The Annual Meeting of the World Economic Forum was held from January 28 – February 1, 2009 in Davos-Klosters, Switzerland.

The World Economic Forum annual meeting has for nearly four decades provided a platform for all leaders equally to shape the global agenda to catalyse solutions at the start of each year.

The Annual Meeting 2009 was organised under the theme “Shaping the Post-Crisis World” with the objective to catalyse a holistic and systematic approach to improve the state of the world in a manner that integrates all stakeholders of global society. The international landscape has been radically altered due to the present global economic crisis. An early conclusion is that complexity and interdependence are not only characteristics of globalization but also at the root of a systemic crisis. Thus future solutions will need to be developed in a holistic and interdisciplinary way to ensure that the concerns of all stakeholders are addressed and a broad-based backlash is avoided. The Annual Meeting explored this through six programmatic tracks:

• Promoting Stability in the Financial System and Reviving Global Economic Growth

• Ensuring Effective Global, Regional and National Governance for the Long Term

• Addressing the Challenges of Sustainability and Development

• Shaping the Values and Leadership Principles for a Post-Crisis World

• Catalysing the Next Wave of Growth through Innovation, Science and Technology

• Understanding the Implications on Industry Business Models

Business Today, presents some of the highlights of the World Economic Forum Annual Meeting 2009.

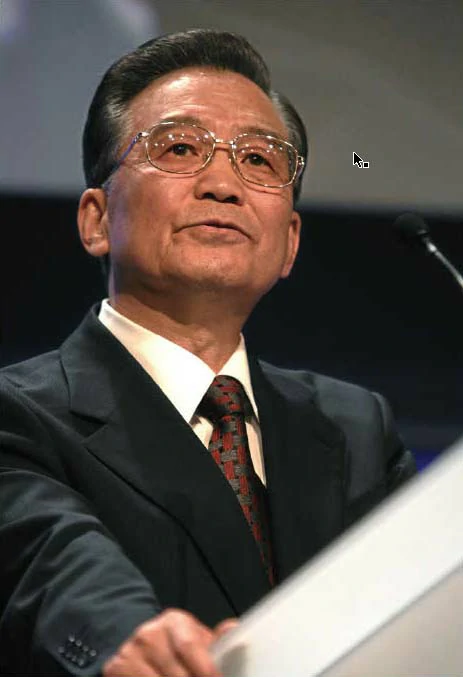

Strengthen Confidence and Work Together for A New Round of World Economic Growth

Special Message by H.E. Wen Jiabao Premier of the State Council of the People’s Republic of China At the World Economic Forum Annual Meeting 2009© World Economic Forum

Professor Klaus Schwab, Executive Chairman of the World Economic Forum,

Ladies and Gentlemen,

I am delighted to be here and address the World Economic Forum Annual Meeting 2009. Let me begin by thanking Chairman Schwab for his kind invitation and thoughtful arrangements. This annual meeting has a special significance. Amidst a global financial crisis rarely seen in history, it brings together government leaders, business people, experts and scholars of different countries to jointly explore ways to maintain international financial stability, promote world economic growth and better address global issues. Its theme -“Shaping the Post-Crisis World” is highly relevant. It reflects the vision of its organizers. People from across the world are eager to hear words of wisdom from here that will give them strength to tide over the crisis. It is thus our responsibility to send to the world a message of confidence, courage and hope. I look forward to a successful meeting.

The ongoing international financial crisis has landed the world economy in the most difficult situation since last century’s Great Depression. In the face of the crisis, countries and the international community have taken various measures to address it. These measures have played an important role in boosting confidence, reducing the consequences of the crisis, and forestalling a meltdown of the financial system and a deep global recession. This crisis is attributable to a variety of factors and the major ones are: inappropriate macroeconomic policies of some economies and their unsustainable model of development characterized by prolonged low savings and high consumption; excessive expansion of financial institutions in blind pursuit of profit; lack of self-discipline among financial institutions and rating agencies and the ensuing distortion of risk information and asset pricing; and the failure of financial supervision and regulation to keep up with financial innovations, which allowed the risks of financial derivatives to build and spread. As the saying goes, “A fall in the pit, a gain in your wit,” we must draw lessons from this crisis and address its root causes. In other words, we must strike a balance between savings and consumption, between financial innovation and regulation, and between the financial sector and real economy.

The current crisis has inflicted a rather big impact on China’s economy. We are facing severe challenges, including notably shrinking external demand, overcapacity in some sectors, difficult business conditions for enterprises, rising unemployment in urban areas and greater downward pressure on economic growth.

As a big responsible country, China has acted in an active and responsible way during this crisis. We mainly rely on expanding effective domestic demand, particularly consumer demand, to boost economic growth. We have made timely adjustment to the direction of our macroeconomic policy, swiftly adopted a proactive fiscal policy and a moderately easy monetary policy, introduced ten measures to shore up domestic demand and put in place a series of related policies. Together, they make up a systematic and comprehensive package plan aimed at ensuring steady and relatively fast economic growth. First, substantially increase government spending and implement a structural tax cut.

The Chinese Government has rolled out a two-year program involving a total investment of RMB 4 trillion, equivalent to 16% of China’s GDP in 2007. The investment will mainly go to government-subsidized housing projects, projects concerning the well-being of rural residents, railway construction and other infrastructural projects, environmental protection projects and post-earthquake recovery and reconstruction. Some of them are identified as priority projects in China’s l Ith Five-Year Plan for Economic and Social Development. The rest are additional ones to meet the needs of the new situation. This two-year stimulus program has gone through scientific feasibility studies and is supported by a detailed financial arrangement. RMB 1.18 trillion will come from central government’s budget, which is expected to generate funds from local governments and other sources. The Chinese Government has also launched a massive tax cut program which features the comprehensive transformation of the value-added tax, the adoption of preferential tax policies for small and medium-sized enterprises (SMEs) and real estate transactions, and the abolition or suspension of 100 items of administrative fees. It is expected to bring about a total saving of RMB500 billion for businesses and households each year. Second, frequently cut interest rates and increase liquidity in the banking system. The central bank has cut deposit and lending rates of financial institutions five times in a row, with the one-year benchmark deposit and lending rates down by 1.89 percentage points and 2.16 percentage points respectively. Thus the financial burden of companies has been greatly reduced. The required reserve ratio has been lowered four times, adding up to a total reduction of 2 percentage points for large financial institutions and 4 percentage points for small and medium-sized ones.

This has released around RMB800 billion of liquidity and substantially increased funds available to commercial banks. A series of policy measures have been adopted in the financial sector to boost economic growth, including increasing lending, optimizing the credit structure, and providing greater financial support to agriculture and the SMEs. Third, implement the industrial restructuring and rejuvenation program on a large scale. We are seizing the opportunity to push ahead comprehensive industrial restructuring and upgrading. To this end, plans are being drawn up for key industries such as automobile and iron and steel, which not only focus on addressing the immediate difficulties of enterprises but also look toward their long-term development. We have taken strong measures to facilitate the merger and reorganization of enterprises, phase out backward production capacity, promote advanced productive forces, and improve industry concentration and the efficiency of resource allocation.

We encourage our enterprises to upgrade technologies and make technological renovation. We support them in making extensive use of new technologies, techniques, equipment and materials to restructure their product mix, develop marketable products and improve their competitiveness. Our financial support policies are being improved, a sound credit guarantee system installed and market access eased for the benefit of SME development. Fourth, actively encourage innovation and upgrading in science and technology. We are speeding up the implementation of the National Program for Medium- and Long-Term Scientific and Technological Development with a special focus on 16 key projects in order to make breakthroughs in core technologies and key generic technologies. This will provide scientific and technological support for China’s sustainable economic development at a higher level.

We are developing high-tech industrial clusters and creating new social demand and new economic growth areas. Fifth, substantially raise the level of social security. We have accelerated the improvement of social safety net. We will continue to increase basic pension for enterprise retirees and upgrade the standard of unemployment insurance and workers’ compensation. We will raise the level of basic cost of living allowances in both urban and rural areas, welfare allowances for those rural residents without family support and the special allowances and assistance to entitled groups. This year, the central budget for social security and employment will increase at a much higher rate than the growth of the overall fiscal revenue. We are advancing the reform of the medical and health system and working to put in place a nationwide basic medical and health system covering both urban and rural areas within three years and achieve the goal of everyone having access to basic medical and health service. It is estimated that governments at all levels will invest RMB 850 billion for this purpose. We give priority to education and are now working on the Guidelines of the National Program for Medium- and Long-Term Educational Reform and Development. This year, we will increase public funds for free compulsory education in rural areas, offer more financial support to students from poor families and improve the well-being of middle and primary school teachers so as to promote equity in education and optimize the educational structure. We are using every possible means to lessen the impact of the financial crisis on employment. We are following a more active employment policy. In particular, we have introduced various policy measures to help college graduates and migrant workers find jobs and provided more government-funded jobs in public service.

These major policy measures as a whole target both symptoms and root causes, and address both immediate and long-term concerns. They represent a holistic approach and are mutually reinforcing. They are designed to address the need to boost domestic demand, readjust and reinvigorate industries, encourage scientific innovation and strengthen social security. They are designed to stimulate consumption through increased investment, overcome the current difficulties with long-term development in mind, and promote economic growth in the interest of people’s livelihood. These measures can mobilize all resources to meet the current crisis.

China’s economy is in good shape on the whole. We managed to maintain steady and relatively fast economic growth in 2008 despite two unexpected massive natural disasters. Our GDP grew by 9%. CPI was basically stable. We had a good grain harvest for the fifth consecutive year, with a total output of 528.5 million tons. Eleven million and one hundred and thirty thousand new jobs were created in cities and towns.

Household income in both urban and rural areas continued to rise. The financial system functioned well and the banking system kept its liquidity and credit asset quality at a healthy level. When China, a large developing country, runs its affairs well, it can help restore confidence in global economic growth and curb the spread of the international financial crisis.

It will also help increase China’s imports and outbound investment, boost world economic growth and create more development and job opportunities for other countries. Steady and fast growth of China’s economy is in itself an important contribution to global financial stability and world economic growth.

Ladies and Gentlemen,

Will China’s economy continue to grow fast and steadily? Some people may have doubts about it. Yet I can give you a definite answer: Yes, it will. We are full of confidence. Where does our confidence come from? It comes from the fact that the fundamentals of China’s economy remain unchanged. Thanks to our right judgment of the situation and prompt and decisive adjustment to our macroeconomic policy, our economy remains on the track of steady and fast development.

Our package plan takes into consideration both the need to address current difficulties and that of long-term development. It is beginning to produce results and will be more effective this year. Our confidence comes from the fact that the long-term trend of China’s economic development remains unchanged. We are in an important period of strategic opportunities and in the process of fast industrialization and urbanization. Infrastructure construction, upgrading of industrial and consumption structures, environmental protection and conservation projects, and various social development programs-all can be translated into huge demand and growth potential and will bolster relatively high-speed growth of our economy for a long time to come. Our confidence also comes from the fact that the advantages contributing to China’s economic growth remain unchanged. With 30 years’ of reform and opening-up, we have laid a good material, technological and institutional foundation. We have a large well-trained and relatively low-cost labor force. We have a healthy fiscal balance, a sound financial system and adequate funds. Our system enables us to mobilize the necessary resources for big undertakings. There is harmony and stability in our society. What is more important, we follow a scientific approach to development which puts people first and seeks comprehensive, balanced and sustainable development. We are committed to reform, opening-up and win-win progress. We have found the right development path in line with China’s national conditions and the trend of our times.

Our people are hard-working, persevering and resilient. It is precisely these fine qualities that endow China, a country with a time-honored history, with greater vitality in the face of adversities. At the same time, there is no fundamental change in the external environment for China’s economic growth. The pursuit of peace, development and cooperation is the irreversible trend in today’s world. The readjustment to the international division of labor offers new opportunities. We have the confidence, conditions and ability to maintain steady and fast economic growth and continue to contribute to world economic growth.

Ladies and Gentlemen,

The global financial crisis is a challenge for the whole world. Confidence, cooperation and responsibility are key to overcoming the crisis. Confidence is the source of strength. The power of confidence is far greater than what can be imagined. The pressing task for the international community and individual countries is to take further measures to restore market confidence as soon as possible. In times of economic hardships, confidence of all countries in the prospect of global economic development, confidence of leaders and people around the world in their countries, confidence of enterprises in investment and confidence of individuals in consumption are more important than anything else. In tackling the crisis, practical cooperation is the effective way. In a world of economic globalization, countries are tied together in their destinies and can hardly be separated from one another.

The financial crisis is a test of the readiness of the international community to enhance cooperation, and a test of our wisdom. Only with closer cooperation and mutual help, can we successfully manage the crisis. To prevail over the crisis, accepting responsibilities is the prerequisite. When governments fulfill their responsibilities with resolution and courage, they can help maintain a stable financial order and prevent the crisis from causing more serious damage on the real economy. Political leaders must be forward-looking. They should be responsible to the entire international community as well as to their own countries and people. It is imperative that we implement the broad agreement reached since the G20 Summit on Financial Markets and the World Economy. We should not only take more forceful and effective steps to tide over the current difficulties, but also push for the establishment of a new world economic order that is just, equitable, sound and stable. To this end, I would like to share with you the following ideas.

First, deepen international economic cooperation and promote a sound multilateral trading regime. Past experience shows that in crisis it is all the more important to stick to a policy of opening-up and cooperation. Trade protectionism serves no purpose as it will only worsen and prolong the crisis. It is therefore necessary to move forward trade and investment liberalization and facilitation. China firmly supports efforts to reach balanced results of the Doha Round negotiations at an early date and the establishment of a fair and open multilateral trading regime. As an important supplement to such a trading regime, regional economic integration should be vigorously promoted.

Second, advance the reform of the international financial system and accelerate the establishment of a new international financial order. The current crisis has fully exposed the deficiencies in the existing international financial system and its governance structure. It is important to speed up reform of the governance structures of major international financial institutions, establish a sound global financial rescue mechanism, and enhance capacity in fulfilling responsibilities. Developing countries should have greater say and representation in international financial institutions and their role in maintaining international and regional financial stability should be brought into full play. We should encourage regional monetary and financial cooperation, make good use of regional liquidity assistance mechanisms, and steadily move the international monetary system toward greater diversification.

Third, strengthen international cooperation in financial supervision and regulation and guard against the build-up and spread of financial risks. Financial authorities around the world should step up information sharing and the monitoring of global capital flows to avoid the cross-border transmission of financial risks. We should expand the regulation coverage of the international financial system, with particular emphasis on strengthening the supervision on major reserve currency countries. We should put in place a timely and efficient early warning system against crisis. We should introduce reasonable and effective financial regulatory standards and improve oversight mechanisms in such areas as accounting standards and capital adequacy requirements. We should tighten regulation of financial institutions and intermediaries and enhance transparency of financial markets and products.

Fourth, effectively protect the interests of developing countries and promote economic development of the whole world. The international community, developed countries in particular, should assume due responsibilities and obligations to minimize the damage caused by the international financial crisis on developing countries and help them maintain financial stability and economic growth. International financial institutions should act promptly to assist those developing countries in need through such measures as relaxing lending conditions.

We should advance the international poverty reduction process and scale up assistance to the least developed countries and regions in particular with a view to building up their capacity for independent development.

Fifth, jointly tackle global challenges and build a better home for mankind. Issues such as climate change, environmental degradation, diseases, natural disasters, energy, resources and food security as well as the spread of terrorism bear on the very survival and development of mankind. No country can be insulated from these challenges or meet them on its own. The international community should intensify cooperation and respond to these challenges together.

I want to reaffirm here China’s abiding commitment to peaceful, open and cooperative development. China is ready to work with other members of the international community to maintain international financial stability, promote world economic growth, tackle various global risks and challenges, and contribute its share to world harmony and sustainable development.

Ladies and Gentlemen,

The harsh winter will be gone and spring is around the comer. Let us strengthen confidence and work closely together to bring about a new round of world economic growth.

Thank you.

“we must not revert to isolationism and unrestrained economic egotism. The concentration of surplus assets in the hands of the state is a negative aspect of anti-crisis measures in virtually every nation.”

Prime Minister Vladimir Putin’s speech at the opening ceremony of the World Economic Forum

© World Economic Forum

Good afternoon, colleagues, ladies and gentlemen,

I would like to thank the forum’s organisers for this opportunity to share my thoughts on global economic developments and to share our plans and proposals.

The world is now facing the first truly global economic crisis, which is continuing to develop at an unprecedented pace.

The current situation is often compared to the Great Depression of the late 1920s and the early 1930s. True, there are some similarities. However, there are also some basic differences. The crisis has affected everyone at this time of globalisation. Regardless of their political or economic system, all nations have found themselves in the same boat.

There is a certain concept, called the perfect storm, which denotes a situation when Nature’s forces converge in one point of the ocean and increase their destructive potential many times over. It appears that the present-day crisis resembles such a perfect storm. Responsible and knowledgeable people must prepare for it. Nevertheless, it always flares up unexpectedly. The current situation is no exception either. Although the crisis was simply hanging in the air, the majority strove to get their share of the pie, be it one dollar or a billion, and did not want to notice the rising wave.

In the last few months, virtually every speech on this subject started with criticism of the United States. But I will do nothing of the kind. I just want to remind you that, just a year ago, American delegates speaking from this rostrum emphasised the US economy’s fundamental stability and its cloudless prospects. Today, investment banks, the pride of Wall Street, have virtually ceased to exist. In just 12 months, they have posted losses exceeding the profits they made in the last 25 years. This example alone reflects the real situation better than any criticism.

The time for enlightenment has come. We must calmly, and without gloating, assess the root causes of this situation and try to peek into the future. In our opinion, the crisis was brought about by a combination of several factors. The existing financial system has failed. Substandard regulation has contributed to the crisis, failing to duly heed tremendous risks. Add to this colossal disproportions that have accumulated over the last few years. This primarily concerns disproportions between the scale of financial operations and the fundamental value of assets, as well as those between the increased burden on international loans and the sources of their collateral.

The entire economic growth system, where one regional centre prints money without respite and consumes material wealth, while another regional centre manufactures inexpensive goods and saves money printed by other governments, has suffered a major setback. I would like to add that this system has left entire regions, including Europe, on the outskirts of global economic processes and has prevented them from adopting key economic and financial decisions. Moreover, generated prosperity was distributed extremely unevenly among various population strata. This applies to differences between social strata in certain countries, including highly developed ones. And it equally applies to gaps between countries and regions.

A considerable share of the world’s population still cannot afford comfortable housing, education and quality health care. Even a global recovery posted in the last few years has failed to radically change this situation. And, finally, this crisis was brought about by excessive expectations. Corporate appetites with regard to constantly growing demand swelled unjustifiably. The race between stock market indices and capitalisation began to overshadow rising labour productivity and real-life corporate effectiveness. Unfortunately, excessive expectations were not only typical of the business community. They set the pace for rapidly growing personal consumption standards, primarily in the industrial world. We must openly admit that such growth was not backed by a real potential. This amounted to unearned wealth, a loan that will have to be repaid by future generations. This pyramid of expectations would have collapsed sooner or later. In fact, this is happening right before our eyes.

Esteemed colleagues,

One is sorely tempted to make simple and popular decisions in times of crisis. However, we could face far greater complications if we merely treat the symptoms of the disease. Naturally, all national governments and business leaders must take resolute actions. Nevertheless, it is important to avoid making decisions, even in such force majeure circumstances, that we will regret in the future. This is why I would first like to mention specific measures which should be avoided and which will not be implemented by Russia. We must not revert to isolationism and unrestrained economic egotism. The leaders of the world’s largest economies agreed during the November 2008 G20 summit not to create barriers hindering global trade and capital flows. Russia shares these principles. Although additional protectionism will prove inevitable during the crisis, all of us must display a sense of proportion.

Excessive intervention in economic activity and blind faith in the state’s omnipotence is another possible mistake. True, the state’s increased role in times of crisis is a natural reaction to market setbacks. Instead of streamlining market mechanisms, some are tempted to expand state economic intervention to the greatest possible extent. The concentration of surplus assets in the hands of the state is a negative aspect of anti-crisis measures in virtually every nation. In the 20th century, the Soviet Union made the state’s role absolute. In the long run, this made the Soviet economy totally uncompetitive. This lesson cost us dearly. I am sure nobody wants to see it repeated. Nor should we turn a blind eye to the fact that the spirit of free enterprise, including the principle of personal responsibility of businesspeople, investors and shareholders for their decisions, is being eroded in the last few months. There is no reason to believe that we can achieve better results by shifting responsibility onto the state. And one more point: anti-crisis measures should not escalate into financial populism and a refusal to implement responsible macroeconomic policies. The unjustified swelling of the budgetary deficit and the accumulation of public debts are just as destructive as adventurous stock-jobbing.

Ladies and gentlemen,

Unfortunately, we have so far failed to comprehend the true scale of the ongoing crisis. But one thing is obvious: the extent of the recession and its scale will largely depend on specific high-precision measures, due to be charted by governments and business communities and on our coordinated and professional efforts. In our opinion, we must first atone for the past and open our cards, so to speak. This means we must assess the real situation and write off all hopeless debts and “bad” assets. True, this will be an extremely painful and unpleasant process. Far from everyone can accept such measures, fearing for their capitalisation, bonuses or reputation. However, we would “conserve” and prolong the crisis, unless we clean up our balance sheets. I believe financial authorities must work out the required mechanism for writing off debts that corresponds to today’s needs. Second. Apart from cleaning up our balance sheets, it is high time we got rid of virtual money, exaggerated reports and dubious ratings. We must not harbour any illusions while assessing the state of the global economy and the real corporate standing, even if such assessments are made by major auditors and analysts.

In effect, our proposal implies that the audit, accounting and ratings system reform must be based on a reversion to the fundamental asset value concept. In other words, assessments of each individual business must be based on its ability to generate added value, rather than on subjective concepts. In our opinion, the economy of the future must become an economy of real values. How to achieve this is not so clear-cut. Let us think about it together. Third. Excessive dependence on a single reserve currency is dangerous for the global economy. Consequently, it would be sensible to encourage the objective process of creating several strong reserve currencies in the future. It is high time we launched a detailed discussion of methods to facilitate a smooth and irreversible switchover to the new model. Fourth. Most nations convert their international reserves into foreign currencies and must therefore be convinced that they are reliable. Those issuing reserve and accounting currencies are objectively interested in their use by other states. This highlights mutual interests and interdependence.

Consequently, it is important that reserve currency issuers must implement more open monetary policies. Moreover, these nations must pledge to abide by internationally recognised rules of macroeconomic and financial discipline. In our opinion, this demand is not excessive. At the same time, the global financial system is not the only element in need of reforms. We are facing a much broader range of problems. This means that a system based on cooperation between several major centres must replace the obsolete unipolar world concept. We must strengthen the system of global regulators based on international law and a system of multilateral agreements in order to prevent chaos and unpredictability in such a multipolar world. Consequently, it is very important that we reassess the role of leading international organisations and institutions.

I am convinced that we can build a more equitable and efficient global economic system. But it is impossible to create a detailed plan at this event today. It is clear, however, that every nation must have guaranteed access to vital resources, new technology and development sources. What we need is guarantees that could minimise risks of recurring crises. Naturally, we must continue to discuss all these issues, including at the G20 meeting in London, which will take place in April.

Our decisions should match the present-day situation and heed the requirements of a new post-crisis world. The global economy could face trite energy-resource shortages and the threat of thwarted future growth while overcoming the crisis. Three years ago, at a summit of the Group of Eight, we raised the issue of global energy security. We called for the shared responsibility of suppliers, consumers and transit countries. I think it is time to launch truly effective mechanisms ensuring such responsibility. The only way to ensure truly global energy security is to form interdependence, including a swap of assets, without any discrimination or dual standards. It is such interdependence that generates real mutual responsibility. Unfortunately, the existing Energy Charter has failed to become a working instrument able to regulate emerging problems.

I propose we start laying down a new international legal framework for energy security. Implementation of our initiative could play a political role comparable to the treaty establishing the European Coal and Steel Community. That is to say, consumers and producers would finally be bound into a real single energy partnership based on clear-cut legal foundations. Every one of us realises that sharp and unpredictable fluctuations of energy prices are a colossal destabilising factor in the global economy. Today’s landslide fall of prices will lead to a growth in the consumption of resources. On the one hand, investments in energy saving and alternative sources of energy will be curtailed. On the other, less money will be invested in oil production, which will result in its inevitable downturn. Which, in the final analysis, will escalate into another fit of uncontrolled price growth and a new crisis. It is necessary to return to a balanced price based on an equilibrium between supply and demand, to strip pricing of a speculative element generated by many derivative financial instruments. To guarantee the transit of energy resources remains a challenge. There are two ways of tackling it, and both must be used.

The first is to go over to generally recognised market principles of fixing tariffs on transit services. They can be recorded in international legal documents. The second is to develop and diversify the routes of energy transportation. We have been working long and hard along these lines. In the past few years alone, we have implemented such projects as the Yamal-Europe and Blue Stream gas pipelines. Experience has proved their urgency and relevance.

I am convinced that such projects as South Stream and North Stream are equally needed for Europe’s energy security. Their total estimated capacity is something like 85 billion cubic meters of gas a year. Gazprom, together with its partners – Shell, Mitsui and Mitsubishi – will soon launch capacities for liquefying and transporting natural gas produced in the Sakhalin area. And that is also Russia’s contribution to global energy security.

We are developing the infrastructure of our oil pipelines. The first section of the Baltic Pipeline System (BPS) has already been completed. BPS-1 supplies up to 75 million tonnes of oil a year. It does this direct to consumers – via our ports on the Baltic Sea. Transit risks are completely eliminated in this way. Work is currently under way to design and build BPS-2 (its throughput capacity is 50 million tonnes of oil a year. We intend to build transport infrastructure in all directions. The first stage of the pipeline system Eastern Siberia – Pacific Ocean is in the final stage. Its terminal point will be a new oil port in Kozmina Bay and an oil refinery in the Vladivostok area. In the future a gas pipeline will be laid parallel to the oil pipeline, towards the Pacific and China. Addressing you here today, I cannot but mention the effects of the global crisis on the Russian economy. We have also been seriously affected. However, unlike many other countries, we have accumulated large reserves. They expand our possibilities for confidently passing through the period of global instability. The crisis has made the problems we had more evident. They concern the excessive emphasis on raw materials in exports and the economy in general and a weak financial market. The need to develop a number of fundamental market institutions, above all of a competitive environment, has become more acute. We were aware of these problems and sought to address them gradually. The crisis is only making us move more actively towards the declared priorities, without changing the strategy itself, which is to effect a qualitative renewal of Russia in the next 10 to 12 years.

Our anti-crisis policy is aimed at supporting domestic demand, providing social guarantees for the population, and creating new jobs. Like many countries, we have reduced production taxes, leaving money in the economy. We have optimised state spending. But, I repeat, along with measures of prompt response, we are also working to create a platform for post-crisis development. We are convinced that those who will create attractive conditions for global investment already now and will be able to preserve and strengthen sources of strategically meaningful resources will become leaders of the restoration of the global economy.

This is why among our priorities we have the creation of a favourable business environment and development of competition; the establishment of a stable loan system resting on sufficient internal resources; and implementation of transport and other infrastructure projects.

Russia is already one of the major exporters of a number of food commodities. And our contribution to ensuring global food security will only increase. We are also going to actively develop the innovation sectors of the economy. Above all, those in which Russia has a competitive edge – space, nuclear energy, aviation. In these areas, we are already actively establishing cooperative ties with other countries. A promising area for joint efforts could be the sphere of energy saving. We see higher energy efficiency as one of the key factors for energy security and future development. We will continue reforms in our energy industry. Adoption of a new system of internal pricing based on economically justified tariffs. This is important, including for encouraging energy saving. We will continue our policy of openness to foreign investments. I believe that the 21st century economy is an economy of people not of factories. The intellectual factor has become increasingly important in the economy. That is why we are planning to focus on providing additional opportunities for people to realise their potential. We are already a highly educated nation. But we need for Russian citizens to obtain the highest quality and most up-to-date education, and such professional skills that will be widely in demand in today’s world. Therefore, we will be pro-active in promoting educational programmes in leading specialities. We will expand student exchange programmes, arrange training for our students at the leading foreign colleges and universities and with the most advanced companies. We will also create such conditions that the best researchers and professors – regardless of their citizenship – will want to come and work in Russia.

History has given Russia a unique chance. Events urgently require that we reorganise our economy and update our social sphere. We do not intend to pass up this chance. Our country must emerge from the crisis renewed, stronger and more competitive. Separately, I would like to comment on problems that go beyond the purely economic agenda, but nevertheless are very topical in present-day conditions. Unfortunately, we are increasingly hearing the argument that the build-up of military spending could solve today’s social and economic problems. The logic is simple enough. Additional military allocations create new jobs. At a glance, this sounds like a good way of fighting the crisis and unemployment. This policy might even be quite effective in the short term. But in the longer run, militarisation won’t solve the problem but will rather quell it temporarily. What it will do is squeeze huge financial and other resources from the economy instead of finding better and wiser uses for them. My conviction is that reasonable restraint in military spending, especially coupled with efforts to enhance global stability and security, will certainly bring significant economic dividends.

I hope that this viewpoint will eventually dominate globally. On our part, we are geared to intensive work on discussing further disarmament.

I would like to draw your attention to the fact that the economic crisis could aggravate the current negative trends in global politics. The world has lately come to face an unheard-of surge of violence and other aggressive actions, such as Georgia’s adventurous sortie in the Caucasus, recent terrorist attacks in India, and escalation of violence in Gaza Strip. Although not apparently linked directly, these developments still have common features. First of all, I am referring to the existing international organisations’ inability to provide any constructive solutions to regional conflicts, or any effective proposals for interethnic and interstate settlement. Multilateral political mechanisms have proved as ineffective as global financial and economic regulators. Frankly speaking, we all know that provoking military and political instability, regional and other conflicts is a helpful means of distracting the public from growing social and economic problems. Such attempts cannot be ruled out, unfortunately. To prevent this scenario, we need to improve the system of international relations, making it more effective, safe and stable.

There are a lot of important issues on the global agenda in which most countries have shared interests. These include anti-crisis policies, joint efforts to reform international financial institutions, to improve regulatory mechanisms, ensure energy security and mitigate the global food crisis, which is an extremely pressing issue today. Russia is willing to contribute to dealing with international priority issues. We expect all our partners in Europe, Asia and America, including the new US administration, to show interest in further constructive cooperation in dealing with all these issues and more. We wish the new team success.

Ladies and gentlemen,

The international community is facing a host of extremely complicated problems, which might seem overpowering at times. But, a journey of thousand miles begins with a single step, as the proverb goes. We must seek foothold relying on the moral values that have ensured the progress of our civilisation. Integrity and hard work, responsibility and self-confidence will eventually lead us to success. We should not despair. This crisis can and must be fought, also by pooling our intellectual, moral and material resources. This kind of consolidation of effort is impossible without mutual trust, not only between business operators, but primarily between nations. Therefore, finding this mutual trust is a key goal we should concentrate on now. Trust and solidarity are key to overcoming the current problems and avoiding more shocks, to reaching prosperity and welfare in this new century.

Thank you.

The opportunities afforded by a fundamental review of the global financial system, predicting an explosion of jobs from government stimulus-fuelled investments in alternative energy technologies. However, “the main thing is to get through this as fast as we can,”

William J. Clinton, Founder, William Jefferson Clinton Foundation; President of the United States (1993-2001), called for urgent action to stem the current financial crisis and restore the global economy.

© World Economic Forum

“People are frightened out there,” said Clinton. “There’s a lot of fear out there in the economy. So I don’t think that now is the best time in the world to get new trade agreements. But I also believe that intelligent people all over the world will see that it is not necessarily the time to pick new fights, either. We have to get out of this together.”

“I believe that when we get through this we’ll have a 21st century finance system that will make money the old fashioned way by investing in goods and services that are needed for the modern world,” said Clinton. “So I think it will be quite a modern economy, but I think we’ll go back to a lot more traditional finance. People will still make money, but it won’t be like it was in this decade, and I think that will be a good thing.”

Agreeing with a statement made earlier by Chinese Premier Wen Jiabao pointing to the US origins of the present turmoil, Clinton underscored the need for US leadership in quelling the downturn. Clinton highlighted the opportunities afforded by a fundamental review of the global financial system, predicting an explosion of jobs from government stimulus-fuelled investments in alternative energy technologies, and the broad confidence and security that will result from a re-engineered world economy.

However, “the main thing is to get through this as fast as we can,” Clinton emphasized.

Clinton stressed the interdependence in the world economy, reminding governments that when they finance the US recovery by buying US Treasuries they are investing in their own export economies. “This financial crisis proves, as nothing else should – or could, the fundamental fact that global interdependence is more important than anything else in the world today. We cannot escape each other. Divorce is not an option.” Clinton applauded what he predicted would be a coming reassessment of global trading and development policies, in particular a return to supporting agricultural programmes in the developing world.

“These problems are, at one level, mind numbingly complex, and at another it’s fairly simple. We have a global crisis of asset deflation and we’ve got to put a floor under those assets, and America has to lead the way because it started there,” said Clinton.

At the end of the session, Clinton outlined his three main current concerns:

• A lack of investment in rural healthcare systems in developing countries. He worried that civil society programmes overly focused on medicine delivery while neglecting a primary public health deficiency that requires systemic and “less sexy” intervention.

• A weak commitment on the part of development programmes to helping poor countries feed themselves. Developing a self-sustaining, agricultural-based economy has proved to jump-start growth in countries such as Rwanda, Clinton said.

• A stubborn and widespread belief that only slower economic growth can lead to less global warming. Clinton called this a false assumption that hampers progress.

The Values behind Market Capitalism

Tony Blair | Stephen Green | Indra Nooyi | Jim Wallis

Moderated by • Maria Ramos

© World Economic Forum

As the global financial crisis deepens, the inevitable question arises on whether the rules and values that were in place to safeguard the capitalist system have failed or whether the system itself is in need of an overhaul. Panellists agreed that, while the financial system needs to be fixed, the solution is not excessive regulation that stifles innovation and free enterprise. A serious reflection of the morals and ethics underpinning the system is clearly warranted and, in particular, the concept of the common good has to be revisited.

Tony Blair, UN Middle East Quartet Representative and Member of the Foundation Board of the World Economic Forum, argued that “the free enterprise system as a whole has not failed. The financial system has failed.” He noted that the financial system was originally there to serve the wider economy and the wider economy to serve the wider society. The financial system wasn’t meant to be an end in itself. Unlike others before, this crisis is global in its impact. But part of the problem, he added, is that “the integration of the world…has moved far ahead of the political capacity to express that integration either institutionally or in terms of the alliances that we have.”

He added that it would be “quite bizarre” to still talk about the G8 as being the forum for the world’s leading economies and “unthinkable” for it to attempt to tackle the crisis without involving other countries. A major challenge for the Obama administration is how to unwind the present strategic alliances and put the right ones in place, Blair said.

Stephen Green, Group Chairman, HSBC, UK, said having long-term sustainable value is key to shareholder value.

He noted that values that once served the system well have seen gradual erosion. “This is about values that have developed in the markets in recent years. We have moved from the old cliché ‘my word is bond’ to a culture and atmosphere where ‘if there’s a transaction, if there’s a market for it, and I have a contract, and it’s legal, that’s it; I don’t need to think about the underlying right or wrong, suitability or unsuitability.'”

Moving forward, the moral order and not the legal order has to prevail, said Indra Nooyi, Chairman and Chief Executive Officer, PepsiCo, USA. Capitalism has to be tempered by sound values and not just those that worship the “almighty buck”. She said:

“You can have laws on the books but it’s personal compliance with those laws that is important.” Another problem contributing to the crisis, Nooyi pointed out, was that poorly-paid regulators were hard pressed to keep pace with the innovation taking place in the financial markets.

Jim Wallis, Editor-in-Chief and Chief Executive Officer, Sojourners, USA, believed that the right question to ask is:

“How would the crisis change us?” If it does not change people for the better, all the pain and suffering will be in vain. He said a contributing problem was the excessive trust in the invisible hand without thought to the virtues that should be brought to bear.

The Middle East: Owning Its Challenges

• Ali Babacan • Abdul M. Al Jaber • Manouchehr Mottaki • Hoshyar Zebari

Chaired by • Tony Blair

© World Economic Forum

The foreign ministers of Turkey, Iraq and Iran discussed the prospects for peace in the Middle East. There could be reason for optimism, despite the recent war in Gaza. “This year could be a successful one in the Middle East,” said Ali Babacan, Minister of Foreign Affairs of Turkey, which has been playing a key role in facilitating indirect talks between Israel and Syria. How the US approaches the situation will be crucial to forging peace, he reckoned. “So far, we have reason to be hopeful. Multilateral dialogue seems to be the main theme of the new administration.” Added Babacan: “We strongly believe that we can proceed in parallel processes along three tracks” between Israel and the Palestinians, Syrians and Lebanese.

To resolve the Arab-Israeli conflict, “you need strong Arab solidarity and support,” warned Hoshyar Zebari, Minister of Foreign Affairs of Iraq. “It is important that the Palestinians, Hamas and other factions recognize that without unity there would not be a peace process.” Asked by moderator Tony Blair, UN Middle East Quartet Representative; Member of the Foundation Board of the World Economic Forum, if Tehran supports a two-state solution to the Palestinian-Israeli conflict, Manouchehr Mottaki, Minister of Foreign Affairs of the Islamic Republic of Iran, stressed that all Palestinians, including those who have been displaced, should have the right to return to and live in their homelands. “We believe that they are the true owners of this land,” Mottaki remarked. On the role of the US, he said, “we are observing the policies of the new administration. We would like to see if President Obama distinguishes his policies in the Middle East from those of his predecessor.”

Meanwhile, Abdul M. Al Jaber, Vice-Chairman and Chief Executive Officer, Paltel Group, Palestinian Territories, questioned why Israel has continued to build settlements and other infrastructure in the West Bank and put up hundreds of checkpoints in the Palestinian Territories if it genuinely wishes to withdraw. He blamed politicians on both sides for the lack of progress in resolving the conflict. “It’s about time we challenge our politicians,” he concluded. “We need real leaders; we need change.”

Before closing the session, Blair argued that if the blockade on the Palestinian Territories were lifted and “if there were the right capacity building on the Palestinian side, you would quickly find the reality on the ground supporting the creation of a separate state.” The commitment by US President Obama to be engaged in the Middle East peace process from the beginning of his administration is “a good start,” Blair said.

The Global Compact: Creating Sustainable Markets

• Ban Ki-moon • Cynthia Carroll • Kris Gopalakrishnan • Muhtar A. Kent

Chaired by • Guy Ryder

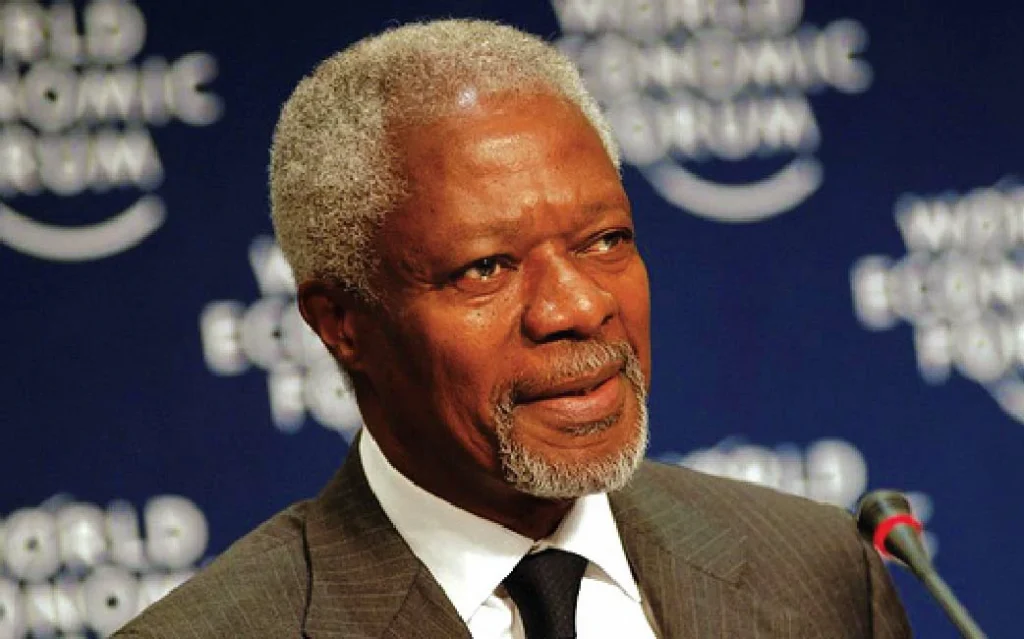

The current global economic slowdown has lead to a crisis in confidence in the private sector’s commitment to good corporate citizenship. “This is a moment when the values business is uppermost in our minds,” said Guy Ryder, General Secretary, International Trade Union Confederation (ITUC), Belgium. Two days before the 10th anniversary of former Secretary-General Kofi Annan’s announcement, at the World Economic Forum Annual Meeting 1999, of the United Nations Global Compact, which encourages corporations to engage in socially responsible and sustainable business practices, Ban Ki-moon, Secretary-General, United Nations, New York, called for a renewal of that commitment.

While some point to the current financial crisis as being an excuse for failing to meet global responsibilities, Ban said it presents “a gilt-edged opportunity”. “By tackling climate change head-on, we can solve many of our cu rrent troubles, including the threat of global recession.”

Under the Global Compact, the world’s largest corporate sustainability initiative, more than 6,000 business participants in more than 130 countries “have moved far beyond mere philanthropy,” said Ban. They have new best practices in the areas of human rights and labour law, as well as reforming their business operations to eradicate corruption and promote global stewardship of the environment.

While some may label Ban’s vision of “a new constellation of international cooperation” as naïve, his idea is not without precedent. Citing the Green Revolution of the 1960s and successful collective efforts to combat ozone depletion, AIDS, tuberculosis, polio, smallpox and malaria, Ban asserted that “today we have an opportunity and an obligation to build on these inspiring examples.”

“Today I urge you to join a new phase of the Global Compact,” said Ban. “We might call it Global Compact 2.0.” The crisis, said Ban, demands “a renewed commitment to core principles,” rather than a “retreat into nationalism, protectionism, and other isms that promote narrow self-interests over common global objectives.”

Following Ban’s remarks, several captains of industry who had already demonstrated their commitment to the Global Compact added their voices in favour of Ban’s call. Kris Gopalakrishnan, Chief Executive Officer and Managing Director, Infosys Technologies, India, held that voluntary adherence to the Global Compact was a good way for the private sector to regain the public’s trust.

Reciting successful engagements in her own industry, Cynthia Carroll, Chief Executive, Anglo American, United Kingdom; Chair of the Governors Meeting for Mining & Metals 2009, held that the Global Compact has already inspired meaningful change. She highlighted the Kimberly Process, which certifies diamonds sold on the global market as conflict-free; as well as the Extractive Industries Transparency Initiative, which aims to reduce corruption, stem conflict and promote sustainable development.

Good corporate citizenship is not just the right thing to do, held Muhtar A. Kent, President and Chief Executive Officer, The Coca-Cola Company, USA; Co-Chair of the Governors Meeting for Consumer Industries 2009, but a key component of his company’s success. Kent cited several example’s of Coca-Cola’s commitment to the environment, including advances in PET recycling, including the recent inauguration of the world’s largest plastic bottle-to-bottle recycling plant in Spartanburg, South Carolina. Kent expressed confidence that the Global Compact would evolve, and expressed hope that the best parts would remain as effective over the next decade as they have been since 1999.

The Economic Governance of Europe

• José Manuel Barroso • Fredrik Reinfeldt • Giulio Tremonti • Jean-Claude Trichet

Chaired by • Josef Ackermann

© World Economic Forum

Josef Ackermann, Chairman of the Management Board and the Group Executive Committee, Deutsche Bank, highlighted the key role Europe is playing in resolving the current financial turmoil and in shaping a new economic order. He acknowledged that the crisis has affected the balance between the state and the market, and called for a “coordinated approach”.

José Manuel Barroso, President, European Commission, echoed the need for unity in the face of crisis. “We are all in the same boat,” he declared. “Even the biggest member states cannot manage global problems such as the financial crisis and climate change in isolation.”

Barroso suggested that, acting together, Europe represents the largest economy in the world. He called for “a new triumph for coordinated European actions.” European integration will not derail, he argued. “Present trends will increase, not decrease, the need for European integration.” Europe will need to help shape the new world order or risk losing relevance.

On the near-term economic outlook, Fredrik Reinfeldt, Prime Minister of Sweden, sees a deepening of the crisis over the coming year. Referring to the experience of previous crises, he cautioned policy-makers to consider the longer term impacts of the large fiscal stimulus packages. “We learned in the early 1990s that huge deficits can lead to future imbalances, and that lesson should be remembered.”

For Jean-Claude Trichet, President, European Central Bank, the long-term objective should be to ensure resilience of the global financial system. “We need to solve immediate problems as well as follow a sustainable recovery path, and ensure long-term stability. To achieve this, he argued it is imperative to combat the insidious tendency towards short-termism.

Giulio Tremonti, Minister of Economy and Finance of Italy, spoke of the need to focus on the “governance of the economy of Europe.” The financial system grew too fast and was too levered, he said, agreeing that in the aftermath of the crisis, the balance of power is shifting towards governments, and pointing to the continued importance of the European Union in resolving the crisis.

Latin America’s Development Imperative

• Felipe Calderón • José Miguel Insulza • Alvaro Uribe Velez

Chaired by • Ernesto Zedillo Ponce de Leon

© World Economic Forum

Financial crises aren’t new to the region. One main difference this time, explained Felipe Calderón, President of Mexico, is that “the origin of the crisis was not Latin America.” Regardless of where or how it began, the global economic downturn has the potential to wreak havoc on the region’s economy. The economy and security emerged as two of the biggest concerns for Latin American leaders.

Calderón noted several reasons for optimism about Mexico’s position. First of all, the country’s banking system is sound. Its foreign reserves are three times as big as its foreign debt. In addition, analysts forecast that the economy will still grow by 1% in 2009, although this is down from 5% in 2008.

Smaller Latin American nations might suffer more severely. These economies are facing difficulties in attracting foreign investment, particularly when credit markets are tight. Because they typically rely on tourism and trade with the US, “most of them are going to have big trouble,” predicted José Miguel Insulza, Secretary-General, Organization of American States (OAS), Washington DC.

All Latin America nations, big and small, will have to rethink their economic approach now that recent revenue generators have faltered. High commodity prices no longer pull in foreign cash. Consumer spending has fallen. And declining consumption in the US has hurt demand for Latin American exports. The panellists had few simple answers regarding what could take the place of these sources of cash, but they agreed that to survive the crisis, Latin American markets will need to identify them.

The faltering global economy could also have a “dangerous impact” on security in the region, according to Alvaro Uribe Velez, President of Colombia. Fighting organized crime will be a huge priority for the region in the coming years. “We are kicking them, and we are kicking really hard,” said Calderón, referring to leaders of organized crime in Mexico. But he said combating crime in the region cannot be a unilateral effort, particularly when the largest market for narco-trafficking from Mexico is the US.

Key points:

• Latin American nations are likely to aggressively seek capital from foreign investors to weather the financial downturn.

• Preventing protectionist trade policies will be a focus for Latin American governments in upcoming negotiations with the administration of US President Barack Obama.

• Fighting organized crime will become a greater priority as the economy worsens.

Pakistan and Its Neighbours

• Ali Babacan • Syed Yousaf Raza Gillani • Bernard Kouchner • Abdul RahimWardak

Chaired by • Richard N. Haass

© World Economic Forum

Pakistan and Afghanistan can win the struggle against terrorism and extremism, but this can only be brought about through a combination of moves to convince ordinary people that they will have a better future under democratic systems and of military and security measures, as well as the support and understanding of the international community, representatives of the two countries told participants.

Moderator Richard N. Haass, President, Council on Foreign Relations, USA, said that getting the two countries onto a path to become stable and successful societies is one of the most pressing and difficult challenges facing the world today. Yet, in the United States there is a widespread perception that Pakistan, with its nuclear arsenal and terrorist problem, is a failing state.

For Syed Yousuf Raza Gillani, Prime Minister of Pakistan, that perception is very unfair. Under its new democratically elected government, all state institutions are working, the judiciary is independent and the media is free, while the economic situation is improving. To tackle the problem of extremism in the areas along the Afghan border, a “3-D” policy of dialogue, development and deterrence has been proclaimed by the government. “We know that army action is not the only solution,” said Gillani. Poverty, illiteracy and unemployment are the root causes of terrorism, and it has to be fought by tackling those issues. “My policy is to isolate the tribes from the militants, and that is what the government is doing very successfully,” he said. But US drone rocket attacks from Afghanistan against Taliban bases “are counterproductive”. They anger ordinary people, who have suffered many casualties, and push tribal people back into the arms of the militants and terrorists.Abdul RahimWardak, Minister of Defence of Afghanistan, also rejected as “too negative” foreign perceptions that his country is failing in its fight against the Taliban and in constructing a stable democracy. “Because of the destruction of the past 30 years, we have not yet been able to make a real difference in the life of the people.” But there is a long list of achievements, especially in institution building. “I am quite sure and optimistic that we can contain the threat, strengthen the government, improve the security situation and win this war,” he declared. Afghanistan welcomes the increase in foreign troops promised by the new US Administration, because it needs to cut the Taliban off from the people and create secure areas. “There is a need for a qualitative and quantitative improvement of the Afghan security forces,” Wardak said. Having a larger NATO force in the country will help buy more time.

Stability and progress in Pakistan and Afghanistan, said Ali Babacan, Minister of Foreign Affairs of Turkey, are vital for all countries in the region. Turkey has played a major role in bringing together the two governments, whose common enemy is terrorism. The deepening of democracy is key in both, and Turkey is reinforcing this view in discussions with all Afghan and Pakistani political forces. “In Afghanistan, it will be very difficult to solve the problem through more soldiers and more money.” Public support against the Taliban has to be won. Turkey is building schools and medical centres in cooperation with the Afghan government, recognizing that “soft” measures like these are highly effective in winning hearts and minds. Babacan echoed Gillani on drone

Gaza: The Case for Middle East Peace

• Ban Ki-moon • Recep Tayyip Erdogan • Amre Moussa • Shimon Peres

Chaired by • David Ignatius

© World Economic Forum

Passions run high and opinions vary widely in the wake of Israel’s recent incursion into Gaza. Yet reconciliation remains within reach in the Middle East. Both Israel and the Arab world remain committed to a two-state solution. With a new administration in Washington DC, there is hope that the US can resume its role as an honest broker in achieving lasting peace.

Much of the World Economic Forum Annual Meeting has focused on the global financial and economic turmoil, but to the 1.5 million Palestinians in Gaza, that crisis must seem distant to the daily one they endure, said Ban Ki-moon, Secretary-General, United Nations, New York. “This is a human tragedy,” he said, calling the situation in Gaza “unacceptable”. Expressing his personal commitment to alleviating the suffering there, Ban said that he had that morning issued an urgent appeal for US$ 613 million to rebuild Gaza.

Ban and other panellists outlined several prerequisites to peace. First, the ceasefire must be honoured and made durable. Hamas must stop its rocket attacks against Israel. Second, the Palestinians must cease the smuggling of arms into Gaza and Egypt must intervene to stop it. Israel must open border crossings, allowing urgent humanitarian aid and reconstruction materials into Gaza. In the longer term, Palestinians must unite and speak in negotiations with a single voice, not that of either Fatah or Hamas.

Recep Tayyip Erdogan, Prime Minister of Turkey, agreed that Israel must open the borders to Gaza, but said Ban’s proposals for aid to Gaza are insufficient to address the severe hardships faced by Palestinians there. “The Palestinian Territories are like an open-air prison, isolated from the world,” said Erdogan. Recalling his own visit to Israel and Palestine, Erdogan said he had to wait half an hour to cross into the Palestinian Territories. Turkey’s own humanitarian aid into Palestine, moreover, faces similarly unwarranted delays. “I have always been a leader who said anti-Semitism is a crime against humanity,” he said. “But so is anti-Islamism.” Erdogan accused Israel of dragging its feet in negotiations and of using disproportionate force in Gaza, he said. Peace negotiations must include Hamas, he said, as a legitimate part of Palestinian society.

The rocket attacks against Israel were in part a reaction to Israel’s long blockade of Gaza, said Amre Moussa, Secretary-General, League of Arab States, Cairo. “You cannot ask Gazans to be calm when they live under a blockade,” he said. But now innocent women and children are forced to pay the price. Moussa conceded that Arab nations have made mistakes in the long conflict over Palestine, but none as egregious as Israel’s recent attacks. The Arab world is ready to live in peace with Israel if it responds formally and positively to the Arab peace initiative. “We are willing to have Israel as a member of the family of Middle Eastern nations,” he said. “If Israel withdraws from the Occupied Territories there is no reason why we cannot live together.”

Shimon Peres, President of Israel, commended the Arab initiative, calling it a bold step forward in a history of the confrontation. He defended Israel’s recent actions, though, citing four years of attacks by Hamas against Israel, including 5,500 rockets and 4,000 mortars. Israel has demonstrated its goodwill towards Gaza, he said, by using its own police to force 15,000 Israeli settlers out and then investing US$ 20 million in local agriculture. He blamed Hamas for stoking the conflict, saying the group had established a dictatorship in Gaza. Quoting from Hamas’ charter, he claimed Hamas is dedicated to killing Jews. Iran also shares blame, he said, for arming both Hamas and Hezbollah. “The problem is not the Arab world, it is the Iranian ambition to govern the Middle East,” he said.

Fresh Solutions for Food Security

• Kofi Annan • William H. Gates III • Irene B. Rosenfeld

• Michael Treschow • Abhisit Vejjajiva

Chaired by • Josette Sheeran

© World Economic Forum

Famine is no longer confined to brief events in isolated pockets of the world; it is becoming a chronic and growing global threat to peace and prosperity, participants agreed.

Last year’s spike in food prices expanded the ranks of the world’s “urgently hungry” by 10%, afflicted one in six humans, caused widespread riots and toppled one national government, observed Josette Sheeran, Executive Director, United Nations World Food Programme (WFP), Rome, and Chair, Global Agenda Council on Food Security. This year, the world may witness “another silent tsunami,” she warned.

The root of the problem is that many farmers, especially in Africa, do not have access to the right seeds, fertilizer, credit, land tenure, irrigation equipment and marketing tools to feed themselves, said Kofi Annan, Secretary-General, United Nations (1997-2006), Member of the Foundation Board of the World Economic Forum, and Co-Chair of the World Economic Forum Annual Meeting 2009. In Africa it is primarily women who bear the burden of labour. But banks will not likely give them loans, since they have no equity or credit history. By banding together with others in a cooperative to share equipment and costs, he said farmers “could gain more from their hard work than they do today.”

The cooperative must go beyond local farmlands, said two multinational business leaders. Collaboration for food security must link coalitions of governments, businesses and civil society globally.

For example, cashew farmers in Africa need not ship their products to India, only to then have them packaged in Europe. Time and money could be saved and quality improved if the entire process took place in Africa. “We suppliers need to look at efficiencies across the supply chain,” said Irene B. Rosenfeld, Chairman and Chief Executive Officer, Kraft Foods, USA. “We have the capability, technology, land and water supply, but we don’t have the right food getting to the right people at an affordable price.”

Michael Treschow, Chairman, Unilever, Netherlands, agreed. “Two thirds of our ingredients come from the agricultural food chain,” he said. The company is expanding its sourcing, going from big farmers to 500,000 small farmers, especially in vegetables. “Where we can do more is to help farmers to self-help.”

“The world has never been more advanced in terms of creating wealth, and yet more and more are becoming hungry,” observed Abhisit Vejjajiva, Prime Minister of Thailand. “The problem we face is a reflection of market and government failures,” in which food production and distribution are being distorted. “The root cause is all about distribution and purchasing power. In some countries, despite a food surplus, the very poorest are the farmers.”

Participants advocated attacking the long-term problem on two fronts. On the supply side, governments should support farmers with advanced technology and reform landholding rights, both of which can usher in another wave of the Green Revolution. On the demand side, developed nations need to get rid of subsidies that distort the value of food grown in developing countries, allowing higher purchasing power and safety nets so that even the poorest can gain access to food.

In the short term, donors and civil society must bridge the gap. While there may not be a need for many new programmes, said William H. Gates III, Co-Chair, Bill & Melinda Gates Foundation, USA, the developed world’s private and public institutions must increase and focus their lending, investments, aid, training, food storage and technology research in the agricultural sector, because doing so now yields multiple benefits down the road. For example, development of drought-resistant seeds will help tropical regions endure the extremes of climate change, while better nutrition means children under five might survive the ravages of viruses and disease.

Special Address by Angela Merkel, Federal Chancellor of Germany

• Angela Merkel

Chaired by • Klaus Schwab

© World Economic Forum

The German chancellor stressed the need to re-establish confidence in the German economy and global markets if new investment by all sectors is to be encouraged. “Only in this way can we emerge from this current crisis on a solid footing,” Merkel maintained.

Many have lost their confidence in market forces and globalization. Without confidence in the stability of our national economy, “no company will invest. Without confidence, no banks will provide credit and no consumers will buy,” she said. In short, “without confidence, there will be no return to productivity.”

Merkel reiterated her economic stimulus package for 2009 and 2010 as “extraordinary circumstances” requiring “extraordinary measures”. This will enable Germany to assume its responsibilities as Europe’s largest economy for stabilizing growth and employment. The package will not be a short-term response, but will link economic stimulus with measures for employment and effective long-term structural reforms.

The chancellor also emphasized the necessity for Germany to rebuild its own financial systems and help the international community establish new confidence for dealing with what she described as the worst economic crisis since the end of World War II. The German government must undertake everything in its power to provide its economy and citizens with the means to stimulate renewed growth.

Germany must support the creation of reforms and institutions needed at the international level, she said. “An international crisis can only be resolved at the international level.” Merkel is inviting the European members of the G20 to Berlin for a preparatory meeting before the scheduled G20 gathering in London on 2 April 2009.

Additional measures include a combination of tax relief and credit guarantees to promote economic stability. “Our goals are clear. Germany should not only survive this crisis, but emerge stronger than when it went in.”

The chancellor warned that the financial package would imply serious financial burdens and performance demands on the German economy. However, Germany has already proven itself capable of pursuing a successful balance of payments course. “This gave us the necessary room for manoeuvre in order to confront the crisis quickly and with force,” she said. From this, she noted, we have learned that we need to keep a lid on new debts once the current situation has been resolved.

Merkel’s proposed measures would not protect specific national, European or international institutions, she said. The need to protect credit providers and citizens as savers is crucial. “We need to draw lessons for the future … we have to imagine the world after the crisis.” This means establishing new rules not only for the international finance system but also for the global economy as a whole. “We have to ensure that such a crisis never happens again,” she said.

Merkel further highlighted the need for transparency in the international finance markets. Such issues cannot be resolved by Germany alone, nor by the European Union or even the G8. That is why the G20 and leading international institutions, such as the United Nations, International Monetary Fund and the World Bank, have to be involved.

A Conversation with Gordon Brown

• Gordon Brown

Chaired by • Christiane Amanpour

© World Economic Forum

Gordon Brown, Prime Minister of the United Kingdom, rejected suggestions from Christiane Amanpour, Chief International Correspondent, CNN International, USA, that his country is becoming “Reykjavik-on-Thames.” “I believe we are better placed to come through the difficulties than we have seen before,” he said. “Why? Because we have low interest rates, low inflation, low public debt, and we’ve got a corporate sector that is not indebted and is in a very healthy position.” His government is taking the decisions necessary to maintain and improve the country’s infrastructure and prepare it for the future after the recession. “I believe the sound fundamentals of our economy will soon show through,” Brown said.

Brown said the crisis in the banking sector is global, although affecting different countries in different ways. One of the problems is that there is no global map to deal with it. The financial industry was not globalized in the 1930s as it is today so governments have no previous experience to guide them in handling the present crisis. “We are learning all the time how to deal with the real problems.” He added the international financial system as presently structured has to be rebuilt, partly as a means of limiting the contagion from problems arising in one country, but this does not mean any retreat from open globalization and basic market principles, although “not everything can be left to the market.”

Brown said trade protectionism is a danger that has to be watched, but the real threat of unilateral national action comes from elsewhere. Decisions by some countries to restrict their bailout funding to the national operations of their endangered banks is “a form of financial protectionism … financial isolationism.” It is hitting especially hard at smaller and developing countries. As a result, they are seeing vast capital sums withdrawn and investment inflows drying up. These countries are already likely to be the bigger victims of the recession, and in many cases, their own financial service industries are insufficiently developed to take the strain. He indicated that there is a need for an international mechanism to ensure that capital flows to them are renewed.