From the World Economic Forum comes concerns about rising interest rates, the strengthening of the US dollar, weaker global growth, and the intensity of the risks of a systemic sovereign debt crisis in emerging and advanced economies. The enormity of the worldwide debt made the case to debate whether the world was in a debt spiral. After all, significant conversations have occurred about resolving the debt-laden nations crippled under its burden by multiple onslaughts of the past years, the pandemic, and bad economic management. Inflation and higher interest rates are piling up on the woes. But those concerns hardly moved creditors to make concessions. The realities have changed in the 21st century. Enter the new breed of creditors beyond the traditional Paris Club. They are the movers and shakers in an ever-growing debate on restructuring debt for poor and developing economies. Meanwhile, Latin America confronts financing issues amid high inflation and considerable debt. Into this equation comes the story of Britain’s near-miss economic disaster of September 2022 due to poor decision-making.

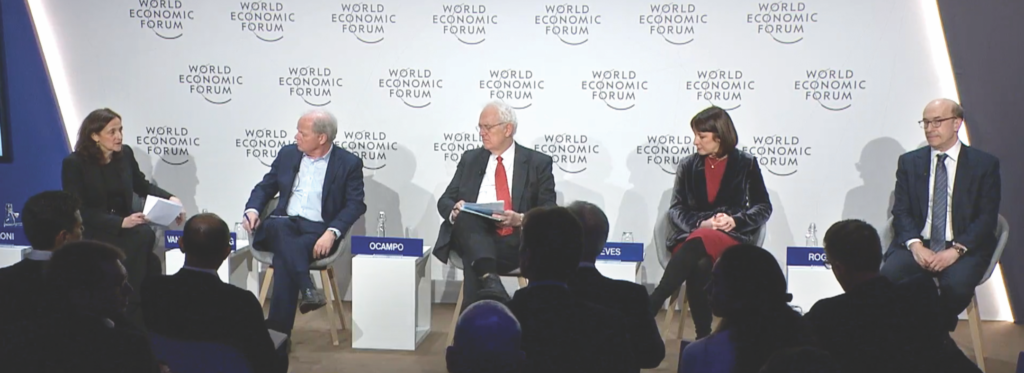

The session developed in collaboration with Thomson Reuters had its Editor-in-Chief, Alessandra Galloni, as moderator. The guest speakers were Rachel Reeves, Shadow Chancellor of the Exchequer, House of Commons of the United Kingdom; Kenneth Rogoff, Maurits C. Boas Chair of International Economics, Harvard University; José Antonio Ocampo, Minister of Finance and Public Credit, Ministry of Finance and Public Credit of Colombia, and Axel van Trotsenburg, Managing Director, Operations, The World Bank.

January 19, 2023. Jennifer Paldano Goonewardane.

In estimating global debt at a whopping $300 trillion in 2023, translating to $37,500 average debt per person compared to a GDP per capita of just US$ 12,000, S&P Global observed that “rising interest rates and slowing economies are making the debt burden heavier.” Global governments, households, financial corporates, and nonfinancial corporates owe a record $300 trillion as of June 2022. The year also marked sharp jumps in interest rates and inflation, making the debt harder to pay.

The global debt conundrum is mindboggling and challenging to resolve as non-Paris Club creditors such as China, India, Saudi Arabia, and the UAE are overshadowing the hitherto big creditors of the Paris Club. China is considered the largest bilateral creditor to developing nations and lent significantly to emerging countries in the last decade. The IMF has often been in the news urging China to play a more active role in addressing the emerging market debt crisis, particularly concerning Sri Lanka and Zambia.

Luckily for Sri Lanka, after months of languishing in limbo, waiting for China’s assurances, the IMF approved the bailout package of $2.9 billion in March 2023. In the meantime, Sri Lanka has work to do while it takes a two-year grace period as a breather to develop a debt sustainability plan.

The Ground Situation – Axel van Trotsenburg, Managing Director, Operations, The World Bank

The world is looking at a very different landscape of debt distress across developing and emerging economies, according to Axel van Trotsenburg, Managing Director, Operations, The World Bank. The situation is complex today, vastly different from how the IMF and The World Bank resolved it in the 1990s. First, various levels of countries are caught in the debt trap, trying desperately for an outlet seeking rescue by snuggling with The World Bank and the IMF to help do their bidding with the creditors.

The debt-distressed developing countries comprise the poorest countries known as The World Bank- supported IDA countries. There are 75 IDA countries, of which 60 are in debt distress. Then there are lower- middle-income countries, such as Sri Lanka, under severe financial stress and in need of near-term debt restructuring to have an opportunity for economic growth in the future.

Progress is possible only with radical transparency where details are made available, including the terms of debt. Parliaments must discuss what a government wants to do, and not doing so is likely to confront information on hidden deals that have contributed to the debt crisis.

While debt has always been a thorn in the flesh of these developing countries that turn to institutions like The World Bank and the IMF to bail them out, Trotsenburg says they are faced with a different reality today. The IMF and The World Bank-sponsored 1990s Heavily Indebted Poor Countries (HIPC) initiative is irrelevant to the current circumstances as the composition of debts has changed radically, with countries over the last decade and more turning to non-Paris Club creditors. Hence, the Paris Club creditors are no longer significant. A good case in point is Zambia. The country desperately needs debt relief and is in its second year trying to negotiate a debt restructuring framework with little success. The spiraling effect naturally spills over internally. The government cutting allocations to vital sectors like health and education leads to political and social unrest, an increasingly widespread challenge confronting debt-ridden countries. The problem for Zambia is that more than 80 percent of its borrowings are from China, while barely 10 percent is from the Paris Club. Traditional lenders, known as the Paris Club, no longer have deep pockets.

He said commercial and bond debt has also emerged as an essential component of global and country-specific debt. Twenty-five years ago, when The World Bank was dealing with debt, commercial and bond debts were dealt with as hopeless arrears and eradicated through by-back and resolved. Today, they involve Euro bonds, requiring discussions with the different groups involved. Institutions like The World Bank grapple with getting those groups to the negotiating table.

On top of that are countries described as fragile states, which are increasing in number. Their conflictual reality compounds the situation as they get increasingly debt- burdened with no access to relief.

The complexity of today’s debt composition has intensified the situation for most countries in debt distress. The World Bank has revealed that many developing nations owe a debt to “private lenders” in countries like China, India, Saudi Arabia, and the UAE. According to The World Bank, this trend spreads the risk but makes it harder for governments to restructure their debt.

The main problem in those dealings is the need for more transparency and debt sustainability, according to Trotsenburg. The countries that were hitherto in debt found new life following the relief they got from the HIPC. The debt relief from the HIPC that were right-offs in the 1990s allowed them to restart their borrowing spree with a temptation to turn to non-traditional creditors as the Paris Club lenders had changed the rules, turned their backs on extensive lending operations, and opted for grants. That allowed these countries to issue bonds or go to non-Paris Club creditors. The downside was that, very often, there needed to be more clarity on conditions for lending. Trotsenburg points out that while it’s easy to issue a 12 percent Euro bond, the cost will be enormous. It all boils down to the fact that these countries had not at any point integrated debt sustainability into budgets while turning a blind eye to the cruciality of maintaining budget transparency to reveal the sources to whom the country owed its new debt. Progress is possible only with radical transparency where details are made available, including the terms of debt. Parliaments, he says, must discuss what a government wants to do, and not doing so is likely to confront information on hidden deals that have contributed to the debt crisis.

The challenge to lure non-Paris Club creditors to the dialogue table is well-known and discussed extensively. To circumvent that glitch, the countries of the G20 drew up the Common Framework for Debt Treatment. Despite its limitations in the last two years, the Common Framework has been critical to bringing everybody around one table. Agreeing to agreements has been an uphill task which is essential on a timely basis, points out Trotsenburg. But at least such frameworks leave the door open for dialogue.

In a sign that China, as the biggest non-Paris Club lender, is thawing and opening up to a conciliatory stance, its leaders met with six major international economic organizations, including The World Bank and the IMF, in December 2022. At the seventh “1+6” Roundtable with Chinese Premier Li Keqiang in December 2022, they agreed on the importance of working together and staying on the path of multilateral and international cooperation to address the many severe challenges facing the global economy. That was followed by the Global Sovereign Debt Roundtable in India in February 2023, with India at the helm of the G20 presidency with The World Bank and IMF cochairing to have an open discussion to help identify barriers to debt restructuring and develop steps to improve the process. Trotsenburg says such talks were essential to arrive at a sense of mutuality as countries like Sri Lanka struggled to create an agreeable restructuring plan for a long time when the country desperately needed enormous financing, showing the urgency of keeping doors to dialogue always open. Fostering dialogue helps the process stay fluid and available until all parties can agree to go ahead (Since the conclusion of such meetings, based on a written commitment by the Export-Import Bank of China offering Sri Lanka a two-year moratorium on its debt, the IMF has approved a $2.9 billion bailout in March 2023).

Advanced Economies are Vulnerable too – José Antonio Ocampo, Minister of Finance and Public Credit, Ministry of Finance and Public Credit of Colombia

The more advanced, extensive, and developing economies in Latin America have been spared debt distress despite being significantly in debt because they maintain their growth momentum. However, many see the growing presence of civil unrest as worsening the situation in those countries leading to similar pressures affecting them over time. According to José Antonio Ocampo, Minister of Finance and Public Credit, Ministry of Finance and Public Credit of Colombia, high-interest rates to curb inflation are increasingly putting pressure on middle-income countries like Columbia, making access to financing scarcer and costlier. The same applies to the availability of refinancing – difficult and more expensive. Therefore, financing problems and the debt burden facing these more significant economies have become a serious concern as they can slow down these economies. The issue of high debt leads to limiting the fiscal space available to these countries, including Columbia, which has a 55 percent debt-to-GDP ratio. He says civil unrest further reduces a country’s fiscal capacity to respond and imposes resource constraints. The minister opines that short- term solutions are required to mitigate situational circumstances of the present.

Speaking on the Common Framework for Debt Treatment, the minister laments its inadequacy for debt-ridden countries to seek recourse through dialogue. Its insufficiency to tackle the mammoth issues is pushing countries into further jeopardy. He cites the reluctance of private creditors to enter into a dialogue for debt restructuring or suspension process, which exposes the lacuna in the world economy for a permanent institution to deal with the problem. Without a permanent body to facilitate debt negotiations, hitherto processes have been ad hoc, with the Common Framework not meeting the desired objectives.

Protecting economic institutions is extremely important. No government should undermine its primacy by resorting to irresponsible economic decision-making.

Britain’s Shocking Downslide – A Lesson for Everyone – Rachel Reeves, Shadow Chancellor of the Exchequer, House of Commons of the United Kingdom

In September 2022, Britain had its moment of financial instability when the Conservative Party Prime Minister Liz Truss, with her right-hand man Chancellor Kwasi Kwarteng, promised to reenergize the economy with a new economic package. Dominating the new reform was a massive tax cut of £45 billion. It was the moment that sparked Britain’s major financial crisis that made the headlines. The mini-budget of September 2022 threatened to put the country in dire economic straits. The government said the tax cuts would be funded by borrowing, despite warnings that could worsen inflation. The government had offered few details on how it would support the package, which shook financial markets at their core. Subsequently, the pound plummeted by 10 percent, increased government borrowing costs as yields on government bonds soared, and mortgage rates rose.

There was chaos in the bond market, which forced the Bank of England to bail out pension funds and stabilize the market by buying billions of pounds of long-term government bonds.

Reeves says that there are important lessons to learn from the crisis. First, she says protecting economic institutions is extremely important. No government should undermine its primacy by resorting to irresponsible economic decision-making. There is danger in undermining financial institutions as they impact investor confidence. There was an undermining of the Bank of England, leading to investors dumping the pound and government bonds. Reeves explains

that rather than a mini-budget, a forecast for the economy and the government finances from the Office of Budget Responsibility would have sufficed. However, barring it from being published gave the impression that the government was hiding something and wasn’t operating within the framework that existed in the UK in terms of the Bank of England since 1998 and the Office of Budget Responsibility since 2010. All that and the unfunded nature of the massive tax cut exacerbated the situation and saw the markets spiral into chaos. Reeves says that as a G7 nation, those reforms were a lesson on how things could go wrong when undertaken without a basis and sufficient explanation.

With a reversal in those disastrous reforms, there is still worry among investors who desire to limit their holdings in pounds and British debt owing to growth- related concerns. When asked about how differently a Labor-led government would fair to overcome such a situation, Reeves said that one should first learn from the September 2022 situation. The first lesson she says is that any economic policy has to be built on a rock of economic and fiscal responsibility, a priority before anything else.

She says it’s also evident that the UK needs a serious plan for economic growth because numbers concerning productivity and growth and FDIs show that the UK has been missing out in the last decade compared to its nearest neighbors and competitors. A Labor government, she says, will work and partner with businesses and bring back growth and productivity to the UK economy. Part of that is sorting out some of the mess of the Brexit deal of several years ago, which has seen a drop in exports and jobs move abroad in many cases and supporting green industries of the future.

The dire debt trap facing the world’s developing economies and low-income emerging markets would not send the world into a spiraling debt trap.

It’s not the end – Kenneth Rogoff, Maurits C. Boas Chair of International Economics, Harvard University

Adding perspective to the discussion, Kenneth Rogoff, Maurits C. Boas Chair of International Economics, Harvard University, said that the dire debt trap facing the world’s developing economies and low-income emerging markets would not send the world into a spiraling debt trap. The economies in debt distress are in dire straits, as The World Bank and the IMF have repeatedly told. However, when those countries default, the global systemic impact will be less and not in the proportions envisaged by naysayers. According to professor Rogoff, the pandemic-led compulsions led those economies into subsequent debt default while many of them are on the cusp of a debt default. However, the world is entering a phase where interest rates adjusted for inflation will be higher in the next decade than they were. While that situation may not lead the world into a debt spiral, individual firms and countries will feel the brunt of the off-kilter problem leading to a deep recession and interest rates remaining high. While that will be a worrying situation for individual groups and economies who may find themselves in a “pants down” problem, it will still not lead to a global debt spiral, assures Professor Rogoff.

Moderator Alessandra Galloni, Editor-in-Chief, Reuters.

Axel van Trotsenburg, Managing Director – Operations, The World Bank.

José Antonio Ocampo, Minister of Finance and Public Credit, Ministry of Finance and Public Credit of Colombia.

Kenneth Rogoff, Maurits C. Boas Chair of International Economics, Harvard University.

Rachel Reeves, Shadow Chancellor of the Exchequer, House of Commons of the United Kingdom.