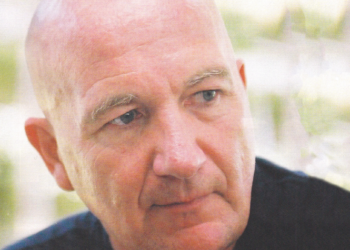

David Griffiths, CEO, HSBC, Sri Lanka and Maldives, talks to Business Today about the local regulatory environment, the bank’s corporate social responsibility philosophy and how they attract, retain, motivate and develop the bank’s key talent as well as about the challenges of doing business in Sri Lanka.

By Dinesh Weerakkody

Assisted by Harin Fernando

Could you give us an overview of the progress made by HSBC in the last two years and how you compare with your main competitor banks on total assets, total advances, NPAs and total deposits?

We bought in US$30mn of capital last year, and in terms of our capital funds and profitability ratios we are among the top five banks in Sri Lanka. In terms of non-performing assets we are one of the lowest and on this basis we run a well-managed, profitable business. HSBC has had a local presence of over 114 years, providing a full range of services to both a corporate and retail customer base.

What sectors do you aggressively service?

Our clients range from multi-nationals down to large local corporates, to Small and Medium Enterprises commonly known as SMEs. We formally established our SME unit this year. We had always been servicing SMEs, but it was thought that this was the time to put it out as a separate business unit, so that we can focus resources specifically on the SME sector. In terms of the retail sector, we cater to the high network Premier customer base as well as to a very broad professional middle market sector. I would say we are upper-middle to high-end market as this is where our customer base lies.

Where is your business growth coming from?

Both from the corporate and retail sectors. When we brought in additional capital last year, we identified potential for growth in both these sectors. We are expected to show our head office a return on such investment and this has been displayed by the growth shown in both these sectors.

The capital for growth was raised from tier one capital. with some of it being from retained profit from previous years. We have also broadened our customer base. One important aspect is that we have not compromised on our credit criteria. So we have raised the bar in terms of our reach and in terms of how we project our retail business, but we have remained consistent throughout and not relaxed our credit criteria at all.

What we have done, however, is re-package our products and become more innovative in the way we present them. We also decided to be more proactive in our promotions. We sat down and said ‘this is the product strategy,’ so what you would have seen from HSBC in terms of credit card promotions, etc. are a consistent style, message and theme. We started reaching out, because we believe that most people in Sri Lanka want to pay their debts, and if we did not think that was the case we would not have bothered doing it. We could have stuck to our corporate business and not really focused that much on the retail sector.

When we started our advertising campaigns last year, we realised that there is a good class of borrowers out there. Today, the results show that our belief was correct. These are some of the things we have done to raise our profile.

Banks are very poor when it comes to brand building. What are you doing to change that?

We have a separate marketing function and a very focused approach to raising the bank’s profile. We have the people to do it. In the past, our employees were very busy trying to do public affairs, CSR and marketing simultaneously.

Our recent Lifestyle Loans campaign was very successful. I think the advertisements we put out are very different; not just the usual happy faces, they were a bit more punchy with phrases like ‘Don’t ask why? Just say why not’ and people responded very well.

We have carried out one Lifestyle Fair in Colombo and another in Kandy, and these saw us reaching out to the general public. In Kandy, we had 15,000 visitors in two days and that is one of the biggest events that Kandy had seen for quite some time.

So the issue at hand is broadening our geographical customer base, while not changing the quality. We find that there are people out there who would like to bank with HSBC, but in the past had felt that we are not interested in them. Now we are going up to people and saying for this sort of salary range, we are interested in you.’ Now you will see that we advertise in all three languages, whereas before we only advertised in English. This tri-lingual policy applies even to our press releases.

Hence, the Lifestyle Fairs were successful in that we had thousands of visitors who came not only for the retailers, but also for the bank. We also had an opportunity to talk to them, and one of the things we asked our staff to do is just to talk to people. We let them know that HSBC Sri Lanka is not a foreign bank for foreigners – in fact, there are only three expatriates out of 1,400 staff. So this is very much a bank that is Sri Lankan run, but we need to show people that, and you can’t do it through advertising, you have to have face-to-face contact.

So, through the Lifestyle Fairs, the public could come and see us, and talk to us with no obligation involved – if they didn’t want a credit card or to open an account, that was fine by us. I think one of the key elements of the success of the Lifestyle Fairs was that we partnered our merchant customers, as we wanted to do something for them as well, rather than just display a poster. We wanted to show them that there was something that we could put together, which is fairly unique.

What are you doing to strengthen and expand the operations of HSBC in deposit mobilisation?

We are happy with our deposit growth, and, as you would have seen, we tend not to offer competitive rates in line with our high credit rating. The recent practice in the industry is that some banks want to outbid each other, which I don’t think is necessary. So it is on that basis that we continue to promote such activities. I think what is of concern is that deposit rates are very high, which therefore means that lending rates are ver high, and the cost to corporate borrowers will thus increase, making them less competitive when compared to other countries in Asia.

Will your growth be organic or will it be through acquisitions?

We will be focusing mainly on organic growth. For example, we are widening our reach by opening a branch in Negombo, and we are looking at other channels through which to do business. We are so large already that we don’t want to dilute the quality of our asset book with the distraction of merging, because we have our own systems that have been built up in-house for decades.

Thinking of the future, will HSBC focus more on retail or corporate banking?

The good thing about us is that we do both retail and corporate banking, and I like the fact that we can engage in several business areas. For example, we have just started a micro finance project with an NGO.The Central Bank operates a fair and level playing field, so we are not prevented from opening more branches. That is just the way we have decided to do our business – whilst the level playing field exists, we are quite happy to grow organically.

Are you also focusing on the rural sector to fuel your deposit growth?

Banking with HSBC gets you into the HSBC global world, so there are still people living in metropolitan areas who would like to have access to that global world and like to be an HSBC Premier customer, that we have not talked to as yet.

But we also recognise that there are People outside of Colombo that want deal with us, so the new branch in Negombo and the existing branches Kandy and Wattala are only the be :inning as we look to expand outside Colombo.

How effective are you when it comes to leveraging HSBC’s global strengths?

With access to the HSBC global network, you are part of a global customer base and a bank that is efficient, secure and well regarded as a top quality brand.

We are a bank that treats everybody the same and a bank that brings in new products and services. We were the first to bring in ATMs, EasyPay machines and Internet banking; we constantly look to bring in such new technologies and services.

We also bring in the Group’s global expertise. For example, the Group first used the EasyPay machines in the Philippines. We saw them there and bought them here, so, yes, we look around the Group.

We are currently looking at the functions of our banks in South America and if they look good we will bring them to Sri Lanka. So, in HSBC, you have a bank that has the potential to do a lot more progressive things.

Are regulators taking a proactive approach to manage the complexity of banking operations as the tools needed to manage this complexity have become more sophisticated?

Yes. We have a good relationship with the Central Bank and their position is to be fair and equal to everybody. We don’t ask anymore than that, because we can compete on a level playing field.

We are currently working with them to review the single borrower limit, so we are contributing to the industry as a whole. When we talk to the regulators we find that they are receptive to the ideas and suggestions we have. We are talking about new products, such as interest rate and foreign exchange hedging products.

Will the introduction of Basel II requirements have an impact on your capital growth and credit quality?

One of the issues of Basel II i the more efficient use of capital, which is why banks wanted to move from Basel I to Basel II. In terms of capital efficiency, we will focus on different areas of the business; in terms of credit quality, we can say that we are already aligning our systems to be able to report and categorise, as Basel II requires. Again, our Head of Credit Risk here is with the working group alongside the Central Bank and other commercial banks to ensure the transition to Basel II is smooth. What we want to see on a continuing basis is a strong banking industry; it is of no benefit to us to have weak performers in the industry. This is why we get involved in these issues, as we want the external perception of the banking industry to be a good one.

HSBC is still seen more as a closed bank, because of limited information in the public domain. What are you doing to change this perception?

We are a branch, but publish results every six months and it is there to see in the public domain. However, we are not a publicly listed company, and, therefore, do not produce an annual report.

Share with us some of your global good corporate governance practices and SOPs.

In terms of good governance, we have segmentation on the lending side. People that market loans and advances are seperate from the credit and approval group. On the corporate side, we have a credit risk management team that looks at credit proposals, monitors accounts closely and are independent of the corporate relationship managers that pursue new business.

The same applies in retail banking. We have a credit risk team, seperate from the branches that bring in customers, that approves loans, so yet again, that function is separate. The issue I see in terms of credit is making sure that you have monitoring systems in place and that you act on it. There is no point in trying to chase a customer after 12 months. If he or she is delinquent, you contact them in the first month and the problem is better solved at that stage.

Are your performance management systems top line or bottom line driven?

Our head office wants to see growth, but they also want to see good business. So it has to be a mix of both, because the bottom line is often your bad and doubtful provisions. There is no point in being the biggest bank, if you have the highest level of bad debt. Shareholders want to see dividends at the end of the day. We make a profit for our shareholders, so we have to be bottom line driven, whilst ensuring that the quality is there.

The HR department is focusing on where the bank is going and the people and skills we need. At the end of the day, it is a service industry and people are the biggest part of it.

What do you think of our banking sector’s credit risk management capability?

Within the industry, there are a number of good practitioners and we see other banks that have good credit risk management. There is a lot of discipline and skill in Sri Lanka and a lot of people here have accountancy qualifications, and on this basis, I would say the industry is doing reasonably well.

Many companies think that by writing a cheque to a charity, they have fulfilled their social obligations. Real CSR, in effect, helps a firm to reduce the cost of transactions – and thus boost profits – by building trust between a company and its suppliers, customers and the community. What is your view?

We do not engage in CSR just to win awards. We were involved in tsunami-related projects: a school building in Matara and lace making in Beruwela. We have also undertaken a tsunami housing project and a long-standing project in Horton Plains, which looks into waste management there. These are complemented by a new project in the Sinharaja rainforest. We have a range of activities that enable our staff to get involved. Because we are in the banking business, we are fairly self-effacing about this. Yes, we tell people we do it, but we try and keep it at a modest level and it is not something we brag about. The important thing for us is that our staff get involved in this as much as possible. We are in the banking business, but CSR shows our staff there is more to life than just making profit, and that is important to us and helps us offer a well-rounded working environment.

On the operational excellence side, what are you doing to cut down costs and to pass on the benefit to the customer?

We have set up a new unit called Organisational Design and Development and we have people who understand ‘six sigma.’ So in terms of operational efficiency, there is a team here that works with all the business units. What we all want to do is make sure that we have got the optimum levels of productivity, and then we can have a clear idea as to how much capacity we can handle. For example, the reason we brought in EasyPay machines, was to make life easier and our operations more efficient. We have had to double them and they are available 24/7. This has seen the freeing up of the banking hall, thus making it more efficient. We need to be efficient, because our head office compares us, not with the local banks, but with other colleagues in the region, and bearing in mind the number of public holidays and weekends we have in Sri Lanka, we have less time to do this work. So our staff has to be more efficient, as they have less days in the year to process probably the same number of transactions.

Why is HSBC reluctant to build up Tier two capital, such as subordinated debt, to support balance sheet growth and new investment?

We are not reluctant to build up tier two, but rather, we have no need of tier two capital as we have enough tier one capital. When we ask for additional capital, we also ask to retain profit because we wanted to grow the business and as long as we do that profitably, we have head office support.

How do you attempt to replicate and practice the HSBC global culture locally?

All the rulebooks, systems, and materials come from head office. The branding is very head office-driven. However, we are allowed to tailor some aspects to meet local requirements, such as those relating to regulations or market requirements.

We are also in the process of standarising simple things like branch interiors so that even if you are in Negombo or New Zealand, the customer will know that they are walking into an HSBC branch.

Is there a rationale to promote some of the value added services that you offer overseas, in Sri Lanka?

We bring in everything we can, the only obstacles are either regulatory policies or the actual market size. Mutual funds and insurance are just two of the facilities that we are yet to offer locally, but we are constantly reviewing this.

HSBC has a track record of attracting the best and the brightest talent in Sri Lanka. What is your secret?

It’s a good brand, with a good reputation, and we are strictly an equal opportunity employer. People are promoted based on ability and we have a HR process that is not externally influenced. I think the younger generation likes this- it doesn’t matter where you come from in Sri Lanka, if you pass the tests, you can get in. I also think that people like to feel part of an international company and people cherish the possibility of going overseas. We have several executives spread across locations like Hong Kong , Vietnam, UK, Australia, China, etc. If you have the ability, you will succeed, and there is no glass ceiling.

Your Employee Value Proposition, is it more to do with cash or career?

We pay to market and do market surveys every year. There is also an opportunity for self-development. We know that a number of our staff, even after joining us, are still in college, and there is a thirst for knowledge. Our training courses cover a very wide range of topics and subjects extending to technical, supervisory and even management.

There is a lot of discipline and skill in Sri Lanka and a lot of people here have accountancy qualifications, and on this basis, I would say the industry is doing reasonably well.

Do you do any handcuffing for talent retention?

We send staff on overseas training at a very high cost. We also econd staff to overseas branches. However, none of these require the staff to enter into a bond, All banks offer loans on a preferential rate basis, but you can always get that at another bank, so there is no handcuffing in that sense. We believe that we are an employer of choice, with lots of freedom to seek employment with the best employer. However, our turnover is very low.

On the talent management side, how do you identify those with the right potential to advance within HSBC’s global network of talent?

We conduct development reviews for the executives and have an annual appraisal system. What we recently made available for all our staff, is a career development road map on the staff intranet site; ‘these are the top jobs in the bank, this is the management structure and you can figure out how you can get there.’ These listin include the job descriptions, educational and experiential requirements. When you have 1,400 people, you can’t really manage them all at once. What we have done is taken out the mystery by saying ‘this is how you can get there,’ and these are constantly under review by our HR department. The HR department is focusing on where the bank is going and on the people and skills we need. At the end of the day, it is a service industry and people are the biggest part of it.

To increase the number of high flyers within the business, what type of leadership development practices do you have?

Our senior cadre takes courses, and we are currently working on a project to bring both the managerial and technical courses together, into a more rounded way, because we find individuals taking the two streams at different times and sometimes they may be out of sync. Our managerial training tends to be overseas. Sri Lanka is a feeder of talent into the HSBC Group, and I am pleased to say that when our local colleagues do go overseas, they have a very good reputation.

HSBC says it is a learning organisation. How much time do you spend coaching and sharing your experiences with your key people?

The working life is very busy, but I spend a lot of time on these aspects. I encourage our people to spend as much time as they can on learning. We have training centres and libraries. Some companies worry about employees going somewhere else, but I don’t see it like that. I believe the training we offer will make them stay with us.

The regulatory environment and legal system, a pool of qualified talent – this is what we have. The biggest problems are inflation and productivity.

Do you promote a work-life balance?

It is a problem for some parts of the business, as we have been expanding very quickly. So the work-life balance in some areas has become more ‘work’ than ‘life.’ There is a tendency for the business to come first and then the headcount lags. In some parts we have lagged a bit, but we are putting together guidelines to promote a healthy work-life balance.

Do you get feedback from your staff and customers regularly?

We do an employee attitude survey every year and it is anonymous, so we get feedback. The marketing section also undertakes qualitative studies with groups of our customers, and they usually revolve around a campaign or service, because statistics don’t always tell you the whole story.

Are you looking to migrate to business outsourcing for support and supplementary services?

We do have some individuals on contract, but security and quality are the two main limiting factors. We would rather re-allocate our headcount than reduce it by outsourcing. We keep a majority of the income generating activities in-house, whereas we try and automate or outsource the cost activities.

What is your future channel management and distribution strategy?

We will develop the branch network and the use of other infrastructure. For example, our credit card customers can now pay their bills at any supermarket chain.

Are rising interest rates an issue for your bank?

What concerns me is that it will affect our corporate customers. The cost for them to do business will increase and this will impact their regional competitiveness. For a bank, if you are running your books well, the issue is just the margin and that is where your profit comes from. Also, the rate of inflation, compared to the region, is very high. This is something that everybody has been struggling with and it needs to be resolved fairly soon.

What keeps you up at night?

You always have to look ahead. Like with any business, you just cannot stay still, because there are people out there that are looking ahead. We don’t have all the good ideas, others out there have good ideas well. What I keep thinking of is how we can be better by doing something different?

We are often told that Sri Lanka has a huge black economy. What should the government be doing to turn this black into white or perhaps even grey?

On the remittance side of business, everybody is working hard, trying to bring that money in through formal channels. One way to encourage people to use banks and other financial institutions is to make them more easily accessible. On this issue, Sri Lanka is fairly well positioned.

How do we position Sri Lanka to attract more foreign capital?

It is difficult, because you are competing with a number of countries. So we really have to be clear on what our competitors’ strengths are.

The regulatory environment and legal system, a pool of qualified talent – this is what we have. The biggest problems are inflation and productivity. If you look around South East Asia, as an investor and see inflation in double-digit figures, you would probably go somewhere else. Salary inflation is an issue; the reason why we want industry to invest is because we want to employ people. BPO is an attractive industry and it requires low capital investment; you can set it up in a rented building and lease the computers, but the people are the biggest cost.