bodies are working round the clock to improve disclosures, presentations and transparency of financial statements. Therefore, the International Financial Reporting Standards (IFRS) are the consequence of stakeholders thirst to understand financial statements better and thereby reveal more than what it conceals.

Sri Lankan Accounting Standards will converge with IFRS from January 1, 2012

Conversion to IFRS should not impact business economics; it will lead to financial statements better reflecting reality. The additional disclosures required under IFRS may provide further insight for investors, influencing how they value stocks. Sectors such as power, banks, insurance, telecom and infrastructure will be most impacted. International investors are likely to attach more credibility to our financial statements post-IFRS convergence and it will significantly improve disclosure in annual reports.

Have you heard a CEO say “preparing accounts based on IFRS is too costly and we can’t afford it?” It is even worse when companies who have taken public monies or borrowed from banks which have lent depositors monies, display such attitudes. The question is; “is it the cost of preparing the accounts or the cost of transparency that is not affordable?” In short, if public funds are used in a business, compliance with higher standards is essential and it’s a cost of doing business.

The conversion process of Sri Lanka Accounting Standards with International Financial Reporting Standards (IFRS) has given an opportunity to the capital market to raise confidence of stakeholders and promote good accounting practices. Of course, it’s human nature to dislike change, and most of the responses to the changes arising from the use of the new Standards have been negative. In some cases, despite a similar requirement being existent in the Sri Lankan Standards (SLASs) companies want to continue their past practices, not recognising that accounting has also changed to keep pace with business and the environment.

However, despite the improvements to financial reporting under IFRS, enhanced use of management judgment may not eliminate ‘creative accounting’, as accounting fundamentally remains a subjective process. Nevertheless, the increased disclosure and more detailed measurement principles under IFRS will make financial statements more relevant to the needs of investors and make it much more difficult for companies to adopt questionable accounting practices.

What are the key IFRS implementation issues?

‘Despite The Improvements To Financial Reporting Under IFRS, Enhanced Use Of Management Judgment May Not Eliminate ‘Creative Accounting’, As Accounting Fundamentally Remains A Subjective Process’

Using IFRS as a basis is a step in the right direction, although its implementation will likely be challenging. One has to understand that the Standards to be adopted in Sri Lanka from 2012 are the older version issued by the International Accounting Standards Board in 2009. Despite the steps taken to upgrade reporting Standards, Sri Lankan reporting standards will be similar to the 2009 version of IFRS and not the latest. Some of the common challenges for companies include:

ï® IFRS contains many areas where management needs to exercise its judgment. These areas can be significant and include how revenue is recognised and how assets are depreciated.

ï® Embedding IFRS reporting into the financial reporting systems and processes is cumbersome and time consuming. It’s not a mere year end conversion activity that can be done with the assistance of auditors.

ï® Creating a high level of awareness in the operational people who don’t understand accounting concepts and getting their buy-in. Eg; marketing will have to accept that there is “no free lunch” and everything has a cost that will end up in the P&L, legal will have to understand that “substance” of a sale will determine accounting and not a court order, HR will realise that concessions given to staff are accounted differently.

ï® There is a need for more clarity on the changes to the regulatory environment; for instance, in the Income Tax Act, Companies Act and Banking Regulations.

ï® Significant time and effort is required to train both internal and external stakeholders and create awareness of the impact of IFRS.

ï® Accounting for Financial instruments also can be considered a challenge as companies will be required to identify such instruments. IFRS provides detailed guidance on recognition, measurement and disclosure requirements for financial instruments. It requires all financial instruments to be initially recognised at fair value, while some instruments are re-measured at fair value at each reporting date. This will result in increased volatility in the income statement and/or equity.

ï® The classification rules between equity and liability instruments would result in certain instruments, such as a plain-vanilla preference share, being classified as debt instruments instead of equity, thereby adversely affecting debt-to-equity and profitability ratios.

ï® Business indicators and bank loan covenants may require review due to changes in reporting of income, classification of assets and liabilities. A reclassification will immediately breach a debt/equity or even a current asset to current liability ratio covenant in the loan agreement.

ï® Making top management realise that knowledge is money and it costs to get the right knowledge and expertise to help.

Tackling complexity of principles

The world would be better off with principles based standards. In the field of corporate governance countries are considering setting out a guidance of best practices so that companies may understand and know why they are required to do something with room for professional judgment. This way one can avoid the mentality of ‘ticking the box’ and complying with rules to say it’s right. In auditing there is the concept that what is correct need not be fair and therefore the opinion of “true and fair” is a difficult decision to be made by the auditor based on his professional judgment.

The pitfalls of implementation arise due to two main reasons among a few others; Firstly, because people don’t understand the fundamental concept behind the new accounting requirements and cannot comprehend or identify any impact on their own companies. Secondly, some of the IFRS requirements sound similar to the existing requirements and have not been implemented by companies in spirit (substance), in the past. Therefore, they don’t see a need to change.

Therefore, the need of the hour is a change in mindset and a positive attitude towards this change. Many of us would know “If you want to get something new, you have to stop doing something old”. Always remember that if we do what we have always done, the result will be that; we will get what we have always got. Sometimes what we have always done, and what we have always got, is still relevant and highly necessary and sometimes it is not. This is an important realisation for a change in mindset when implementing the new Standards. We also require adequately trained professionals and should not be shy to seek out professional help in the new areas.

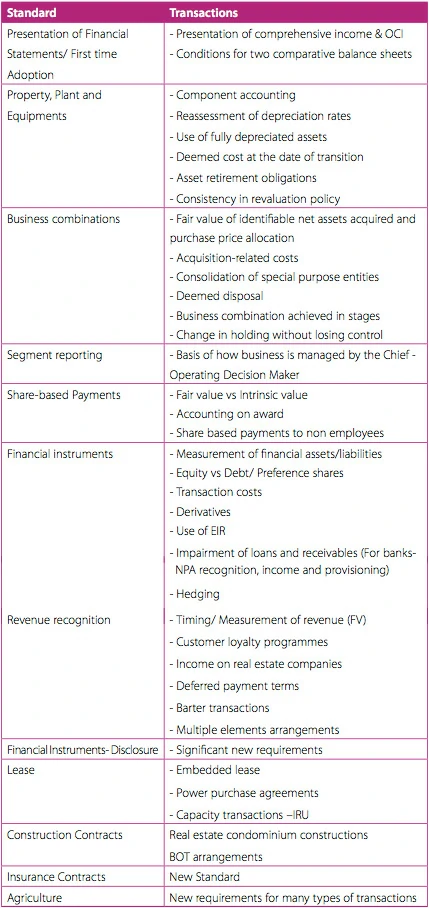

An overall understanding of differences may be useful to think that something new is required. The following list of significant issues or transactions (refer table) that may need to be accounted differently commencing January 1, 2012, hopefully will convince the readers to take the first step towards this journey.

This Way One Can Avoid The Mentality Of ‘Ticking The Box’ And Complying With Rules To Say It’s Right. In Auditing There Is The Concept That What Is Correct Need Not Be Fair And Therefore The Opinion Of “True And Fair” Is A Difficult Decision To Be Made By The Auditor Based On His Professional Judgment.

Should Sri Lankan reporting standards be world class?

Generally, “once you say you’re going to settle for second best, that’s what happens to you in life!” The standard of annual reports including presentation and disclosures of financial statements in Sri Lanka has been applauded by the SAFA Region and other International bodies as world class. Suppliers, lenders, counter parties, customers, investor community and many other stake holders will give a premium for the best. This benefit cannot be measured directly, but the quality of financial statements depends on the accounting standards used as a basis. Therefore, to keep pace with changes globally, we should embrace global standards for reporting because it’s easily understood across borders and good for business.

Suren Rajakarier FCA, FCCA, FCMA(UK), Head of Audit at KPMG Ford Rhodes Thornton & Co.