by Chitra Weerasinghe

Tele-banking in Sri Lanka is a totally new concept. Union Bank, located on the third floor of Colombo Trade Center, boasts of comprehensive tele-banking service.

The screen phone introduced by us in December, 1995, is the first of its kind in South Asia, says Union Bank’s Managing Director, S Shanmuganathan. According to him, the basic focus of a bank should be towards the introduction of innovative products and services to its customers which are user-friendly. And Union Bank’s focus is on communications, a fast-developing technology.

Anything to do with a phone is more acceptable to the general public than computers, says Shanmuganathan. Hence, 25 phones have been installed at the bank for this purpose and Shanmuganathan finds the response “pretty positive”.

The bank’s General Manager Janaka de Silva, talked about the two types of tele-banking facilities hey have.

According to one facility, a bank’s customer could call the 24hour tele-banking system and get whatever information he/she requires. This facility can also be used to convey instructions to the bank. For example, information like the balance to date, whether a cheque had been cleared and credited to the account, whether a cheque issued was paid, etc., can be obtained. The customer can also issue instructions to the bank like stop payment on a cheque, transfer funds from one account to another if both accounts are in this bank, transfer current account to savings and vice versa. Tele-banking also allows the customer to get a fax message of his/her bank statement, instruct the bank to pay utility bills like electricity and water, make third party payments, provided the customer has already made an arrangement with the bank.

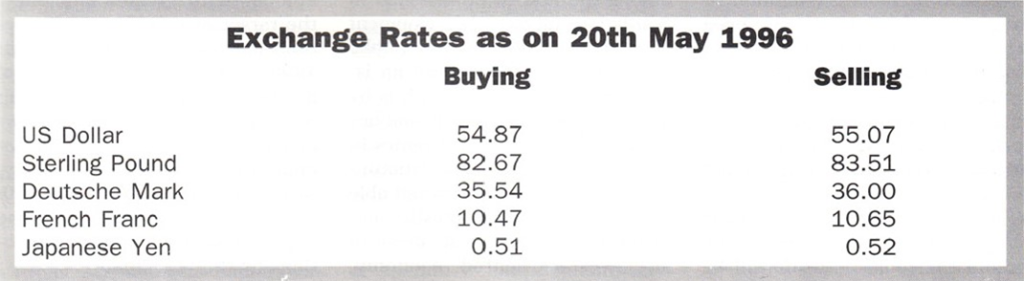

All this can be done simply by means of a push button or a rotary phone. “What is unique to us in this system is that even a rotary phone could be used,” says Mr. de Silva. Non-customers too can avail themselves of certain facilities like getting information on exchange or deposit rates and the like. So much for tele-banking.

The other new and more unique system they have introduced is what they call the “UB Virtual” or the “Union Bank Virtual”. This is basically a screen phone. And here you can not only hear the information that is relayed but also see it on the screen.

“For this, you need a telephone with a built-in screen and here you could do all that is available on the tele-banking system plus see the details of the process involving the activity in any of your accounts,” says Mr. de Silva.

This phone costs about 70,000 Sri Lankan rupees. And if any eustomer desires to possess one, he could do so from the bank itself on payment of this sum. This instrument can also be leased for a monthly payment of Rs.1,500 .

“For our customers who have significant deposits with us or those who meet with certain criteria laid down by us, we will waive this fee,” says de Silva.

The screen banking system, he pointed out, was meant mostly for heavy users. This system also has the facility to print whatever information is displayed on the screen.