January 16, 2023 Edith Muthoni

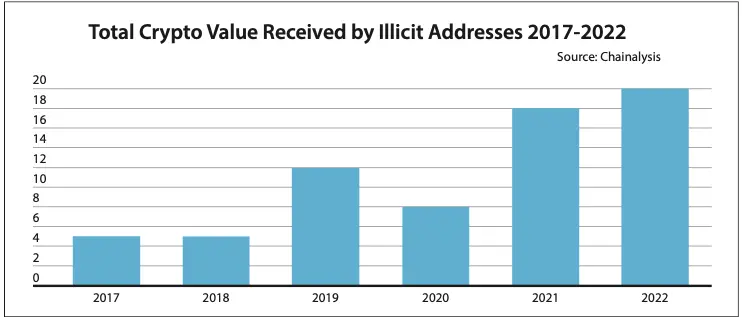

Governments typically impose sanctions to punish or isolate a particular entity. Therefore, most entities targeted for sanctions would try to find a way to overcome or bypass the sanctions. Luckily for them, cryptocurrency is giving them a way to circumvent these sanctions. Worse, they turn to illicit crypto transactions to beat the sanctions. According to StockApps.com, 44% of 2022’s illicit transaction volume came from sanctioned entities.

Speaking on the data, StockApps.com’s Edith Reads said. “Sanctioned entities are increasingly using crypto to hide their tracks and get away with crimes that would be impossible through traditional financial systems. This is a worrying trend, and governments must act fast to combat it.”

Hydra, a Russian dark web marketplace where criminals can purchase and sell items and services, was one of the sanctioned companies. Others include sources like Blender.io tumbler and the North Korean hacking group Lazarus.

How Cryptocurrencies Offer a Way to Circumvent Sanctions

Cryptocurrencies have been in the news a lot lately. Some people think they are a great investment, while others consider them a risk. However, the true potential of cryptocurrencies is in their ability to provide a way around sanctions.

Sanctions are put in place by governments to punish various entities. For example, the United States has sanctions against Iran, North Korea, and Russia. These sanctions prevent financial institutions from doing business with entities in those countries.

However, cryptocurrencies are not subject to these same restrictions. You can use them to send money to anyone worldwide, regardless of location. This makes them a perfect tool for circumventing sanctions.

There are a few different ways that cryptocurrencies can be used to circumvent sanctions. One is by using a decentralized exchange. These exchanges are not subject to the same regulations as traditional financial institutions. Thismeans they can trade with entities in sanctioned countries without problems.

Besides, using the peer- to-peer network can make it easier for illicit traders to rely on crypto. These networks allow users to send and receive payments without revealing identities.

Need for Strict Regulations

The crypto industry is largely unregulated. The lack of regulation has led to some bad actors taking advantage of investors, leading to losses of millions of dollars.

There is a growing need for regulations in the crypto industry to protect investors and ensure that the industry can continue to grow. Rules would root out

bad actors, provide clarity for investors, and create a level playing field for all participants.

The crypto exchange sites should enforce know-your-customer (KYC) and anti-money laundering (AML) compliance for cryptocurrency exchanges.

Edith Muthoni is a fintech expert and a trader with over 10 years of industry experience. She is knowledgeable about blockchain, NFTs, Cryptocurrencies, and stocks – all from an informed perspective that will help you make better decisions when it comes time to invest your money.