Asia

The stocks strongly responded to the movements in Wall Street and overall the stock exchanges in the region moved upwards. The biggest winners for the month ending were the Japanese.

Japan

The Nikkei average took an upward trend, after continued. drops in the last few months falling below its psychological 19,000 barrier. The fall in the stock price from 1996 was due to the slowdown in the Japanese economy and the drop in the trade surplus the country was enjoying with the US. The stocks however took an upward turn with the intervention of the government in the banking sector and in the ever-dropping real estate market. The government has introduced a new set of regulations, by revising the budget and imposing lesser control on the banks. The stocks in the banking sector soared with this news and some of the biggest were the Nippon Credit Bank and the Sakura Bank, which jumped up nearly 10% for the period.

Hong Kong

The stocks have dropped nearly 1.5% due to the slump in the real estate market in Hong Kong. Overall the market is vulnerable to the US currency and to its economy. Due to the high linkage the Hong Kong Dollar has with the US Dollar the movement in the US directly affects the market.

Analysts however expect the market to drop in the next few months with correction in the Wall Street tumbling the prices to fall by 10%. But there will be no major impact as expected from the handing over of Hong Kong to China. Even though China has not mentioned any clear signals as to the direction of the country other investing countries such as the United States have enacted regulations which allow the economy to be as it is.

Malaysia

Malaysia one of the emerging economies in Asia, with a GDP growth rate of 8% and inflation of 3.5% for 1996, is facing a down turn in its economy. The stock market in Kuala Lumpur that rose 25.4% in 1996, has dropped by 15% from February 97 which was the lowest record for the nine months ended. Analysts expect the market to drop further with the releasing of other economic indicators. Central Bank of Malaysia as a pre-emptive measure hopes to control inflation and the money supply by reducing the lending power of the commercial banks. Malaysia has the best balance in risk/return characteristics in investments compared to other Asian markets such as Indonesia, Taiwan, etc.

India

The Bombay Stock Exchange dropped in the beginning of the period with the market adjusting itself to the budget but later responded to the ending of War in Kashmir with the agreement to sit for bilateral talks with Pakistan. However, during the last week Indian politics took a new turn. With the political turmoil investors are worried about the future of the Indian economy. According to the latest information India is hoping to resolve the problems regarding the budget. Analysts expect a roller-coaster-ride, fluctuating nearly 10% either up or down in the next few weeks.

South Korea

Stocks gained during the period as a response to the government move to case control on the local security market. The government has made new regulations which allow brokering firms to issue bonds and other derivatives with a margin of 15% from 6%

Corporate news – Asia

Nike’s Vietnam branch employees are on strike saying that the company has treated its workers as prisoners of war and have demanded that the government solve this problem for them. Nike which holds 45% of the world sport shoe market says that the action has not troubled the market share they enjoy and that profits will not be affected.

In Singapore the shipping giant of that country Neptune Orient Lines has made a takeover bid on the American shipping company American President Lines. Neptune Lines will pay US$825 million for the acquisition. This, analysts believe, if accepted will be the biggest takeover a Singaporean company has made. And after the takeover Neptune will carry 10% of trans-pacific trade around the globe.

Europe

The stocks have suffered a slight decline mainly due to the high sensitiveness the market had to Wall Street movements. Stocks however have not reflected much of the strong economic conditions prevailing in most of the European countries. Analysts believe that London and Frankfurt markets are the most sensitive to Wall Street. The economies in the region are over-heated and soon will need to be adjusted by means of a rise in interest rates.

United Kingdom

Election worries have rocked the market with uncertainty spreading across the country about the battle between the present Conservative government against the Labour party. Although Labour was in a stronger position in the beginning, Prime Minister John Major, has shown the public the strong economic figures he has achieved during his time. The GDP growth rate has risen to 2% in 1996 and inflation has dropped to 2.7%, below the Bank of England expectations. And during the same period he has managed to bring down unemployment by 1/3. Germany

Banking stocks have shown a remarkable improvement with a price per earning ratio of 18 in most of the banking stocks com- pared to 14 to 13 in UK and France. However, analysts expect that this trend will not continue and will soon come down with the corporate earning reports. The Bundes Bank has so far not signaled that the rates will be in- creased but market watchers are expecting such a move as a solution to the over-heated economy.

Spain

After discovering a 30 year lower inflation rate of 2.5%, Central Bank of Spain decided to reward the market by cutting its key short term interest rates by 0.25% to 5.75%. The market responded to this move but later moved in line with Wall Street. The stocks have climbed up only by 2% in the last 2 months, but will go up later with new economic results.

Italy

The market has achieved strong gains during the period, rising by nearly 3.5%. This movement was seen after the government’s decision in releasing a mini budget with welfare spending cuts and short term measures to the down turn in the economy. Italy is facing the worst economic conditions after decades with the fall in GDP, rising inflation and weakening of Lira mainly against the D.Mark by almost 3%.

Bulgaria

The government announced a privatization plan by offering 75% of state owned Industries to the private sector. Some of them were telecom, mining and banks. The decision was taken after an agreement with IMF as an Economic Reform package. Countries such as Poland, Hungary and Russia are undergoing similar measures to bring in foreign investments to their countries.

Poland

The GDP growth rate has dropped to 5.6% compared to last year with an inflation rate of 17%.The government expects a lower inflation rate with new measures such as raising the lending percentage to boost the consumer spending. With a Producer Price Index of 11%, Poland expects a growth rate of 8% in this year.

Corporate news – Europe Daimler

Benz which recorded the biggest loss in German history in 1995, has posted a profit of UK$1.75 million in 1996. The motor industry giant says that the reported profits have been achieved mainly by the increase in Mercedes sales. The stock prices in Frankfurt rose by 40% since 1997 after German markets anticipated the good earnings growth of the company.

P & O, the UK shipping giant recorded a profit of US$1.5 billion in 1996. P & O which is undergoing difficulties with the restructuring plans says that profits will be lower in 1997.

Adidas, sales have risen by 35%. Even with high competition from Nike and others and changing styles Adidas expects a 26% growth by the year 2000. They are hoping to achieve this by being official sponsors for Football World Cup in France next year and spending heavily on advertising.

British Telecom & MCI will form a merger after agreeing on the structure of the new company by both parties. After the merger both companies expect a major holding in the world telecommunication market. While the talks are going on, BT & MCI expect to form a strategic alliance with Portugal Telecom by holding 1% and 0.5% respectively.

Thompson CSF the French. high-tech company is for sale and calling bidders till June 1997. So far Alcatel is the only bidder who has offered a big bid.

North America

The stocks in Wall Street suffered a 6% drop after the Federal Reserves raised the bench mark rates by 0.25% to 5.5% but rebound to its current position in 5 straight sessions. Dow Jones Industrial Average 6,679.87 down 255.59 The stocks are slowly edging up to the previous 7,000 level. The recent drop in Dow was experienced after a 6 year long-stretched up turn. The Dow has not suffered a 10% decline since then.

The market is optimistic about the changing conditions developing the economy and responds more than expected. According to some analysts, to display the true position, the Dow should reach below the 6,500 level.

Corporate News – United States

Stock prices in Phillip Morris and others in the tobacco industry rose after the ending of the dispute in the industry, although the deal was not very attractive.

Apple Computers is suffering hard for the past 6 months with its restructuring plans to reduce the work force. According to the latest release the company has made a second quarter loss of US8708 million. After releasing this the NASDAQ alone suffered a 2.61% decline on that day.

Ford has earned a US81.5 billion profit in the first quarter of 1997 which is double last year’s. The reason for good earnings were the plans for cost cutting & restructuring and the strong demand for its latest cars, in Europe and the US.

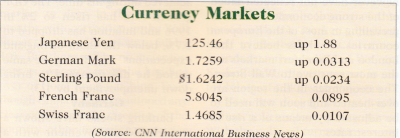

Eastman Kodak & Caterpillar have recorded profits for the first quarter which was above Wall Street expectations. The Dollar edged up strong against the other currencies gaining more than 2% during the period. The strongest was against the Yen which once stood at ¥127.00. The weakening of the Yen was due to the interest rate deferential between the two countries. The finance minister of Japan has said that he would allow further weakening of the Yen as it supports the exporters in Japan. Analysts say that a strong Dollar may not be what Fed is looking for and would soon interfere if the trend continues