Hatton National Bank posted robust overall performance in 2024. Group Profit After Tax improved to 44.8 billion rupees and Profit After Tax increased to 41.3 billion rupees.

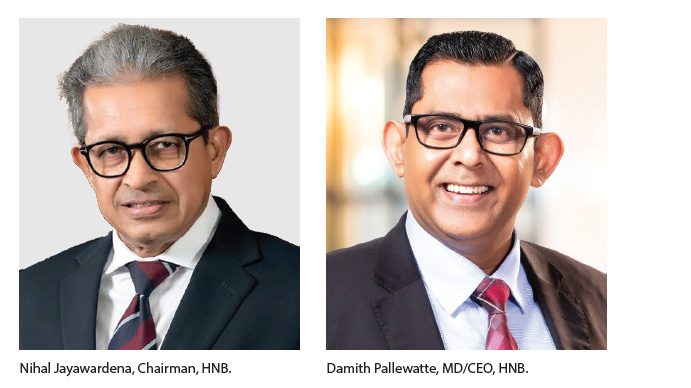

Nihal Jayawardena, Chairman, HNB, stated, “With the improving economic landscape in 2024 providing the impetus for renewed business confidence and financial sector expansion, HNB leveraged its strong foundation to prove its leadership in the local banking industry. HNB’s solid capital position, strong liquidity, and digital-first strategy enabled the Bank to respond swiftly to emerging opportunities for business expansion, culminating in an exceptional financial performance in 2024. I would like to extend my heartfelt gratitude to all our stakeholders for their continuous support and for the trust and confidence placed in us during good and bad times”.

The bank achieved an 11.3 percent YoY growth in loans and advances. However, interest income declined by 21.6 percent due to a relaxed monetary policy, causing average yields on loans and government securities to fall nearly 45 percent. Net fee and commission income increased by 12.7 percent to 17.8 billion rupees.

Following the International Sovereign Bond (ISB) restructure, the Bank opted for the ‘Local option’, exchanging 30 percent of ISB exposure for LKR bonds and keeping 70 percent in USD bonds with a 10 percent impact. This restructure boosted profit before taxes by 38 billion rupees, leading to a net gain of 11.8 billion rupees in profit after tax, factoring in a 26.2 billion rupee deferred tax asset.

Damith Pallewatte, MD/CEO, HNB, stated, “We are pleased to report our performance for the year 2024, which reflects the outcomes of our strategic actions as the operating environment stabilized. Focus on supporting all key sectors of the economy, efforts to combat pressure on margins, and aggressive focus on asset quality contributed towards the sound performance in our core banking operations. In alignment with the national vision of uplifting the MSME sector of Sri Lanka, we provided support to revive these businesses through multifaceted rehabilitation programs. We introduced initiatives such as HNB Sarusara, which caters to the quintessential agriculture sector – the lifeline of the rural economy, and provides access to domestic and export markets while enabling transactions through digital platforms, driving a cashless eco-system for the value chains. These efforts have provided much-needed impetus for these entrepreneurs to scale up to the next level.”

“I am optimistic for the future, especially with the Sri Lankan economy now poised for significant growth acceleration over the next few years. The completion of the external debt restructuring process, the resultant sovereign upgrade, and the progress on the reform agenda are positive signals that will undoubtedly boost investor confidence, benefiting the country and the banking sector in the coming years. We are well-positioned to capture this growth potential with our comprehensive range of products and services channeled through our diverse physical and digital presence. Our latest acquisition of 100 percent control of Acuity Partners, which was rebranded HNB Investment Bank (HNBIB), indicates HNB’s foray into fully fledged investment banking, further solidifying our position. As we remain committed to continuing our legacy of being a true ‘partner in progress’ to all our customers, we will also pursue opportunities to extend our footsteps beyond our borders to enhance the value we create for all our stakeholders”.

In 2024, the Bank’s Asset base surpassed two trillion rupees, showing a 7.5 percent YoY increase. Gross Loans and Advances rose by 117.8 billion rupees to 1.16 trillion, despite a 26.5 billion rupee decline in Q1 2024. The deposit base grew by 8.6 percent YoY to 1.7 trillion rupees, primarily driven by a 113.5 billion rupee increase in CASA deposits, elevating the CASA ratio to 34.2 percent. The Bank’s capital ratios stood strong, with Tier 1 and Total Capital Adequacy at 19.59 and 23.96 percent, surpassing the statutory requirements. Additionally, the Liquidity Coverage Ratio remained robust at 331.5 percent, well above the 100 percent minimum.

HNB was ranked number one in ‘Business Today Top 40’ rankings for the year 2023-2024.