March 21, 2023. Justinas Baltrusaitis.

With the United States banking crisis claiming several casualties, the situation’s impact has spread over to the general sector, taking a toll on investor sentiment. Consequently, with investors looking for alternatives, Bitcoin (BTC) appears to be the winner of the crisis, with the maiden cryptocurrency attracting significant capital inflow dwarfing the traditional financial players.

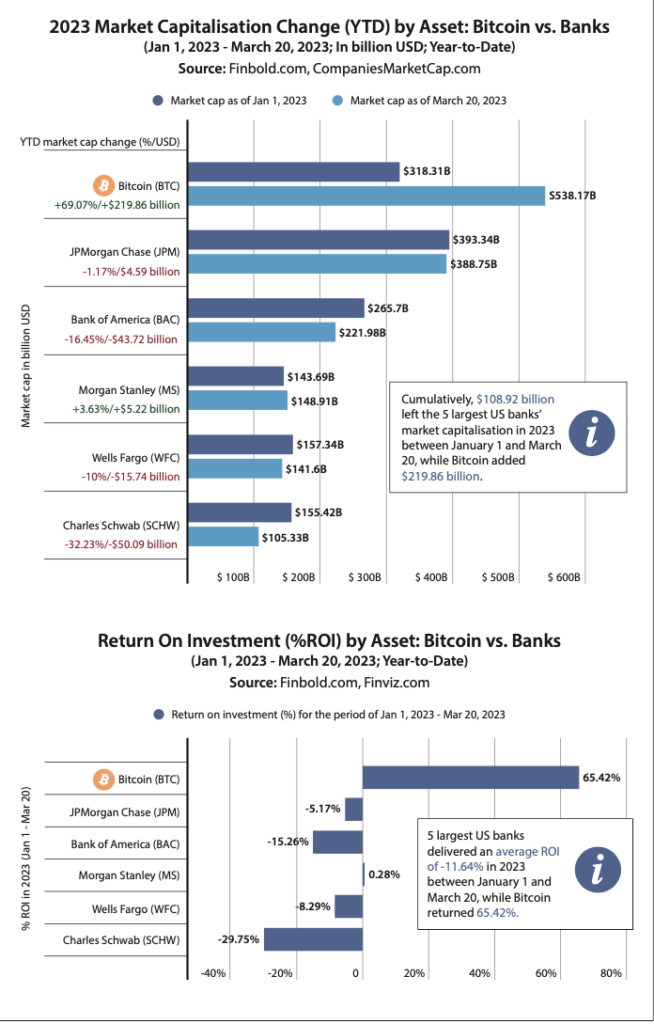

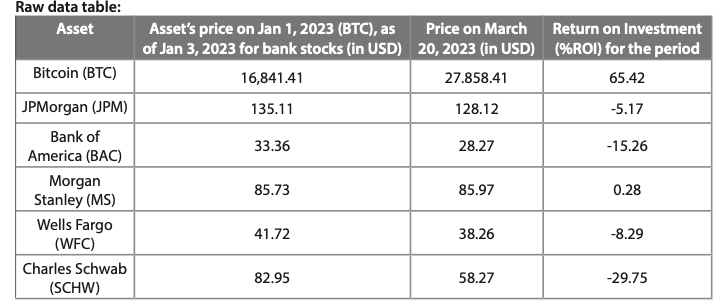

Data acquired and calculated by Finbold indicates that as of March 20, five leading U.S. banks have lost a cumulative market capitalization of $108.92 billion in 2023 alone. In comparison, Bitcoin has added $219.86 billion to its market cap during the same period.

Among the banks, Charles Schwab (NYSE: SCHW) suffered the worst loss in capitalization, dropping from $155.42 billion to $105.33 billion. Bank of America (NYSE: BAC) has the second highest losses at $43.72 billion, followed by Wells Fargo (NYSE: WFC) at $15.74 billion, while JPMorgan Chase (NYSE: JPM) recorded an outflow of $4.59 billion. Only Morgan Stanley (NYSE: MSCI) recorded gains, with $5.22 billion added to its market cap year-to- date (YTD).

A breakdown of the market cap movement shows that Bitcoin has gained 69.07% from $318.31 billion to $538.17 billion. Bitcoin has also dwarfed the banking giants regarding return on investment (ROI). On a year-to-date basis, Bitcoin’s return stand at 65.42%, while the average ROI of the banks is -11.64%.

Bitcoin thrives as banking crisis takes toll

The enormous variation in the performance between Bitcoin and banking stocks highlights the impact of the instability in the financial sector in recent weeks. The banks have been affected by the general concerns of investors with trust issues in the banking system after the high-profile collapse of seasoned lenders.

Indeed, the surge in Bitcoin’s price has come as a surprise, given the closure of Silvergate Capital and Signature Bank, two of the biggest lenders to the crypto industry. Silicon Valley Bank, viewed as the backbone of the technology startup industry, also failed. The situation worsened with the near-collapse of First Republic Bank (NYSE: FRC) and Credit Suisse, which were saved at the last moment.

Bitcoin is likely being considered by some investors as a hedge against systemic risks, and its decentralized nature has likely attracted investors attempting to navigate the banking chaos as trust issues become paramount. The crypto has been positioned to benefit, considering that its the torchbearer of decentralized finance (DeFi), driving interest from retail investors.

Bitcoin’s volatility and traditional finance

The performance also shows that despite being far more volatile than traditional banking stocks, Bitcoin is proving to be the winner in the current market. Advocates of the crypto continue to campaign for the asset’s global adoption, which might propel its market capitalization to unprecedented heights.

Another important factor that could be in play is the expectation of a lower or zero interest rate hike by the Federal Reserve. The uncertainty surrounding the financial sector has increased the importance of the Federal Reserve’s interest rate decision. Notably, the continuous rate hikes have had a material impact on the market, both traditional and crypto, over the last year. Therefore, the expectations of a lower or zero hike could also influence BTC prices and stabilize the banking stocks.

Bitcoin correlation with banking stocks

Generally, BTC’s current prices have not significantly correlated with banking stocks. On the contrary, the crypto market tends to perform better when the traditional financial markets experience turbulence.

It should be emphasized that Bitcoin and the mentioned stocks are not in the same asset category. Stocks are supported by tangible assets and the success of the company. On the other hand, Bitcoin is not backed by any hard assets, and its value is driven by market speculation.

The fact that Bitcoin has recorded a higher market capitalization growth than the five largest U.S. banks is surprising, given that it is a relatively new asset compared to the decades-old financial institutions it competes against.

Looking ahead, as the U.S. banking sector continues to face challenges, Bitcoin’s decentralized finance ecosystem offers a viable alternative to traditional banking systems, as initially envisioned by the founding principal. The continued surge in value underscores the need for a transparent, decentralized financial system that can provide a hedge against risks.