The year 2020 was a pivotal year for DFCC Bank, marking 65 years of being a pioneer in Sri Lanka’s banking sector and one of the oldest banks in the region.

A profitable strategy

Against all odds, under adversarial conditions, DFCC delivered sound results for the year ended 31 December 2020. Total income grew to Rs. 43,300 million from Rs. 43,297 million in the previous year. Deposits experienced a 25% growth to Rs. 310 billion, and advances grew 11% to Rs. 302 billion.

Although net fee and commission income grew slightly to Rs. 2,061 million from Rs. 2,046 million the previous year, net interest income declined by 13% to Rs.11,007 million due to the developments during the year. It decreased the interest margin to 2.53% in December 2020 from 3.25% in December 2019. The non-performing loans ratio grew to 5.56% from 4.85% over the same period, in line with the rest of the banking sector. The cost management procedures employed during the pandemic proved effective, with total operating expenses declining by 2% to Rs.7,387 million and a cost-to-income ratio of 48.97% for the year.

The Group recorded a profit before tax of Rs.3,944 million and profit after tax of Rs.2,847 million compared to a profit before tax and profit after tax of Rs.3,308 million and Rs. 2,300 million, respectively in 2019. Subsidiaries contributed positively to this growth. Earnings per ordinary share improved by 9.7%, increasing from Rs. 7.14 in 2019 to Rs.7.83 in 2020. A final dividend of Rs. 3.00 per share was declared.

Relationships are key

The priority for the Bank was its concern for customers. With that in mind, the Bank’s focus was on three key facets. Building upon the existing relationships with customers, building relationships with customers, and building relationships with key players in underserved markets. This will be accomplished by combining the commercial banking mindset with the development banking mindset that has been crafted for over 65 years.

DFCC Bank is one of the few in the market who possess this mindset and can leverage this expertise to build long-lasting relationships. While most commercial banks will seek to lend for up to five years, DFCC will lend up to ten years to fulfill customers’ needs and aims to build long-term relationships. While other banks classify industries by risk, DFCC is willing to look at any industry with a fresh perspective. DFCC has identified smaller industries such as the cinnamon trade to do business with and remains bullish on the tourism industry despite the challenges it faces.

Celebrating 65 years of banking

DFCC Bank celebrated its 65th anniversary in 2020, marking its presence as one of the oldest banks in the region and a pioneer in Sri Lanka’s banking sector.

Over time, the Bank has refined its processes to the highest levels, evolved its vision. The Bank and its employees worked diligently and achieved substantial lending, brought in deposits, and strengthened liquidity not to be reliant on development funding.

A rejuvenated approach to sustainability

In 2020, DFCC took a fresh look at how the Bank approaches sustainability and felt that its existing initiatives needed to be revitalized and better aligned to the overarching Vision 2025 strategy.

Thus, a new Sustainability strategy was developed and implemented. It focused on: building the resilience of the Bank by creating a resilient business and working towards becoming a bank specialized in green finance, careful consideration of the Group’s impacts on the environment and working towards becoming carbon neutral, and developing resilient communities by creating a sustainable culture and lifestyle. The agenda of the sustainability initiatives are to: strengthen the resilience of the Bank, its stakeholders, and the country through digitization, empowerment, innovation, and inclusivity.

J Durairatnam

Chairman

L H A L Silva

Director/CEO

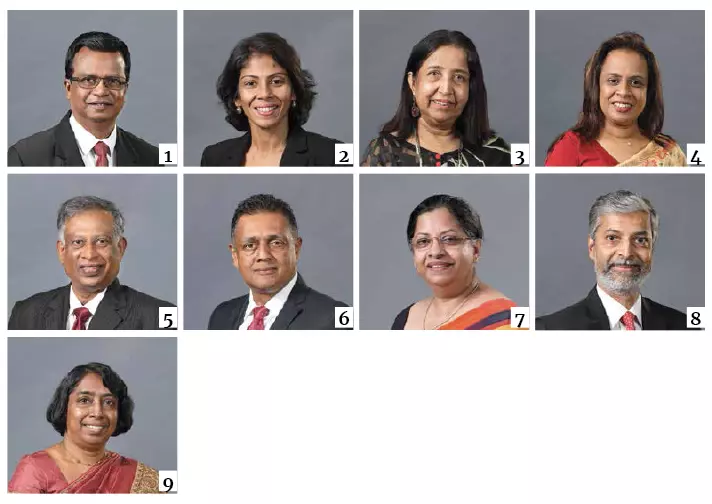

1. P M B Fernando

Senior Director & Independent

Non-Executive Director

2. S R Thambiayah

Independent Non-Executive Director

3. V J Senaratne

Non-Executive Director

4. L K A H Fernando

Independent Non-Executive Director

5. N K G K Nemmawatta

Independent Non-Executive Director

6. N H T I Perera

Director/Deputy CEO

7. H M N S Gunawardana

Non-Executive Director

8. H A J De S Wijeyeratne

Independent Non-Executive Director

9. A Withana

Secretary to the Board