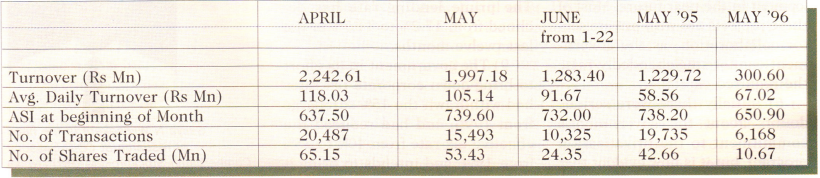

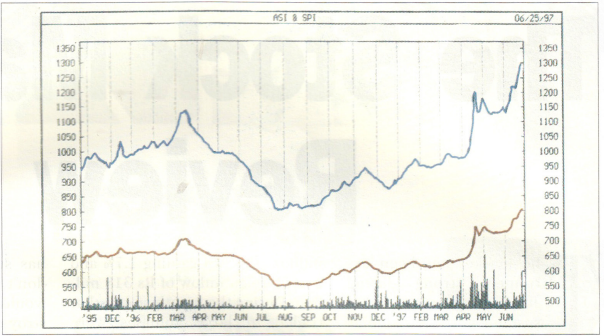

The market has been extremely strong during June with turnover being sustained at levels similar April and May and the indices appreciating by 10%. With the current gains the broader All Share Index (ASI) has gained 30% for this year and is an impressive 43% above the level of July 1996.

Strong foreign buying has been the main cause for the impressive performance of the market. Latterly retail buying has also been seen in the market adding further momentum to its appreciation.

The first week of June was relatively quiet with average weekly turnover at Rs 58.9 million and a net foreign inflow of Rs 69.6 million. Both indices gained above 3% and blue chip stocks witnessed significant price appreciations. In the second week, turnover increased marginally to Rs 61 million while the ASI gained 2.5%, and the net foreign inflow was a marginal Rs. 10 million. Again the blue chip stocks were the main gainers, al- though the quantities traded were relatively small. The third week was one of the most active periods seen during recent times with the average turnover at Rs 171

million, the ASI gaining 1.7% and a net foreign inflow of Rs 318 million. During the month stocks that traded in large volumes were DFCC (Development Finance Co- operation of Ceylon), Grain Elevators, Asian Hotels, Sampath Bank, Hotel Services, Ceylon Brewery and Lion Brewery.

Foreigners have been very active in the market during the last three months with a net inflow of Rs 258 million in April, Rs 451 million in May and Rs 450 million for June. This inflow is certainly a very healthy sign and has been the highest seen since the first quarter of 1994.

POLITICAL OUTLOOK

Recent events in the political front confirm the government’s confidence in taking bold and decisive steps. Firstly, it was the cabinet reshuffle in which a pro labor minister of labor was shifted to another ministry, and the removal of a dissident minister from the cabinet. The President also shifted ministries of certain ministers whose performance was not up to expectations. The military also continues to maintain its operation to take over further LTTE held areas, but in recent weeks it has suffered some setbacks. We don’t believe that the military would be able to completely destroy the LTTE in the near future, but it will certainly be a depleted force incapable of its current destructive capability.

CORPORATE RESULTS

An analysis of the corporate results released for the quarter ended March 31, indicated a very positive trend. In general most results were above analysts’ expectations with the three blue chip diversified holdings John Keells, Aitken Spence and Hayleys being the top performers. The hotel sector was also a strong performer after the disastrous performance in the previous quarters. The banking and manufacturing sectors were inline with analysts’ expectations and they also did show healthy growth except for the two development banks.

MARKET OUTLOOK

After the initial rapid appreciation of the indices we now believe that the market is on an uptrend at least in the medium term. Our forecast is based on the fact that some of the major concerns with regard to the government, economy and the equity market

have now receded. Our major concerns were the following:

1) A possibility of a drought similar to last year which resulted in a power shortage and decline in rice production. As sufficient rainfall was witnessed this year we did not witness any power shortages. Now that required additional thermal power generation capacity has also been installed we do not foresee any power shortages in the next few years.

2) As the fear of a drought no longer exists rice production is expected to increase by 25% after a similar percentage drop last year, and tea output is also expected to marginally improve after a 8.8% decline in 1Q 1997.

3) Industrial output is also on an upturn as production can continue unhindered from any power shortages. Last year many small and medium scale industrialists were very badly affected by power shortages.

4) Labor unions have in the recent past been exerting excessive influence but with the recent cabinet changes the new labor minister is expected to reduce the power of the trade unions. Many employees believed that the former minister of labor was more sympathetic towards the demands of trade unions.

5) The government is now embarking on significant infrastructure development programs particularly in telecommunications, highways and power generation. They will also embark on port development in the near future. Most of these projects are with private sector collaboration, as the government cannot singlehandedly raise the required capital.

6) Initially there were serious doubts about the government’s commitment to the privatization program, but it is now evident that it is going ahead with its ambitious program. The privatization of Lanka Telecom in the next few months coupled with the completion of the privatization of the plantation sector and Air Lanka will certainly be welcome news to the market.

7) Some analysts believe that a 10-15% devaluation of the currency is necessary to ensure the competitiveness of exports, given that the average inflation for the last six years was 11.4% while the rupee depreciated by 6.5% (against the USS) on average per annum during this period. Considering that export growth has been maintained, and the adverse impact devaluation could have on inflation we don’t expect devaluation to exceed 7% p.a. for the next two years.

8) High cost of borrowings have been a major cause of concern for industrialists, and the government has made a conscious effort to bring down the cost of funds by Central Bank intervention and by reducing the reserve requirements. The prime lending rate has declined from 17.2% to 14.7% in the last twelve months.

9) The government in its effort to bring down corporate tax rates had withdrawn the 15% surcharge from 1996, and had reduced the effective tax rate from 40% to 35% from 1996 and intends to bring it down further to 30% by 1998. The government’s objective is to make Sri Lanka the lowest tax regime in the South Asian region.

The only real concern is the continuing conflict in the North which is not expected to subside in the next two years. The government appears to have adopted a two-pronged strategy to solve this conflict. Its first approach, a negotiated settlement failed as the LTTE unilaterally broke the ceasefire and commenced hostilities two years ago. Now, the government is on one hand pursuing a military strategy to completely weaken the LTTE in order to bring them back. to negotiations while, offering substantial devolution to the provinces to enable the moderate Tamil parties to govern the North ern Province. Saliya N Wijesekera is the head of research at CDIC Sassoon Cumberbatch Stockbrokers (Pvt) Ltd.