February 8, 2024. Justinas Baltrusaitis

Banking giant JPMorgan Chase (NYSE: JPM) has suffered financial and possible reputational setbacks due to a series of legal oversights stemming from the firm’s failure to adhere to regulatory requirements. This has resulted in substantial fines that have brought attention to the banking industry’s broader challenges in combating related offenses.

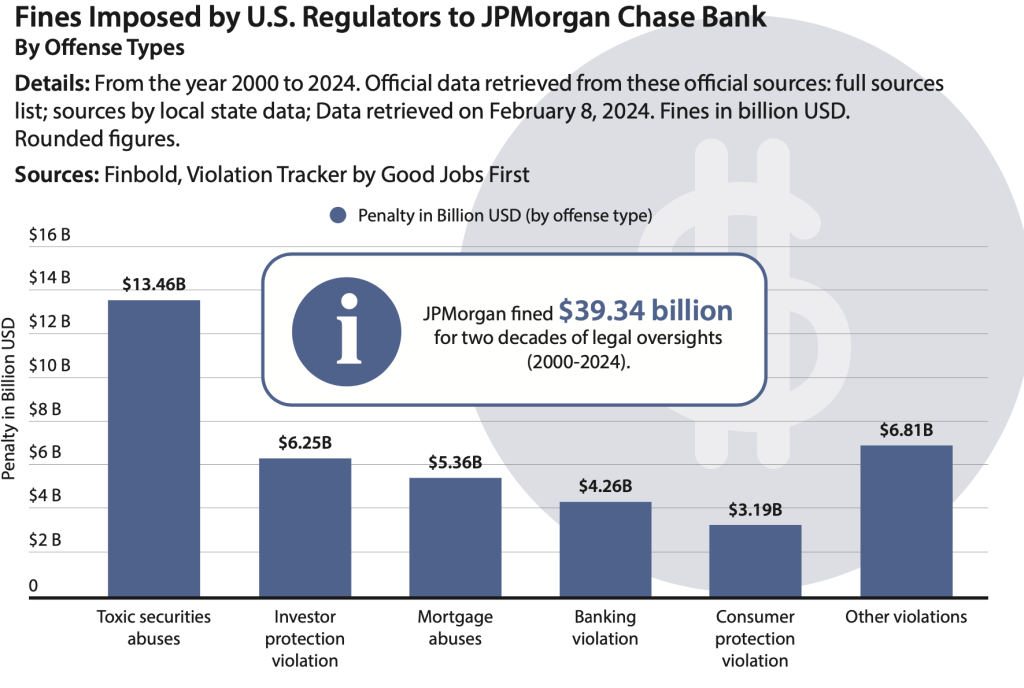

According to data compiled by Finbold, from 2000 to 2024, JPMorgan incurred fines totaling USD 39.34 billion for various violations. The largest fine, amounting to USD 13.46 billion, was related to toxic securities abuses. Failure to comply with investor protection policies resulted in a fine of USD 6.25 billion, followed by USD 5.36 billion for mortgage abuses. Additionally, banking violations led to fines totaling USD 4.26 billion during the same period.

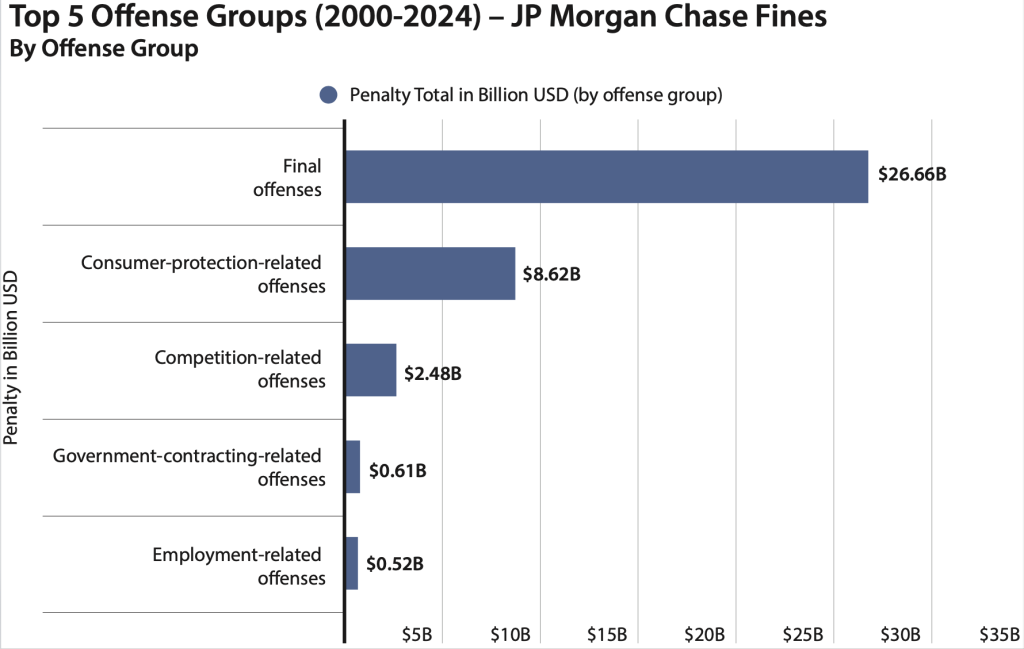

A breakdown of offense categories reveals that financial violations accounted for the highest amount, totaling USD 26.66 billion across 117 records, followed by consumer protection at USD 8.62 billion from 63 records. As documented in 28 records, competition-related violations amount to USD 2.48 billion, while government-contracting violations stand at USD 0.61 billion from a single record. Employment-related offenses rank fifth, totaling USD 0.52 billion from 50 records.

Understanding JPMorgan’s hefty fines

Indeed, by any measure, the amount of fines incurred by JPMorgan Chase is considered hefty, and they compliment the fact that such institutions operate in a complex environment, and occasional legal issues may arise due to the intricate nature of financial markets, transactions, and regulatory compliance. When violations occur, they are typically addressed through legal proceedings, settlements, or regulatory actions.

Clearly, the fines are not from isolated incidents but rather what can be considered systemic failures over the years. The lack of adequate internal controls, combined with a failure to address misconduct promptly, has potentially allowed unethical practices to play out over the years, resulting in hefty fines.

In this case, financial violations are leading considering that JPMorgan is operating in the sector, and violations encompass a wide range of activities, including misconduct, market manipulation, money laundering, and other breaches.

Notably, a significant share of the fines is linked to the 2008 financial crisis. In 2013, the bank reached a historic USD 13 billion settlement, concluding months of tense negotiations with the Department of Justice (DoJ) concerning a series of investigations into its risky mortgage deals. This fine, the largest civil settlement with any single company, resolved several investigations and lawsuits initiated by US authorities regarding the sale of home loan bonds between 2005 and 2008.

It is worth noting that based on JPMorgan’s size, the bank can handle the hefty fines imposed by the regulators. The bank typically has substantial resources and risk management capabilities to absorb fines, but the impact on its overall financial performance and reputation can still be significant. Additionally, it’s crucial to differentiate between isolated incidents or legal challenges and a systemic pattern of high financial offenses. Financial institutions like JPMorgan are subject to rigorous regulatory oversight, and authorities typically thoroughly investigate and address any misconduct.

The impact of fines

The repercussions extend beyond the financial sector, as the violations and the magnitude of fines have raised questions about the practices of banking giants. Critics advocate for stricter oversight and regulatory reforms to prevent similar situations from arising.

Calls for enhanced transparency and accountability within the banking sector have also surfaced, with proponents urging more robust regulatory measures to curb corporate misconduct. Interestingly, these shortcomings have given voice to alternatives, such as the shift to cryptocurrencies like Bitcoin (BTC).

From a border perspective, the fines imposed on JPMorgan highlight the emerging concerns, risk management, and regulatory compliance issues facing the US banking sector. With regulators such as the Securities Exchange Commission (SEC) fining most banks, there has been an uproar among Wall Street players regarding the situation.

Looking ahead, the likelihood of fines increasing is significant, considering that regulators are implementing stricter mechanisms for monitoring. At the same time, given the intricate nature of obtaining information on violations, entities such as the SEC have underscored the importance of enforcing whistleblower protection rules in recent months.

This emphasis has led to a series of actions against companies for language in employee agreements that the agency deems as discouraging individuals from reporting wrongdoing.

Justin crafts insightful data-driven stories on finance, banking, and digital assets. His reports were cited by many influential outlets globally like Forbes, Financial Times, CNBC, Bloomberg, Business Insider, Nasdaq.com, Investing.com, Reuters, among others.