Shell is in Sri Lanka on a long term commitment, because of the prospects in this market and the importance of the South Asian region as an area of emerging growth. So says Frank Van Den Akker, Managing Director of Shell Gas Lanka Limited, which was established when Shell International purchased the majority stake in the privatization of the Colombo Gas Company, a government-owned enterprise. Shell Gas Lanka Ltd., has a five year monopoly for the supply of LP Gas for domestic and industrial use in Sri Lanka. Van Den Akker who is very optimistic about the potential for growth in Sri Lanka, was interviewed for Business Today by Lucien Rajakarunanayake.

BT: What is it that made Shell come back to Sri Lanka?

Well, the real answer is that Shell never left Sri Lanka. After the political changes in the sixties, we scaled down our operations and maintained only a small presence. We were involved in the chemical trade, and had our own representative here. We have now come here in a much bigger way because of the opportunities that we can see today. Earlier, when the lubricants business was being privatized we looked at coming in there too, but didn’t get the opportunity. So, in fact Sri Lanka has not been out of our sights. We can see the huge potential for development in this country, specially from the long term point of view.

We operate with a long term perspective, always trying to find suitable partnerships, and believe in co-operating with the people, in the market, and looking towards the broader national interests, wherever we invest.

BT: There has been considerable opposition to privatization in Sri Lanka from vocal sections of the trade unions. What has been your own experience so far in dealing with employees of the company?

I must emphasize that the overall employee response has been very positive. The Government has apprised them of the changes. They had been promised a partnership in the new company, and were given shares in it. This has helped in creating a mutual partnership. There had been good dialogue right throughout the privatization process with the Government and other related authorities.

It is obvious that there has been a conscious effort by the Government to point out to the employees the benefits which would accrue from privatization, both to themselves and the country. A lot of this understanding was passed through union representatives.

BT: There was considerable criticism of the increase in the price of LP Gas very soon after Shell took over the major stake in the company. Many sections of the public felt that privatization would inevitably lead to higher prices, and there was a build-up of opposition to privatization. Why was the price increase done at that time, and will such increases be the order in the future?

This certainly needs careful explanation. This involves the very rationale of privatization. At the time we took over, the price of LP Gas had been sold for a long time at a subsidized price. This is something that a government can do. Just a matter of cross subsidy. But a private company has to do business at real market prices. We have to realize that the country is fully dependent on the import of LP Gas. So we are also dependent on supply and demand at world market-related prices. That international price is the key element which determines the final price at which it comes to the consumer. We can’t just ignore it. We have to pay the price.

I must also say that the price increase was done on the basis of a properly defined pricing formula which was included in the privatization agreement. So, there is in fact a price control in place on LP Gas. There is a regulator that has to approve any price change, upwards or downwards. Please note that when considering the relationship to world market prices, there could be times when the price could be lowered too.

BT: There have been reports that Shell has refused to buy LP Gas from the Sapugaskanda refinery, which compelled the refinery to burn the gas. Is this correct, and if so why?

LP Gas is the by-product of the refinery process. As far as we are concerned we will buy the entire volume of LP Gas produced locally, throughout the year, as long as the price is competitive. It is competitive at the moment. I would like to point out that there are tremendous benefits to us, in buying locally. These include safety, greater security in terms of availability, and all the logistical advantages, such as not needing special barges to transport the gas from ships, and a few 100 trucks to move the gas to our facilities. However, the local refinery’s output is limited by its capacity. A word about burning gas. It is very important that in a refinery the gas is kept burning, and a flame seen. That is a sign both of work and safety. If there is flame, there could be a dangerous build up of gas within.

BT: What is the new venture with regard to the construction of an LP Gas terminal in the port that has been launched, after privatization?

It is a new venture, but part of the privatization agreement. The Government was very keen that whoever takes over a majority stake in the Colombo Gas Company should also invest in infrastructure development. The others who made bids only showed an interest in the marketing of LP Gas. We shared the government’s view that infrastructure improvement should be a key consideration. One of the biggest challenges that an LP Gas company has to face in Sri Lanka today, is the building up of a satisfactory infrastructure.

While we have invested in building new infrastructure facilities, we are also very much concerned about improving the existing facilities, which have been dangerously run down. There is cause for concern about the existing facilities. Concerns about safety and supply reliability. These are all being addressed.

BT: What exactly are these concerns?

Just to give you one example. Take the cylinders that go to every home that uses LPG. According to international standards of safety, more than 50 percent of these cylinders are below the minimum standards of safety. They have been poorly stored. They are transported dangerously. We have now begun a programme to replace all the substandard cylinders. In addition, during the next three years we will bring an average of 200,000 to 250,000 new cylinders. The public must already be seeing the blue cylinders on which we have placed our branding. These are cylinders that meet all safety standards.

BT: One of the conditions of privatization of the Colombo Gas Company was that the new investor would make a special effort to supply the more deprived areas with LPG. Have you begun this move, or will you be concentrating on the urban market for a longer period of your monopoly? As you know, the demand for cooking fuel in the rural areas, is a serious threat to the environment through depletion of the already limited forest areas?

Our vision is that LPG as a clean fuel should be given all opportunities to reach its full potential, and as such should be made available nationwide. I share your concern about preserving the forests. We have a very clear policy that will facilitate the introduction of a smaller portable cylinder linked to a burner, which can penetrate the rural areas, at an affordable price. A proto-type of this is already being tested. We are hopeful of making it available soon.

BT: What are the main infrastructure improvements you will be making?

There is the construction of a new terminal. There will be new storage facilities; new cylinder filling facilities, and most important a pipeline connecting the port to this new terminal. In terms of tank capacity this will be one of the biggest LPG filling facilities in the world. We believe in the potential of the product and can achieve the maximum potential in the long term.

BT: You say it will be one of the largest filling facilities in the world. Are you thinking of selling LPG from Sri Lanka to other South Asian countries?

Of course, the opportunities are good for our company in these countries. We have taken a realistic view, taking into consideration the expansion by others in the area as well.

BT: One of the promises of privatization has been the opportunity for training of employees in better, more modern skills. Before privatization there was apprehension by workers whether typists will be made redundant with the use of computers. What is the real position?

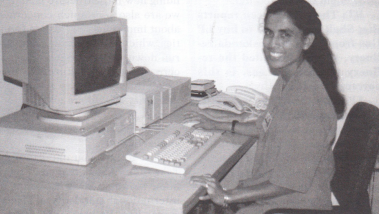

Shell worldwide puts great emphasis on training and the upgrading of skills of staff throughout our operations. Our employees will be given all the opportunities to develop their skills. You mentioned about typists. There was not a single computer when we took over the majority stake in the company. Now you will see the same typists working on Personal Computers. There is very keen interest by the employees to acquire new skills, and it is our policy to encourage this.

Personally, I am aware of the good name that Shell has had in this country, when we were a larger operation. We care about and are very proud of it. We want people to be sure that Shell always cares.

BT: You mentioned safety on the larger scale. But what is the situation within your facilities?

I can tell you that safety is one of the main concerns at Shell. This company has been below average standards of safety. But we are putting this right. We are giving priority to safety and protection of the plant and the employees. When we took over there were employees in barefeet working in an LPG facility. This could not be allowed. We have given all of them safety shoes. We have given helmets to the workers who need them. Safety glasses have been provided for those whose work needs these. None of this was in existence when we took over. The Pettah facility is very old, and very unreliable for that reason. It is located in an unsuitable place. We are checking all the tanks regularly for safety. All our bowsers are checked and the port operations are constantly monitored for safety.

We have a safety training programme for employees. At least 80 per cent of our staff are already. participating in safety training and awareness programmes. We are keen to make people have the proper attitude towards safety considerations.

BT: Will these safety considerations be extended to your dealer network as well?

The dealer network that was in place is still in place. That is because we do not wish to disrupt services. But we are gradually making changes to make the dealers do the job as Shell would do it ourselves. There should be a high measure of safety; supply to customers should be ensured. The network has over 1000 dealers. We will be making them more customer-friendly and responsive as standard bearers of Shell.

BT: Will Shell confine its activities to supplying LPG to the domestic and industrial sectors during its five year monopoly, or will it look at other areas such as automobile gas as well?

The agreement does not prevent us looking at that sector. We already see that some others are in it. In Korea, Japan and Australia auto gas is very popular. It also causes much less, environmental pollution. We can always look at that sector.

BT: There have been reports that Shell has stopped the supply of LPG to the National Hospital, Colombo, and other hospitals. Is this correct?

There should be no concern whatever about our continuing the supply to hospitals, or any other facility that uses LPG. If supplies cannot come through the existing pipeline network for safety reasons, we will supply it from cylinders. It is only a small supply, and we know the necessity and importance of supplying facilities such as hospitals.

BT: Having decided to invest here, and now having come here, despite the many problems that Sri Lanka has, how do you assess the potential for other big investors in Sri Lanka?

There is certainly very good potential and prospects. Of this I do not have any doubts. If we look at the fuel and energy sector, there is now the process of privatizing the operations of the Ceylon Petroleum Corporation. This will attract interest from major oil companies. One must not forget that Sri Lanka is a sizeable country. It is not just a dot on the map. It has 17 million people. With a similar population in Malaysia, there is at least 10 times the consumption of LPG.

You can be sure that most people who will take an interest in Sri Lanka, given the current circumstances, are those with a long term policy and interest. They will certainly want to have a good stake in Sri Lanka, which is located in the current growth area, and with plenty of opportunity for enterprise.

BT: What is your assessment of the capabilities of the work force in Sri Lanka?

I came here from the Philip pines, which is not a bad comparison. I think the work force here has a very positive attitude. They have a great asset in that a good many can speak or understand English. They have a great potential to pick up new techniques and methods very quickly. All that is needed is the right motivation. Given that, one can say there is no problem whatever with the workers in Sri Lanka.

BT: There have been reports issued by trade unions, which were published in the Press, that some employees of the Colombo Gas Company have been retrenehed since Shell took over. Is this correct. There was the understanding that privatization would not involve any retrenchment?

There has been no retrenchment. Not a single member of the permanent staff of the company has been asked to leave. The privatization agreement lays down clearly that the staff will be assured of employment and at conditions which are not less favourable at the time of privatization This we have strictly observed. Of course, some so-called trainees and some contract labour have been terminated.

BT: Why stop the work of trainees?

They are not exactly trainees chosen for special skills. There has been a practice here that the children of some parents employed come in, in the form of trainees and then become absorbed to the permanent staff. That is not a policy which is conducive to efficiency. As for the contract labour, there was really no need for them, and they had a very poor record in attendance. We did not need their services.

BT: Is your coming to Sri Lanka an indication of Shell’s greater interest in this region?

I would say yes. We are in Bangladesh and Pakistan. We are looking at all emerging markets. We are in almost all the new states which have been established after the collapse of the Soviet Union. With regard to our asset base, Shell has so far mainly been in the traditional markets of the West We are now looking at the areas with future growth potential in South and South East Asia, and would like to be the first in our category wherever we go. We are in Vietnam, Laos and Cambodia. There are also the mega markets of India and China.

BT: With your international network, will employees of Shell in Sri Lanka be able to obtain training in your other facilities abroad?

This is certainly part of our core policy as an international company. We believe in cross-fertilization of skills. We will not only bring in expatriates to support the operation in Sri Lanka, but there will be all opportunities for Sri Lankans to be posted abroad, not only for training, but for management as well. We already sent a person of General Manager rank for training in the UK. Very soon. we will be sending four employees. from Floor Managers to Superintendent level to France, for training in a filling plant there. The opportunities are always open. This can emphasize my answer to your first question. Shell is here to stay, as we have always been, because we believe in the potential of Sri Lanka.