by Saliya N Wijesekara

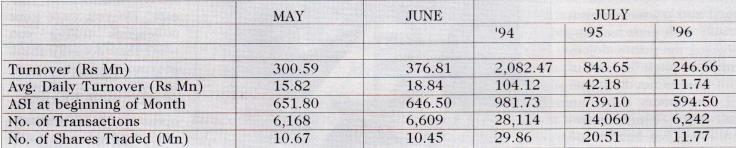

The market continued to be dull and unexciting during the month of July but showed some signs of a marginal recovery in early August. The average daily turnover of Rs 11.7 million recorded for July was the lowest for the year. The market has shrunk to levels not witnessed in the last three years and this is clearly indicated when considering the average daily turnover of Rs 104 million and Rs 42 million recorded for July ’94 and July ’95 respectively. The marginal upward movement in the All Share Index and the Sensitive Index in August could be mainly attributable to the 14% decline in the market in June and July and some positive thinking in the minds of investors. A change in investor perception was due to the following factors.

• The power crisis which reached alarming proportions in June and early July has since receded due to heavy rainfall in the hydropower generating regions This will allow small-scale industrialists to return to regular production hours. Large-scale manufacturers particularly in the tile and textile sectors will also benefit, resulting in an improved performance for these companies.

• The labour charter which was criticised by both local businessmen and foreign investors alike, appears to be held back until market conditions are appropriate. This will reduce the excessive powers labour unions would have wielded if the labour charter was approved.

• Improved rainfall will help to increase agricultural output particularly tea, which is enjoying very attractive prices in the last few months. This will also help to improve the country’s export earnings, and to some extent reduce the negative impact of the reduced manufacturing sector output on the GDP.

On the regional front, the South Asian region appears to be showing some degree of political stability with the coalition government in India surviving without any major problems. In Bangladesh, also we have witnessed some political stability after the new government of Prime Minister Sheikh Hasina took office. But the reaction to the Indian budget was mixed and the introduction of a minimum tax on corporates resulted in a decline in stock prices. This tax mainly affected blue chip stocks as most of these companies enjoy tax exemptions through effective tax planning. But these factors are not sufficient to change foreign investors’ “wait and see” attitude immediately. If the region can continue to show these positive swings in the medium term. then, we could expect another inflow of foreign investment which would certainly benefit Sri Lanka.

On the international front, the economies of the United States. and Japan will continue to record attractive growth rates, and this argues well for Sri Lankan exports, and the export manufacturing companies will certainly benefit. Of the emerging stock markets, South East Asian markets such as Malaysia and Philippines and the Latin American markets are expected to attract a bulk of the funds, as their economies are expected to record growth rates far more attractive than the South Asian countries.

Market and Corporate Earnings Outlook for the Short Term

For the quarter ended June 30, corporate earnings are expected to be bleak, as most companies were affected by the power crisis during this period. But Commercial Banks have recorded an earnings growth, and this is commendable given the fact that the economy was faced with a multitude of problems during this period. The easing of power cuts will result in increased economic activity and both Commercial and Development banks will benefit due to increased demand for credit and improved servicing of credit facilities already extended. The direct beneficiary of the above mentioned positive factors is the manufacturing sector. The immediate impact of easing the power cuts will be reflected in the earnings of the manufacturing sector during the current quarter and the next quarter.

In the medium-term, the withdrawal of the labour charter will induce greater investment by these companies. The plantation sector will continue to record impressive earnings growth as both tea and rubber prices are at extremely attractive levels, provided, the plantation trade unions don’t make excessive demands. If the weather conditions remain favourable, and the plantation sector workers don’t create problems we expect most plantation companies to record a 15%-20% profit growth for 1997. This is due to the expectation that both tea and rubber prices will remain relatively stable during this period. This also argues well for the privatisation of plantation companies, as the government will be able to attract significant investor interest for these plantation companies.

A diversified portfolio consisting of blue chip and growth stocks with a concentration in the banking, manufacturing and plantation sectors will provide the best returns to investors.

The offer for sale of Tea Small-holders Factories Ltd., was well received by the public, and was oversubscribed by over 3.7 times. When the stock commenced trading, it traded at a 30% premium to the issue price. This was certainly a boost to the market and clearly identifies the need for new issues to be well priced, as they will attract interest even in the current dull market. The Lanka Lubricants offer for sale which most analysts believe is overpriced has not attracted substantial retail investor interest although some institutional investor interest was witnessed.

At present, the outlook for corporate earnings is positive as compared to the previous quarter but we don’t expect a significant revival of the stock market in the short term, mainly due to the negative macro environment. The government’s stated intentions of reducing the budget deficit and controlling inflation appear a distant dream, but a 16% rate of inflation which is expected for 1996 would not impede growth. On the economic front, the privatisation proceeds are expected to fall far below the targeted Rs 21 billion, which will result in an increased budget deficit. The expected reduction in subsidies will reduce pressure on the next year’s budget and must be viewed favourably as in some instances it is not the most needy that benefits.

In this context, our recommendation is for investors to cautiously take positions on market weakness. A diversified portfolio consisting of blue chip and growth stocks with a concentration in the banking, manufacturing and plantation sectors will provide the best returns to investors. Our top recommendations are Vanik Inc., National Development Bank, Lanka Ceramics and Richard Pieris. Vanik Inc. which suffered immensely due to its overexposure to short term borrowings is not expected to suffer the same fate in 1996 and 1997, as they have reduced their asset liability mismatch. Further in the medium-term we don’t expect a tightening of liquidity as witnessed in the last quarter of 1995. The price of the National Development Bank declined mainly due to the uncertainty regarding the sale price of the convertible debenture. Once this is overcome, we expect the stock to appreciate. Lanka Ceramies at the current discounted price offers a very attractive opportunity if one has confidence in the long-term potential of the ceramic industry.