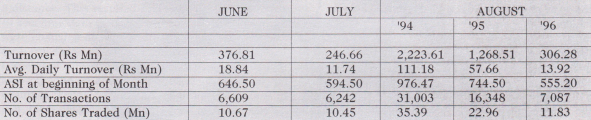

The continuous decline wit nessed during June and July abated in August. In June and July the All Share Index (ASI) lost a staggering 14%, making Colombo the worst performing market in the region and possibly one of the worst performers in the world for 1996. The rapid decline in the market was mainly attributable to the deteriorating economy both at the macro and micro levels. The power crisis was the main cause although a host of other factors also did contribute. In August and in early September, we witnessed marginal improvements in turnover and in the number of transactions when compared with July. Also, the All Share Index stabilised during this period. The marginal improvement in the indices were mainly on account of retail investor interest in low-priced stocks, which had declined by over 30% during June and July, and limited foreign interest in blue chip stocks. With the power crisis over atleast for the present, new expectations ensured that the market would not decline further. But an immediate revival of the market was not witnessed as the corporate results released for the quarter ended June 30 were unexciting in most cases. Further, due to concerns on the escalating defence expenditure, cost of subsidies and reduced inflow of foreign direct investments, foreign portfolio investors have largely kept away from the Sri Lankan market. Still, some limited foreign investor interest was seen in blue chip stocks during mid-August.

The plantation companies have attracted significant investor interest, both from retail and institutional investors. All the offers for sale of plantation companies which were undersubscribed, are now trading at a minimum premium of 50% above issue price. During August, the offer for sale of the controlling interest of Agrapatana and Hapugastane Plantations were sold at Rs 35.75 and Rs 23.50, a massive premium of Rs 25.75 and Rs 13.50 respectively. This argues well for future privatisation of plantations as the government will be able to raise over Rs 4 billion from these privatisations. Holder- bank’s (the largest cement manufacturer in the world) decision to take controlling interest in the Puttalam Cement Company also argues well for the long term potential of the economy. Another positive factor is that, due to the government’s interventionist policy of infusing new money, treasury bill rates will not reach the expected 21% by year end, but will peak at about 19%. The government’s decision to indefinitely delay the Labour Charter and possibly reintroduce it with the consent of the employers is also a positive indicator. The government has also decided to reduce the wheat and bread subsidy and this will reduce pressures on the budget deficit.

It is certain factors in the macro outlook that is currently depressing the market. Inflation is also expected to increase to approximately 19-20%, due to the increase in money supply, reduction in bread and wheat subsidies and increase in public sector salaries.

Corporate Earnings Outlook for the Short Term

Of the corporate results released for the quarter ended June 30, Seylan Bank recorded an impressive 40% growth in turnover and a 41% growth in profits for the first six months of 1996. Commercial Bank also recorded a commendable 17% growth in turnover and a 13% growth in profits. Further, Sampath Bank also recorded a steady 10.8% growth in profit after tax. These results are admirable given the fact that the economy has suffered a massive slow down during this period. The more established development banks and the other listed commercial banks did not record any growth in their profits during the said period. The blue chip Hayleys recorded a marginal growth in profit mainly on account of the impressive performance of its subsidiary and associate companies namely Haycarb and Dipped Products. We expect corporate results for the quarter ended September 30 to improve in the manufacturing and banking sectors. With the power crisis now under control, the manufacturing sector can return to previous levels of production, and this will ensure improved cash flow for these companies. This will also help the banking and finance see tors as their loan loss provisioning and write-off of bad debts will reduce gradually. If this scenario does develop, which appears to be a strong possibility, then a minor revival of the market is expected by early 1997, provided there is no deterioration on the military and economic front.

Regional market outlook

The outlook for Asian markets is not as optimistic as when the year began, mainly due to the attraction of emerging East European markets and the expectation of a possible interest rate hike in the United States. But Asian economies continue to record strong economic growth, and in most cases have been able to overcome possible overheating of their economies. Therefore, interest in Asian markets that had declined substantially during the last two years, is expected in the near future, although not of the magnitude witnessed during the bull run in 1993. The Asian markets which are expected to attract the most interest are the Philippines, Thailand and Malaysia.

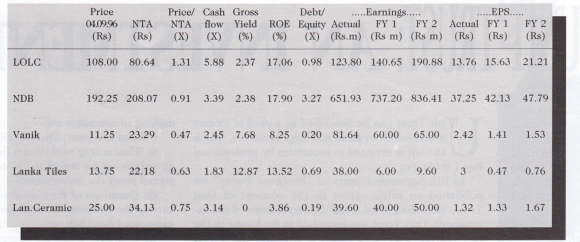

Outlook and Strategy for the Sri Lankan market

In the case of Sri Lanka, although our market has been the worst performer, significant investor interest is not expected in the short term, and therefore in the current context the expectation is for the market to remain dull and directionless. Turnover levels are expected to be low as there is no sustained foreign buying, as country fundamentals are poor. Further, local retailers and institutions are expected to concentrate on fixed income securities in the short term. Therefore, atleast until the end of the year no significant change in the market be it increased activity or indices is expected. In the current context, some strong shifts in sentiment is needed to change the market outlook. Most investors, we believe, will adopt a wait and see attitude to ensure that corporate results are on the right track. Investors should now build cash positions to take advantage of buying opportunities that will arise by end 1996. In this context, our recommendation is for investors to carefully watch the market and take advantage of any buying opportunities that may arise due to overreaction of the market to some negative news. This would be the most ap propriate time to build one’s portfolio with an investment time frame of two to three years. The most appropriate strategy is bottom-up stock picking with the expectation of improved corporate results for the third quarter and fourth quarter.